GET IN TOUCH

- Please wait...

Despite significant socio-economic developments, Bangladesh still remains to have less than 1% of GDP allocation for the healthcare sector. While public spending increases at a rate slower than the growing demand, how can we attract more private funding into the Healthcare sector?

Bangladesh has made significant socio-economic developments in recent years, with a decrease in mortality rates and an increase in average life expectancy. The country’s healthcare sector has yet to reach its full potential, with widespread deficiencies that impact the population. According to WHO, Bangladesh is one of the ten countries with the lowest health expenditure. 11% of the country’s GDP is estimated to be spent on healthcare. In contrast, the national budget 2020-21 has an allocation of 5% for the healthcare sector, which is less than 1% of GDP.

This low expenditure on healthcare is not a new phenomenon. The sector has the potential to grow significantly through the implementation of reforms coupled with investment in technological innovation and public-private partnerships.

The key challenge of Bangladesh’s healthcare sector remains to be the lack of investment. Public spending on healthcare has been increasing, but at a slower rate than the population’s growing demand for services. Meanwhile, there is a dearth of private funding.

How can we propel further private sector investments into the healthcare sector? Can blended finance be the answer?

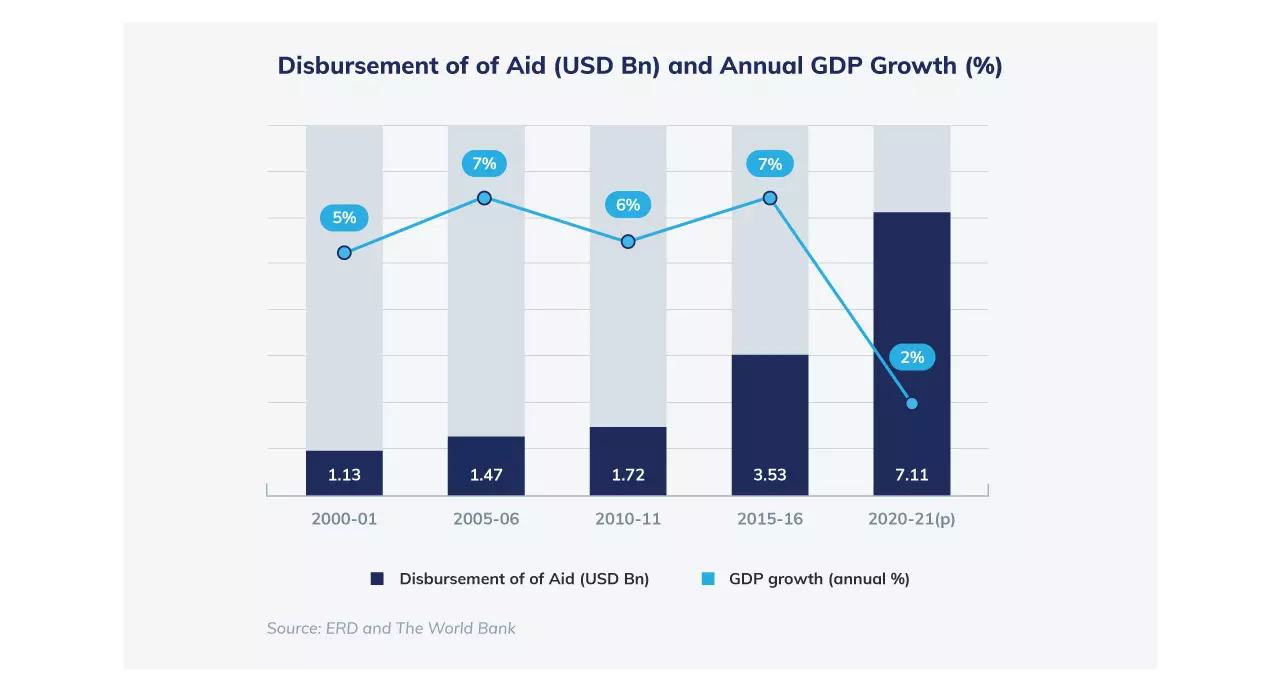

One of the most important ways that the Bangladesh government has helped reduce healthcare costs for its citizens is through donor funds. Over the last five decades, various development organizations, including the World Bank, the World Health Organization, the United States Agency for International Development, and others, have made substantial contributions to Bangladesh’s health sector by providing financial and technical assistance as the inflow of foreign aid grew 550% from US$1.13 Bn (FY01) to US$7.37 Bn (FY19-20).

These contributions have helped address the immediate challenges of providing affordable healthcare services to all population segments. At the same time, they have provided the capital and expertise needed to develop independent strategies for the sustainable improvement of health infrastructure across the country.

As Bangladesh progresses towards LDC graduation by 2026 – the country would possibly receive less Overseas Development Assistance (ODAs). Additionally, low-cost loans that Bangladesh enjoys from bilateral and multilateral development partners would also be substituted with more expensive capital as the shift from aid to trade happens. Hence to bridge the gap private sector investments must play a role.

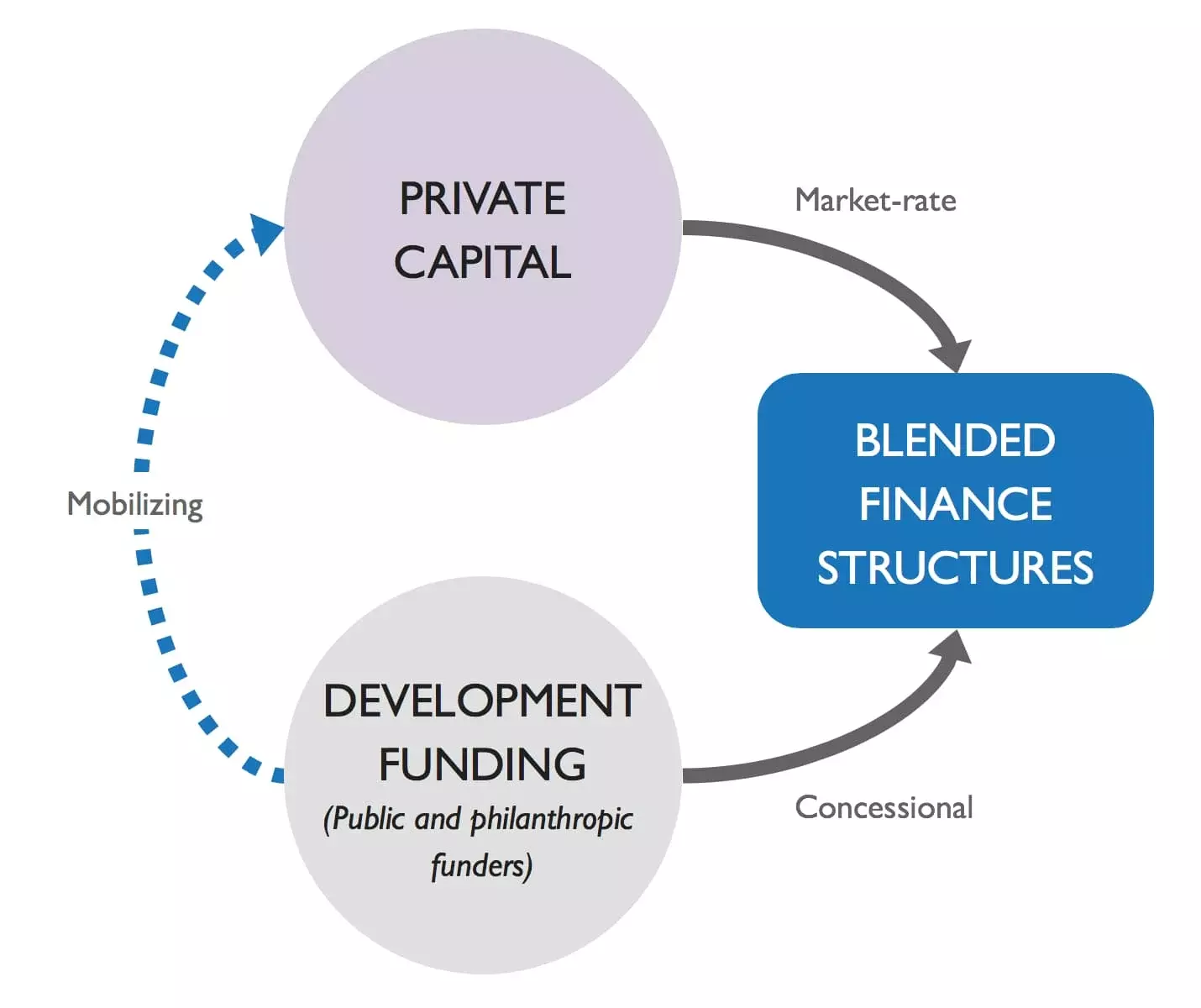

Blended finance is a relatively new concept that combines private sector capital with public funding to achieve development goals. The rationale behind blended finance is that it can reduce the risk of project failure and improve development initiatives’ overall efficiency and effectiveness.

In the healthcare sector, blended finance can be used to propel private sector healthcare service providers that have greater expertise, experience, or reach in delivering health services than the counterpart public sector. Thus, it can play an essential role in improving health outcomes and addressing emerging health issues in Bangladesh.

Key reasons why blended finance can be beneficial to healthcare service providers:

Mobilizing blended finance in the healthcare sector brings its challenges. For example, it can be difficult to identify and assess the appropriate mix of private and public funds. In addition, it can be politically challenging to mobilize adequate funding from both the public and private sectors.

In Bangladesh, there are several avenues through which the government could seek the support of private sector investors in promoting blended finance in the health sector. These include establishing a public-private partnership in healthcare management, implementing a program to reward private healthcare providers for promoting public health, and developing partnerships with multilateral organizations to coordinate efforts to improve healthcare infrastructure.

Catalytic capital from public or philanthropic foundations will help increase private sector investment in developing countries like Bangladesh to grasp the SDGs. Such philanthropic initiatives include ‘Mission Save Bangladesh’ and Bangladesh Cancer Aid Trust (BANCAT). Some notable blended finance and impact-oriented fund cases are as below.

| Program | Impact Focus | Implementation/ Donor | Launched | Impact Traction |

|---|---|---|---|---|

| Biniyog Briddhi an impact investment-focused PDPP programme | Employment generation, rural and gender empowerment | Embassy of Switzerland in BangladeshLightCastle PartnersRoots of Impact | 2020 | Disbursed US$1Mn Impact-matching finance commitments to impact enterprises Mobilized US$200K matching investments from the private sector |

| Truvalu Enterprises; prominent advisory partner active in Bangladesh | Agriculture, Gender, and Rural Empowerment | Truvalu Global | 2018 | Created 312 jobs, of which 43% are females, 77% are youth. Impacted 10,000+ smallholder farmers with 36% female participation and 50% youth involvement. |

| BRAC OSIRIS Impact Fund; Impact Investment Fund | Education, Healthcare, Digital Economy | BRACOSIRIS | 2022 | $140Mn fund allocated to accelerate market-based development approach |

| BFP-B; A challenge fund backed by the UKAID | Financial inclusion | UKAIDBangladesh BankNathan Associates | 2015-2019 | Managed 36 interventions through challenge fund, providing financial services to 180,000 MSMEs, among which 88,150 are new inclusion in the formal financial sector |

| Syngenta Foundation for Sustainable Agriculture; Development foundation in the agriculture sector | Agriculture, Rural Empowerment, Digital Technology | Syngenta Ag | 2001 | In Bangladesh, SFSA increased 25% yield of 350,000+ smallholder farmers connected through 350+ farmers’ hubs30% female concentration$182+ household income increase |

| LCP: Oxfam – Blended Capital; Quasi-equity- based impact investment fund | Agriculture, Rural Empowerment, | OxfamLightCastle Partners | 2021 | Invested US$20K+ in 15 SMEs through revenue sharing model |

Given Bangladesh’s move to middle-income status, and the funding gap created by a reduction in aid from international agencies, innovative financing mechanisms are critical to continue Bangladesh’s current impressive trajectory on development goals. It is also vital to identify important sectors where blended finance might be most effective and have the most significant impact in spurring sectoral growth, including the healthcare sector.

In addition to sustainable development solutions, donors and implementers are looking forward to a new alternative green trend known as impact investment. Given Bangladesh’s upcoming LDC status graduation, it will be crucial for the businesses and stakeholders to jointly contribute to achieving the SDGs by 2030 with the Government of Bangladesh and look beyond the traditional profit maximization methods.

Impact investments generate promising financial returns coupled with quantifiable positive social and environmental impacts. This moderately new industry is evolving in Bangladesh, addressing the most persistent challenges of the country by supporting sectors such as sustainable agriculture, microfinance, and affordable and accessible essential services, including housing, healthcare, and education.

Nevertheless, alternative financing structures still remain very new to the market. For this reason, they are not yet well understood by many practitioners, entailing less clarity about their tax, accounting, and legal merits than traditional methods.

The Health Finance Coalition mobilized a US$19.7Mn loan guarantee facility unlocking US$35.5Mn in emergency loans for 1,600 small and medium enterprise (SME) healthcare providers in Ghana, Kenya, Nigeria, Tanzania, and Uganda through the Medical Credit Fund. More than 5.1 million patients have benefited from this initiative, with 56% of patients reaching being in the low, or very low-income segment.

Blended finance can be a positive tool for creating investment opportunities and promoting tri-sector collaboration between public, private, and development organizations towards scaling impact for development. A couple of recommendations include:

Traditionally, most healthcare financing relies on debt financing, which is highly leveraged and generally consists of long-term loans with high-interest rates. By contrast, equity financing is typically used to support startups and ventures with little or no track record. While both forms of financing have their advantages and disadvantages, blended finance represents a more flexible option that provides borrowers with both debt and equity funding so they can combine the benefits of the two approaches.

Although an enormous funding gap still exists towards fulfilling the gap in SDG financing, there is growing momentum for blended finance, and positive signals are being received from the capital markets for greater adoption. Blended finance can be an essential tool for healthcare providers looking to expand their operations and support the development of new and innovative medical treatments and technologies in Bangladesh.

Mehad ul Haque serves as a Project Manager @ LightCastle Partners as well as the Country Coordinator @ Biniyog Briddhi. He looks upon business development, projects, and research related to startups, entrepreneurship, and investment advisory. During leisure, he enjoys occasional traveling and unraveling startup financials and business models.

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights