GET IN TOUCH

- Please wait...

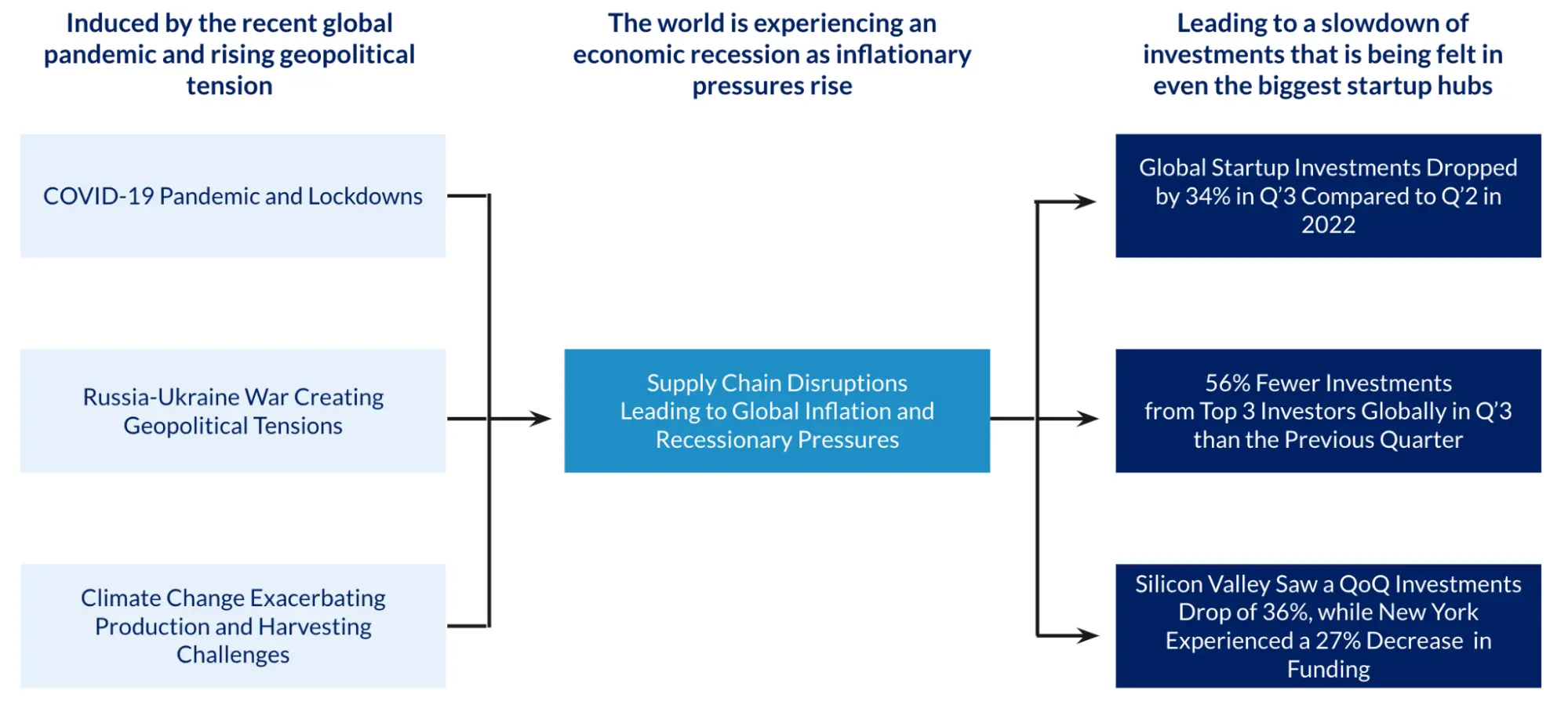

Fueled by the COVID-19 pandemic and consequent lockdowns, recent geopolitical tensions, and challenges induced by climate change have led to supply-chain disruptions around the world. As a result, inflation and recessionary pressures have spread across economies, including Bangladesh. These disruptions have taken a toll on startup ecosystems globally, even in the largest startup hubs.

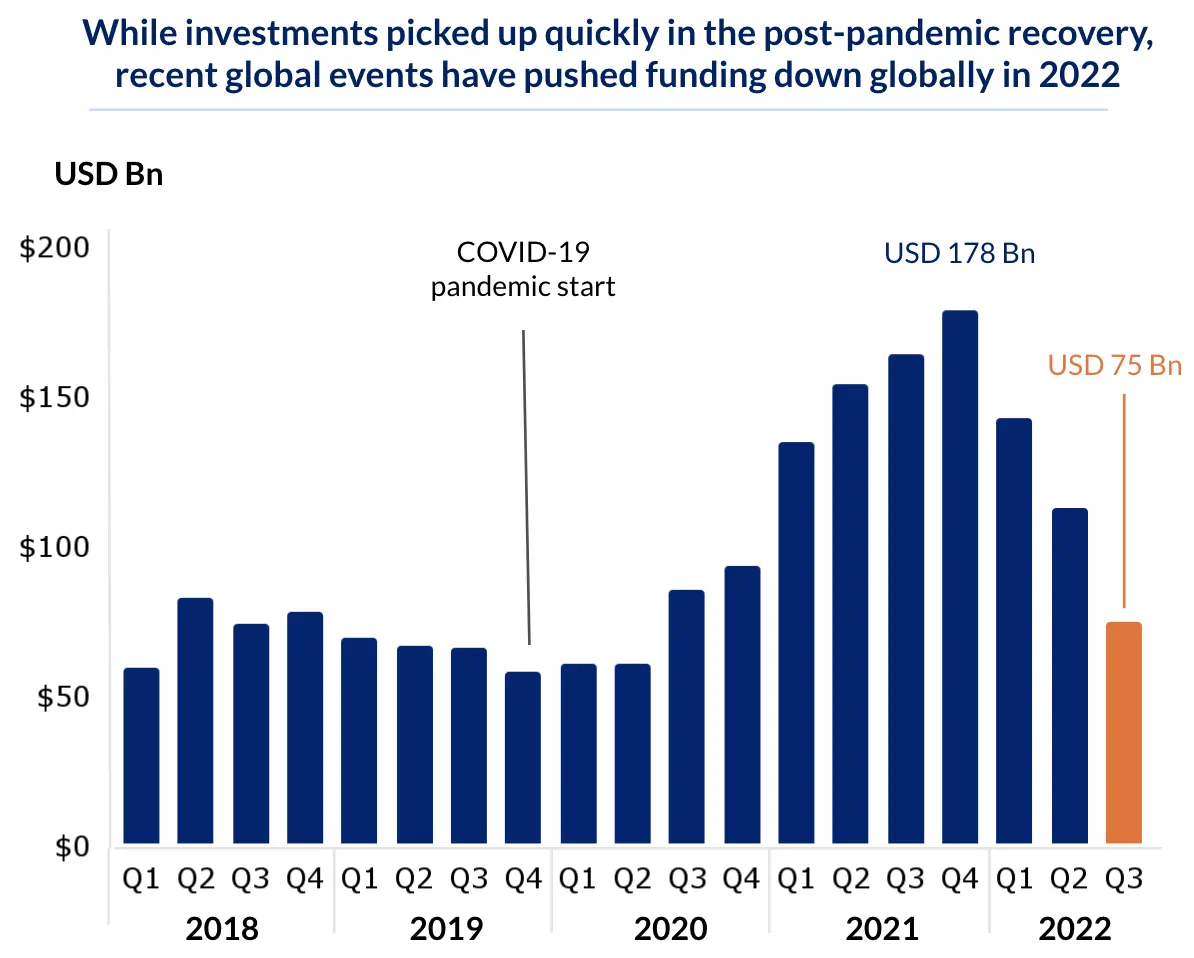

Global investments have seen a 34% quarter-on-quarter drop in Quarter 3 of 2022, from USD 113 Bn to USD 75 Bn. Although the impact of a funding slowdown is felt globally, Asian startups are predicted to see the largest drop in investment:

“With an active war in Europe, post covid global supply chain disruption, and multiple trade wars, the outlook for global financial is bleak. I believe the capital will be scarce for some time. In this scenario, A company should think about running independently and focus more on to attained profitability rather than rapid growth. This situation will also make us more resilient, which can help us to fight any future challenging case.”

Sinthia Islam, Co-Founder and Chief Content Officer, Shajgoj Limited

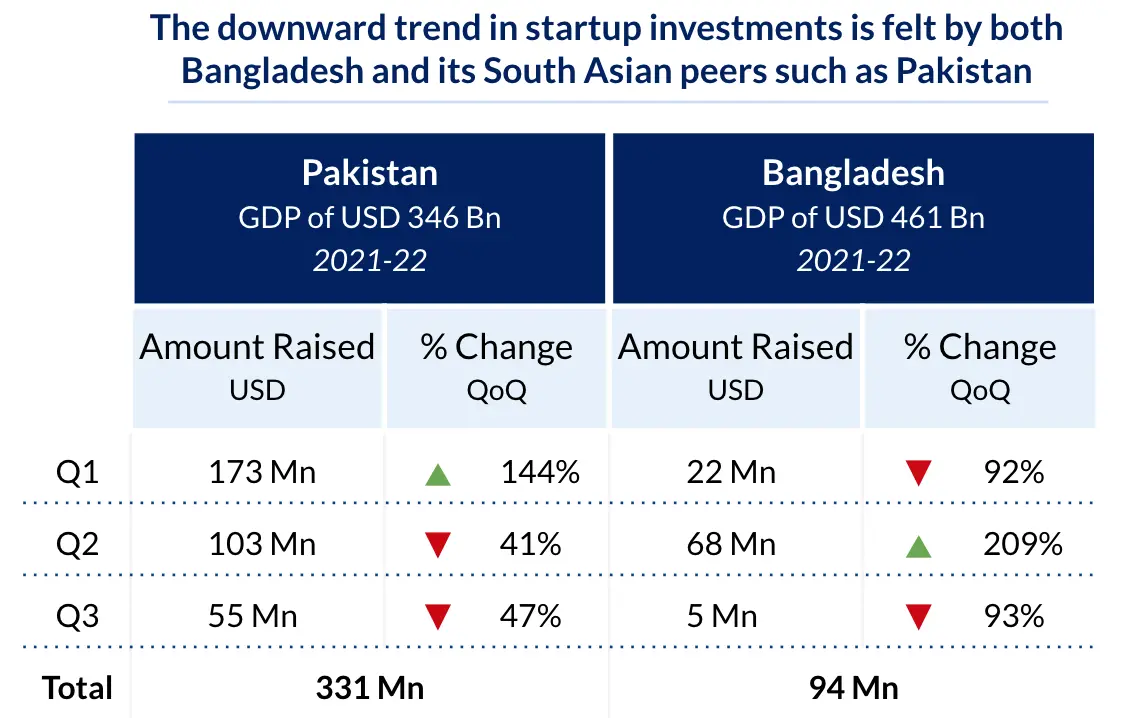

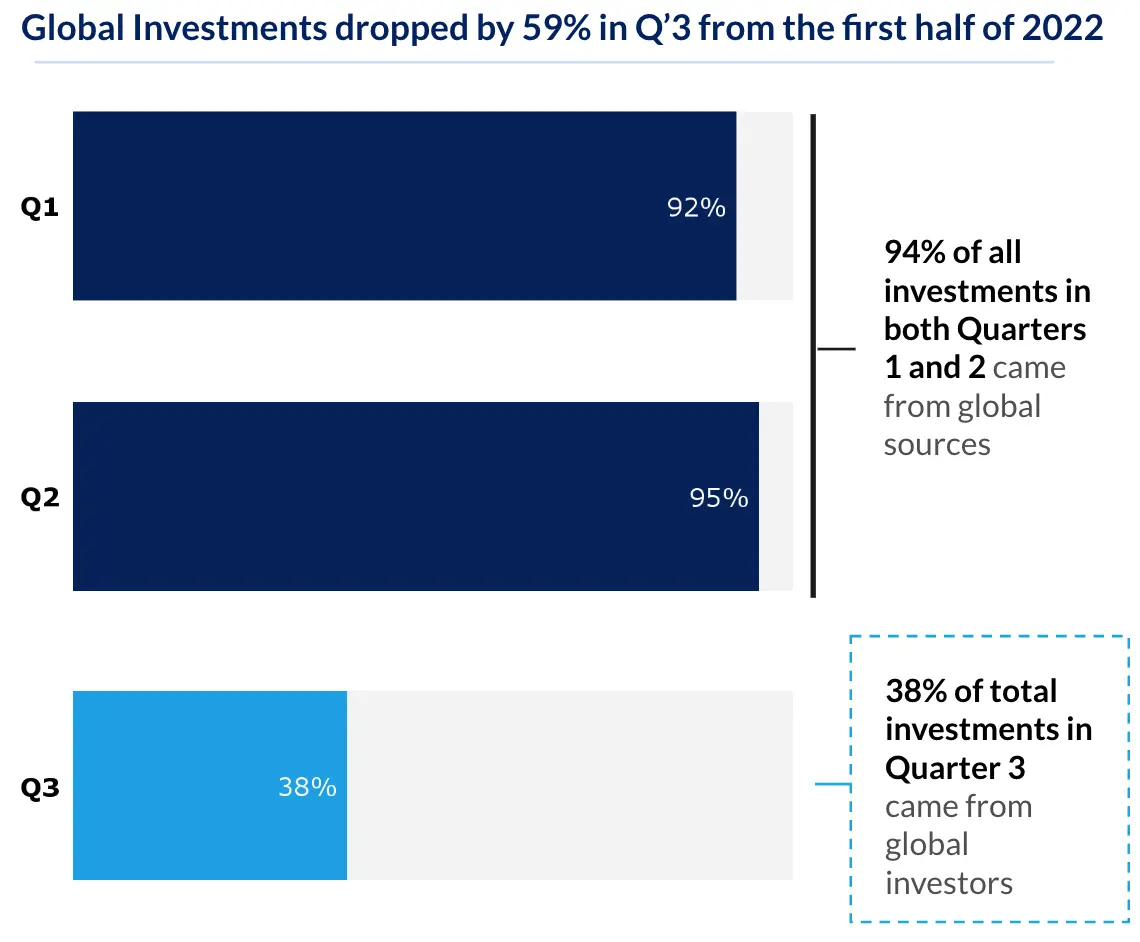

As uncertainty rises around the world, global attention to Bangladeshi startups has already decelerated. The Bangladeshi startup ecosystem relies heavily on global sources of investment, making up around 94% of all investments on average in the past decade. As investments decrease globally, homegrown startups are predicted to experience:

“As the world economy is pushing unfavorable tides towards us, we need to be like sailors against the angry sea, going into survival mode. An integral part of building this resilience is managing cash flows for keeping the business sustainable. Startups coming out of this difficult scenario will be able to tackle any other problems in the future.”

Adnan I. Halim, Founder & CEO, Sheba Platform Limited

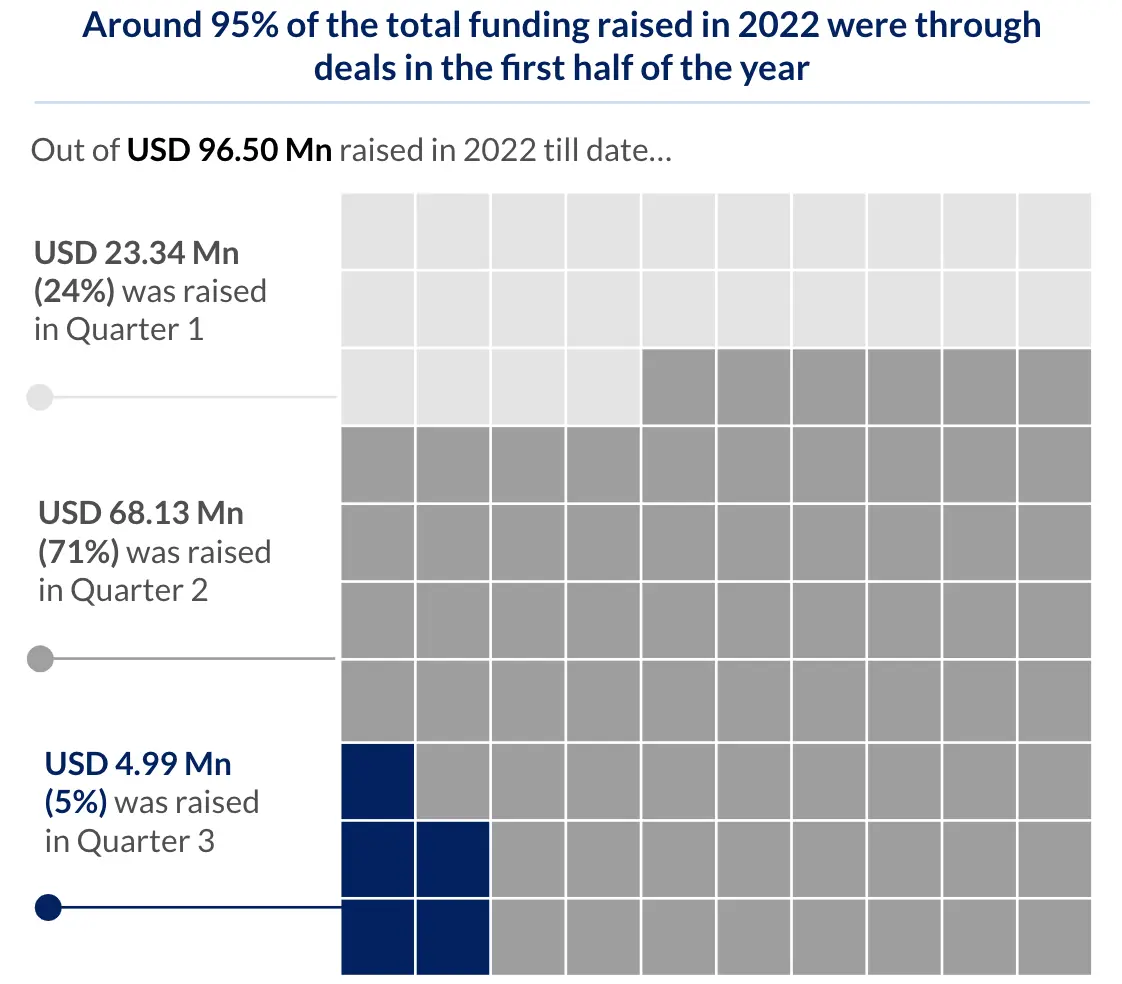

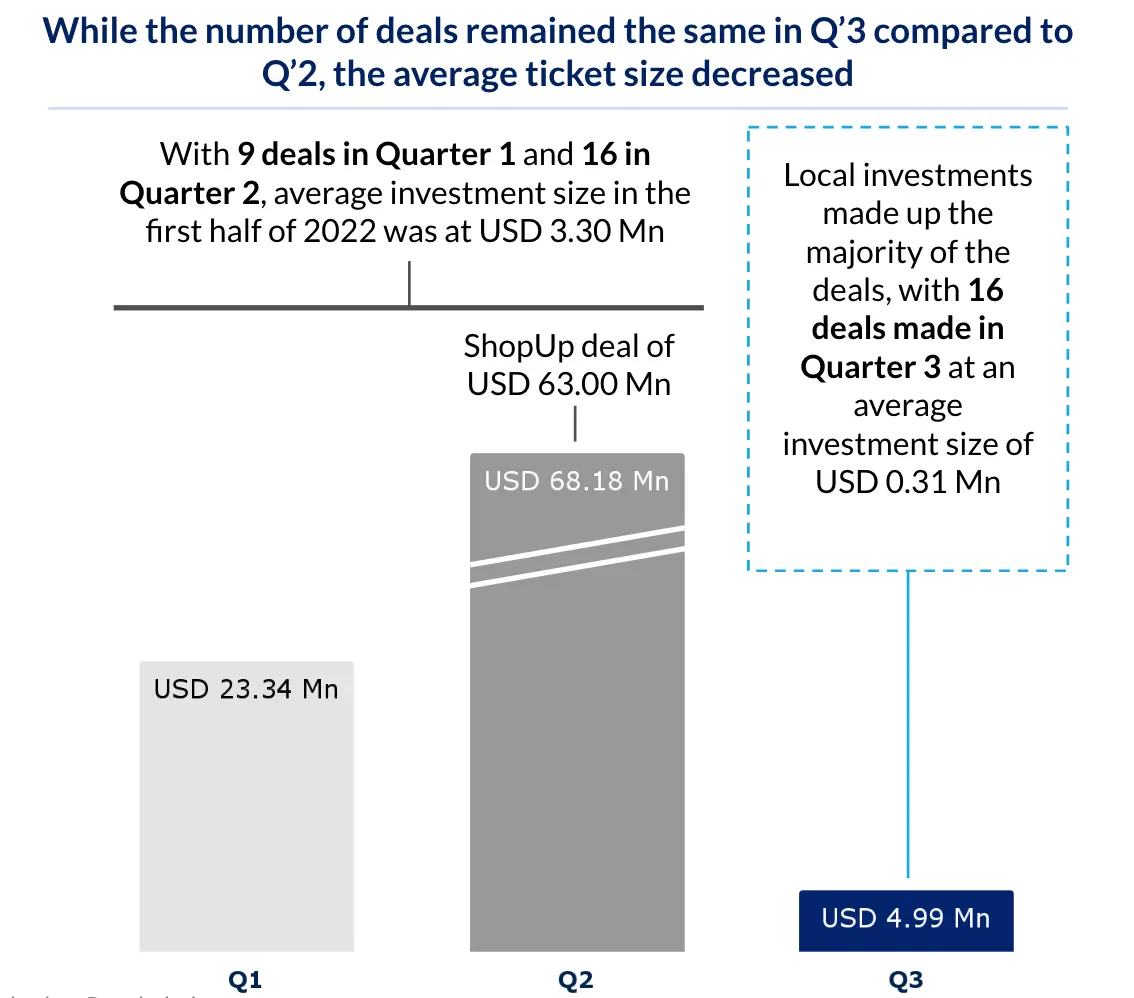

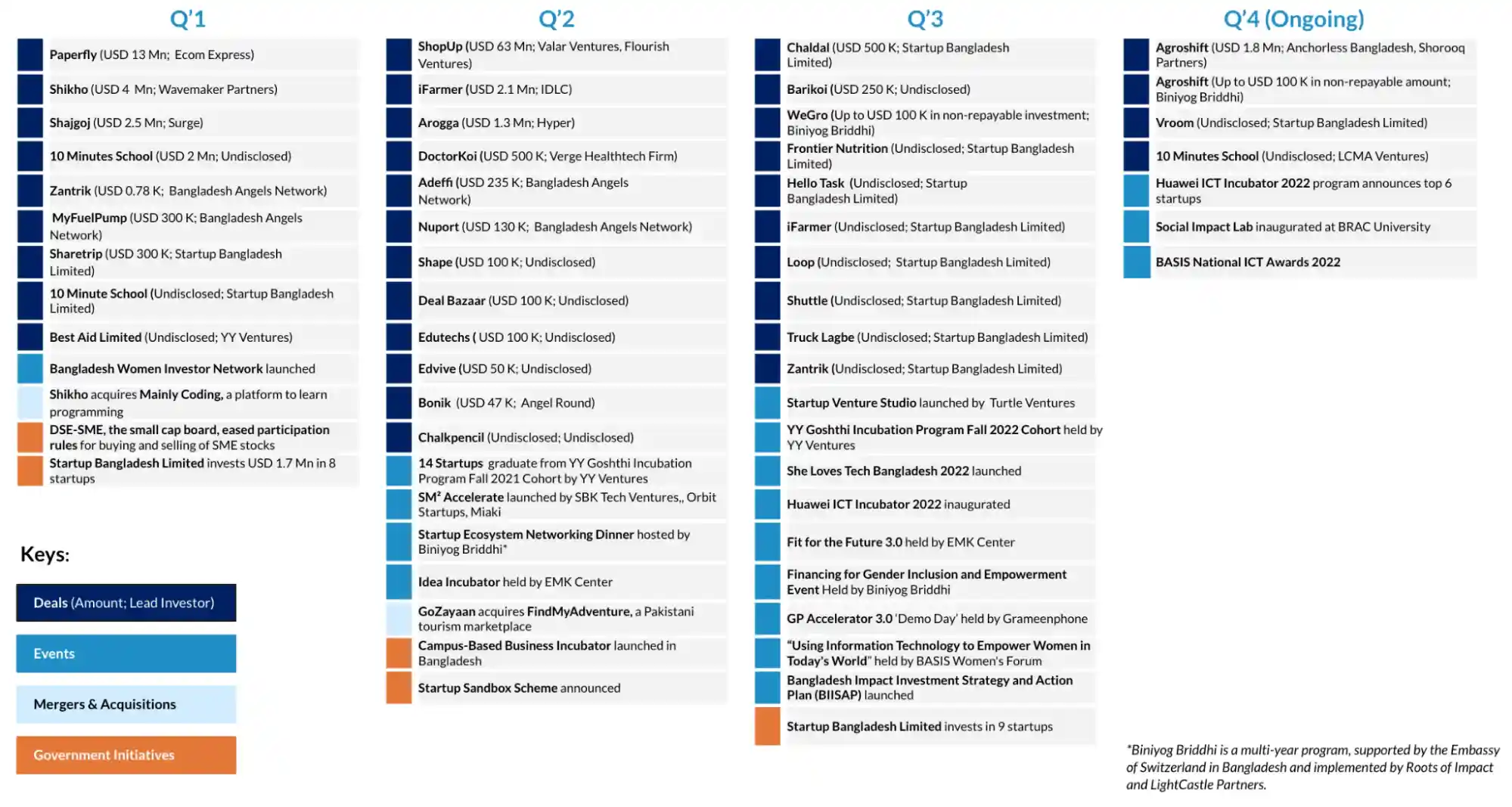

Quarter 3 made up around 5% of total investment in 2022. In comparison, 71% of the total investments of 2022 were raised in the second quarter, owed to the Ecom Express’ investment in PaperFly and ShopUp’s Series B4 funding from Valar Ventures and Flourish.

Despite a consistent number of deals, Quarter 3 was behind in terms of total investment raised compared to previous quarters of the year. This led to the average investment size falling in Quarter 3, making up 9% of the average investment size in the first half of 2022.

With an average ticket size of USD 312 K across 16 deals, in Quarter 3 of 2022 investments from global and local sources funded 15 startups in Bangladesh.

Global investments made up only 38% of total investments in Quarter 3 – a drop from a 94% average in the first half of the year. With global funds declining, homegrown investors such as Startup Bangladesh Limited took the lead in Q’3. Overall, this brings the proportion of global sources of funding to 75% for 2022 to date.

“It’s an exhilarating time for the startup ecosystem in Bangladesh as we see a lot of innovations coming to us for funding. We’re working to implement the government’s vision of Smart Bangladesh by supporting the ecosystem to develop at least five unicorns in Bangladesh by 2025.”

Sami Ahmed, Managing Director, Startup Bangladesh Limited

“In 2022, we have seen many top VCs, LPs, and other institutions visit the country to understand the startup landscape further. I strongly believe that with the current conversation changes taking place in the ecosystem in terms of policy, entry and exit strategy for global investors, startup IPOs at an early stage and others will provide the foreign investors with much needed confidence to come and invest in the Bangladeshi startups.”

Sadia Haque, Founder & CEO, Sharetrip

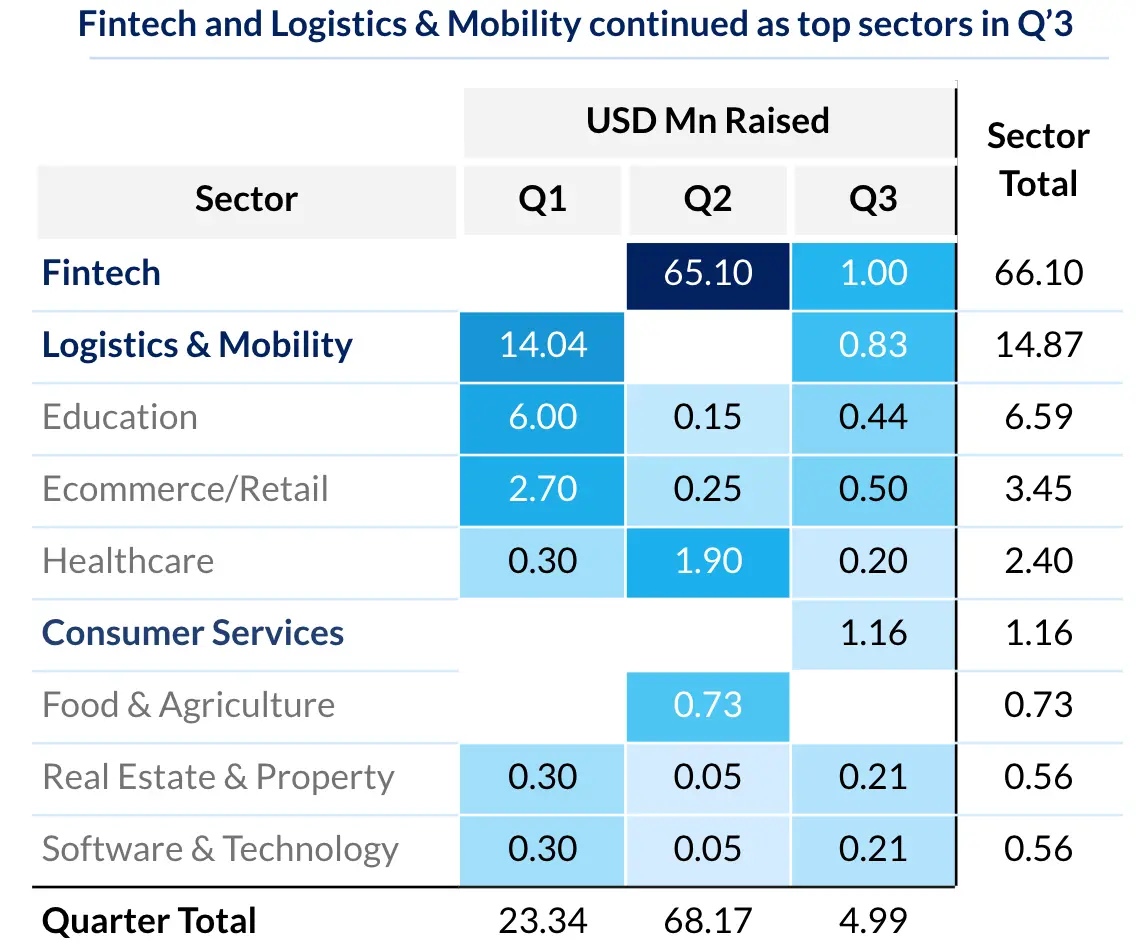

Consumer Services, Fintech, and Logistics & Mobility accounted for 60% of all funding raised in Quarter 3. Consumer Services has been the leading sector throughout the entirety of 2022, followed by Fintech and Logistics & Mobility.

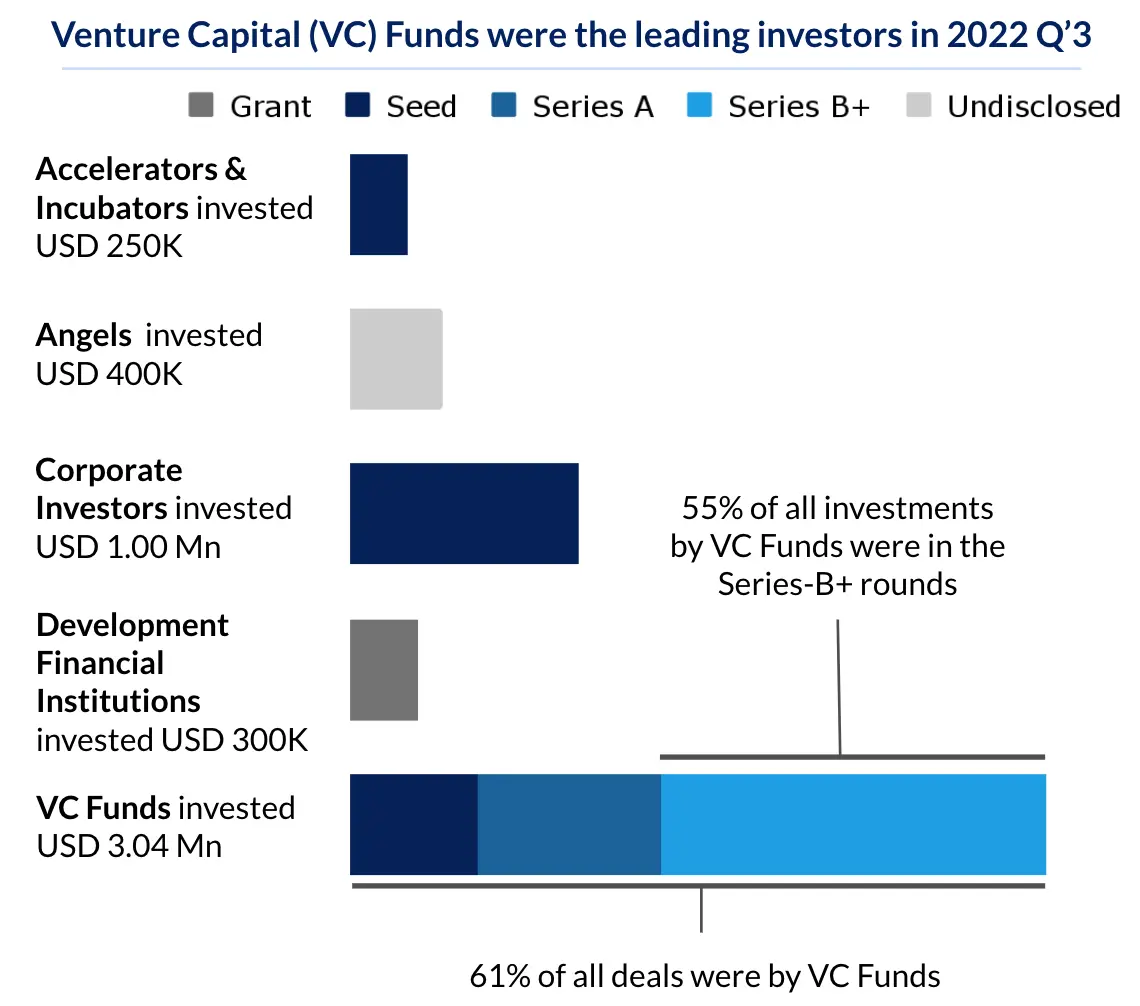

Venture Capitalists made up the largest segment of all investments in Quarter 3. 36% of all investments in Quarter 3 were made in Seed rounds, followed closely by 34% in Series B rounds.

Increasing accelerator programs, government initiatives, and mergers & acquisitions indicate a maturing startup ecosystem in the country.

“I’m cautiously optimistic to see more companies raise international investments in the coming year and adding to the total raised by the ecosystem, as I know of several companies already negotiating and trying to conclude rounds with regional and international VCs.”

Nirjhor Rahman, CEO, Bangladesh Angels Network

“Qualified founders solving real problems for a country of 170 million people should not have issues raising capital. The dollar amounts are still relatively small, and international investors are keen on exposure to Bangladesh’s strong macroeconomic story — and it’s possible that a high-quality Bangladeshi startup can outperform shiny tech stocks like Tesla and Snowflake in the next few years, which is not something we could have said easily a year or two ago.“

Rahat Ahmed, Founding Partner & CEO, Anchorless Bangladesh

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights