GET IN TOUCH

- Please wait...

Nahid Sharmin, Gender Specialist at a2i; Syed Javed Noor, Deputy Managing Director of IDLC Finance Limited; and Suman Chandra Saha, Deputy General Manager at SME Foundation, in a panel discussion moderated by Bijon Islam, CEO & Co-Founder of LightCastle Partners

Enhancing access to finance for cottage, micro, small, and medium enterprises (CMSMEs) stands as a fundamental challenge crucial to Bangladesh’s financial and economic advancement. The diverse nature of CMSMEs spans various sectors and involves multiple agencies in shaping policy. Presently, a significant barrier to formal financial access for CMSMEs is the inadequate level of institutional coordination. Cumbersome and costly processes hinder the formalization and governance of CMSMEs, hampering their ability to secure capital, particularly through established banking avenues.

As part of the UNDESA Project DA2124B titled “Frontier Technology Policy Experimentation and Regulatory Sandboxes in Asia and the Pacific,” a regulatory sandbox concept was conceived to implement an initiative that facilitates access to finance for CMSMEs in Bangladesh.

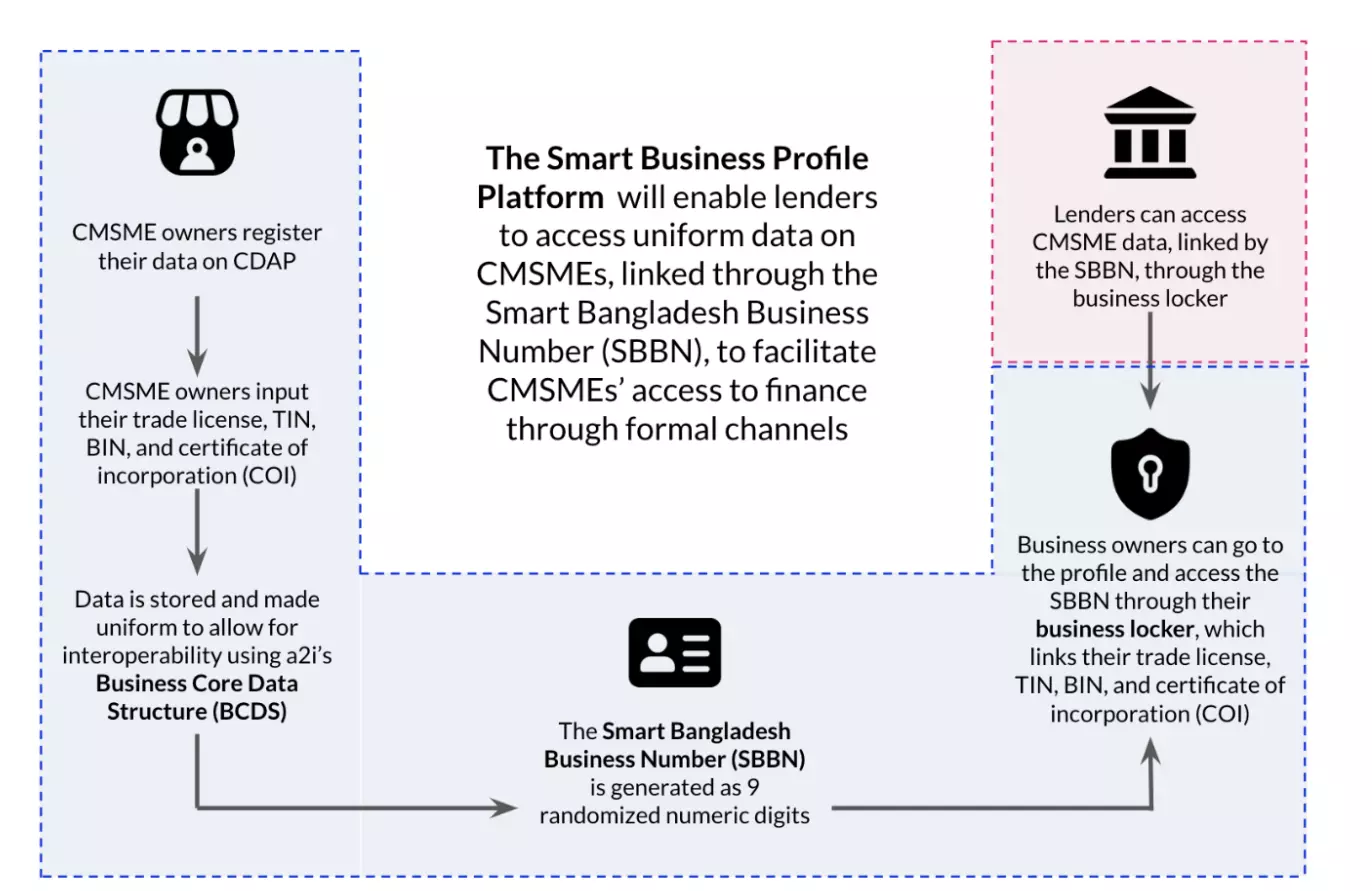

The proposed regulatory sandbox takes the form of the Smart Business Profile Platform (SBPP), a data aggregation platform for CMSMEs that links all their business documents through a unique identifier. This promotes their access to formal finance channels. The grand launch of this groundbreaking platform took place on Thursday, August 17, 2023, at Crowne Plaza Gulshan.

The event brought together experts, thought leaders, and stakeholders to discuss the SBPP initiative in Bangladesh, emphasizing its potential to revolutionize finance access for small-scale entrepreneurs. The event unfolded through a series of insightful sessions and discussions, shedding light on crucial challenges, innovative solutions, and the transformative impact of the SBPP.

The event commenced with welcoming remarks by Mr. Vincenzo Aquaro, Chief of the Digital Government Branch at UNDESA, setting the stage for a forward-looking dialogue on using regulatory sandboxes to advance access to finance for CMSMEs. This was followed by opening remarks from Mohammad Ashiqur Rahman, Director of SME and Special Program Department at the Bangladesh Bank, highlighting the importance of inclusive financial mechanisms.

Bijon Islam, CEO & Co-Founder of LightCastle Partners, delivered a keynote presentation providing background on the sandbox framework’s establishment. Emphasizing the identification of opportunities and addressing gaps in institutional, policy, regulatory, and infrastructure support, he underscored the need for an innovative approach to integrate CMSMEs into formal finance channels.

Following the keynote presentation was a panel discussion moderated by Bijon Islam. This panel delved into the practical aspects of implementing the Smart Business Profile Platform and the anticipated outcomes. Esteemed panelists included Nahid Sharmin, Gender Specialist at a2i; Syed Javed Noor, Deputy Managing Director of IDLC Finance Limited; and Suman Chandra Saha, Deputy General Manager at SME Foundation.

The panel discussion highlighted the challenges encountered by CMSMEs in Bangladesh and the transformative potential of the SBPP to facilitate financing for small-scale businesses. Key themes covered included technology adoption among CMSMEs, data security and platform concerns for lending to CMSMEs, and potential key performance indicators for measuring the success of a regulatory sandbox project like the SBPP.

Furthermore, concerns unique to women entrepreneurs were addressed, focusing on the distinctive challenges they face in accessing finance. Initiatives aimed at mitigating these challenges were recognized for their potential to empower women’s financial independence and autonomy.

In the event’s final session, FinTech experts Fahim Ahmed, CEO of Pathao; Seyed Mosayeb Alam, Chief of Staff of ShopUp, and Adnan Imtiaz Halim, Founder & CEO of Sheba Platform Ltd, explored the transformative role of FinTech in tackling challenges faced by CMSMEs. Their insights demonstrated how existing startups in Bangladesh are already leveraging innovation and technology to empower small and medium-sized enterprises.

The event concluded with closing remarks from Wai Min Kwok, Senior Governance and Public Administration Officer at UNDESA, and Md Mamunur Rashid Bhuiyan, Project Director at Aspire to Innovate (a2i), ICT Division, Bangladesh. Their remarks underscored the significance of the SBPP initiative and its potential to reshape the CMSME landscape in the country.

The UNDESA Pilot Launch Event illuminated the promise of the Smart Business Profile Platform in creating a more inclusive and empowered financial ecosystem for small-scale entrepreneurs. This initiative is poised to unfold throughout the remainder of the year, enabling greater financial access for CMSMEs by securely democratizing their financial data for lenders.

Our experts can help you solve your unique challenges