GET IN TOUCH

- Please wait...

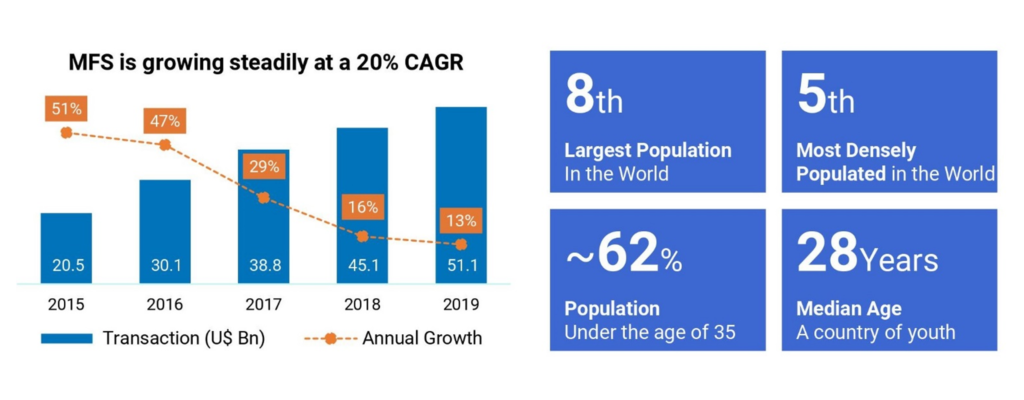

Strong Economy Vitals for Startups: Tech adaptable young population 62%+ under 35 years, 164 million people (8th largest in the world) with high density (1200 people/Sq Km). Middle class growing at 10% per annum to reach 34 million by 2025, 98% mobile phone connection, 62% internet penetration, 102 million+ people on the internet with 94 million mobile internet penetration. The pandemic has also accelerated the use of ICT technology, including digital commerce, education, healthcare, agriculture.

Demographic Bulge with the Right Skill-sets: The country generates 5,000+ IT graduates each year is creating a strong group of entrepreneurial waves focused on solving critical problems, including those during the pandemic. The country’s median age of 27.9 years means more young people are willing to take risks and explore innovations in the economy. With limited opportunities from STEM graduates (due to the absence of large scale industrialization except for RMG/Textile, which is still more labor-intensive than automation) – they are looking into forming ICT enabled companies and Startups. NRBs (Non-Resident Bangladeshis) are also returning, bringing in both investment capital and knowledge remittance.

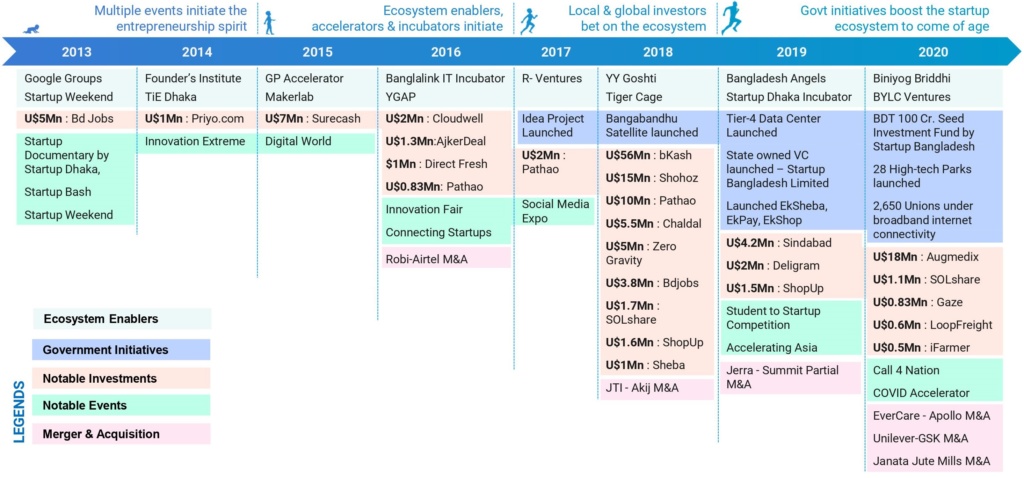

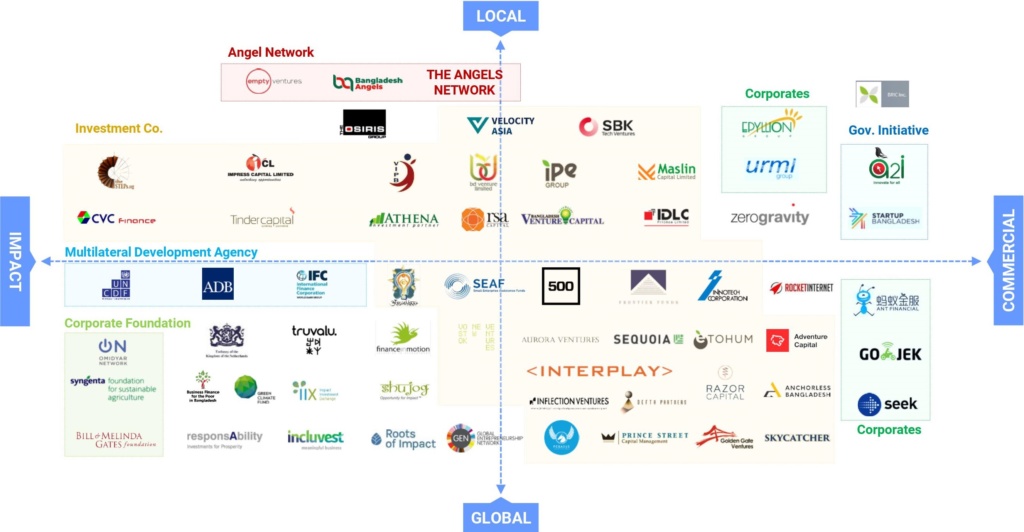

Bangladesh Startup Ecosystem at an Inflection Point: The Bangladesh Entrepreneurship Ecosystem is at an inflection point with an excess of U$ 200 million in international investments from big-name corporate investors and venture capitals, investing in industries like FinTech, Logistics, and Mobility over the last four years. The emergence of active Angel Investment Networks, Impact Investing, host of local and international operating accelerators/ incubators propelled 1,000+ active Startups, generating 1.5 million+ employment – embracing products and services of Startups as part of the country’s everyday life. Additionally, B-SEC (Bangladesh Securities and Exchange Commission) has also approved small-cap stock exchange guidelines, which is a big step towards providing investors with Startup exits.

Government Support: The Government of Bangladesh deployed the National ICT Policy in 2009 to become Digital Bangladesh by 2021. Government policies and projects from the ICT Ministry, such as IDEA Project and Startup Bangladesh Limited with 100 crore BDT (U$ 11.5 Million) funds, are taken to improve the local startup ecosystem. Additionally, GoB is setting up 28+ Hi-Tech Parks, including infrastructure support like data centers, to support technology companies.

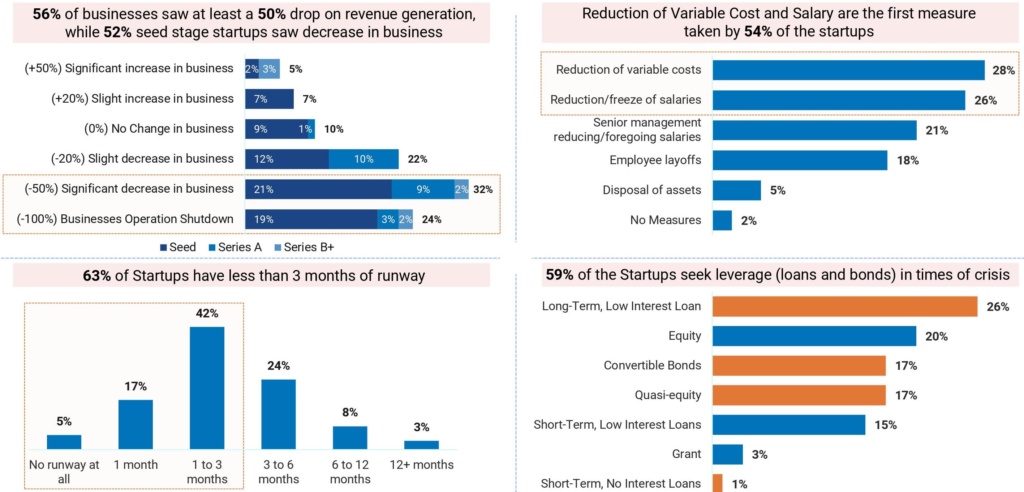

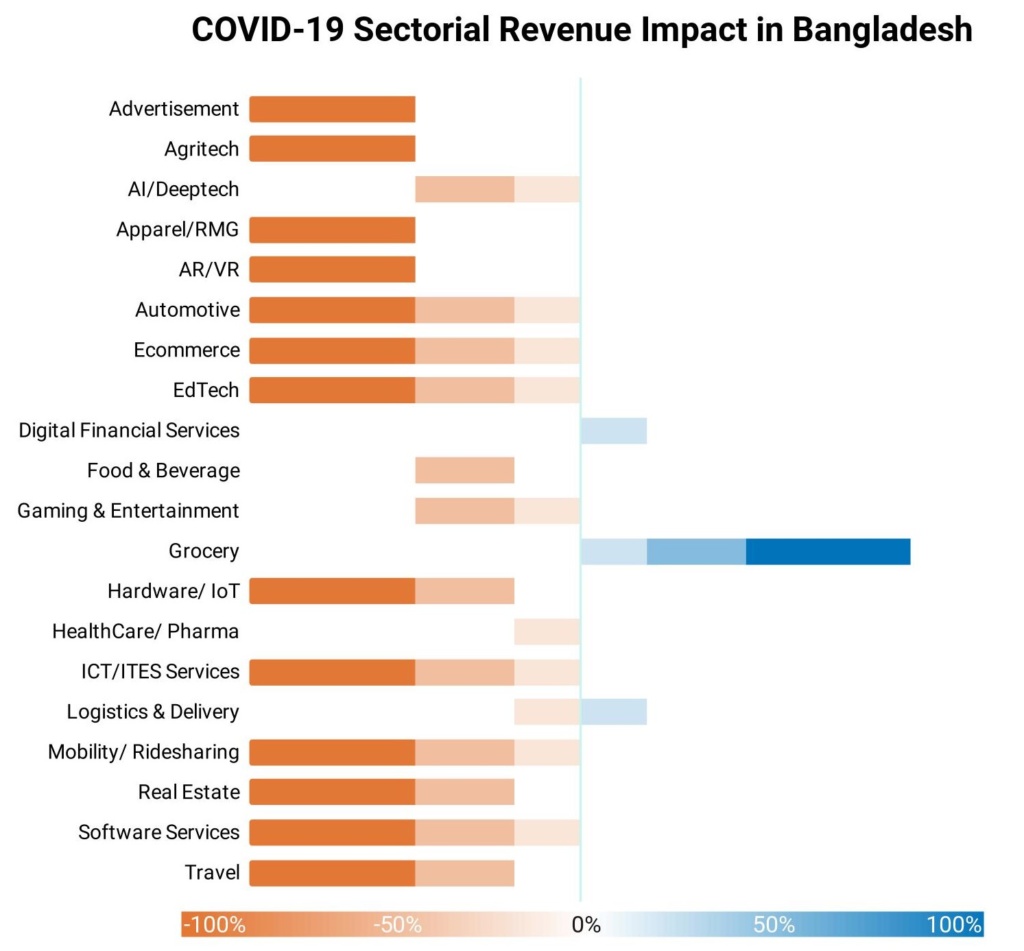

COVID-19 Impact: Since March 2020, the country and all its businesses and startups have been affected drastically by the COVID-19 disruption. 24% of companies reported to have stopped operations, with 56% of startups seen at least a 50% drop on revenue generation. 60% of Startups have runway less than three months threatening 1.5 million employment and an annual loss of over U$ 53 Million in 2020. The disruption, however, is also propelling accelerated adoption of digital services with Digital Financial Services, Logistics, and Grocery on-demand, EdTech, HealthTech seeing steep growth.

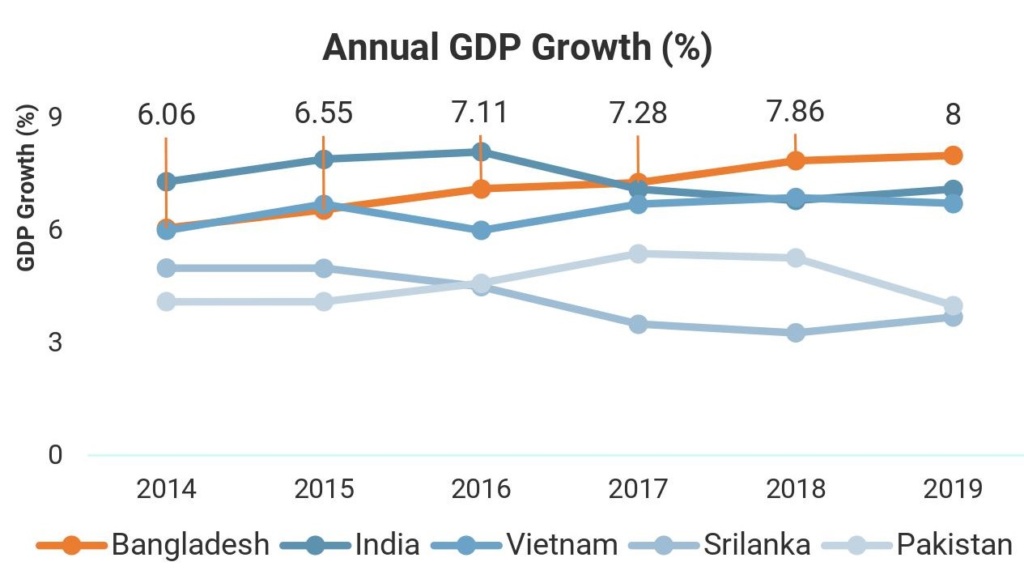

Bangladesh, the 39th largest economy and one of the fastest-growing countries, showed an impressive annual GDP growth rate of ~6.5% over the last decade. The country’s annual GDP growth rate officially surpassed that of India’s in 2016 and has been higher than that of its neighbor since then.

GDP per capita has been growing at rates over 5% since 2015 peaking at U$ 1,855 (as of 2019), which is almost equal to China in 2005. The final consumption expenditure, which accounts for private consumption and general government consumption, has been growing positively for the last 10 years.

The economy is on track in graduating from the LDC status in 2024 and has made impressive strides in human development. PwC, a global consultancy, also predicts Bangladesh to become the 28th largest economy in the world by 2030.

It dominates the global RMG market in 3rd position, right after China and Vietnam, earning U$ 34Bn (83% of total export earnings) as of 2019. Its ICT sector is booming, exporting U$ 800Mn worth of service across the globe.

The country has a population of 164 Mn and has reached 37% urbanization. Connectivity has reached its peak, with 98% mobile phone connection (161Mn) and 62% internet penetration (102Mn) and 57% mobile internet penetration (94Mn).

Bangladesh recorded an impressive annual GDP growth rate of 8.1% in 2019; the highest in the country’s history and in South Asia for 2019. The strong performance is attributable to a number of factors that have contributed to inclusive economic growth

According to The Bangladesh Bureau of Statistics (BBS), the country has a young population with a median age of ~28 years and 62% of the population below the age of 35.

The country also benefits from ‘density dividend’, as 164 Million population is nestled in a country with a land size similar to that of Michigan, USA.

Bangladesh’s rapidly growing economy has spawned an economic class of urbanites, who are upwardly mobile with a growing appetite for consumer spending. This Middle and Affluent Class (MAC) population is young, tech-savvy, and optimistic about their future, leading them to spend on living standard enhancing goods and services.

According to a study by The Boston Consulting Group (BCG) on Bangladesh’s surging MAC population, the projected MAC population stands at 19 Million as of 2020 and is projected to grow at 10% per annum to reach 34 Million by 2025.

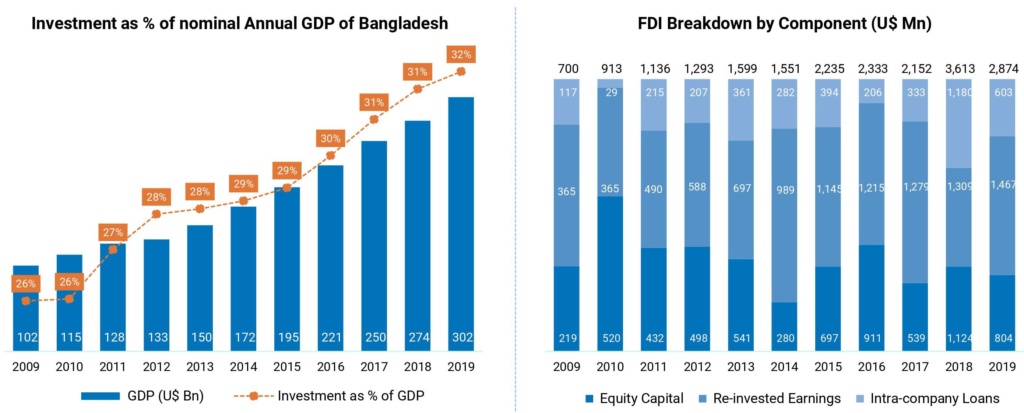

Alongside steady economic growth, the investment to GDP ratio of Bangladesh has grown to 32% (U$ 96Bn) in FY 2018-19 from 26% (U$ 26Bn) in 2009-10. Despite the excellent progress, the country’s Foreign Direct Investment (FDI) in CY 2019 stood at a mere 3% (U$ 2.87Bn) of the country’s total investment. With policymakers devising policies to attract FDIs, investments are expected to increase in the new decade.

The Bangladesh Entrepreneurship Ecosystem is at an inflection point with an excess of U$ 200 million in international investments from big-name corporate investors and venture capitals, investing in industries like FinTech, Logistics, and Mobility over the last four years. The emergence of active Angel Investment Networks, Impact Investing, host of local and international operating accelerators/ incubators propelled 1,000+ active Startups, generating 1.5 million+ employment – embracing products and services of Startups as part of the country’s everyday life. Additionally, B-SEC (Bangladesh Securities and Exchange Commission) has also approved small-cap stock exchange guidelines, which is a big step towards providing investors with Startup exits.

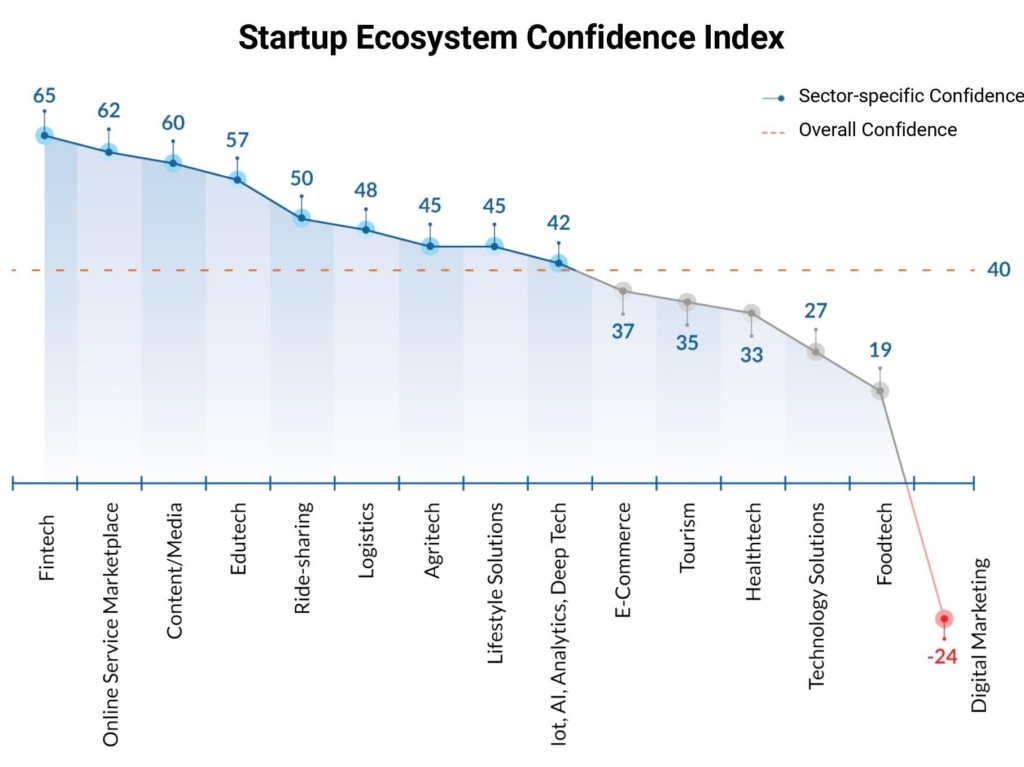

A survey source from 100+ startup founders and investors rated Fintech and Ride-sharing and Logistics as the most promising sectors.

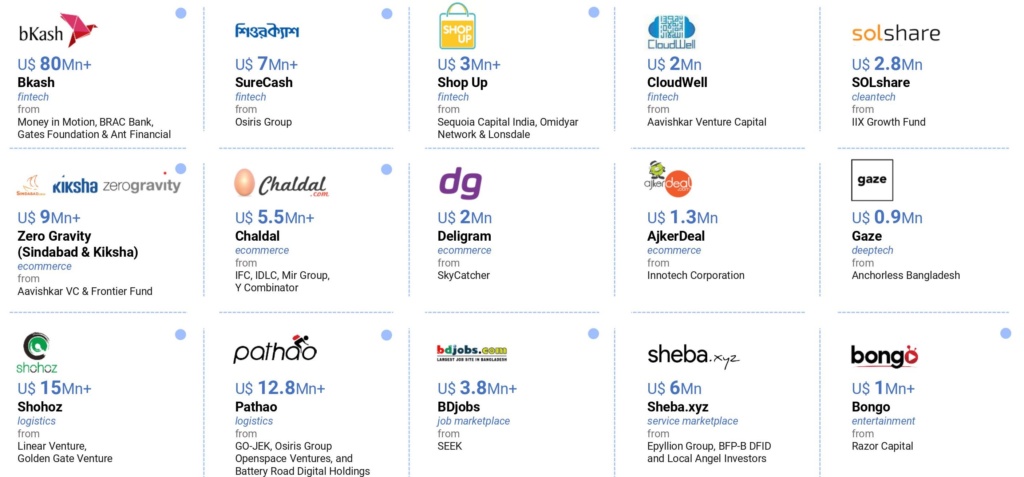

Online-enabled service marketplace platforms have captured the urban market significantly over the last 5 years. Players like Sheba.xyz, Smanager, Jantrik and Hellotask are formalizing the unstructured SME market and informal workers boosting financial inclusion.

eCommerce & fCommerce sector garners high confidence from investors. Startup players like ShopUp, Chaldal, eValy, Daraz and Sindabad

Meanwhile, digital marketing showed a drop in confidence, due to market saturation and thinning profit margin coupled with the latest TAX issuance.

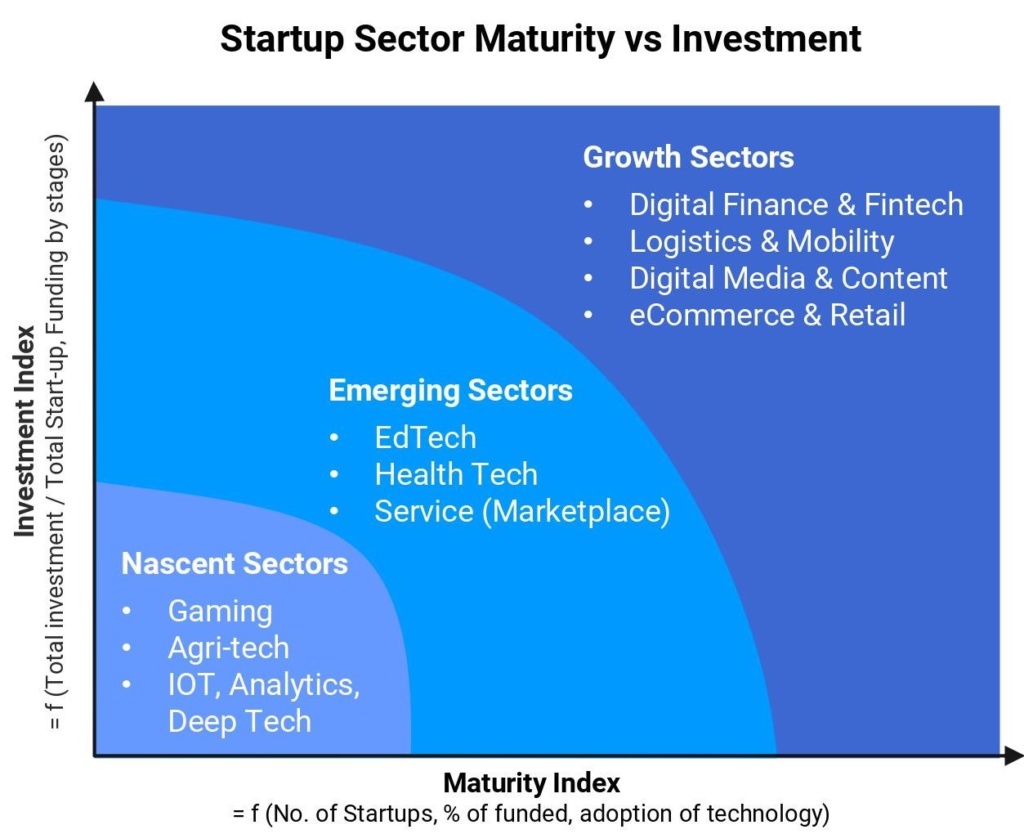

Growth Sectors: Sectors with large funded startup base with the highest adoption of deep-tech coupled with local & global investor attraction

Emerging Sectors: Sectors with medium funded startup base with relatively low-to-high adoption of technology and medium investor interest

Nascent Sectors: Sectors with small startup base with relatively low investor activity

Bangladesh in comparison to the global ecosystem ranks at 98, while its neighbor rushes quickly to the top spot, currently at 23.

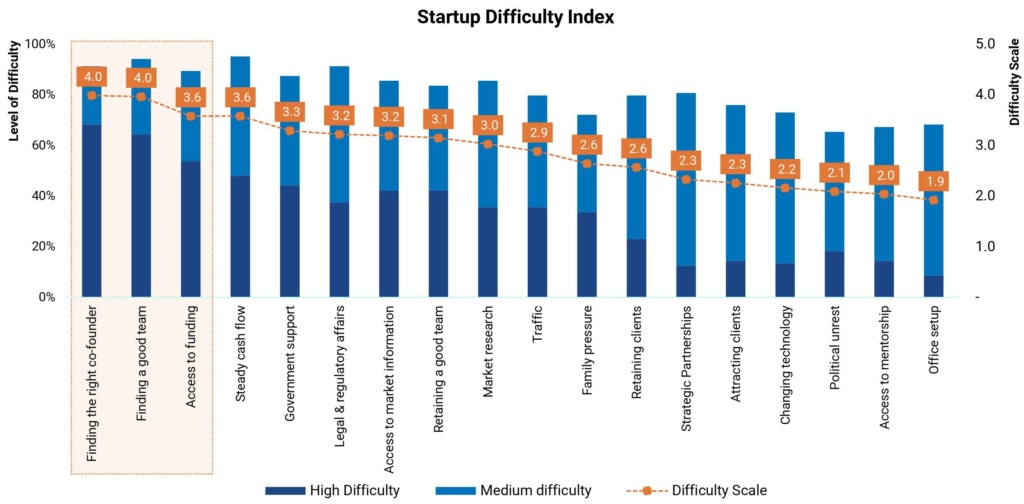

An internal survey on 100+ Startup company founders was carried out to understand what are the severe bottlenecks they are facing in operating a business in Bangladesh. The findings show the top three problems for the startup founders were related to either finding the right talent (co-founder and team- top 2 challenge each with a score of 4/5) and access to funding (3.6/5) followed by cash flow management (3.6/5), government support (3.3/5), and legal/regulatory affairs (3.2/5).

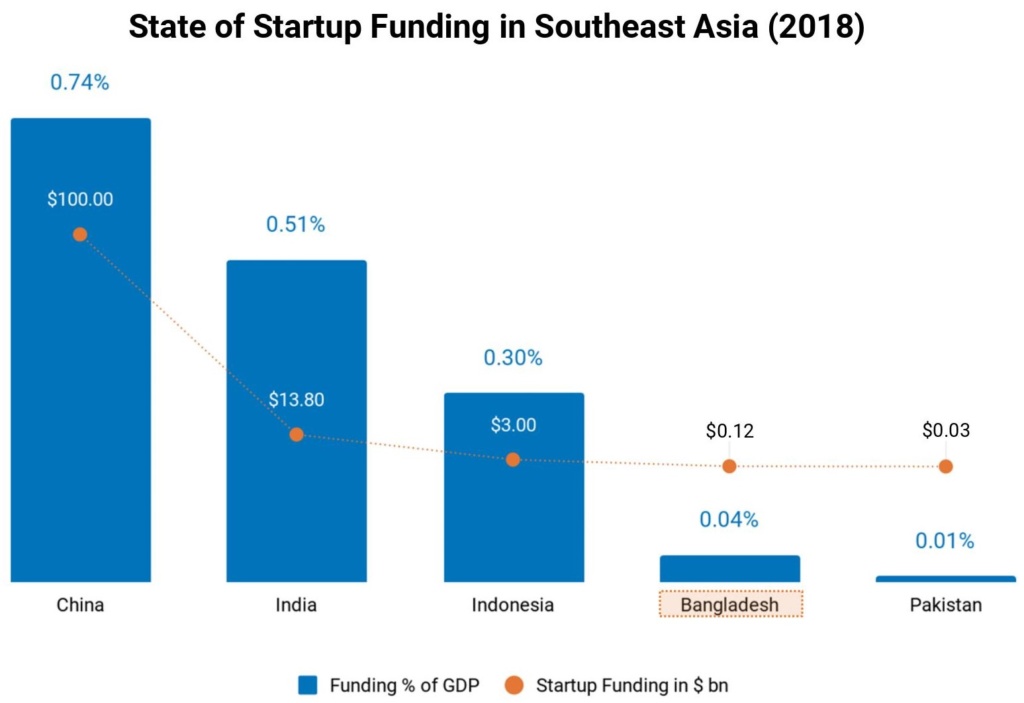

The already low Startup Funding State of Bangladesh (GDP 10x lower than India), (GDP 50x lower than China) – is at stake due to COVID-19

Due to pandemic recession kindled by COVID-19, number of startup investment deals worldwide per month have dropped by half (55%) since pre-COVID era (November 2019)

Grocery, Logistics, Digital Financial Services are the essential sectors that have seen a positive impact in business

To learn more insights, check out the slides here:

LightCastle Partners acknowledges the valuable contribution of the following notable personnel and organizations from the Bangladesh Startup Ecosystem to prepare this report.

Authors:

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights