GET IN TOUCH

- Please wait...

The First Industrial Revolution is known to be the point in history when economies started shifting from agriculture to industry, and it began in countries like the United Kingdom, France, and Germany. The prominent names like Bangladesh, India, Vietnam that we see today in the manufacturing map came about over the last fifty years when most of the developing countries then had begun shifting away from the manufacturing sector to service sectors because of factors like rising costs, changing customer demands and increasing use of technology. The service sector now contributes over 70% to the GDP of those advanced economies, while the manufacturing sector is dominated by nations such as China. [1]

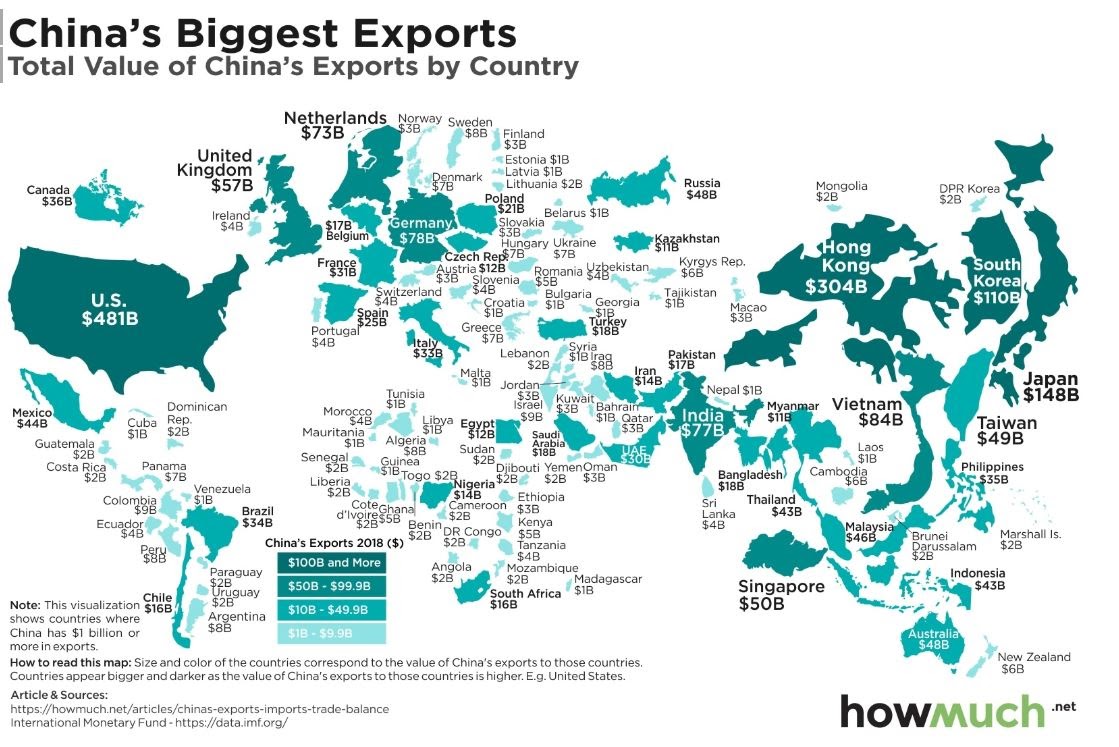

China is considered to be a global manufacturing powerhouse, due to its undeniable presence in all industries of the manufacturing sector. In fact, the country ranks first in the output of more than 220 of approximately 500 global industrial products. [2] In 2018, the exports and imports of China alone accounted for 12.4% of the global trade. [3] The United States, Germany, Singapore, EU are all overly dependent on imports from China. [4] The first steps for the dominance that China enjoys now were taken in 1979 through major economic reforms to empower the grass-root producers, encourage FDIs and decentralize economic policymaking activities primarily. [5] The reforms prompted large-scale capital investments and expeditious growth in productivity in the country, which eventually led the country to become the “factory of the world”.

Changes in factors affecting the production in China such as geopolitical crises, rising costs or necessity for skills and expertise are highly likely to have spillover effects on other countries, creating both opportunities and threats.

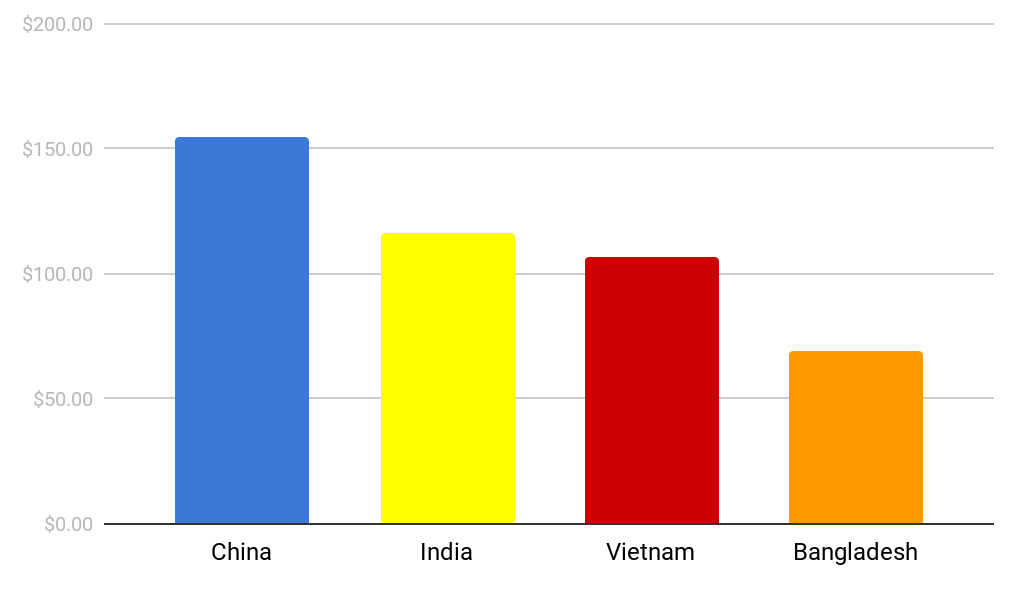

China gained popularity among international manufacturers by being one of the lowest labor cost countries. In recent years, China has turned its focus towards creating more value-added products rather than apparel manufacturing. This, together with the increasing living standards of the people of China and the significant brain drain that the country suffered, has raised the labor costs in the country, breaking down one of its competitive advantages. Markets in countries like Bangladesh, Vietnam, and India developed by ensuring cheaper labor. In 2018, the minimum monthly wage in China was USD 160, while those in Indonesia, Vietnam, and Bangladesh were USD 75, USD 154 and USD 69 respectively. [6] Despite being the second-largest exporter of RMG products, Bangladesh’s productivity in the garment exporting industry is approximately one-third of that of China. [7] Nonetheless, China’s rising wages and lack of skilled labor due to its shift from the textile industry to more high value-added manufacturing like consumer durable and electronic items and the service-driven sectors are set to create more opportunities for low cost serving South-Asian and African countries.

While the impacts of geopolitics on the production in China pose a threat to some nations, it presents an opportunity to others. The US-China trade war decreased bilateral trades between the two countries while increasing product prices thus ultimately harming the consumers. China suffered USD 35 billion of export losses, which were absorbed mostly by developing countries such as Taiwan, China, and Vietnam. [8] 70% of the shoes sold in the US were manufactured in China and faced duties above 67%. [9] These duties were taken a notch higher due to the trade war which meant that the footwear industry took a hard hit. Brands like Nike suffered negligibly compared to others, as they had already been moving their production to Vietnam. [10] Due to the impacts of the war, more brands began to diversify their production and supplies focusing primarily on Vietnam and India. Even though opportunities for making higher-value products were guaranteed to increase for the countries, competition from China could present itself in a newer way. India and Vietnam feared competing with Chinese products in other markets given the excess in supply, or worse, suffering through the dumping of cheaper Chinese products into their local markets.

Even though China became the first choice for buyers by providing low costs, it eventually strengthened itself in technical skills and expertise. In 2015, highly skilled technicians and workers were officially given the same value as scientists or entrepreneurs in China. [11] However, in recent years, companies have started to diversify their production into different countries. India has been making its name as a global manufacturer in electronics manufacturing, due to continued government initiatives and policies in this regard like the Modified Incentive Special Package Scheme (M-SIPS) or the “Digital India” initiative. [12] While Xiaomi set up its 7th manufacturing plant in India, Samsung opened the world’s largest mobile factory in the country. [13] Other global manufacturers like Oppo and HMD Global also plan on commencing manufacturing in India due to the cheap labor and skills it has to offer. Government and private initiatives such as the “Learn and Earn” scheme by Lava, the Indian handset maker, are focusing on building the right skills and expertise in India to compete with China in this industry and garner a bigger global market share. [14] However, China continues to invest in building and maintaining its competitive edge through workshops and vocational training.

But what happens to industrial production when all the factors are triggered together? What spillover effect do countries like Bangladesh face when both the demand and supply connected to China dry up? The coronavirus (COVID 19) outbreak, which was first detected in Wuhan, in the Hubei Province of China on 31st December 2019, has recently been declared a pandemic. The virus has spread over 210 countries and territories and has claimed 165,174 lives already. [15] With 2,414,595 detected cases, China has been hit the hardest by the pandemic, but the health of the people isn’t the only concern for the country. It is feared that the Chinese economy could contract for the first time after 44 years of constant growth. With most of the major importers of China going into lockdown and factories in China shutting down, the industrial production of the country has taken a hit. The China Caixin Manufacturing PMI dropped from 51.1 to 40.3 by the end of February. [16]

Bangladesh, like most developing countries dependent on the Chinese economy, has been negatively affected. In the worst-case scenario, the pandemic has the potential to wipe off USD 3.02 billion and 894,930 jobs from the economy of Bangladesh. [17] Bangladesh has become handicapped due to shortage of supplies, travel restrictions, slip in lead time and quality of the products reduced. Furthermore, the Chinese experts who were employed in the different industries of Bangladesh have not yet been able to return after the Lunar holidays.

Thirteen possible sectors including the leather, plastics, pharmaceuticals, and jute sectors are likely to be negatively affected the most according to a report by the Tariff Commission. [18] The leather industry is likely to be damaged the most taking a potential loss of about BDT 30 billion, followed by the apparel and textile industry.

The RMG industry, the main driver of the economy of Bangladesh, faces a potential halt as well. China alone comprises 26.1% of the total imports of Bangladesh which includes over 40% of textile and related goods and 30% of capital machinery and spare parts for the textile and garment industry imported into the country. [19] As a result, the prices of many accessories increased by around 50%. [20] The factory owners are also facing financial constraints as buyers continue to request payment rescheduling and hindrance in supplies push towards defaulting on L/Cs opened. Till April 13th, the total value of RMG orders lost summed approximately to around USD 3.15 billion. [21]

Companies all over the world were already diversifying out of China, especially US companies after the trade war. The recent pandemic underscored the necessity for supply diversification, and it is opined that Mexico and South Asia have the most to gain. According to a recent survey by QIMA, a popular name for countries looking to diversify away from China is Bangladesh. [22]

Is Bangladesh ready to handle the influx of orders? The factories of Bangladesh are already facing canceled orders worth millions of dollars and matters are expected to become worse in the short term. Factories have also shut down because of preventive measures or a shortage of supplies. Bangladeshi factory owners are hence facing numerous obstacles of which working capital management, supply sourcing, and lack of expertise rank the highest. In the long run, however, because of the newfound direction of global companies towards diversifying away from China, Bangladesh is highly likely to get increased orders in different industries.

Policies and structural changes need to be made to prepare for this shift. The garment factories have been kept closed for almost a month now while competitors like Vietnam, Cambodia, and Indonesia are still partially, if not fully, open. The GoB also instructed factory owners to pay off the wages of its employees by April 16th. However, 609 BGMEA factories failed to meet the deadline. Furthermore, Bangladesh continues to lose orders but some have been reinstated due to the efforts of BGMEA and GoB. Bangladesh needs to meet these orders by June and commence production for winter orders in the short run to retain its buyers. In the short term, the controlled opening of the factories is necessary through strict protocols and policies.

Special interest-free funds have already been introduced to manage short-term expenses like employee wages. The government has initiated multiple stimulus packages for supporting working capital requirements, pre-shipment credit, and paying salaries and wages of export-oriented industry workers. The interest rates for borrowings from the Export Development Board have also been capped. However, the apparel industry makes up about 80% of the total exports of the country, and thus requires special attention.

The factories in Bangladesh are already over-dependent on China for fabric, chemicals, and accessories, and the huge amount imported from China cannot easily be substituted. Even though the task may not be easy in the short term, strategic alliances and trading partners need to be made to avoid such setbacks in the long run. Bangladesh also needs to incorporate lean manufacturing methods in its production as early as possible, especially to cope with the aftermath of the COVID-19. The skill and expertise of the people need to be developed further to not only reduce foreign dependence but also prepare for the advancement of technology in manufacturing production. Finally, In the long run, Bangladesh needs to build brands of its own to ensure demands even in trying times in the future.

Author: Mashiath Khurshid, Trainee Consultant, LightCastle Partners

The LightCastle team has been analyzing the macro and industry level picture and possible impacts wrought about by the Covid-19 crisis. Over the following days, we’ll be covering the major sectors shedding light on the possible short and long-term ramifications of the global pandemic. Read all the articles in the series

1. Is Manufacturing Still the Main Engine of Growth in Developing Countries? – UNU WIDER

2. China becomes world leader in industrial economy scale – China Daily

3. Is China the world’s top trader? – article on the platform “China Power”; data sourced from UN Comtrade Database

4. Mapping China’s Biggest Trading Partners – Is Your Country One of Them?

5. China’s Economic Rise: History, Trends, Challenges, and Implications for the United States – A report on EveryCRSReport.com

6. CPD Working Paper 122: Livelihood Challenges of RMG Workers – CPD

7. RMG hourly productivity still lower in BD – The Financial Express

8. Trade war leaves both US and China worse off – United Nations Conference on Trade and Development

9. 70% of shoes sold in the US come from China. With new tariffs, the industry braces for a hit – CNBC

10. How Nike is Winning the U.S.–China Trade War – Investopedia

11. Producing China’s manufacturers of tomorrow – The Telegraph

12. India to be the next big Electronics Manufacturing Hub

13. Can Vietnam or India challenge China’s manufacturing leadership in the global electronics industry? – techradar.com

14. Skill India: How Lava is boosting mobile manufacturing

15. Worldometer- Coronavirus accessed on 20th April, 2020

16. China’s factory activity slumps in February to weakest reading on record, private survey shows – CNBC

17. Coronavirus stands to wipe $3b off Bangladesh economy – The Daily Star

18. Bangladesh export-import may be affected by coronavirus: Commercial counselor – Prothom Alo

19. Bangladesh’s economy braces for coronavirus fallout – Dhaka Tribune

20. RMG sector faces the heat – The Daily Sun

21. Pins and needles at the time of a pandemic – The Daily Star

22. Bangladesh to benefit from coronavirus fallout: survey – The Daily Star

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights