GET IN TOUCH

- Please wait...

Bangladesh is set to graduate from its status as a Least Developed Country (LDC) in November 2026. After 46 years of being enlisted in the category, the country has met all three criteria as assessed triennially by the Committee for Development Policy (CDP) of the United Nations, for the second time in February 2021 and has received the final recommendation to graduate.1 The article highlights the journey as well as the way forward for Bangladesh from the perspective of graduating LDC status.

Previously in 2018, Bangladesh fulfilled all 3 criteria for graduation for the first time, where passing only 2 is required. To successfully receive a recommendation from the wing, Bangladesh would need to fulfill the requirement for two more consecutive periods (at a gap of three years). Hence, a total of three consecutive assessments ensures a country’s graduating LDC status.

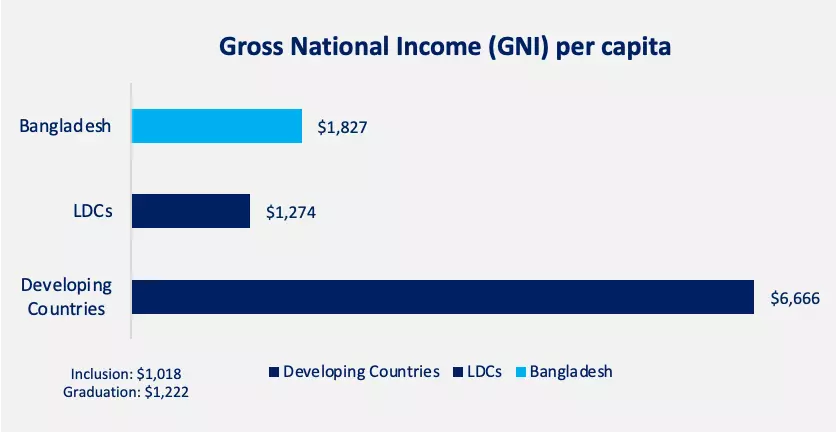

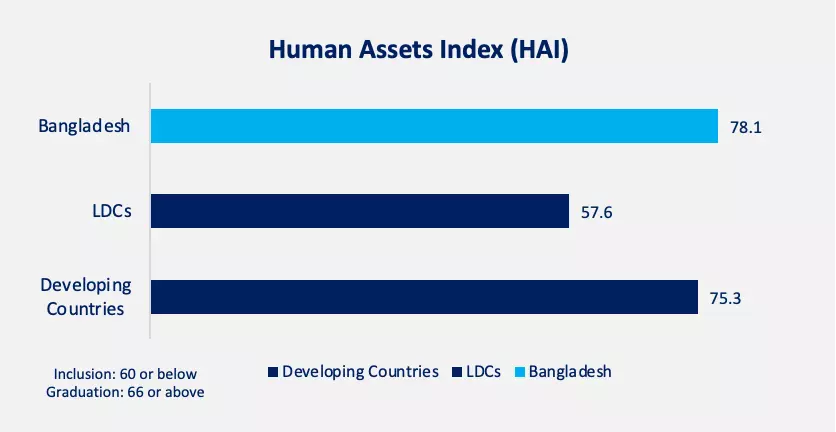

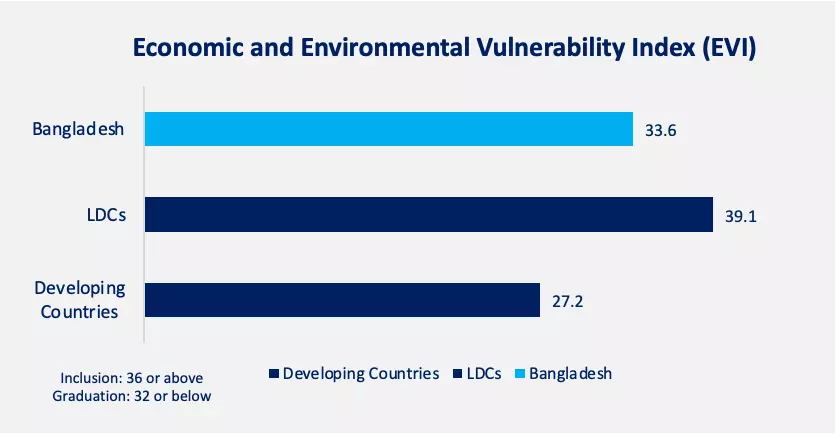

Performance in the three requirements, namely, Gross National Income (GNI), Human Assets Index (HAI), and Economic and Environmental Vulnerability Index (EVI) measure a country’s income levels on a per capita basis, levels of human assets, and the ability to adapt to economic and environmental shocks. These benchmarks assess the capability of a country to continue its path of development and its corresponding assistance needs. Bangladesh has performed exceptionally well in terms of all three indexes, where passing only two would suffice for a recommendation in graduating LDC status.2 Not only does this go a long way to prove the economic strength of the country for a sustained period, but also hold resilience during times of economic and environmental shocks, like the COVID-19 pandemic.

Graduating LDC status would tangibly convey economic strength, more capable human resources, and increased resilience to economic and environmental shocks. What these components intangibly bring forth is a revamped brand image for the country.

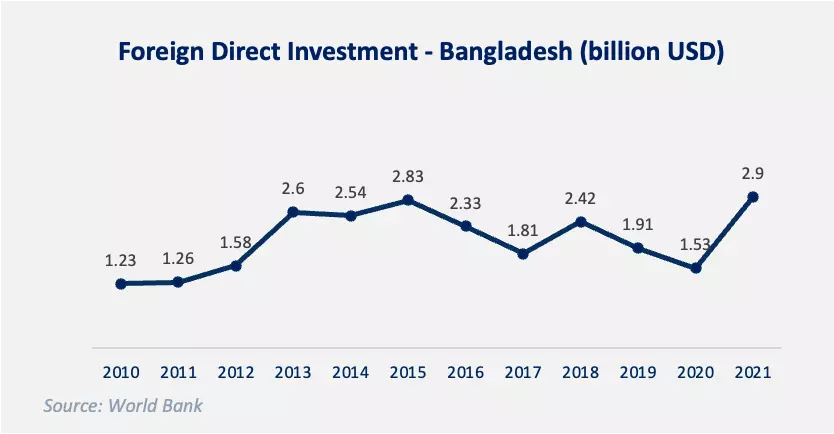

Financing both debt and equity would be more accessible and compliant as the country would be perceived by debtors and investors as more capable of returning loans and generating returns. A better outlook creates more attractive opportunities in terms of Foreign Direct Investment (FDI) for external stakeholders since the economy would be perceived as more capable and amicable for a profitable business. FDI is an important driver of development and innovation, and graduating LDC status would theoretically attract more of it. Considering Bangladesh has seen varying sums of FDI in the last 10 years, a stable increase is more likely to transpire upon graduation from LDC status. In 2021, FDI inflow increased by 13% with a corresponding tripling of international project financing deals3, somewhat proving increased confidence due to Bangladesh’s rapid and effective control of the pandemic and resilience in times of crisis.

Increasing FDI has been linked with overall economic benefits for developing countries. Studies show that higher FDI leads to technology spillovers in the sense that cleaner technologies and know-how are transferred and human capital formation in the form of more effective and efficient workflows. Moreover, linkage with foreign investors directly enhances trade integrations internationally and allows for a more competitive business environment in the country.4

Apart from this, Bangladesh would also hold a more prominent position during negotiations and in global partnerships owing to potentially better deals and policy initiatives. Moreover, an indirect, albeit significant impact would be a boost in people’s confidence in both the economy and prospective growth opportunities.5

Although this is a noteworthy achievement for Bangladesh, graduating LDC status brings more tangible challenges than benefits. As part of the LDC bloc, the country currently enjoys support measures that can broadly be categorized into three areas – international trade, development assistance, and support in international forums. [6] Upon graduating LDC status, the country would lose access to these comforts leading to potential issues in trade, financing, and development support. For ease of understanding, these are the key areas we would be focusing on.

Bangladesh could lose some 14% or USD 5.73 billion worth of export earnings a year following graduation to LDC status.7 Possibly the most significant component for the country, Bangladesh continues to enjoy preferential market benefits known as the Generalized System of Preferences (GSP), which includes Duty-Free and Quota-Free (DFQF) access for exports to international development partners of the World Trade Organization (WTO).

The country enjoys duty-free access to 38 countries under GSP including the UK and 27 EU countries, where the majority of our apparel exports is concentrated.8 Although Bangladesh stands to lose this access, reformation in human rights and labor rights regulations could renew the country’s DFQF access under the Everything But Arms (EBA) initiative of the EU for smooth transition.9

GSP+, an extension of the regular GSP, is expected to initiate new policies where Bangladesh would not be eligible for being a “large supplier” and require more regulatory compliance. Under the scheme, an exporting country’s share in EU’ total import should not exceed 7.4%, where Bangladesh’s figure stands at 26%.10 Considering EU is our largest apparel export destination, losing out on these facilities requires strict attention and renewal strategies.

These impacts on Bangladeshi exports have an interesting implication on imports as well. According to Bangladesh Investment Development Authority (BIDA), raw materials (excluding machinery and parts) for the production of export goods currently have no import duties. Considering a potential downward shift in exports resulting from higher duties, demand for these imported materials is likely to shift downward. This has a further implication on trade relations with countries like India, China, and USA (major cotton importers to Bangladesh)11 which could potentially increase trade deficits with the corresponding countries.

Apart from direct trade benefits, Bangladesh enjoys Special and Differential Treatment (SDT) which includes special access Trade Related Intellectual Property Rights (TRIPS). Under this agreement, the country enjoys free access to numerous IPRs (Intellectual Property Rights), the most significant of which is the patent allowance in the pharmaceutical industry. The pharmaceutical industry, capable of serving 97% of the local demand, would lose TRIPS access in 2026 upon graduation although the initial agreement was supposed to last till 2033 under a “special transition period”.12 The pharmaceutical industry would be adversely affected as TRIPS allows them to manufacture patented drugs without paying royalty fees. The nullification would also carry considerable burdens for exporting industries reliant on the TRIPS agreement.

Moody’s currently rates Bangladesh as Ba3, considered a ‘junk’ status or ‘high-yielding’, which is considerably below investment grade.13 This outlook is likely to shift upward based on the fact that LDC graduates are seen as less risky. However, any upgrade in the credit rating would be reliant on factors like real GDP growth, public debt level, effective governance and overall potential to repay debts. Moreover, graduation also means that Bangladesh will not be eligible for support in the form of concessional loans (low interest rates with longer repayment periods) and grants from development funds. This directly increases the cost of borrowing since non-concessional loans are more stringent, have less favorable conditions, and have shorter payment periods.

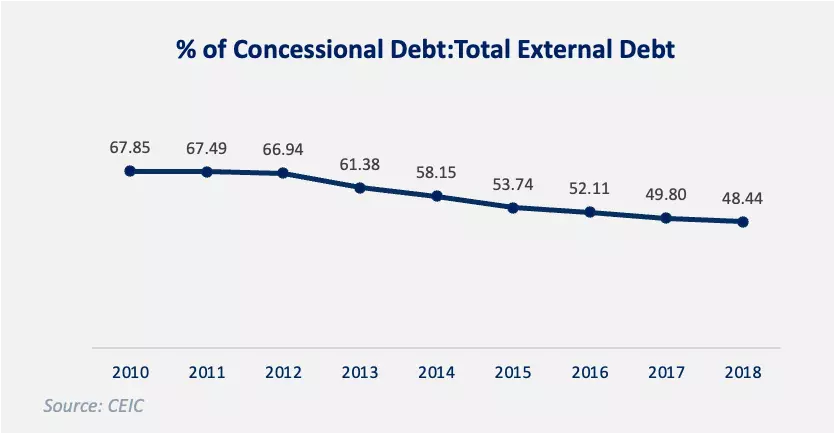

Bangladesh is already facing increased cost of borrowing from its biggest multilateral lenders. The World Bank will base 33% of its $6.05 billion loan on market rates (non-concessional terms) over the next 3 years from 2022-25. In the previous 3-year term, this portion amounted to only 13.7% of the loan amount.14 JICA has also revised its loan repayment period to 30 years from 40 years previously.15 It is believed that other international lenders would soon follow suit as the country moves upward. Although Bangladesh has been able to reduce reliance on concessional debt to 48% in 2018, the factor must still be keenly observed.16

In terms of domestic revenue, Bangladesh would be required to set specific import duties according to WTO policies. This implies lower import tax revenue from items that previously had higher import rates and potentially higher costs associated with corresponding industries which would now be competing with goods from international markets with reduced tariffs (leading to more market entry). Even though domestic revenue from income tax is not supposed to change mathematically17, in an unfavorable case, tax structures could be raised if the country faces challenges in meeting non-concessional external debt liabilities.

Considering these changes, tax revenue would increase for the government on one hand but on the other, people would have less to spend and opt for higher savings. This implies lower investments in the production and service sectors leading to stunted growth in the economy.

Bangladesh would be forgoing grants worth USD 700 million over time as it leaves the LDC bloc.18 Upon graduation, the country would lose out on Official Development Assistance (ODA) in the form of foreign grants, development funds, and other relevant technical and infrastructural support from global partners. Developed countries have committed to providing 0.15-0.20 % of their respective GNI in the form of ODA to LDCs.6 The ODA can be further classified into bilateral aid (directly from one country to another) and multilateral aid (to several countries; handled by UN, IMF, etc.) whose participation in Bangladesh may differ upon graduating.

However, commitments by donors represent their net outflow to LDCs and are not restricted to a particular country. Hence, when Bangladesh is seen as a Developing Country, it would imply less necessity for development funds since it has been capable of maintaining GNI thresholds. Funds would automatically be diverted to nations that are more in need of them, and this is especially the case for multilateral ties since these development organizations have limited funds to allocate. Hence, accessing monetary and technical assistance could prove to be even more difficult when Bangladesh is no longer in the LDC bloc. The Green Climate Fund (GCF), which assists in adaptation to and mitigation of climate impacts, is one such scheme that Bangladesh would no longer have access to.19 However, the consequences would be dire if the flow of funds stops abruptly in some particular development areas like healthcare and education for the low-income group where the country has inadequate resources. Hence, the government would have to negotiate with donor agencies for amicable terms to continue a steady flow of resources to these areas.

Moreover, in 2015, when Bangladesh rose in status according to metrics of the International Development Association (IDA) in terms of GNI/capita, a favorable loan structure with 0.75% service charge, 0.25% commitment charge, 0.25% commitment fee transformed into a flat 2.62% as the interest rate and as the rate for other charges with the corresponding reduction in the payment period and grace period.20 This is tangible proof of how loan structures can quickly turn unfavorable for Bangladesh while going up the ladder.

Although Bangladesh is set for graduating LDC status in 2026, it would still enjoy LDC benefits and support for 3 more years to ensure a smooth transition and preparation. This means there are two stages to the transition: the official leap in 2026, and the actual strike in 2029, giving the country 7 more years to get ready to lose all LDC perks.

The government has already initiated preparation in different forms, starting from changes in the budget and policy formation. The Principal Secretary of the Prime Minister’s Office has already formed a committee, with seven sub-committees involving private sector stakeholders and researchers, to head the entire reformation procedure and consider all potential challenges regarding graduating to LDC status.21

Firstly, to tackle the challenges from loss of preferential market access, Bangladesh is considering the execution of bilateral trade agreements in the form of PTA (Preferential Trade Agreement), FTA (Free Trade Agreement), and CEPA (Comprehensive Economic Partnership Agreement) with 13 potential trading partners including India, China, Japan, USA and more. This would allow duty-free trade to continue, lowering the impact of restricted market access. Moreover, the government has also been active in formulating a nine-point action plan to be implemented by 2026 to continue enjoying benefits in the EU market in the form of GSP+. Although EU officials have expressed interest and have considered guiding Bangladesh to obtain preferential status, the country still lags behind in terms of implementing necessary labor rights and regulations in the stipulated timeline.22

Secondly, with graduating LDC status, Bangladesh cannot continue to provide cash incentives to export industries to meet WTO criteria. To circumvent this, the government plans to provide subsidies to relevant parties under different names to ensure export competitiveness and revenue inflow from the international markets. It is important to note that the finance ministry had allocated BDT 7,350 crores as cash incentives for exports.23 Moreover, the latest budget also incorporates a 5% VAT on locally manufactured refrigerators to increase competitiveness and innovation in the market, which would potentially lead to higher capacity of the country in exports. Initiatives like this generally reduce industry backwardness and are expected to improve the overall export basket of Bangladesh, increasing export diversification and potentially reducing the heavy reliance on apparel exports.

The Government of Bangladesh has even more scope in terms of intervention and policy measures to enhance international trade and financing opportunities in the post-LDC era.

Firstly, the government should opt to ensure more FTAs and PTAs with more trading partners across the international market. Bangladesh already has a competitive advantage in garments and apparel and is gradually increasing its expertise in the leather and engineering industries. This could be an extremely strong negotiating stance considering the demand for Bangladeshi apparel in the EU, USA, and more recently, China. Experts also suggest taking efforts in regional trade partnerships and trading blocs to further enhance relations in the international market and increase the export scope.

Moreover, in regard to duty-free market entry, although Bangladesh would continue to enjoy benefits in the EU for an extended period, it should strive for GSP+ approval. Not only would that ensure duty exemption up to a certain extent for particular products, but also reduce stress on future exports. Hence, regulatory changes in labor rights, climate sustainability, and other necessary criteria set by EU officials should be strictly taken into account considering the heavy reliance on the EU for apparel exports.

Secondly, some form of tax exemption should be allowed for rising export industries, since cash incentives would no longer be approved. For example, leather goods, home textiles, and light engineering products have growing export trends and the government should divert resources to such fields which could potentially diversify our export basket. Assistance can be provided to stated industries through the purchase of capital machinery and training. Such measures would potentially increase productivity and efficiency in areas that are capable of generating greater returns. Correspondingly, a diversified export basket would reduce the dependency on RMG and create new markets for Bangladesh. An important reference point in this segment would be the case of Malaysian fish exports.13 Even after losing preferential access to the EU, Malaysia was able to overcome challenges by shifting export destinations by taking advantage of favorable agreements in Thailand. On the other hand, even though it was receiving preferential access to garments, it was unable to deliver due to productive incapacity. Hence, emphasizing not only markets but also improving productive capacity is vital in ensuring the continuation of international trade.

Thirdly, and on the note of financing, Bangladesh should opt to create a better investment and business environment domestically. A higher image would only benefit the country in terms of investments only when investors are interested, and a rough business environment is not a friendly scene. As grants and ODAs start to disappear, Bangladesh would need to rely more on private financing and high-cost loans. Attracting higher Foreign Direct Investments (FDI) would reduce debt liabilities and would reflect structural sufficiency, economic strength, and general confidence.

Moreover, in terms of monetary assistance, Bangladesh has good relations with the USA and Japan, the country’s biggest supporters in financial and developmental contributions. Continuing relations with them, and proving its position as a well-governed and productive economy could provide necessary negotiating grounds in rallying funds at low cost. Considering the chaotic geopolitical scene wrought on by the Russia-Ukraine war, it has become even more difficult to tread the waters. Bangladesh must put considerable effort to maintain relationships with Western allies in a manner that doesn’t harm its outlook in other parts of the world.

On the other hand, as external debt is bound to increase, a keen eye must be kept on the foreign reserve of Bangladesh and efforts should be made to not deplete it to a point that creates chaos and fear among residents. Currency devaluation and exchange rate policies are important factors in this regard that must be observed for steady growth. Moreover, the foreign ministry should bolster its strategic stance with a team of experts to effectively negotiate trade deals in the country’s favor.

In conclusion, policy measures and well-governed public interventions are vital in smoothing the transition for Bangladesh. Stakeholders ranging from domestic industrialists to foreign eyes should be noted during implementation. Brazil and South Africa have long been in the “middle-income trap” due to poor governance and mismanagement of resources, and their struggles should be reference points for Bangladesh as it must strive to continue on its glorious path of sustainable economic growth.

This article was authored by Mehedi Hasan Mahir, a Content Writer at LightCastle Partners. Advisory and editorial support was provided by Samiha Anwar, Business Consultant at LightCastle Partners. For further clarifications, contact here: [email protected]

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights