GET IN TOUCH

- Please wait...

The apparel sector of Bangladesh started its journey in the late 1980s and gradually became the backbone of the country’s economic success story. Over the past decades, the industry has rigorously contributed to export earnings, foreign exchange earnings, employment creation, poverty alleviation, and women’s empowerment. While the phase-out of the export-quota system from the beginning of 2005 has fuelled the competitiveness of the Bangladesh apparel industry as a top priority, the abundance of low-cost labor bolstered the industry’s growth. Subsequently, the sector’s rapid growth and modernization over the past decade, along with the strides it has made in exemplary working conditions for the country’s approximately four million garment workers, has resulted in the sector being the second-largest apparel exporter in the world.

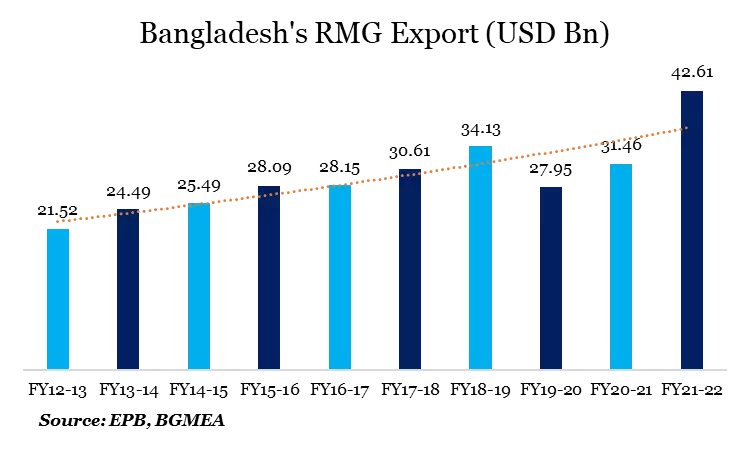

According to the Export Promotion Bureau of Bangladesh, the apparel sector accounted for 68 percent of the country’s total exports in the fiscal year 1997-97, which stood at 82 percent in the last fiscal year.

Furthermore, Bangladesh’s second leading apparel export destination, the USA market, registered 53 percent Y-o-Y growth in the first nine months of the fiscal year 2021-22. In the same period, the country’s apparel exports to the non-traditional markets (all countries excluding EU, USA, UK, and Canada) increased to USD 4.78 Bn from USD 3.84 Bn the previous year. [1]

However, Bangladesh’s apparel export basket has always been concentrated and unexplored in terms of product, fiber, and market destination through this remarkable journey. Following the Multi Fiber Agreement quota phase-out, Bangladesh mainly focused on a volume-driven growth strategy resulting in limited product diversification. While Vietnam, its closest competitor, exports ten types of products to a single market, the US, Bangladesh’s product basket mostly consists of five items: men’s and women’s t-shirts, trousers, shirts, jackets, and sweaters.

Moreover, owing to the increase in prices of raw materials on the global market and worldwide supply chain disruptions, value addition in Bangladesh’s apparel products in the FY 2021-22, dropped to a record low of 54.37 percent.[2]

The pandemic proved to be a presage for the downfall of Bangladesh’s apparel industry as exports dropped almost 18 percent in FY 2019-20. Factories were shut for almost 2-3 months as exporters faced order cancellations and payment delays. Reopening factories also proved challenging for owners as they had to comply with stringent health protocols. Moreover, while the Bangladeshi manufacturers were forming contingency plans to resolve the crisis following the first wave, Europe and North American markets were still overcoming the blow of the pandemic with unsold clothes in the warehouses, valued at USD 169-192 Bn.

However, quickly following the global economic lockdown, proving its tenacity, resilience, and ingenuity, Bangladesh exported apparel worth USD 3.8 Bn in December 2021, making the total apparel export value USD 2.5 Bn higher than the previous record of USD 33.07 Bn, which was set in 2019.[3]

Additionally, the US-China tug of war was a major reason behind the increase in Bangladesh’s apparel exports to the US in recent months. China’s declaration of a weekly three-day closure of manufacturing plants in an immediate attempt to reduce carbon emissions poses a major setback for the world’s largest apparel-exporting country. Moreover, China is also gradually shifting its focus from apparel to high-tech industries, having steadily accounted for declining shares in the world’s total apparel exports since 2015.

However, being an LDC, approximately 80 percent of the apparel exports from Bangladesh enjoy preferential treatment and incentives from the EU (under the EBA initiative), Canada, Japan, and the US under their respective GSP schemes. Subject to the country’s graduation to a middle-income country, Bangladesh will be the only country among the top apparel manufacturers to lose out on preferential agreements with the EU. In contrast, countries like China, Vietnam, Indonesia, India, and Cambodia’s tariff regimes will remain unchanged.

To cushion the upcoming economic vulnerability of Bangladesh, experts suggest the government engage with the European Union for Extended EBA (Everything but Arms) negotiation for at least 7-10 years.[4] The extension of the EBA will buy Bangladesh enough time to adjust itself to the upcoming economic position. Furthermore, the country needs to develop stronger diplomatic relations with major export markets such as the US to maintain an enabling environment to continue pre-graduation trades.

Additionally, with graduation, the country will have to follow the ‘double transformation’ rules of origin to become eligible for the GSP+ benefit. That is, for Bangladesh to get DFQF access to markets, the country will have to convert fibers into fabrics and then fabrics into apparel.[5] In March 2022, BGMEA signed an MOU with the American Apparel and Footwear Association (AAFA) to reinstate the GSP status for local merchandise in the American market.

The global apparel industry has been flourishing following a cost-saving model. Owing to the industry’s labor-intensive nature, countries with high populations and relatively lower production costs could achieve cost-competitiveness in the global market, hence Bangladesh’s positioning in the global apparel market. However, over the past decades, there has been a substantial shift in the consumer market, resulting in a change in the sourcing model for the industry.

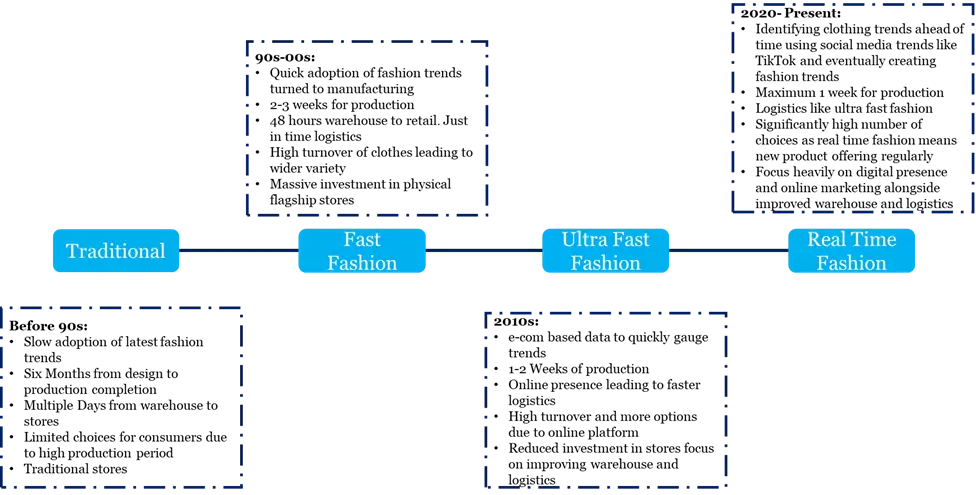

The global apparel industry has gradually transitioned from a cost-based model to cater to a trend termed “fast fashion.” To elaborate, fast fashion refers to inexpensive and trendy apparel made and sold in the market within record times. The concept of fast fashion has been to design, manufacture, and produce high volumes of clothing at a faster pace, replicating any ongoing trend and constantly updating the shelves of retail stores. The financial success of the fast fashion business model has been attributed to its speedy process and the customers’ desire to associate with the ongoing fashion trends.

While previously, the traditional apparel manufacturing process was produced on a seasonal basis. In contrast to fast fashion, seasonal clothing takes about a year to go from a concept to the hands of a customer. It takes about 6 to 8 months to conceptualize a design and prepare the clothing articles for production. Then, it takes another 2 to 3 months for the finished clothing to reach the hands of a customer. This 1-year lead time is inefficient for meeting the ongoing consumer demand, as fast fashion requires trendy clothes to reach customers within weeks. Hence, cost-efficiency is not the only requirement anymore. Faster production and shorter lead time are needed to stay competitive. Digitization and automation are crucial for the ready-made garments industry to keep up with the pace of the market.

Change from a cost-based model to fast fashion has fueled the concept of near-shoring in the west. While earlier fashion giants such as H&M, Zara, and Topshop would release new clothing lines every season, now they are being introduced every other week. According to a study conducted by Business Wire in 2021, the global fast fashion market is expected to reach USD 39.84 Bn by 2025 from USD 25.09 Bn market size in 2020 with a CAGR of 7 percent.[6]

In addition to the uprise in demands for shorter lead time in production, the global pandemic outbreak emphasized the increasing necessity for nearshoring the manufacturing hubs since frequent shutdowns and congestion of ports and harbors, shortages in vessels and containers, and sea and air freight capacity was witnessed. These supply chain disruptions caused massive pressure and financial loss across all value chain actors.

Furthermore, global apparel companies are introducing automation in almost every production stage, from digitizing designs to substituting manual labor to be at par with the ongoing consumer demands. Subsequently, to thrive in global competition, Bangladesh’s apparel sector needs to innovate, upgrade capacities, and diversify product baskets and customer countries to keep up with the upcoming trends in the fashion industry. While job creation in the apparel sector has decelerated due to increased automation, according to the World Bank, this trend will likely continue in the post-pandemic era. So, Bangladesh cannot compete globally with low labor-intensive productivity anymore. Instead, firms must adopt improved technology across business functions, resulting in higher efficiency.

While the global shift in consumer behavior has roared the changing trend in the apparel industry, the shift comes with a major consequence of ensuring sustainability. With decreased apparel lifetime, fabric quality has decreased, reducing multiple uses of the same fabric in contrast to the traditional journey of an apparel product. With the rising concerns about climate change, the global apparel manufacturing industry is anticipating adopting a “recycling process” by regenerating waste and restoring them into new products or raw materials under an industrial mechanism through the circulatory system. Under this system, products enter the market at their highest value and re-enter after use in a cyclical approach.

Although Bangladesh’s contribution to the global GHG emission is 0.45 percent, the country is disproportionately impacted by the fallout of climate change. Bangladesh needs to play its part in the green transition of its economy and work towards developing a sustainable production system as one of the leading apparel manufacturers in the world. To adopt a circular production model, Bangladesh’s apparel sector would require high investment and increasing awareness among the key industry stakeholders.

In addition to achieving sustainability in the production process, ensuring a sustainable working environment for its four million workers is also a major concern for the apparel sector of Bangladesh.

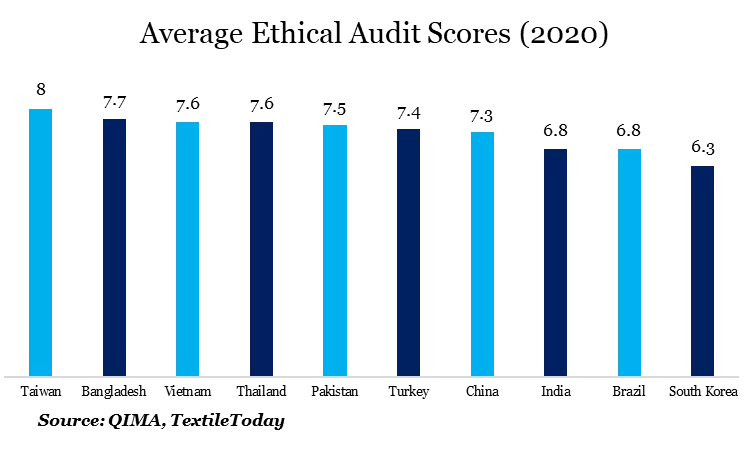

According to the latest survey report by Hong Kong-based supply chain compliance solutions provider QIMA, Bangladesh ranked second in “Ethical Manufacturing” with a score of 7.7 after Taiwan which scored 8.0. Vietnam came in 3rd, trailing Thailand, Pakistan, Turkey, China, India, and Brazil.

Moreover, a recent McKinsey report dubbed Bangladesh’s apparel sector a frontrunner in transparency regarding factory safety and value-chain responsibility, thanks to initiatives launched in the aftermath of the Rana Plaza disasters. Mckinsey also highlighted that more than 1,500 Bangladeshi companies are certified by the Global Organic Textile Standard, the second-highest number in any country in the world.[7]

With the goal of sustainability in mind, the BGMEA, Global Fashion Agenda (GFA), Reverse Resources, and P4G have partnered in an initiative, “Circular Fashion Partnership,” to achieve a long-term, scalable transition to a circular fashion system. Over 30 renowned fashion brands, manufacturers and recyclers are collaborating in the new initiative to capture and reuse textile waste in Bangladesh.[8]

With the escalated digitization and technical advancement to ensure the successful implementation of circular economy policies, Bangladesh is expected to transition away from its core competitive advantage of low-cost labor. It is moving towards a higher-value-added manufacturing method by incorporating automation at stages of production. With this transition, Bangladesh must consider the circular economy model’s labor market implications, as the country relies heavily on low-wage labor.

Over the last five decades, Bangladesh’s apparel export industry has been witnessing a state of “arrested development”.[9] With the limited updates on HS codes by Bangladesh customs, apparel manufacturers cannot move from the cheap mass commodity category to a higher value-added segment. In order to maintain global competitiveness, the apparel sector of Bangladesh has been reaping the benefits of cheap labor rather than focusing on raising labor productivity.

Over the past decade, increasing labor productivity has been a major concern in increasing output in the global apparel arena. As one of the world’s lowest wage-paying countries, Bangladesh is currently witnessing stagnant job growth in the apparel sector. Moreover, with low technological advancement in the sector and the persisting low technological adaptability among the apparel worker population group, Bangladesh is missing out on the competitive edge achieved by countries like Vietnam, India, Indonesia, and Thailand through technology adoption.

Moreover, Bangladesh’s apparel sector has been facing a double blow from slowing global demand and an energy crisis at home threatening to thwart the nation’s pandemic recovery. Waning orders are a risk to the economy, where the apparel sector makes up more than 10 percent of the gross domestic product and employs 4.4 million people. It couldn’t be happening at a worse time for Bangladesh as authorities are resorting to productivity-killing power cuts to preserve fuel reserves amid a region-wide energy crisis caused partly by the war in Ukraine. As the energy crisis struck, the cost of doing business surged.[10]

At present, the most crucial improvement area for the apparel industry of Bangladesh is to reduce the lead time of garment manufacturing. The country will gradually improve its competitive stance in the global market by improving competitiveness over the reduction in total production and distribution time.

This article was authored by Dipa Sultana, Business Consultant at LightCastle Partners. For further clarifications, contact here: [email protected]

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights