GET IN TOUCH

- Please wait...

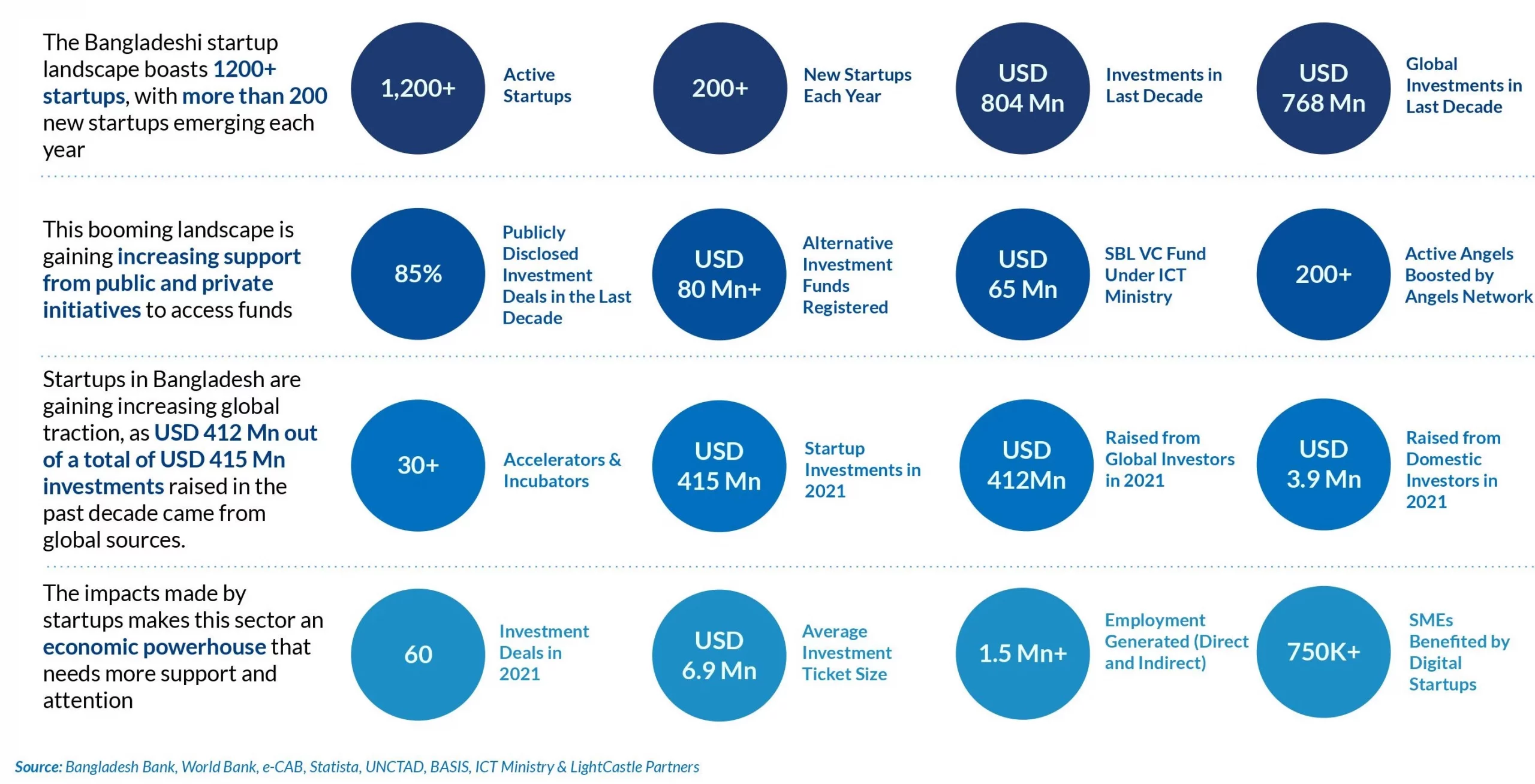

The trends in startups in Bangladesh indicate increasing levels of development in the ecosystem, with more than 200 new startups emerging across the country every year, supported by more than USD 80 Mn in registered alternative investment funds and more than 200 active angels. Startups have also become more and more crucial to the economy, supporting 1.5 Mn in employment as well as more than 750K SMEs.

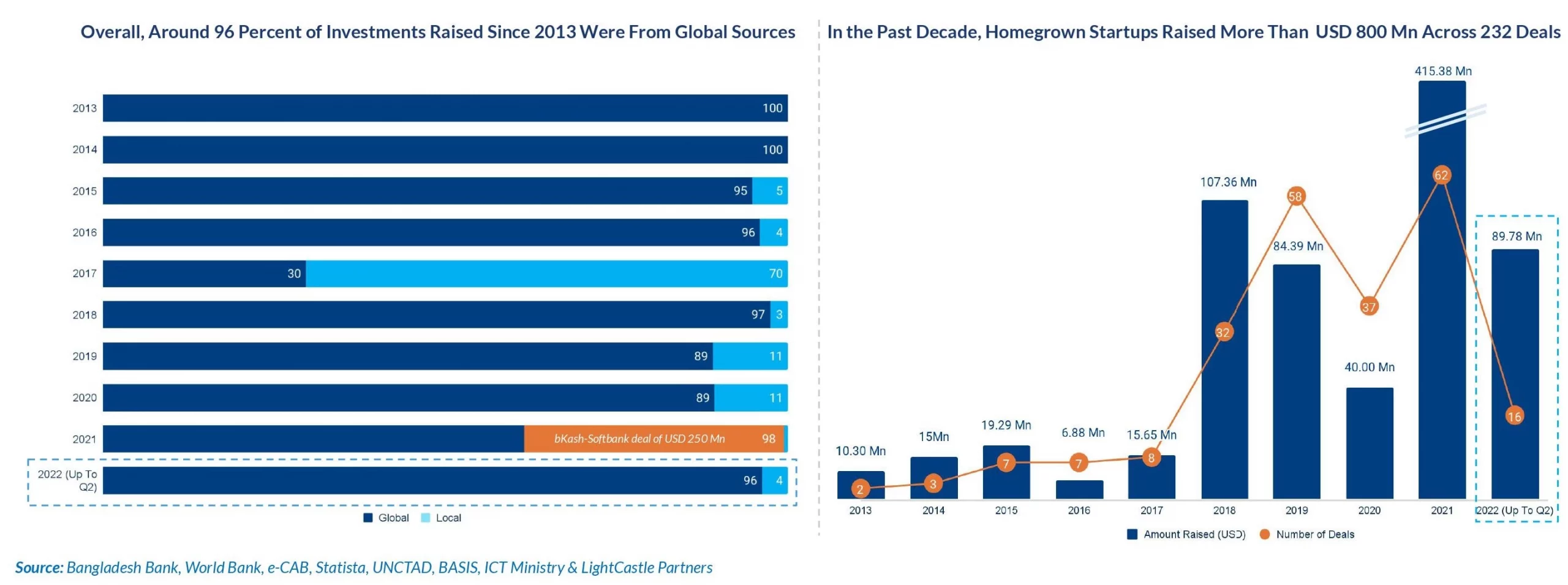

Over the last decade, the Bangladesh startup ecosystem saw a total investment of USD 804 Mn through 232 deals. In 2021 alone, nearly USD 415 Mn was raised in investments, including SoftBank’s capital injection of USD 250 Mn in bKash.

Since 2013, almost USD 36 Mn investments were raised locally across 101 deals, with an average ticket size of USD 354 K in pre-seed, seed, or pre-Series A rounds. Meanwhile, global investors, mainly VCs, invested USD 773 Mn across 132 deals. With a bigger risk appetite, the average ticket size is USD 3.99 Mn (excluding bKash) mostly put in Series A, B, or venture rounds.

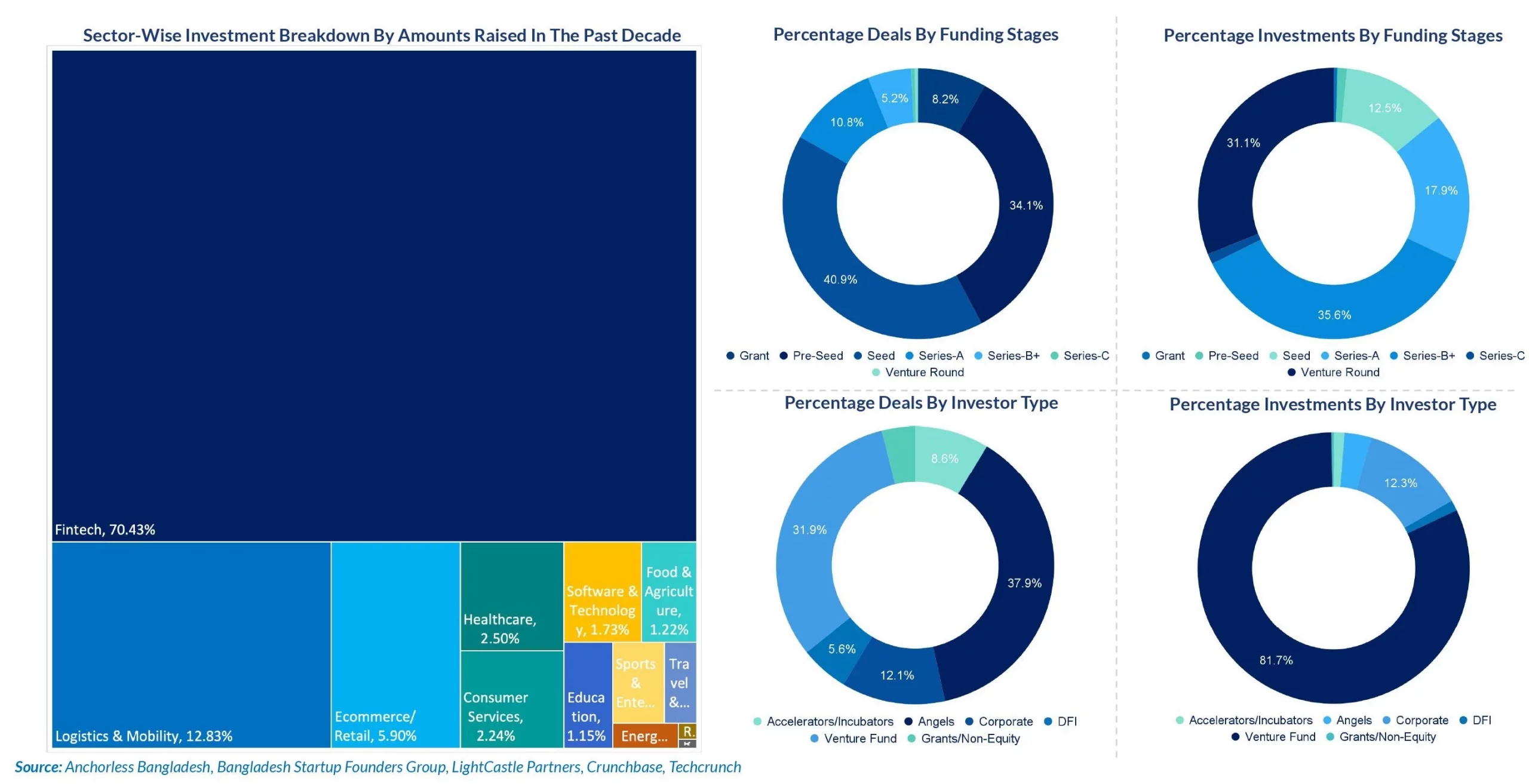

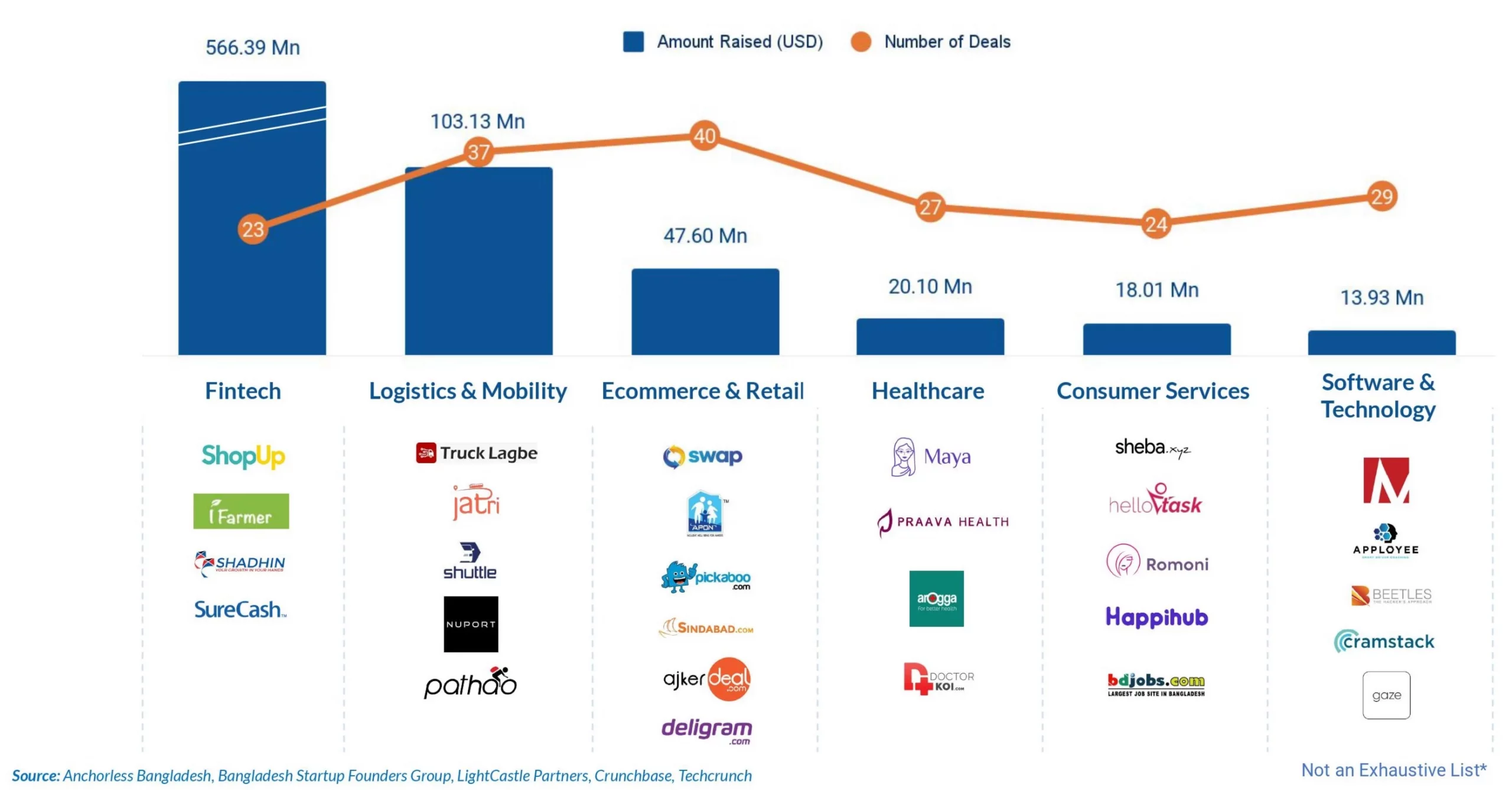

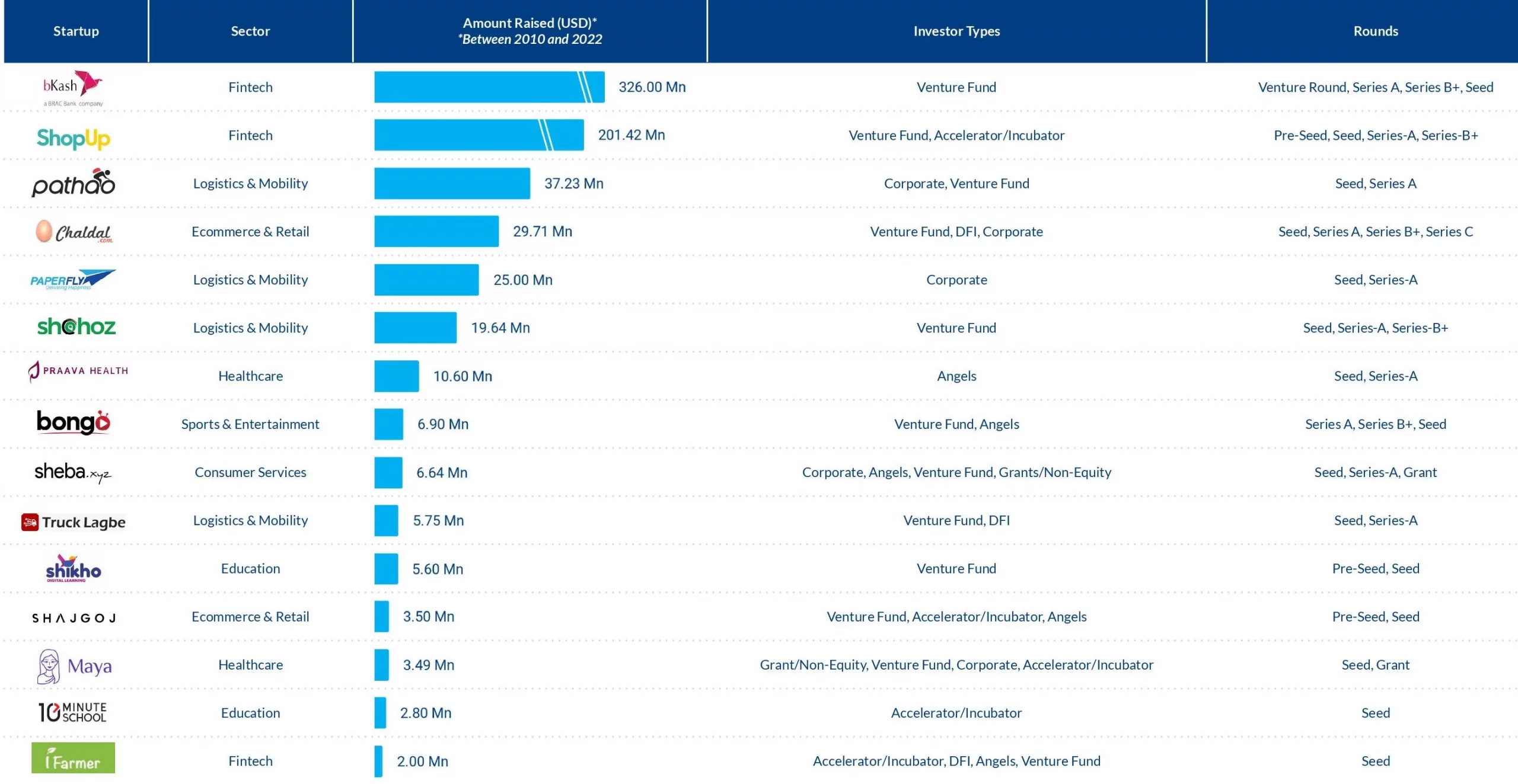

Following global trends of increasing traction towards fintech, fintech startups in Bangladesh grabbed the largest amount of investments in Bangladesh. Logistics and Mobility, Ecommerce and Retail, and Healthcare were the subsequent largest sectors in terms of startup investments.

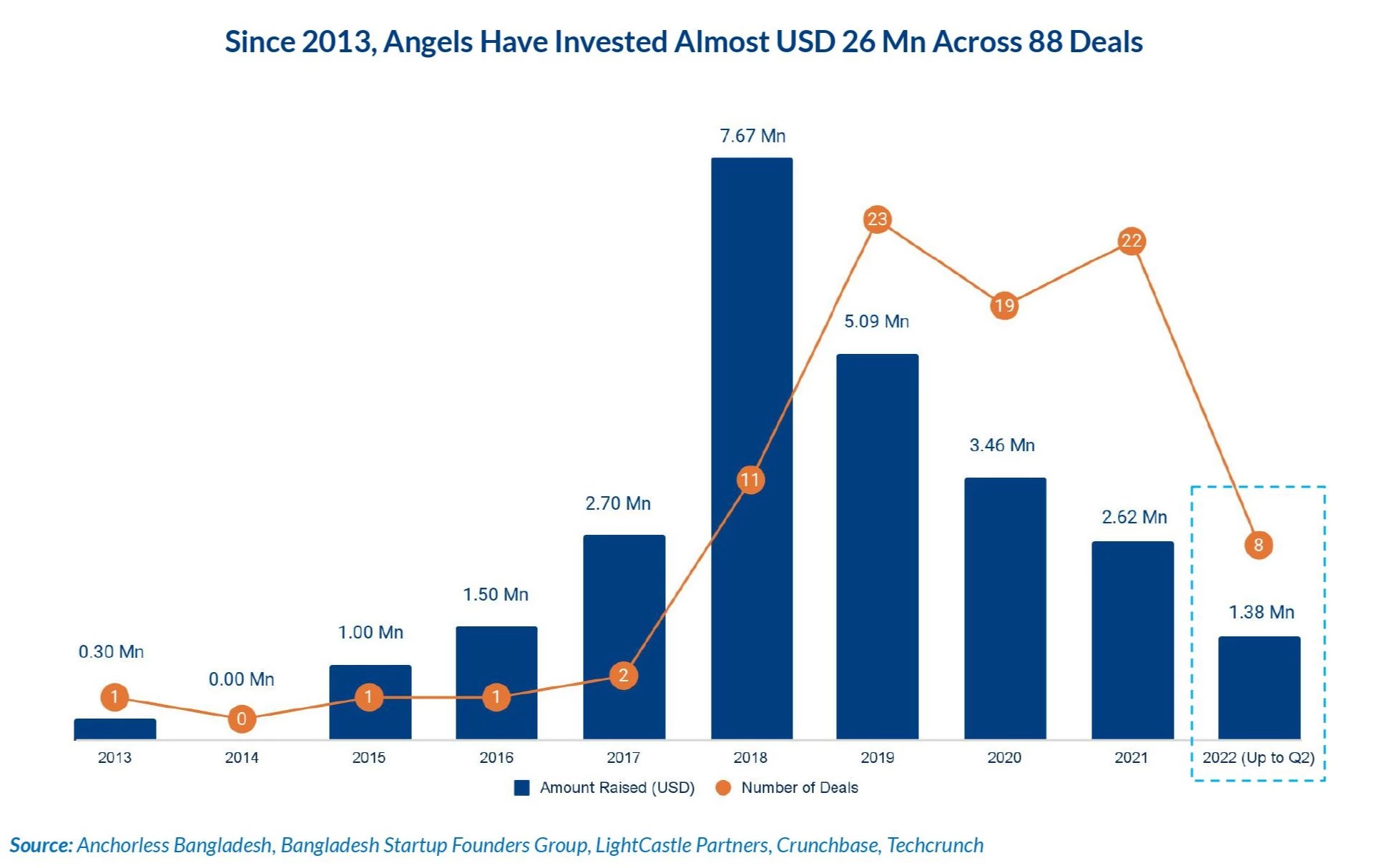

Pre-seed and seed stages received the most attention from investors, with angel investors making the most number of deals, throughout the past decade.

Fintech startups such as ShopUp, Shadhin, iFarmer, and SureCash raised more than USD 500 Mn in the past ten, making up 70 percent of the amount raised by the top 6 sectors.

The following table captures some of the largest deals since 2013.

As startups continue to grow to new heights, mergers and acquisitions mark key milestones in the startup landscape.

Over the past decade, angel investors have invested an average of USD 292 K in over 88 deals, with more than 95 percent of the deals being made in seed and pre-seed funding stages. Notable local angel investors include Bangladesh Angels Network, the largest angel network in Bangladesh, SBK Tech Ventures, BYLC Venture, GP Accelerator, and YY Ventures.

Key Highlights:

Sectors of Investment:

Rounds of Investment:

Biggest Deals:

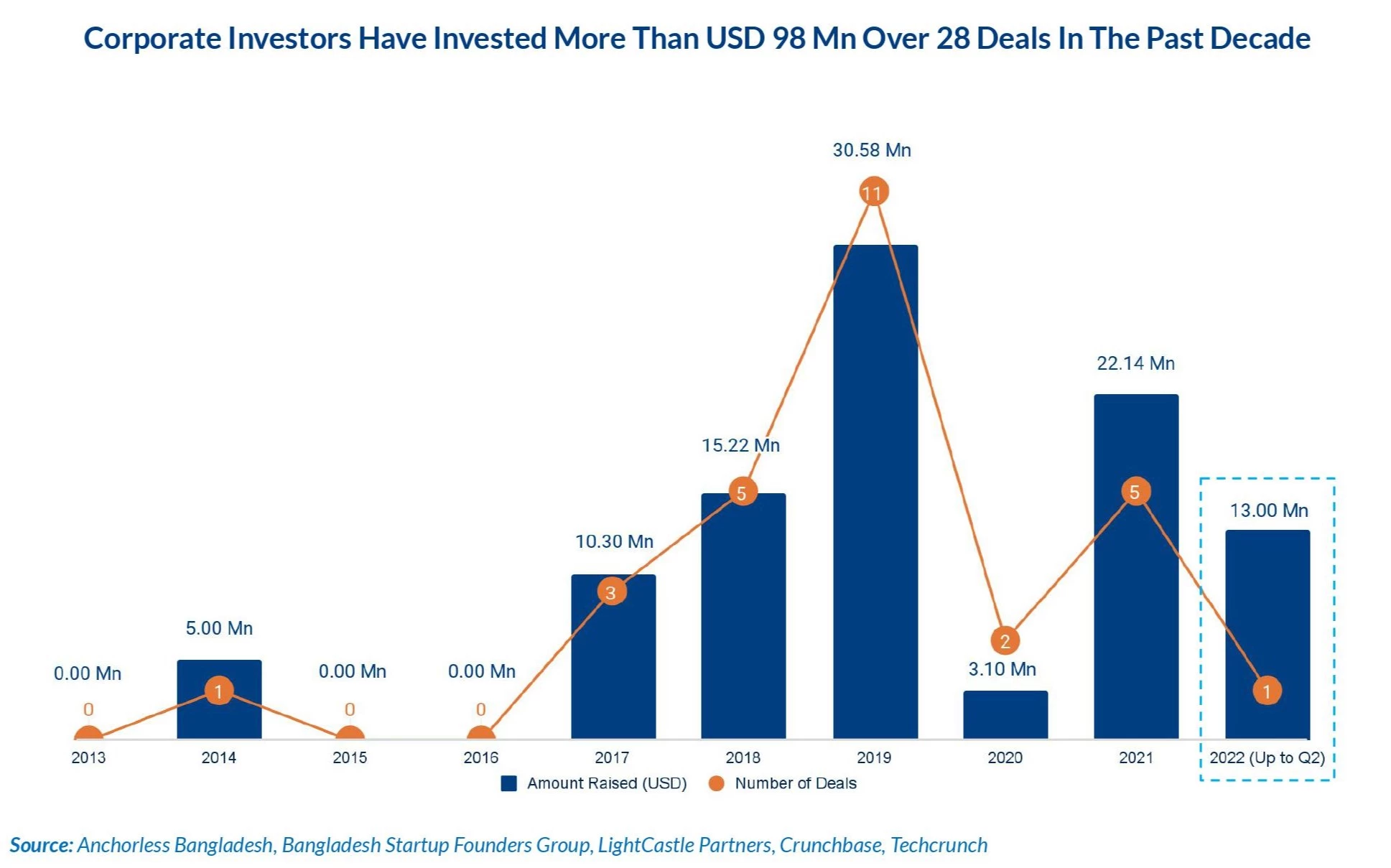

Corporate investors invested at an average ticket size of over USD 3.50 Mn across 28 deals, since 2013. The majority of these deals were in the series-A and seed stages of companies. These include investments from global sources such as Ecom Express, Go-Jek, and SEEK. Notable local investors include BRAC, ACI, and Robi.

Key Highlights:

Sectors of Investment:

Rounds of Investment:

Biggest Deals:

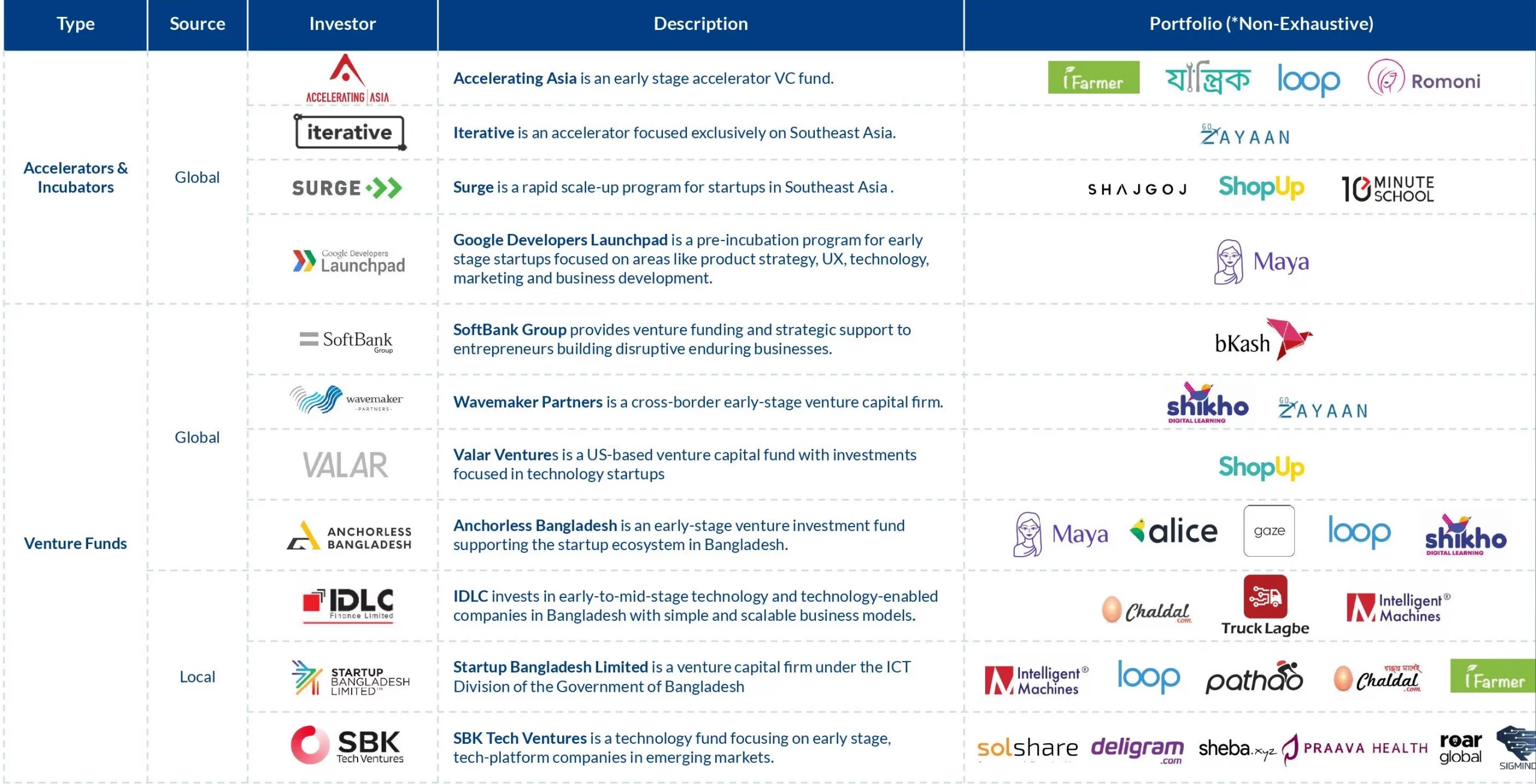

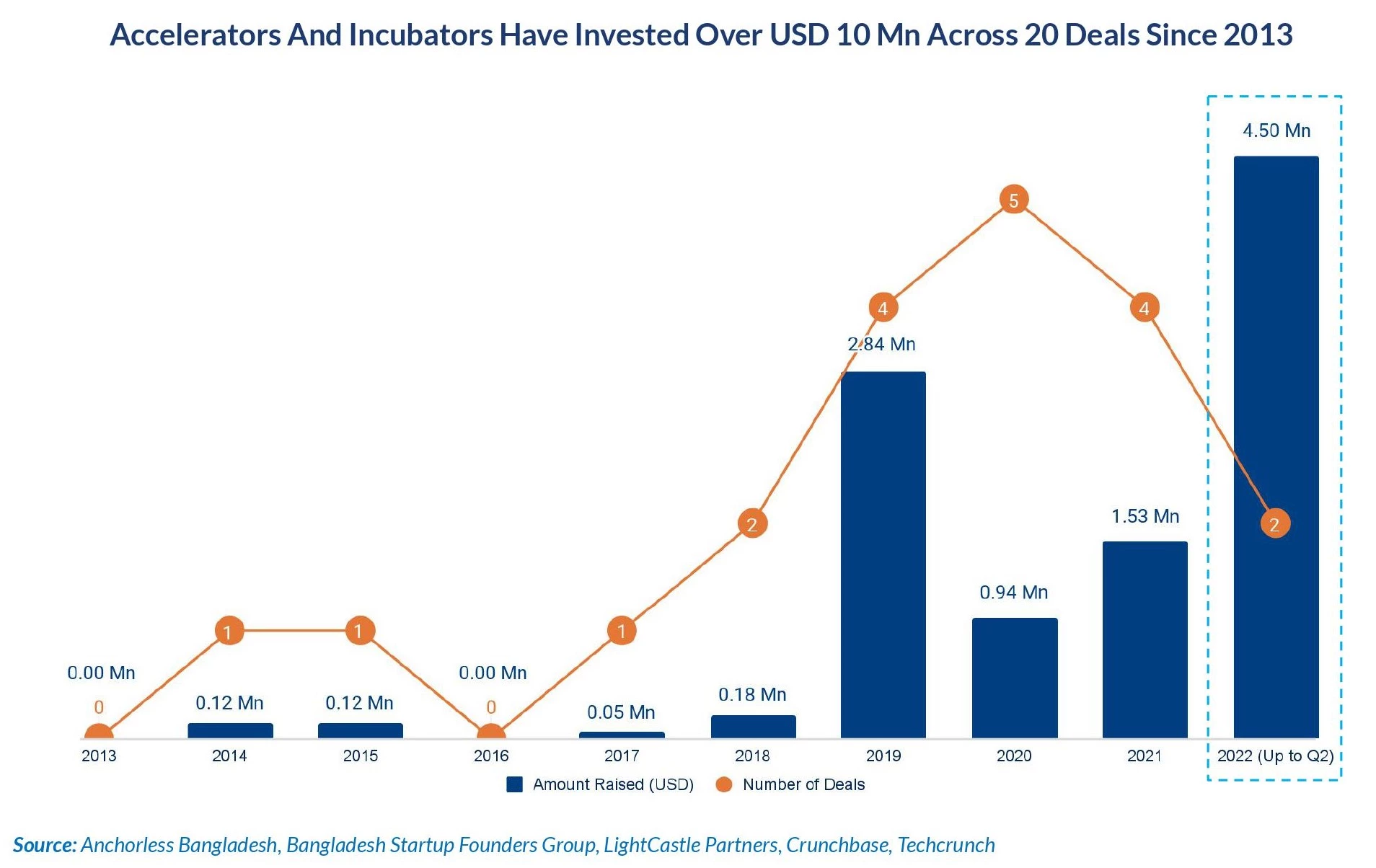

Investments from accelerators and incubators averaged more than USD 500 K, with 20 deals in the past ten years. All of these investments were in the seed stages of companies, with around 5 percent of total investments in the pre-seed rounds. Notable global investors include Surge, Accelerating Asia, and ODX Flexport.

Key Highlights:

Sectors of Investment:

Rounds of Investment:

Biggest Deals:

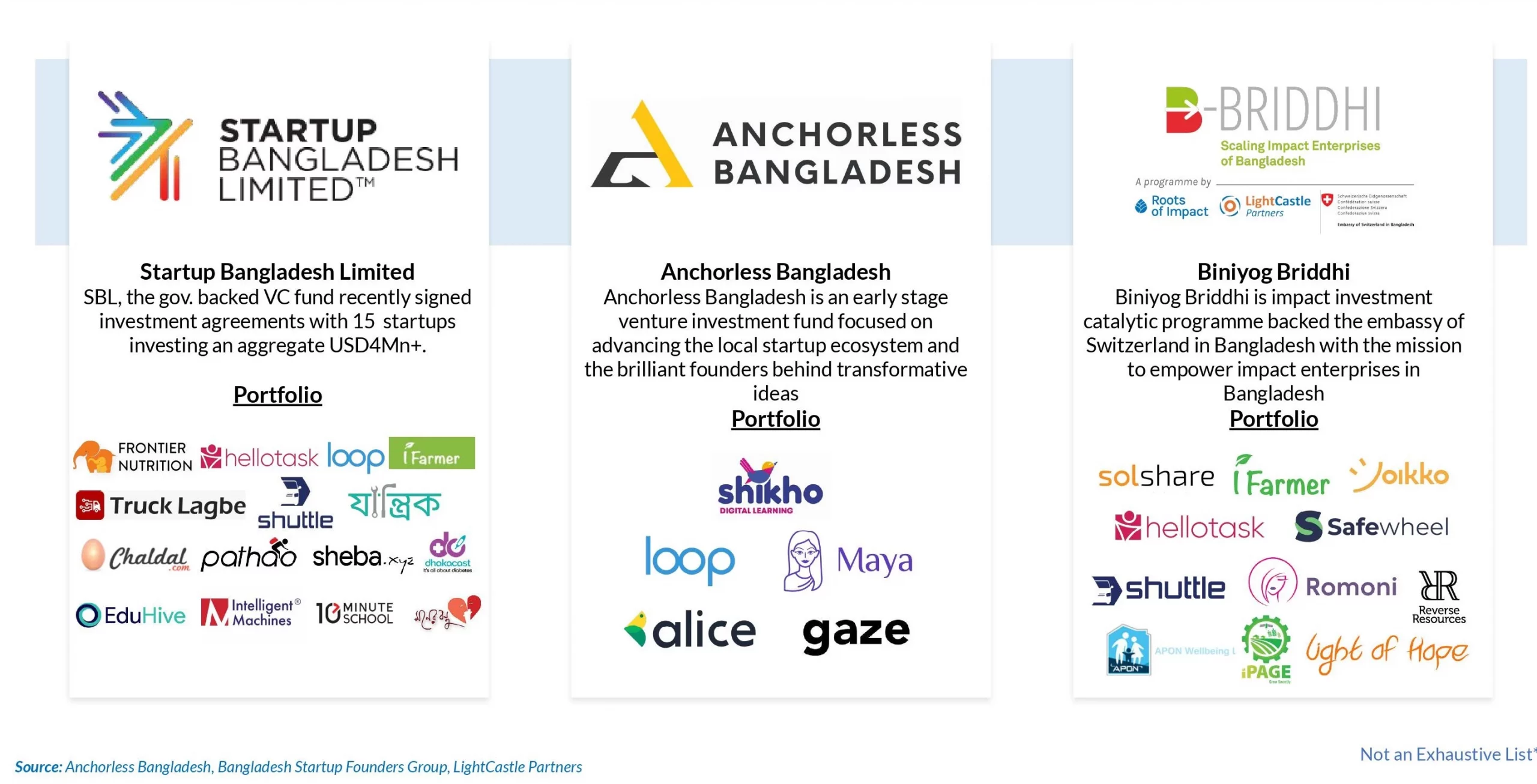

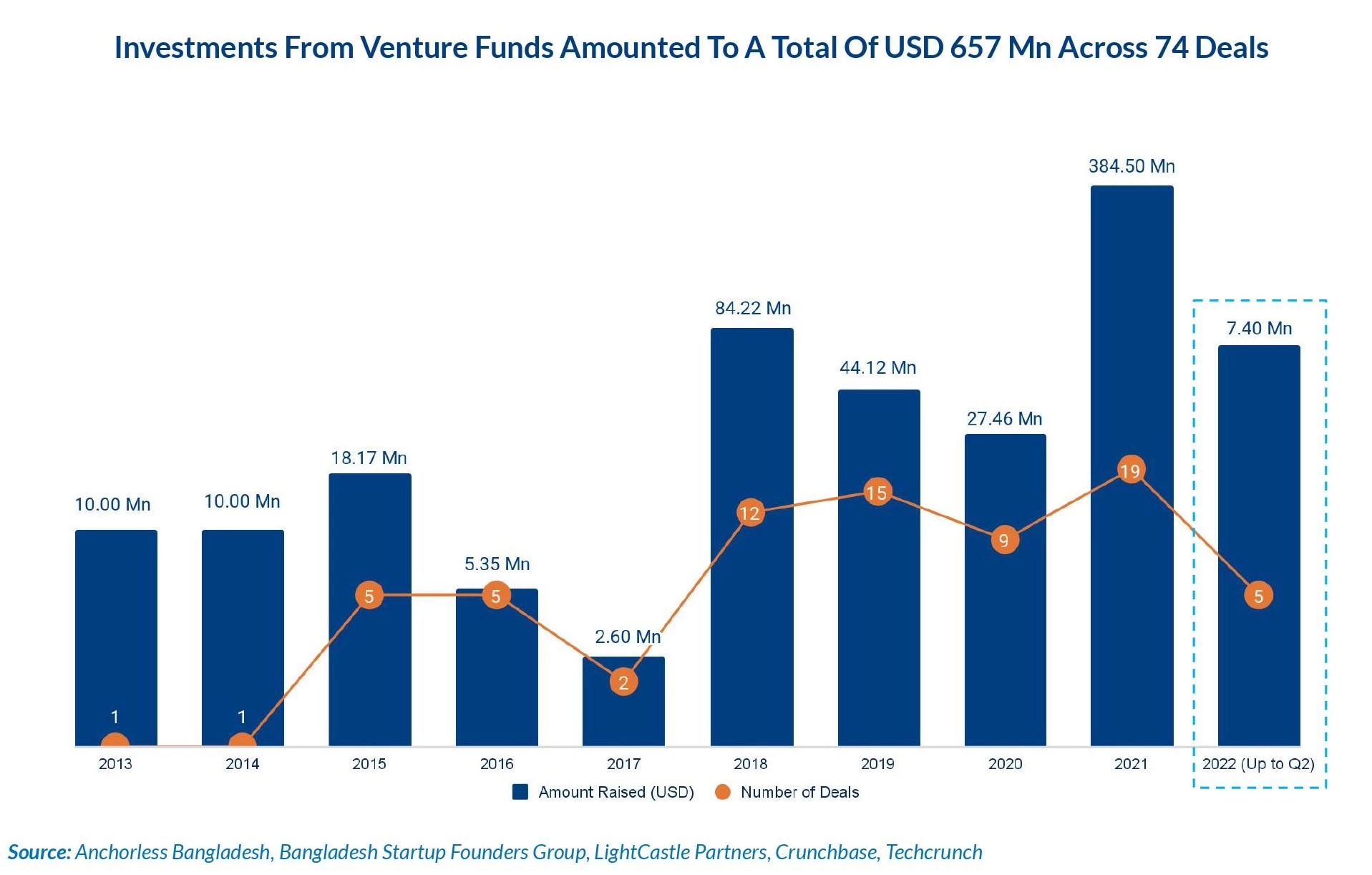

With an average ticket size of around USD 5.58 Mn (excluding the bKash-Softbank deal of USD 250 Mn in 2021), venture fund deals made up 74 of 231 deals since 2013. The majority of these deals were in Series-A and Series-B+ rounds. Notable investors include Anchorless Bangladesh, SBK Tech Ventures, Softbank, Valar Ventures, and Wavemaker Partners.

Key Highlights:

Sectors of Investment:

Rounds of Investment:

Biggest Deals:

Policy frameworks demonstrate a strong commitment from the government to support startups through ICT sector development strategies and policies, as well as government-led facilities for investments and accelerator and incubator programs. The government is also planning to incorporate coding for kids in the national curriculum to educate the next generation with coding knowledge to meet the job market demand

Cultural perceptions of youth entrepreneurship and freelancing are increasingly positive, with entrepreneurial and technology-based skills being integrated into educational curricula to boost interest. This is driving more and more youth into online freelancing jobs and entrepreneurial activities.

Phone manufacturing has grown into a massive industry in only five years, prior to which the market was entirely import-dependent. Bangladesh has also met the affordability target on internet prices set by the United Nations Broadband Commission for Sustainable Development in 2021.

Public sector initiatives such as Startup Bangladesh Limited as well as accelerator programs by private entities are enabling more effective access to financial resources for startups. Ecosystem builders and programs contribute to developing the budding startup ecosystem in Bangladesh and encourage collaborative efforts to boost access to resources and networks.

Social media platforms and B2B and B2C platforms provide more opportunities for entrepreneurs. NGO and government-led initiatives also ensure that market access is extended to rural and marginalized communities. Trends in digitization were catalyzed by the impacts of the COVID-19 pandemic and boosted the affordability of smartphones. This, combined with government efforts towards digitization under the banner of “Digital Bangladesh”, promoted greater access to technology which creates greater opportunities for startups to harness

Varying policies and regulations across ministries, combined with lengthy bureaucratic processes, hinder the ease of doing business for startups. Legal legislations and startup policies are still absent in Bangladesh, furthering difficulties for entrepreneurs.

Opportunities and support to develop entrepreneurship skills are still limited for young people, especially in rural and marginalized communities. A gap in the skills demanded in the market compared to the skills and training taught leads to a scarcity of competent labor. Weak infrastructure, especially for rural communities, and limited digital literacy limit businesses’ abilities to effectively harness technology to initiate startups.

Due to the risky nature of startups, banks and other financial institutions are usually reluctant to provide loans or offer loans at unfeasibly high costs. This is amplified by the insufficient number of angel investors available in the market. Furthermore, female entrepreneurs face a greater burden of this inaccessibility due to institutional and cultural constraints.

While the overall scale and availability of support for businesses is inadequate, there is also a disparity in the support available in Dhaka compared to the rest of the country.

Complex supply chains and value chains pose challenges for entrepreneurs, particularly in rural and marginalized areas. The absence of a single platform for business-related formalities as well as inadequate national statistical data stands as challenges for young entrepreneurs. Low FDI compared to peer countries as well as a low Ease of Doing Business rank holds the country back from being more business-friendly.

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights