GET IN TOUCH

- Please wait...

Tanwi Golder started her entrepreneurial journey at a very young age with a new idea of making vermicompost. The use of vermicompost was very new to the people in her locality. But the compost that she produced was highly potent because of this her business skyrocketed in the Khulna region. After experiencing tremendous growth, she now wants to transform her product “Jhorbhanga Vermicompost” into a brand. For that, she needs to work on several aspects starting from packaging and logo designing to promoting the product to the target market. But lack of capital emerges as the biggest threat to her entrepreneurial ambitions.

This situation of Tanwi Golder is the depiction of a quintessential MSME owner’s reality. In fact, the situation is not very different for startups as well. Getting funds is a challenge for early-stage startups that are playing an active role in creating impact. But we believe that we can combat these issues by applying the concept of blended finance.

Blended finance is essentially a mix of government/non-profit grants, equity investments, and loans put into a company. If sequenced rightly and at the right proportion this can create sustainable growth for the entrepreneurship ecosystem. It is defined differently by different people but primarily, blended finance has three main characteristics:

Blended finance is the future of development globally. It tackles the two main barriers that private investors face while investing in developing countries- a) high risk and b) poor return in comparison to the risk taken. The presence of public and philanthropic capital helps to de-risk the investment for private investors by improving the risk-return ratio. As a result, in addition to bringing in additional funds to the development sector, blended finance creates a sustainable growth for the entrepreneurship ecosystem.

While there is excitement around the potential of blended finance, these deals are difficult to structure. There are several guiding principles to consider while structuring such deals – rooted in development rationale, mobilizing private capital, accounting for the local context, effective partnering, and the effectiveness and transparency of the deal.

Considering all these challenges, LightCastle Partners has recently successfully applied blended finance in two projects: Biniyog Briddhi and Oxfam Impact Investment.

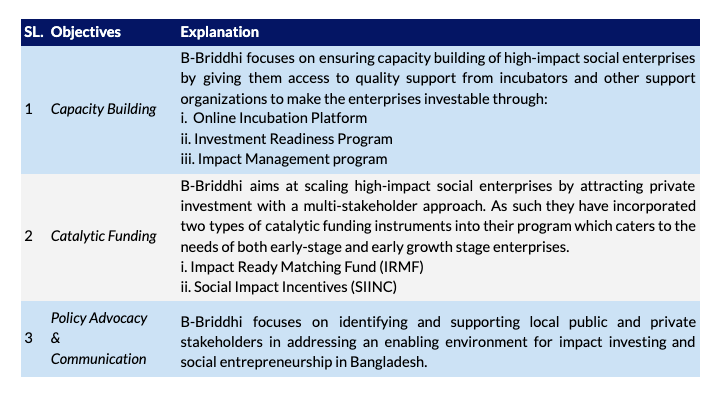

Biniyog Briddhi is a multi-year partnership between the Embassy of Switzerland in Bangladesh, Roots of Impact, LightCastle Partners, and other stakeholders including investors, private sector organizations, incubators, and support organizations for impact enterprises. This project stands on three pillars which signify the three core objectives of the B-Briddhi Project. These are- Capacity building, Catalytic Funding, and Policy Advocacy and Communication.

Catalytic Funding: B-Briddhi aims at scaling high-impact social enterprises by attracting private investment with a multi-stakeholder approach. As such they have incorporated two types of catalytic funding instruments into their program which cater to the needs of both early-stage and early growth-stage enterprises.

i. Impact Ready Matching Fund (IRMF): This is a conditional grant designed for early-stage enterprises to incentivize impact measurement practices in their enterprises and comes in parallel with a repayable investment from angel investors when they are investment-ready.

ii. Social Impact Incentives (SIINC): This instrument is designed for those social enterprises that have an earned revenue model but are not achieving their full potential or are not able to attract investors due to their low capacity to provide returns on investment. The investor in this case pays the social enterprises based on the social impact they generate through their operations.

In order to bring in qualified social enterprises to be a part of this program, the potential social enterprises have to undergo a meticulous filtering and selection process based on the selection criteria. The criteria include:

LightCastle Partners is working as an implementing partner for this project. As such, our roles entail the selection of the social enterprises according to the criteria, onboarding the SEs to the online incubation platforms, conducting online training sessions for the trainers, conducting workshops, etc. Once the startups are equipped with the knowledge and tools, we put them on the pathway to catalytic funding.

Through the use of the aforementioned catalytic funding instruments, we tried to remove one of the main barriers for early-stage impact enterprises which is access to finance. Through these funding opportunities, social enterprises can scale from early-stage to growth-stage enterprises and thus create a positive impact on the entrepreneurial ecosystem of Bangladesh.

Romoni is one of the successful enterprises to avail support from the B-Briddhi program’s Impact Ready Matching Fund (IRMF) scheme. Armin Zaman Khan, the Co-founder, and CEO of Romoni, started her journey with a simple motivation fueled by the problem of inaccessibility to credible beauty advisors or experts who could provide decent services at home and save time.

In addition, Romoni focuses on helping those providers improve their standards and access funds from financial institutions for supplies and growth. Even though the beauty sector of Bangladesh strives on the labor of skilled but unduly underpaid and unprivileged women, who are, oftentimes, disproportionately exploited by the system, simply because the industry lacks structure in terms of regulation and applied labor law. To address this issue, Romoni partners with financial institutions to bring these micro-entrepreneurs under the umbrella of financial inclusion. Through Romoni’s fintech platform, micro-entrepreneurs can begin to maintain a structured process of bookkeeping and reach out to financial institutions for help, such as opting for loans.

Currently, Romoni is working with over 300+ active female beauty service providers, of which 40% belong to the indigenous ethnic minority group.

The Oxfam “Empowering Youth for Work (EYW)” project was focused on creating an impact on the youth of rural Bangladesh. To implement this goal, EYW focused on four key aspects that needed to be ensured through this project- increased employment, reduced vulnerability to climatic risks, improved sexual and reproductive health rights, and increased influence and participation in decision-making.

As such, the project has looked for sectors that provide opportunities to reach large numbers of young people; have good economic prospects; and support climate-resilient practices and adaptation in the Khulna and Rajshahi divisions in Bangladesh. But in the process, the EYW project identified access to finance as the biggest challenge to the growth of SMEs.

Access to finance is the second most challenging aspect for SMEs, according to the World Bank as well. From the diagram above, we can see that for micro and small enterprises (SMEs) – the options are mostly leverage – microfinance which besides their high cost of funds also requires frequent payments (not necessarily matching the enterprises’ cash cycle) and often require investment in a savings scheme, agent banks also at the moment are more focused on deposit mobilization compared to disbursing credit. And here is the gap while early-stage enterprises/entrepreneurs require patient or risk capital which is also termed seed funding.

Besides, financial institutions consider a lot of SMEs unbankable due to inadequate revenue generation and high lending risk. Therefore, most of the time these SMEs do not get access to getting traditional financing. But we at LightCastle Partners believe that blended capital has a massive role to play in shrinking the gap.

So, we initiated a blended capital instrument with support from Oxfam Bangladesh in 2020 to address this challenge. It is a quasi-equity instrument and the goal of the fund is to promote equity/quasi-equity investments to micro-entrepreneurs, allowing them to access growth capital on convenient terms. Learn more about the project here.

The way the fund is designed to work is fairly simple. After a rigorous selection process, we identified and shortlisted 15 entrepreneurs, who would be eligible for the impact investment. Characteristics of this financing method are often similar to that of a flexible loan repayment schedule. However, quasi-equity is different from a traditional loan. The repayment of the investment is dependent upon the performance of the enterprise once the investment is made.

This form of investment will involve the enterprises entering into a revenue-sharing agreement with LightCastle for three years. Once they complete the three-year period, the enterprises will no longer have the obligation to continue sharing their revenue with the fund. If the enterprise fails to reach the expected performance benchmark in terms of revenue, the fund will receive a lower return. On the other hand, if the business is more profitable and is able to grow higher than expected, the fund will receive a greater financial return. Although the fund is eligible to receive greater financial returns, LightCastle has capped the return to not more than 1.5 times the initial investment.

To monitor the progress of the selected enterprises and to keep track of the revenues they generate after receiving the funds, we have given them access to the Soluta-ag app which works as a digital bookkeeping system for these enterprises. In addition, we have our on-field monitoring team who will audit the sales records of the enterprises.

By adopting the above-mentioned approach and using the quasi-equity instrument, we have strived to address two of the most prominent challenges that SMEs face while looking for funding opportunities through traditional methods: frequent repayment and high-interest rates.

Blended finance de-risks the investment opportunities for the private sector and divides the risk in a way that the private sector can come in, intervene and be efficient. It brings in more capital to the development sector. These kinds of financing can motivate a new generation of entrepreneurs who will be focusing on creating impact in addition to financial return. Looking at the potential of blended finance, it seems likely to grow in the coming years, transforming the future of the impact investment landscape in Bangladesh.

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights