GET IN TOUCH

- Please wait...

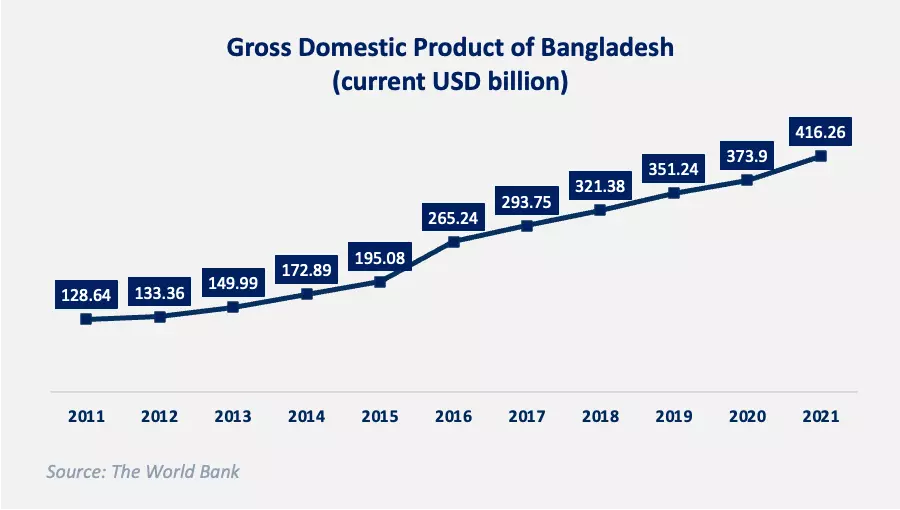

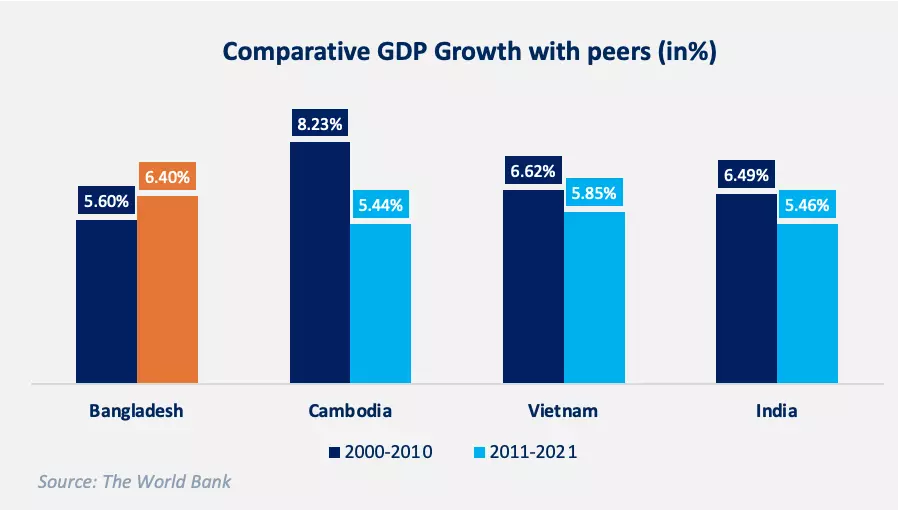

Bangladesh more than tripled its Gross Domestic Product (GDP) over the last decade, standing out as one of the top 10 fastest-growing economies in the world. [1] World Bank reports the country’s real GDP growth to have accelerated over time since independence, reaching a remarkable 6.4% growth on average in the 2010s. [2] Moreover, not only is Bangladesh set to graduate from its Least Developed Country (LDC) status in 2026, but it also aims to reach the upper middle-income status by 2031, corresponding to its consistent growth in per capita income. [3] These exceptional feats came with substantial obstacles and even more significant policy reforms over the years. This article delves deeper into the analysis of a recent publication on Bangladesh by the World Bank titled ‘Change of Fabric’ and attempts to explore the financial sector of the country in particular. [4]

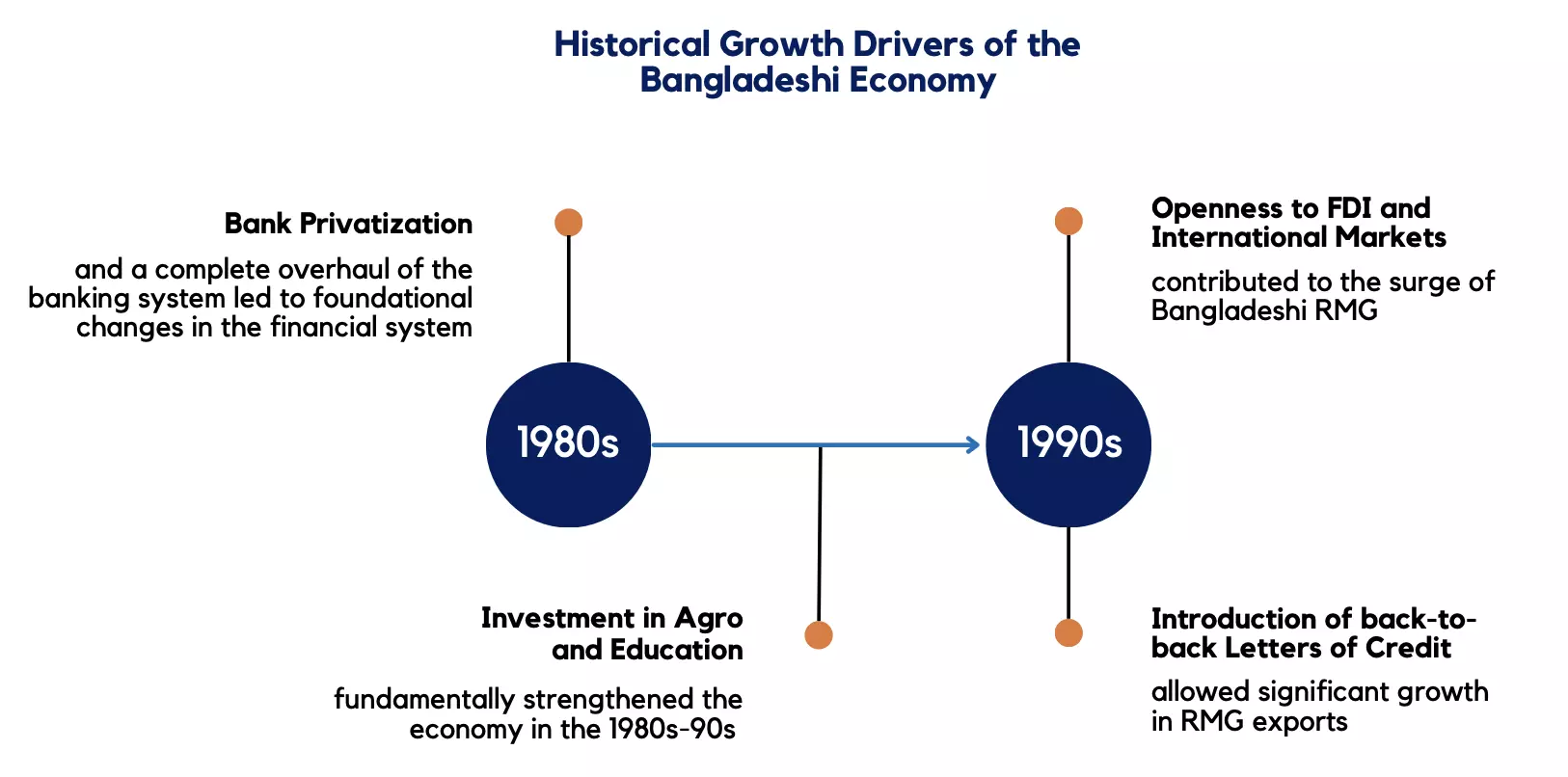

Before commencing the venture, it is imperative to understand the drivers behind such extraordinary growth.

Firstly, infrastructural investment from the public sector and policy reforms for agriculture and education in the 1980s-90s strengthened the economy’s structure.

Secondly, in the late 1990s, openness to the international markets and FDI contributed to the surge of Bangladeshi Reade-Made Garments (RMG), which now contributes over 83% of all export earnings. [5]

Thirdly, and most importantly, the banking system in the country was extensively overhauled in the late 1980s from a near insolvent condition by privatizing two public banks (Pubali Bank and Uttara Bank) and licensing private commercial banks. Another significant structural reform included introducing back-to-back letters of credit (LCs) that enhanced RMG exports. This allowed banks to act as an intermediary by handling two simultaneous LCs, which would reassure buyers of the authenticity of sales and guarantee sellers of the payment. [6]

These factors added to increasing political stability in the region, and containment of inflation, fiscal deficits, and debt levels boosted further supported growth over time. Moreover, remittance inflow, as a key macroeconomic factor, has seen an accelerating upward trend since 1981.[7] Positioned as the 7th highest remittance recipient in 2022 [8], Bangladesh has received a considerable boost in terms of improving the balance of payments, stabilizing exchange rates, and relieving foreign exchange reserve constraints over the decades.

Given its capital efforts, Bangladesh has been able to reap higher GDP growth compared to its structural peers, namely – Cambodia, Vietnam, and India, in the last decade (2011-2021). [4]

Moreover, Bangladesh has ranked 5th among 121 countries in the Nikkei’s COVID-19 Recovery Index and 1st among South Asian countries, demonstrating considerable resilience in times of global economic perils during the pandemic. [9]

However, there are alarming questions about the sustainability of the country’s rapid growth. Firstly, only a handful of countries have been historically successful in sustaining growth figures over a long period, empirically implying slowing economic growth and the possibility of stagnation. Secondly, the World Bank seems to be suspicious of Bangladesh’s GDP growth figures because the numbers do not seem to match the country’s fundamentals. The lack of policy reforms and structural inefficiency to keep up with the growing economy in recent years is another cause of concern.

Moreover, the increasing GDP has not translated into greater economic inclusion and poverty reduction in the country, meaning possible inefficiencies in the system. Three specific growth constraints have been identified by the World Bank based on extensive economic analysis – export concentration on RMG, loss of benefits from urbanization, and finally, the focus of this article – increasing financial sector vulnerabilities. [4]

For the purpose of drawing a clear picture, the financial sector will be discussed in three broad headers – the banking sector, policy interventions, and private sector credit, highlighting vulnerabilities in each category.

The banking sector comprises 90% of the total financial sector assets in Bangladesh. As of 2021, a total of 61 banking institutions, including 43 domestic private commercial banks, operate in the country with assets equivalent to 67% of GDP. [10]

According to a score of 346.2 on the Herfindahl-Hirschman Index (HHI), Bangladesh’s banking sector is highly competitive, leading to suboptimal decisions in terms of investments and loans and, in general, ill practices not beneficial to the market. In comparison, our neighboring country India has only 21 private commercial banks.

Bangladeshi banks have the lowest capital to mitigate risks compared to their peers. The capital-to-risk-weighted assets ratio (CAR) measures a bank’s available capital compared to its risk-weighted credit. This measure denotes the stability of a bank and conveys its ability to absorb or mitigate losses in case of risks materialize. [11] The CAR of Bangladeshi banks stood at 11.6% in 2019, implying high-risk exposure and undercapitalization predominantly among state-owned banks. This is substantially lower than all of its peers except Vietnam (whose CAR stands close to 12%). For example, the CAR of India and Indonesia lie roughly around 15% and 23%, respectively, implying relatively better capital support and consequently lower risk.

Bangladeshi banks also have the highest non-performing loans (NPL) among their peers, even though the figures are officially understated due to faulty legal definitions of default. Low capitalization paired with a high NPL load limits the ability of banks to supply credit to the private sector and be efficient in the long run. This is evident in the fact that the biggest banks by market share (mostly state-owned banks) have lower lending growth than deposit growth, suggesting misallocation or subpar use of funds. Such practices, combined with the dire condition of available capital, pose serious risks to the financial stability of the country.

The fundamental flaws are reflected in Standard & Poor’s (S&P) long-term sovereign credit rating of BB- for Bangladesh. This indicates that though Bangladesh might be able to fend off short-term financial needs, the country would face significant trouble dealing with long-term economic and financial adversities. A lower credit rating leads to higher borrowing costs for Bangladesh. Although the country is hinging on increasing per capita income and other external indicators to maintain a stable rating, if the banking sector is somehow exposed, Bangladesh could face devastating outcomes. [12]

The cap of 9% on the lending rate from April 2020 was initially a measure to contain high-interest rates during the COVID-19 turmoil, which could have limited access to credit and led to an economic slowdown. Banks cannot charge any borrower an interest rate above 9% until the regulator says otherwise.

Frequent meddling in interest rate policies does not allow market forces to act and inhibits economic efficiency. For example, as banks cannot charge higher interest rates for lending, they would have to provide lower interest rates for deposits. Real returns from deposits have turned negative in several cases owing to higher inflation. Hence, Bangladesh Bank had to step in once again to set a floor for deposit rates pegged against the Consumer Price Index (CPI) inflation rate. This is one of many interventions that authorities have taken over the years to promote financial stability and keep the inflation rate and currency value in check. [4]

Interest rate ceilings cloud banks’ judgment of risks and profitability, leading to poor lending decisions and compromising their capital positions. Again, deposit rate floors disincentivize banks from lending since they would operate on a tighter margin. Banks are hence unable to assess the best investment decisions based on the highest value to their shareholders and, ultimately, the economy. Government intervention is necessary to maintain stability and competitiveness in the economy, but too much involvement can inhibit market forces leading to economies that become inefficient and suffer in the long run. [4]

Increasing credit to the private sector denotes higher economic activity in a country as more people are confident in borrowing owing to amicable policies and monetary support. Bangladesh has been improving its private credit to GDP ratio over time but still lags behind compared to its peers, with one of the lowest figures in the category. In 2020, the private credit to GDP ratio stood at 45.2%, gaining stability around the 45% mark since 2016. This means that although GDP has grown substantially, borrowing from the private sector remains stagnant, implying the underutilization of funds and inherent inefficiency in the economy.

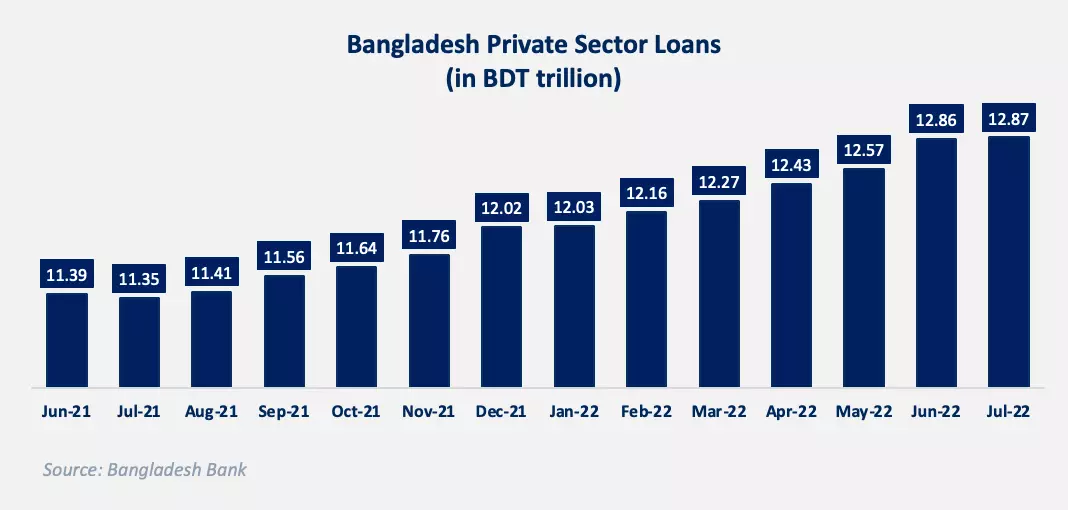

Although comparatives draw a negative image of Bangladesh, the domestic growth of private sector credit indicates a different picture. Private borrowing has increased over the past year, given an interest rate cap of 9%, reaching a staggering BDT 12,870 billion in July 2022. Private sector credit growth reached 14.07% in August 2022 compared to the same month of last year, whereas the government initially set a target of 14.1% for the current fiscal year. [13] From one perspective, this growth would mean an improved business environment in the country with a considerable boost in GDP.

However, higher credit growth is only helpful when the money being borrowed is returned with interest, or in other words, recirculated in the economy. Otherwise, increased credit creates inflationary pressure and can lead to price rises owing to greater money flow in the economy. The inflation rate stood at 7.48% as of July 2022. [14] Money does not flow back into the banks when loans are not returned in due time (usually 180 days), hence increasing the amount of non-performing loans (NPLs).

Over the past year, while private credit was increasing, so was the portion of NPLs among the debt, reaching 8.9% in the April-June quarter of 2022. The corresponding increasing trends suggest that more and more people are struggling to repay their debts while banks are lending away more money. An interesting highlight would be the sudden spike in NPLs from the beginning of 2022, especially in the January-March quarter. A plausible cause would be the Russia-Ukraine turmoil which had adverse impacts on commodity prices nationally and internationally. Businesses are likely to have incurred higher costs which created obstacles in terms of loan repayments.

Banks in Bangladesh that already struggle to secure profits in the fierce competition had to comply with policy restrictions and were required to operate on fixed interest rates. The scenario would have prompted commercial banks to make riskier lending decisions to hope for higher returns. Hence, increased private sector borrowing, added to the fact that a higher portion of these debts is being defaulted, means that banks would start to deplete their capital. When banks run low on capital, it is no longer a private concern but rather a national one since banks are the fundamental blocks of an economy. Hence, intervention from Bangladesh Bank and policymakers is imperative when the entire financial system is put at risk.

Reality substantially differed from the initial plans by the government of crafting a contractionary monetary policy. First, to curb inflationary pressures and mitigate risky lending from banks, the interest rate caps should be removed or raised.

According to experts from the Centre for Policy Dialogue (CPD), interest rates should be deregulated and be determined by the markets based on the supply of funds and demand for credit. [15] Although this might mean a higher cost of borrowing for any borrower, the action would tighten the money supply in the economy and ultimately reduce inflationary pressures. The result would also potentially lead to banks making more feasible lending decisions, ultimately lowering the number of defaulted loans.

Although the government has increased the repo rate (the interest rate at which Bangladesh Bank lends money to commercial banks) to 5.50% in June 2022 from 5% in May 2022, there is still much room for restriction. The United States is setting a prime example in controlling inflation and sweeping money supply through consecutive hikes in federal fund rates (similar to the repo rate), which stands at 3-3.25% in September 2022, a 0.75% raise from the previous rate. [16]

Clear guidelines and legal support should be catered to by the banks to incentivize effective NPL resolution. A keen eye on each bank’s CAR could effectively deal with separate institutions in this regard. Not only would timely recognition and resolution of NPLs prove profitable to banks but also reduce burdens on the entire economy. This action ensures that credit growth not only remains stable but also accelerates, provided that banks would have greater returned capital and would be capable of driving further investments. Private sector credit would hence be effective and have its desired economic advantages.

Strengthening corporate governance, especially in state-owned banks, is imperative to address fundamental flaws in the entire banking sector of Bangladesh. Numerous banks are involved in related party lending, meaning that owners’ acquaintances are given higher priority in terms of debt irrespective of the risk they carry. These activities put the banks’ interests in question, in addition to raising their risk exposure. Not only does this create structural inefficiency in the economy but also halts potential growth prospects for the country. Hence, in the long term, addressing banking sector weaknesses from the cores of its operation would be cardinal in pushing the financial sector beyond its current limitations.

Bangladesh is on the track of mammoth economic expansion, and for further development to take place, the country needs to recognize the massive untapped potential in the financial sector. Tackling short-term limitations in policy-making and setting fundamental standards in the banking institutions for long-term sustainability would be key to efficient and effective allocation of financial resources.

This article was authored by Mehedi Hasan Mahir, a Content Writer at LightCastle Partners. Advisory and editorial support was provided by Samiha Anwar, Business Consultant at LightCastle Partners. For further clarifications, contact here: [email protected]

References

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights