GET IN TOUCH

- Please wait...

Bangladesh has long set its sights on becoming a middle income economy by 2026 and has determined to achieve the targets of Vision 2041, which includes aspects like increasing export earnings to $300 billion, increasing life expectancy to 80 years, and bringing down the poverty rate to less than 3%.

Studies show that high-value horticultural crops including fruits, vegetables, aromatic plants, herbs, and flowers, have been playing a key role in agricultural development and economic progress in developing countries. [1] They not only reduce malnutrition by contributing a balanced, diversified, and nutrition-rich diet but also decrease poverty through increased income and women empowerment.

On the other hand, these high-value crops can be a significant addition to our export basket as the global horticulture market is expected to reach $40.24 Billion by 2026 at a CAGR of 10.2%. [2]

In 2021-22, crops and horticulture contributed to 5.64% of the total GDP, which amounted to 20.487 billion USD. [3] Currently, 7% of total crop production in Bangladesh comes from horticulture, while it utilizes only 4% of the total farming area. [4]

However, agricultural land is decreasing due to the rise in sea level, and by 2050, Bangladesh is projected to lose 11% of its total land, displacing 18 million people. [5] Besides, as per the World Bank, Bangladesh will lose 18% of its cropland on its southern side and could lose a third of its agricultural GDP. [6]

Along with calling for mitigating steps to abate the effects of climate change, there’s a need for developing higher-yielding crops to best utilize the remaining land and to ensure food safety for the increasing population.

In this situation, improving the horticultural value chain management as a whole, starting from the input suppliers to the output traders, can go a long way in alleviating the stress resulting from the irregularities existing in the value chain of this highly prospective sector.

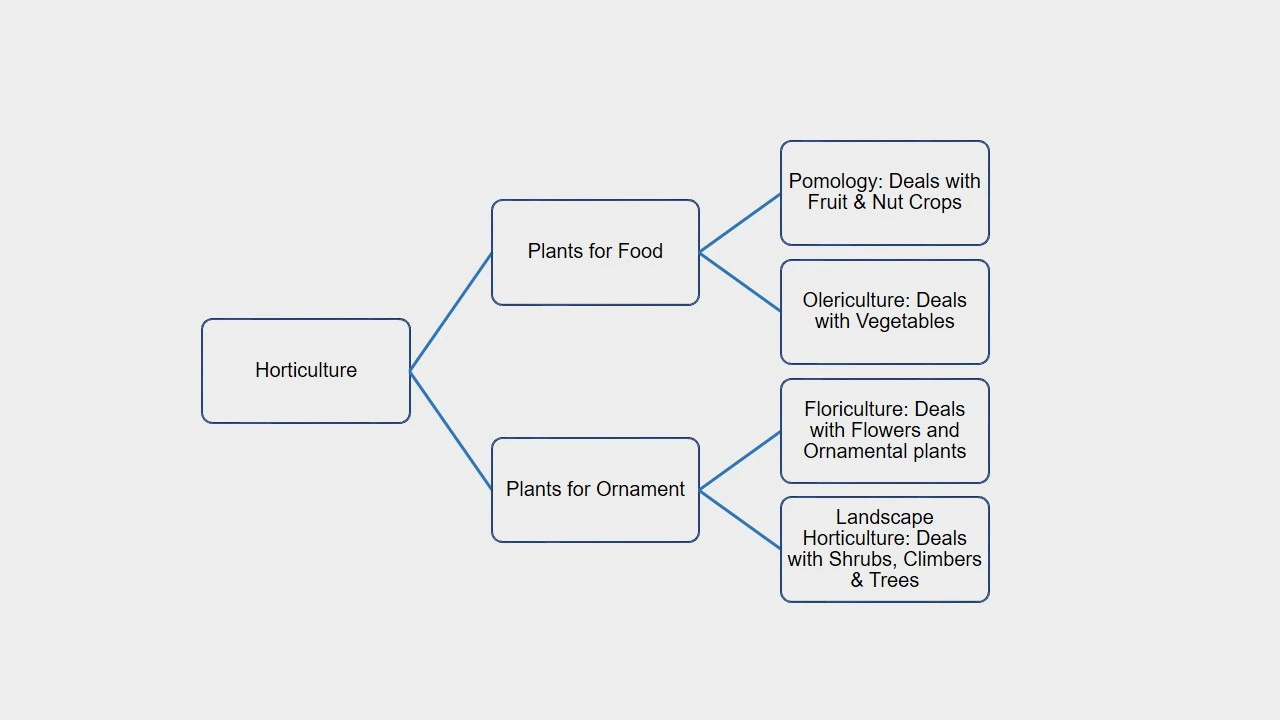

Horticulture is that branch of agriculture science that refers to the commercial plantation of flowers, fruits, and crops for the purpose of profit. The overall division of this branch is demonstrated in the figure below:

Bangladesh produced 1.97 crore tons of vegetables on 9.35 lakh hectares of land as of FY 2020-21, and the production has increased by seven folds in the last 12 years causing Bangladesh to be the third-largest producer of vegetables in the world. Bangladesh currently grows 100 species of vegetables. [7]

Again, the floriculture sector of Bangladesh is also booming which grows a total of 50 variants of flowers and, as per BBS, Bangladesh produced a total of 32,120 tons of flowers on 3,930 acres of land, and the export earnings stood at $80,000 from this sector in FY 2022-23. [8].

Lastly, at present Bangladesh lists among the top 10 countries of the world for producing seasonal fruits, with a total annual production of 1.22 crore fruits of 72 different varieties.[9]. For export, Horticulture products are mainly destined for the markets of the Middle East, United Kingdom, and Italy, targeting the large Bangladeshi Diaspora.

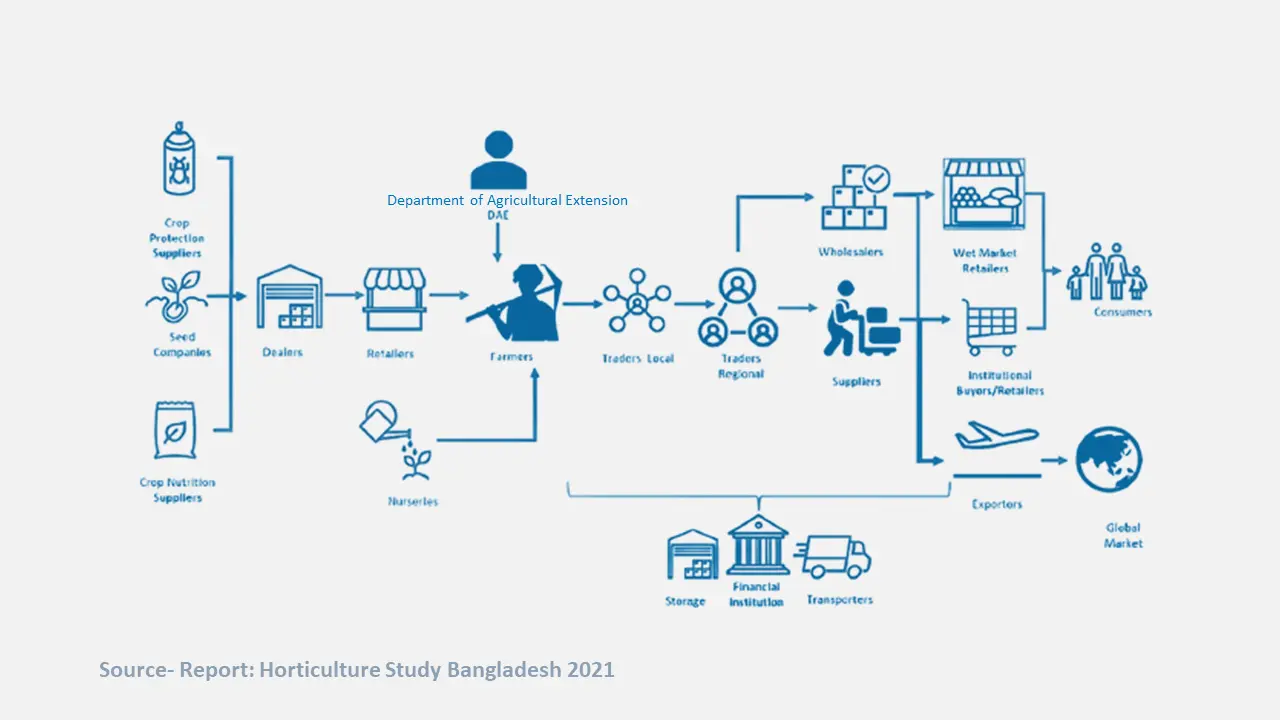

The value chain in horticulture has three key groups of actors: input suppliers, primary producers, and produce traders.

The main inputs in horticulture are seeds, saplings, fertilizers, insecticides, and pesticides. When it comes to seeds, Lal Teer is the largest local vegetable seed producer and distributor company. Besides this, there are at least 20 other companies active in the industry and also many smaller unorganized players. Overall, in Bangladesh, the seed distribution network comprises over 17,000 dealers, 160,000 retailers, and 4,500 mobile vendors. [4]

Fertilizers are mainly supplied by BADC, a government agency, while a huge portion is imported. Crop production products are supplied by big companies like – Syngenta, Bayer Crop Science, Partex Agro, and Petrochem. At the local level, they share the same distribution channels as seed manufacturers. [4]

Challenges:

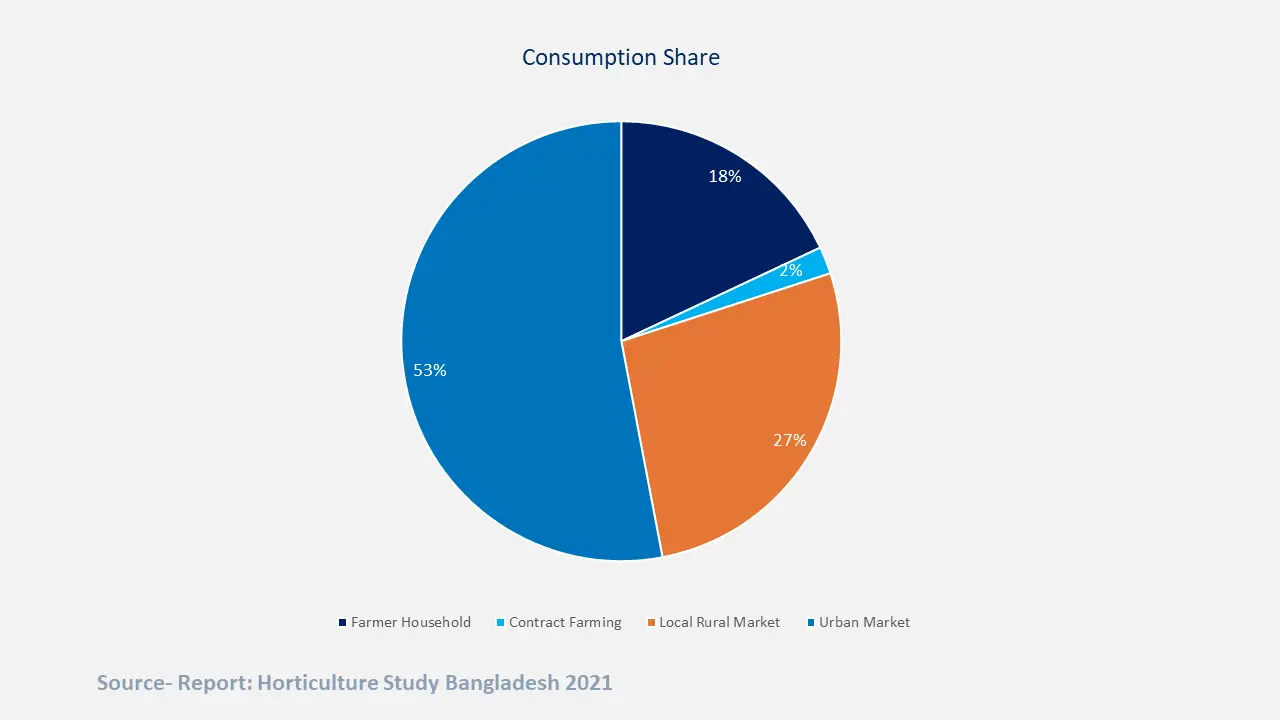

As per the National Agricultural Census of 2019, 16.5 million households contribute to farming in Bangladesh. Out of the rice and vegetables that they grow in rotation, less than 20% is consumed by the farming households themselves. [4] As per a report by USAID, vegetable farmers grow on a very small scale, 60% of them cultivate on land measuring one acre or less, while commercial vegetable growers comprise only 1%.

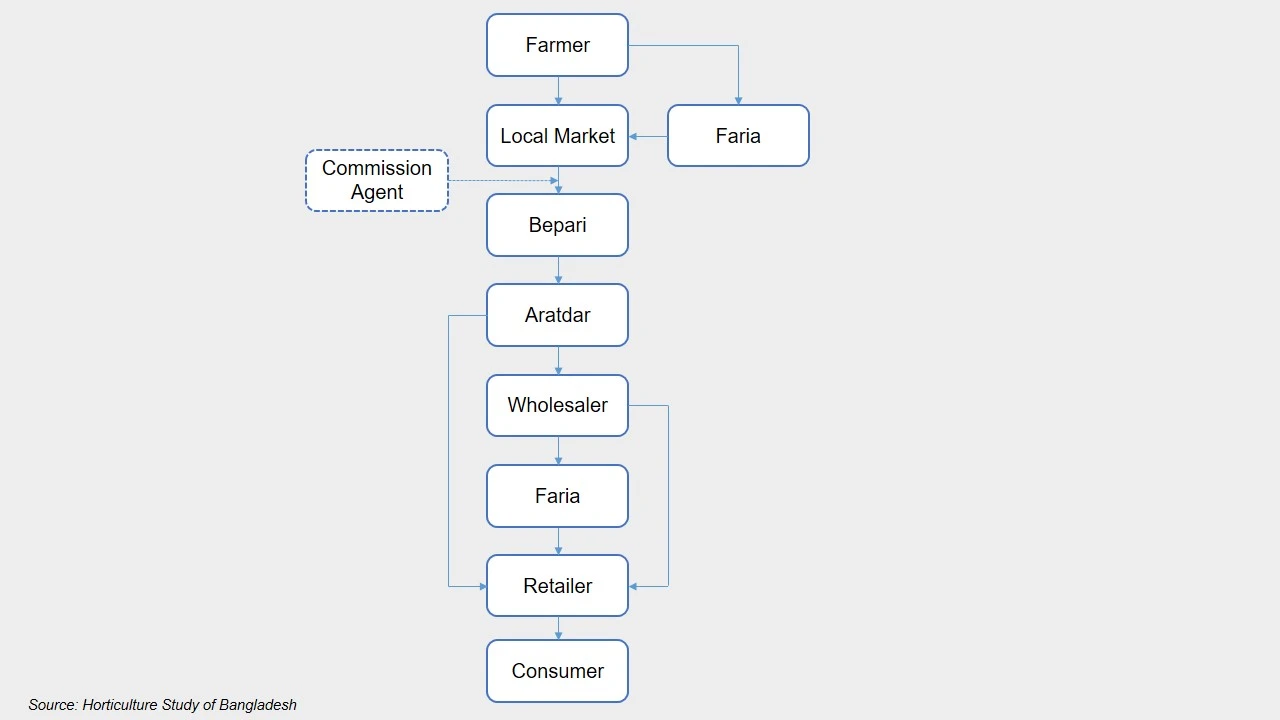

There are several intermediaries in the chain named farias, beparis, and arothdars, which thus makes the chain from the farmers to the end consumers a lengthy one.

Small-scale farmers sell their produce to an aggregator who takes them to the market yard, where marketing activities like assembling, grading, storage, sale, and purchase take place.

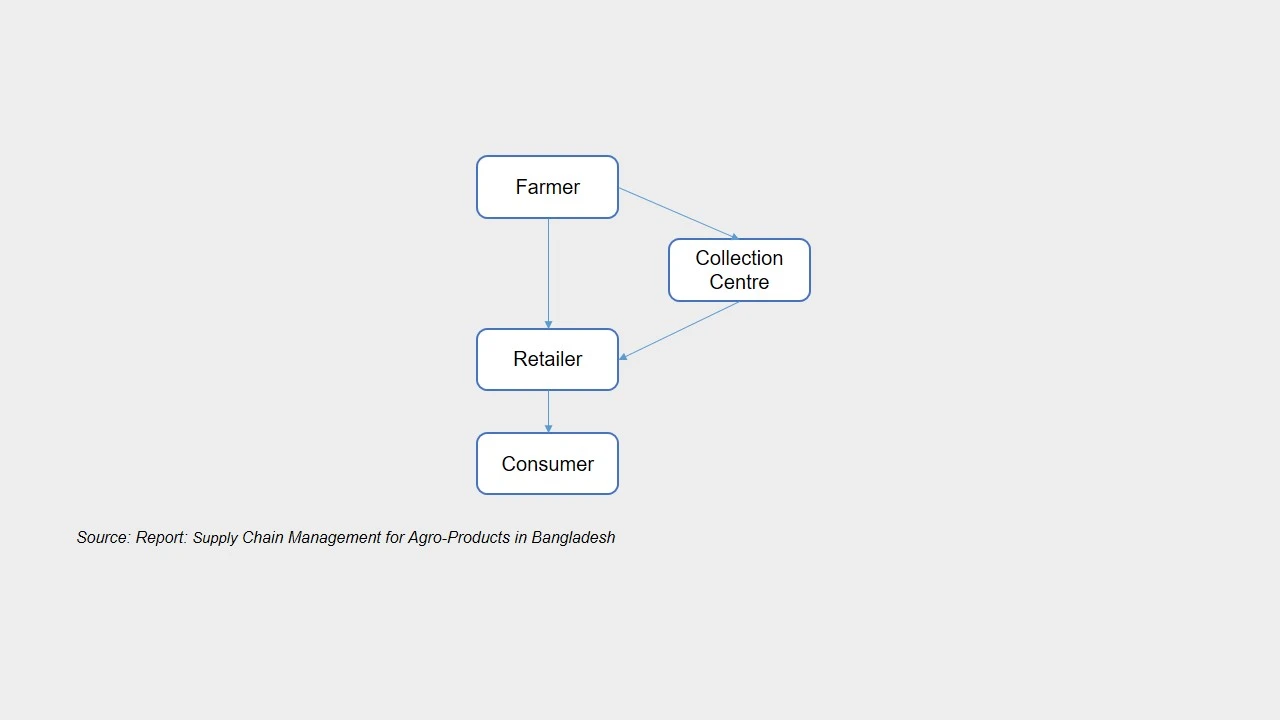

Large-scale wholesalers purchase the produce, selling them to smaller ones. Finally, the crops go through retailers to the final consumers. The intermediaries present in each stage of the supply chain play an important role in linking two parties to each other. A simplified version of the supply chain is shown in the figure below:

Among various horticultural crops, vegetables are one of the most highly consumed. [9] Annually, a total of 6.5 million tons of 150 varieties of vegetables are produced. Yet, USD 203 million worth of vegetables were imported in 2019.

Surprisingly, some of the highest levels of imports amount to crops we are entirely capable of producing ourselves geographically. In the Year 20-21, 28.066 billion BDT (265. 08 million USD) worth of onion and garlic [12] were imported.

Here’s a look at the challenges present in the value chains of Bangladesh’s most consumed crops.

One of the main challenges in onion farming is the yield gap, the difference between yield potential and actual yield, which is present due to managerial incompetence leading to yield losses. In 2022, Bangladesh imported 0.67 million tonnes of onion, which is an increase of 0.11 million tonnes compared to the previous year.

Even though the production in the 2021-22 fiscal year was a record high of 3.504 million tonnes, [13] this rise in import can be owed to the disruption of the supply chain due to flooding [13] as well as post-harvest losses caused due to lack of cold storage facilities. [14]

In contrast, India harvested 26.64 million tons of onion in the fiscal year 2021-22 and is estimated to increase to 31.12 million tons in 2022-23 as the acreage increased from 1.62 million hectares to 1.91 million hectares in just a year. [15] Their post-harvest loss management is in much better shape with available cold storage. To reduce post-harvest losses further to 10-12%, they plan to do gamma-ray irradiation before sending the harvested onions to cold storage. [16]

Tomato production all year round is increasing and farmers have accepted hybrid seeds sourced locally. In Bangladesh, tomato is produced with traditional methods on open land as well as in a controlled setting of greenhouses and polytunnels. Even with such advancements, the post-harvest loss is as high as 40% in tomato production. [4]

Tomatoes happen to be perishable in nature and it’s challenging to keep them fresh. External damages, harvesting at incorrect maturity stage, disease and insect infestation, and lack of proper storage are factors that mainly contribute to the losses. There’s a demand for tomatoes in the agro-processing industry that isn’t met locally due to such high losses.

In order to remedy some of the long-standing challenges within the horticultural value chain in Bangladesh, a number of initiatives, avenues, and opportunities can be pursued.

An increasing number of super shops and online grocery companies are running parallel supply chains that cut through some of the intermediaries to offer traceable, quality produce to high-end customers.

The supermarkets are expected to grow bigger in ensuring fresh produce and fresh products as the country transitions towards urbanization. This drive will move upward improvement where the suppliers will be encouraged to ensure better production, as well as harvesting and post-harvesting techniques.

Higher investment in modernized refrigerated transport, temperature-controlled warehouses, and distribution centres are expected by supermarket retailers.

Companies like Chaldal have built their own network [17] of farmers and small-scale retailers, connecting the two. This in effect ensures that farmers get a much fairer price and a better lifestyle.

The retailer benefits from traceability as they can return produce that doesn’t meet quality standards. Their long-term collaboration with farmers and small-scale retailers enables online grocery startups to bulk supply vegetables and earn most of their revenue. Their online marketplace cuts the cycle even shorter than their B2B model as they use their own network of farmers and directly cater to consumers through the same network. Besides, other online grocery platforms are FoodPanda, HungryNaki, Pathao, Daraz Mart, SodaiHut, etc.

There’s a long way Bangladesh needs to go in terms of the horticultural value chain. But some of the recent developments show promising changes that can result in improvement.

In January of 2023, AR Malik Farms became the first farm in Bangladesh to receive good agricultural practices (GAP) certification. [18]

As the certificate reassures that the food produced meets globally accepted standards of safety and quality, this improves the cultivator’s reputation and opens up previously untapped marketplaces that question food safety seriously. This can be a stepping stone in acquiring the agro-products market in Europe as sanitation has always been the primary issue in exporting there. For that to happen, more farms need to follow the example of Malik Farms.

For GAP certification, working with an experienced consultancy firm like SGS is a great way to improve quality management and regulate food safety in every stage of production to marketing. The company delivers GLOBAL GAP certification in over 30 countries including Bangladesh.

Inadequate research and innovation have also been a barrier to improving yield and developing varieties to combat climate change.

The government took the initiative of setting up the Bangabandhu-Pierre Elliott Trudeau Agricultural Technology Centre at BRRI in partnership with the Global Institute for Food Security at the University of Saskatchewan in Canada with the view to cooperation in research, ensuring sustainable food security, training, and development partnership programs. [19]

Increased emphasis on providing research stipends and providing agriculture-based education at higher levels is also aimed toward technological advancement in agriculture.

The use of AI in aquaculture and dairy farming is an inspiring example of innovation. Akbar Hossain is an agricultural entrepreneur who brought the in-pond raceway system (IPRS) to Bangladesh. IPRS allows more fish to be farmed in less water by ensuring optimal water chemistry, especially adequate oxygen supply. [20]

ACI Agribusiness introduced an AI-based app called Rupali. It sends automated suggestions to fish culturists based on the scanning of different patterns with a view to maintaining water quality.

There have been some small changes in the horticulture sector too. An AI-based company, iPage is helping farmers conduct instant soil tests to improve their farming conditions. The company also focuses on aiding farmers with information about correct farming practices and ensuring proper value for products.

While still working on making something as basic as soil testing accessible, IoT, Probe sensors, data analysis, and automated greenhouse may seem like a thing of a faraway future for Bangladesh, but the government is trying to make it happen with the vision of 4AR or Agricultural Revolution 4.0. [21]

While Bangladesh paves its way to achieving its economic and developmental targets, such as graduating LDC status by 2026, horticulture has already been considered an important stepping stone in this path. Hence, various policies regarding process modernization and product diversification for this sector have been undertaken.

However, not every initiative to improve the sector is going smoothly. There are still various challenges lingering in different parts of the supply chain, but with enhanced public-private partnerships and increasing interest of foreign investors in the horticultural and agricultural sector of Bangladesh, there are hopes to see an efficient resolution of the current dysfunctionalities in this sector.

As India has already shown to benefit from investing in cold storage, the leap could have been taken quicker in Bangladesh as well. Necessary steps should be taken to develop a proper window for sustained collaboration between the public and private sector players in this value chain of high potential to reap valuable benefits in terms of employment generation, entrepreneurship growth, per capita production increase, and protecting our valuable foreign currency from vegetable imports.

Tasnia Tarannum, Content Writer, and Adiba Haque Ahona, Trainee Consultant, at LightCastle Partners, have prepared the write-up. For further clarifications, contact here: [email protected]

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights