GET IN TOUCH

- Please wait...

As the second largest exporter of RMG in the world, Bangladesh is slowly transforming towards being the green capital in the global ready-made garments sector, with 200 LEED-certified factories, the highest in the world. In its path towards sustainability, over the years Bangladesh has shown tremendous resilience in revamping worker safety and working towards meeting international standards in practice. As the trajectory of growth moves upwards it is essential that Bangladesh attempts to brand itself as a responsible sourcing hub for businesses across the world. Hence, it is time to look deeply into the waste that this sector has generated.

The big volume of export of clothes brings with it a big pile of leftover waste in many forms. Before we delve to understand in what ways can the pile be addressed, a look into the numbers :

It is estimated that globally – 92 million tonnes of textile waste are produced each year. In simple terms, this is equal to one truck full of clothes dumped into landfill sites every second. Forecast suggests that the amount is likely to be 134 million tonnes a year by the end of the decade.

To bring clarity to the contents of the pile, textile waste in general is divided into two segments:

These are also termed as production waste as they are generated during the first phase of the supply chain. Primarily inclusive of scraps and leftover fabrics, the pre-consumer textile waste can also contain papers and packaging. Globally, about 15% of fabrics are cut and discarded, although over time with automation, the number has significantly decreased. Discussion with experts in the field by LCP Team revealed that 10 years back, the wastage amount, particularly in the cutting section was much higher.

Currently, due to newer technological innovation and improved machinery, the wastage has been reduced to an impressive 3-5% in this section.

However, recent study by Reverse Resource suggests that the leftover wastes can be in different forms (yarns, scraps, roll ends, rejected pieces etc). and can range from 20%-47% in the worst cases. This brings the overall amount of waste generated to over 500,000 tonnes a year.

Asides from solid wastes, the manufacturing process also generates pollutants, particularly during dyeing, resulting in dangerous and hazardous chemicals entering river streams. The wastewater with their high chemical and biological oxygen demand is difficult to treat and dispose of [1].

Moreover, waste due to wear and tear of components in the process, such as torn conveyor belts, filters or geo-textiles are also part of the pre-consumer textile waste pile.

This refers to the leftovers at the consumer’s end of the chain. Worn out, damaged, outdated or simply a victim of fast changing closet, the post-consumer textile waste amounts to 3.3 kg of textile waste per year for each average person [2]. Aside from clothing, the items also include sheets, towels and curtains. The 92 million tonnes of waste estimation quoted above majorly consists of post-consumer textile waste.

The increasingly mountainous waste filling up the landfill, upon incineration leads to GHG emissions. Study by the United Nations Environment Program suggests that around 10% of global GHG emissions are caused by the fashion industry, which is higher than maritime shipping and all international flights combined. Locally, Bangladesh’s CO2 emissions have grown at an average of 8% annually over the past two decades and the RMG sector is the major contributor [3].

Furthermore, the production process involves a high amount of water in production. Over 2700 liters of water are needed in the cotton production for a single t- shirt [4], which would quench the thirst of a person for 900 days. Dyeing and finishing processes which require application of chemicals, and are highly energy-intensive, are estimated to be responsible for 3% of global CO2 emissions and the cause of 20% of water pollution.

Moreover, as manmade fabrics catch up, making up for 74% of globally produced RMG products basket, the use of fossil fuel rises exponentially. Around 70 million barrels of oil per year is required for polyester fibers needed to make the convenient clothes we are used to. It is estimated that a polyester shirt has double the carbon footprint and produces 5.5 kg of carbon dioxide compared to 2.1kg from that of a cotton shirt.

While the impact and extent of water pollution has been recognized, with most factories currently having an effluent treatment plant, addressing the textile waste pile is yet to become a priority.

Apart from ensuring that the amount of waste is controlled during the production process, the leftover waste can become the source of raw materials, such as recycled yarn.

The waste pile represents not only the consequence of fast fashion, but also a possible opportunity for Bangladesh to market itself as the most sustainable source, reduce import dependency of raw materials, introduce diversified products in its basket of goods and alongside, possibly create more employment opportunities. Globally around 500 billion is lost yearly due to lack of recycling and only 12% is recycled.

In essence, Bangladesh already has a thriving local market with the rejected or excess production of the RMG sector. The local fashion market currently valued at over USD 2.2 Billion [5] is poised to rise further with increasing domestic demand for diversified clothes. Moreover, recycled fabrics have led to a new market for new goods through downcycling such as hosiery, and flourishing the fabric scraps – “jhoot” market.

Of the total estimated 400,000 tonnes of garment waste, only 5% is recycled. Currently, Simco Spinning Mills in Bangladesh, the first recycled yarn factory, collects local “jhoot” to produce recycled yarn, and has grown 4 times in capacity to meet the demand.

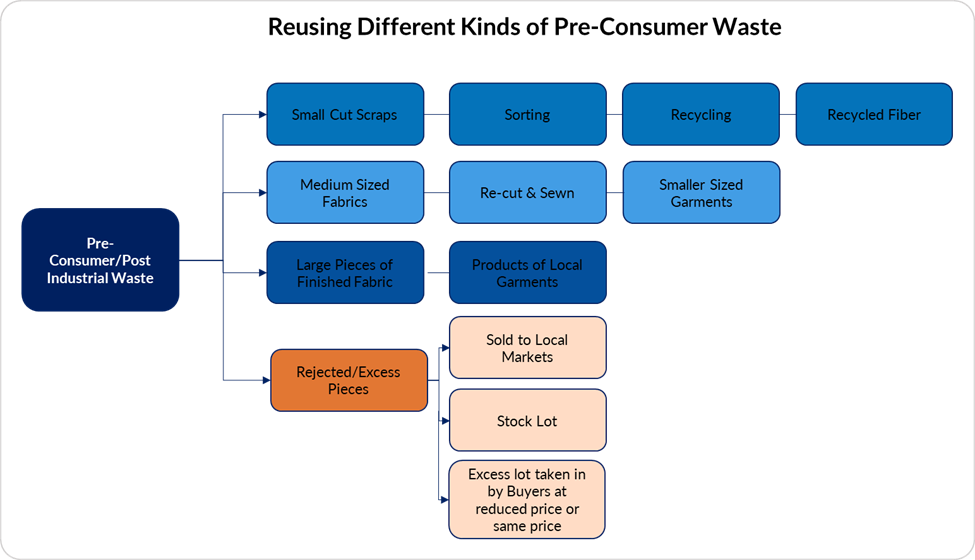

The opportunities for the recyclable clothes are clear – selling excess capacity in the local market, upcycling and downcycling textile fabrics to facilitate the local market.

Moreover, with brands promoting sustainability, such as H&M targeting to produce 100% of their clothes from recycled yarns, the recycling companies and RMG sector are on to the next big revolution within the RMG sector – that of circularity [6]

In its essence, circularity means consumption and production flow in a circular model, to prevent excessive waste generation. It takes the take-make-consume-waste chain and turns it into an ouroboros loop, whereby processes are designed to ensure materials stay within the technical and biological circle for as long as possible. According to Ellen MacArthur Foundation – global leading think-tank in circularity, the circular economy “is a systems solution framework that tackles global challenges like climate change, biodiversity loss, waste and pollution”. The core guiding principles are to eliminate waste and pollution, circulate products and materials and regenerate nature. Moving towards circularity involves not only looking into the consumption pattern of customers, but also ensuring that raw materials used stay within the loop of production.

But how is circularity an answer in dealing with the massive textile waste pile?

Recycling is one of the solutions, and a major step towards the transition to circular economy. It is estimated that globally USD 500 billion are lost each year due to lack of ability, capacity and awareness in recycling clothes. Only 12% of the materials in cloth production are recycled. Much of the reason behind that is due to the lack of technology needed to recycle blended fabrics or manmade polyester fabrics. Co-incidentally, Bangladesh’s product basket in the RMG sector consists primarily of cotton fiber clothing, and these can be recycled using currently available and rapidly expanding recycling technologies.

In fact, in Fashion on Climate – a report by Global Fashion Agenda and McKinsey & Company, estimated that Bangladesh can produce potentially USD 1.2 Billion worth of recycled textile and garment items from the cotton fibers. However currently Bangladesh exports cotton scraps for recycling to other countries such as India, Hong Kong, Sweden.

However, as more brands become committed towards incorporating sustainable practices, the demand for recycled yarns rises, forcing Bangladesh to import recycled yarns. Currently, around 20 yarn recycling facilities are operating in Bangladesh, with a recycling capacity of 2,400,000 tonnes [7]. If all the 100% of cotton-based waste could be recycled, Bangladesh could eventually retain USD 1 billion locally [8].

As Bangladesh prepares for graduation from LDC status, the creeping weight of removal of GSP facilities have already started to feel heavier. In the coming years, with more countries across Africa and Eastern Europe boosting their apparel industries, increased high value product offerings from well placed competitions and the continued lag in lead time due to inefficient infrastructure at ports in Bangladesh, the nation’s biggest exporting sector needs to look into ways to ensure buyers remain interested in Bangladesh as a sourcing hub. Through reducing dependency on recycled yarn and increasing sustainability quotient as manufacturers, the RMG sector stands to gain competitive advantage in the years following LDC graduation. But to do so, efforts must be made to strengthen the sectors and its sub-sectors, by various stakeholders.

Manufacturers need to be shown the business case in reusing textile waste. Initiatives have been taken by multiple partnerships of enabling organizations – involving buyers, recyclers, ngos, innovators and donors. These have started to yield benefits, although the pace is yet to catch up to the ticking clock of graduation ahead. Given the sheer size of the industry, stronger involvement driven by active initiatives to address the bottlenecks related to waste recycling, from associations of manufacturers might be required for quicker impact.

Alongside manufacturers, buyers have a crucial role to play in knowledge and technology transfer. To transition towards a circular economy, the necessity for scalable and efficient technology is inevitable, and buyers like H&M, Primark, Lindex, have already started to take leaps of faith in supporting green innovations across the globe. Moreover, buyers can also help spur local recycling technology within the manufacturing hubs, which can help reduce cost of imports and thus keep prices of products competitive.

Perhaps what is the most necessary first step at this point is the involvement of academics and researchers to create a transparent landscape of the entire textile waste management system across the country. Currently, while much of the waste is exported to neighboring countries for recycling, the value chain of the process is still unclear due to lack of credible studies. To bolster the sector, the importance of good quality research on the textile scraps value chain must be undertaken.

Lastly, government bodies and institutions related to this sector must recognize the necessity and the advantage of textile waste. Beyond viewing this sector as a possible subsector that operates without a formal market, the institutions need to set goals and incentives to strengthen and align the nascent recycling industry with the apparel industry, for a strong and efficient backward chain.

The need for collective action to help futureproof the apparel sector is both ardent and immediate. Lightcastle Partners, as one of the partners of “Oporajita: Collective Impact on the Future of Work”, funded by H&M Foundation and managed by The Asia Foundation in Bangladesh, is working to gauge the upcoming shifts and the relevant factors causing the shifts, which might impact the apparel industry of our country, and along with it the livelihood workers – particularly women garment workers who make up the majority of employees.

The burgeoning pile of textile waste, with its massive carbon footprint, and accumulating cost in Bangladesh can no longer be considered as simply an externality of growth. The opportunity to turn the pre-consumer wastes into a value-generating and market creating channel has been already locally evidenced. As brands and export destinations prioritize sustainability through not only demand-side push for it, but also imposition of newer regulations, it is essential that the RMG sector of Bangladesh prioritize not wasting out on the opportunity to position itself as a circularity hub.

The article was authored by Subrina F Eusa, Business Consultant at LightCastle Partners. For further clarifications, contact here: [email protected].

[1] Ali, N., & Mahmood, R. (2019). Waste water treatment in textile industry- A review. Journal of Cleaner Production, 220, 35-54 Hossain, M. S., & Azam, M. S. (2020). Pollutants from dyeing industry and their impact on the environment: A review. Journal of Environmental Chemical Engineering, 8(4), 104177

[2] UNEP Sustainability and Circularity in the Textile Value Chain

[3] https://www.greenclimate.fund/project/fp150

[4] World Wildlife Fund

[5] https://textilefocus.com/bangladesh-domestic-market-size-apparel-products-around-tk-250-billion/

[6] https://www.tbsnews.net/economy/rmg/when-waste-jhut-turns-gold-168103

[7] https://thefinancialexpress.com.bd/trade/stop-garment-waste-export-to-ensure-supply-for-local-recycling-units-1671161568

[8] https://www.thedailystar.net/business/economy/news/bangladesh-misses-out-using-textile-scraps-full-3222086

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights