GET IN TOUCH

- Please wait...

The current generation in Bangladesh is growing up with smart devices and convenience services as a greater number of businesses seek to bring their products and services to the doorsteps of consumers. In finance, however, businesses are using smartphones and other devices to bring financial services as close as to the palm of our hands. Digital financial services (DFS) allow users access to services like banking and utility/merchant payments at their time and place of leisure instantly, and companies to save costs of servicing in person. However, beyond convenience, DFS holds much greater potential – to promote greater financial inclusion in areas where financial institutions are scarce, combat fraud by ensuring payments to the right person, and reduce costs associated with making a large number of financial transactions. Besides benefiting just consumers and businesses, it also has the potential to benefit government through taxes as more financial transactions are made formal. It seems almost too good to be true, but the reality of this growing segment of fintech is that it’s changing the financial landscape of the world, especially in emerging countries like Bangladesh.

According to Findex, 78% of the world’s unbanked adults receive wages in cash and have access to mobile phones [1], giving the market a high potential profitability. Companies dedicated to mobile-money such as Alipay and bKash already boast a user base of 520 and 30 million respectively [1]. Although big players in the industry started initially with only mobile money services, there is a growing trend towards providing a wider variety of financial services including e-wallets, payment platforms, savings accounts, insurance, fixed deposit schemes and other services. Despite the growth in the number of adults with a bank or mobile-money account in the world, growing by 515 million in the past 3 years, a quarter of all accounts worldwide remain inactive with no deposits or transactions in the last year [1].

The bulk of profits earned by facilitating companies come from cash-in-cash-out and transactions(McKinsey global banking practice March 2018). Mobile-money carries a great potential for reducing the need for cash and making everyday payments easier. In Africa its effects were much further reaching, where it was used as a tool for fighting corruption and providing emergency-response workers their salaries while avoiding increased propagation of Ebola. Despite the reduction in need for cash, it unlikely to be brought down to zero, as seen in Norway, which has the lowest cash usage still set at 17% of all payments despite being the world’s greatest adopter of digital financial services (DFS) [1]. In developed countries the mobile money market is fragmented, but in emerging nations are dominated by few players like bKash in Bangladesh which holds 60% of the total, M-PESA holding 80% in Kenya, and China dominated collectively by Alipay and Tencent [1]. In emerging countries, however, weak digital literacy among the population also means agents are part of the business model as middle men to facilitate transactions.

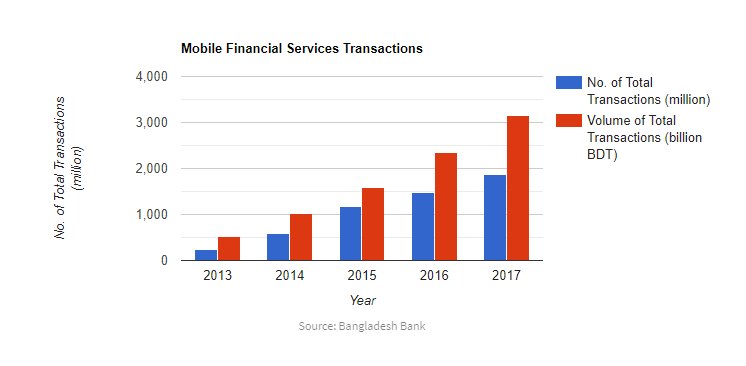

In 2011 Bangladesh Bank issued “Guidelines on Mobile Financial Services (MFS) for Banks” bringing MFS activities under formal regulations. This includes the adoption of only bank-led model for financial services, where customers deal with banks through a mobile finance intermediary. The government has also taken initiatives to promote digital financial services through Access to Information (a2i) with initiatives like Digital Financial Services Lab in partnership with Bangladesh Bank, aimed towards incubating fintech startups targeting low-income groups. Currently the central bank allows multiple uses of MFS but is not limited to remittance, cash in/out, utility bill payments, C2B payments, salary disbursements, and government payments. Recently in 2016, there was a sharp decline in number of banks authorized to provide MFS due to non-compliance of regulations. However despite this, the number of transactions and volume has seen a steady growth.

Since then, MFS has seen exponential growth due to the proliferation of low-cost mobile phones and increasing network coverage throughout the country. However challenges such as digital literacy, limited competition, and security concerns remain an issue in taking the next step towards greater financial inclusion. In 2017 there were 58.6 million registered customers in total, however, only 23.1 million are active [8]. In 2018, mobile banking alone has been estimated to be generating 994 crores, or over $188m in daily transactions [7]. According to 2017 report, 37% of the population was financially included through registered accounts with a full-service financial institution [2]. However, this 5% growth from 2016 is a result of an increase in registered accounts and decline in users of microfinance and NBFIs [2], showing that greater financial inclusion through use of MFS has a significant effect on other activities with the similar goals.

The mobile-money market in Bangladesh is currently dominated by bKash with Rocket as a distant second. However there are many other digital financial services (DFS), each with its own distinct focus.

| Service | Objective | Institutional Backing | Advantage |

| iPay | Payment Platform | N/A | Digital Payment Focus |

| Nagad | Digital Financial Service | Post Office | Larger Transaction Limit; Regulatory Advantage |

| D Money | Digital Payment Platform | Post Office | Digital Islamic Wallet 2tk Accounts |

| bKash | Mobile Financial Service | BRAC Bank | Largest Market Share & Network of Agents |

| Rocket | Mobile Banking | Dutch Bangla Bank | Banking Facilities |

| Nexus Pay | Mobile Financial Service for Existing Customers | Dutch Bangla Bank | No Transaction Commission Charged |

iPay is a digital e-wallet that allows users to make payments by linking their bank account to the system to access funds. The service is currently linked with all 57 banks in the country and is recognized as a payment system by over 100 brands covering more than 2000 outlets [4].

Nagad is a digital financial service of Bangladesh’s Post Office, which has over 8500 branches in the country. Unlike other players in the market, this service has a regulatory advantage. This is due to it not being regulated by the central bank as a result of the postal act [13]. This allows users to make over 5 times greater daily transaction limits of other MFS in the country [13].

D Money is fintech company working in collaboration with the Post Office, with an aim to reach the greater population in rural and remote areas. It recently launched ‘Daak Taka’ a banking service allowing users to open an account for as little as 2tk. It allows users to make payments as well as withdraw and deposit money. Recently they signed an agreement with Al Arafah Bank to provide the first islamic e-wallet.

bKash is the most popular MFS in the country with a market share of over 60%. Besides facilitating cash transactions, they also boast over 180,000 agents in the country, and an increasing number of integration with banks in the country. It has the largest user base, and is unique in that it also facilitates remittance and provides interest on savings. Recently the company announced a strategic partnership with Ant Financial, which will be taking a 20% stake in the local MFS giant.

Rocket is a bank-led mobile banking service, with agents that are also available in the 182 branches of DBBL in the country. It is the first company to provide banking facilities through mobile phones. It is second to bKash in terms of MFS market share in the country and currently has 218,818 agents.

Nexus Pay is an app provided to DBBL account holders with the goal of providing advanced banking services and integrating cards of customers. Unlike other vendors, all services through Nexus Pay are completely free and does not require any additional commissions.

Given the increasing penetration of smartphones and internet, coupled with a growing number of agents and users, in the near future we may see a larger variety of financial services available digitally to the greater population. This includes but is not limited to:

Given the exponential increase in volume of transactions, we may also see a stronger KYC framework in place as more information will be available on individual purchase patterns and spending habits of users. This may also pave the way to individual credit ratings to facilitate instant credit disbursements to the greater population. If this occurs, there may be a significant rise in consumption in the country. If the current market players provide incentives to local small sized merchants, we may in addition see a significant decrease in the amount of hard cash circulating in the economy. No matter what the future holds in store though, one thing is for certain, the next generation of Bangladesh will be growing up with digital financial services as an inseparable part of their lives.

Mohammad Shehab, Junior Associate at LightCastle Partners, has prepared the write-up. For further clarifications, contact here: [email protected].

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights