GET IN TOUCH

- Please wait...

The apparent effects of climate change have caused turmoil across the globe. Starting from the wildfires and extreme heatwaves in Australia to the flooding in South Asia and the melting glaciers of Antarctica, climate change has been affecting millions of people. It can no longer be brushed under the carpet as an issue to be addressed in the future. Between 2008 and 2016, about 21.5 million people have been forced to become climate refugees. By 2050, the climate crisis could displace up to 1.2 billion people [1].

The increase in CO2 levels due to production and combustion of fossil fuels and emission of other greenhouse gases caused by human activities are liable for deteriorating climate conditions [2]. It is estimated that developing countries will need around $565 billion by 2050 to fight climate change. However, such a high amount cannot be managed through public funding and hence would require private sector participation [3]. To mobilize investments from the private sector, it will be imperative to ensure alignment of incentives.

To make matters worse, climate change has a series of adverse effects on the global economy. High humidity and temperatures lead to disruptions in work, which leads to lower labor productivity and eventual loss in labor hours. Due to exposure to high humid heat, over 650 billion labor hours were lost every year globally from 2001–2020 [4].

About 18% of the global GDP is at risk of being wiped off by 2050 if global temperatures rise by 3.2 degrees. Rising temperatures not only lead to a loss in labor productivity but also affect production levels, which in turn impact the global GDP. It is expected that Asian countries will be at the highest risk with an estimated fall in GDP by 5.5% in the best case scenario and 26.5% in the worst case by 2050 [5].

Almost every country has contributed to the rising patterns of climate change to varying degrees; however, there is an evident inequality in this contribution. The top 10 countries with the largest emissions contribute to 68% of the global emissions, the result of which are mostly borne by the developing countries [6].

Developed countries such as the United States, Canada, Japan, and parts of Western Europe have contributed to 50% of the greenhouse gas emissions from fossil fuels over the past 170 years [7]. Nearly three-quarters of the global greenhouse gas (GHG) emissions from them were contributed by the energy sector. It was followed by the agriculture sector in terms of GHG emissions. In the energy sector, electricity production, manufacturing/construction, and transport were the highest contributors [8].

The consequences of the rising temperatures and worsening climate are disproportionately borne by the developing nations due to their limited access to resources. Thus, it has led to the discourse and development of several agreements and frameworks through which the concept of climate financing has emerged. These are designed to allocate resources to developing countries that are constantly struggling to adapt and mitigate the effects of climate change.

According to the United Nations Climate Change, “Climate finance refers to local, national or transnational financing—drawn from public, private and alternative sources of financing—that seeks to support mitigation and adaptation actions that will address climate change” [9].

Climate funding is essential for widespread emission reduction initiatives. However, the large fund requirement has made it difficult to take sufficient steps towards tackling climate change. In order to implement the United Nations Framework Convention on Climate Change (UNFCCC), developed countries are required to play an active role in providing financial assistance to the developing countries that are most susceptible to climate change.

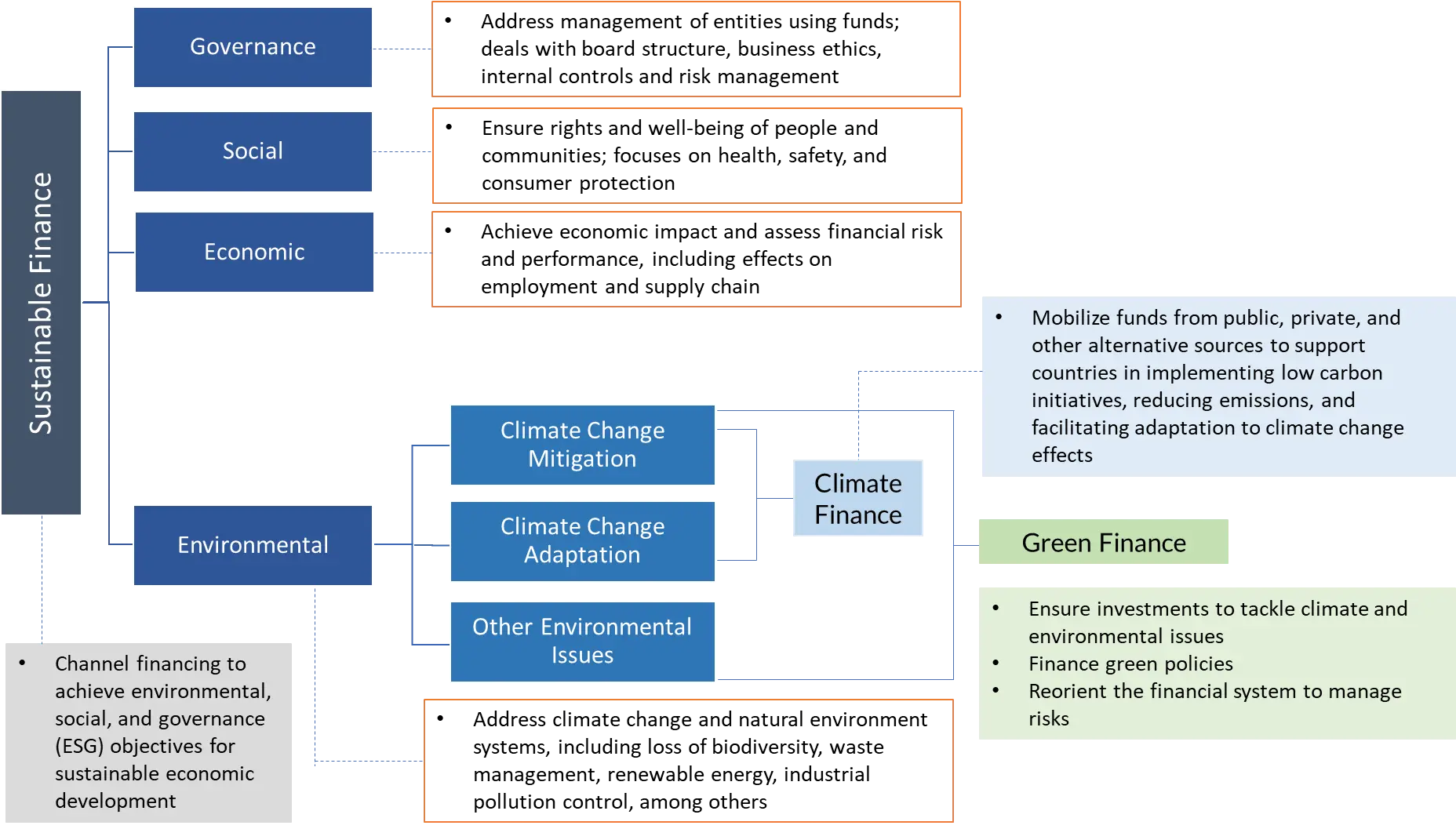

Climate finance is a subset of green finance which is again a part of sustainable finance [10]. UNFCC mobilizes international efforts to mitigate climate change and adapt to its adverse effects. Mitigation primarily refers to the reduction in greenhouse gas emissions while adaptation focuses on adjusting to the changing climate conditions and developing climate resilience.

On the other hand, green finance encompasses financing mechanisms to address both climate and environmental challenges as well as reorienting (greening) the financial system to better manage associated risks.

Sustainable finance is the broadest term that considers social and governance objectives and risks along with environmental issues. It covers all financing activities that are aimed at long-term sustainable development. Social concerns include relevant considerations on surrounding working conditions, local communities, and health and safety, among others, while governance concerns focus on compliance and ethical practices [11] [12] [13].

An overview of the financing structure is shared below to demonstrate both distinctions and overlaps in key components:

The concept of climate financing emerged in 1992 at the first United Nations Framework Convention on Climate Change (UNFCCC) summit in Rio de Janeiro. It conveyed the idea that developed countries should offer substantial financial resources in order to ensure that developing countries are able to tackle the rising effects of climate change [14].

In order to strengthen the global response, the parties launched negotiations in 1995, after which the Kyoto Protocol was adopted in 1997. The first commitment period for the Kyoto Protocol started in 2008 and ended in 2012 while the period for the second commitment lasted between 2013 and 2020.

The Paris Agreement was adopted in 2015, which focused on the financial flows that could lead to achieving a sustainable low-carbon future. Its main objective is to keep the rise in global temperature below 2 degrees Celsius compared to the pre-industrial levels [15]. A commitment was made to mobilize $100 billion annually for developing countries by 2020.

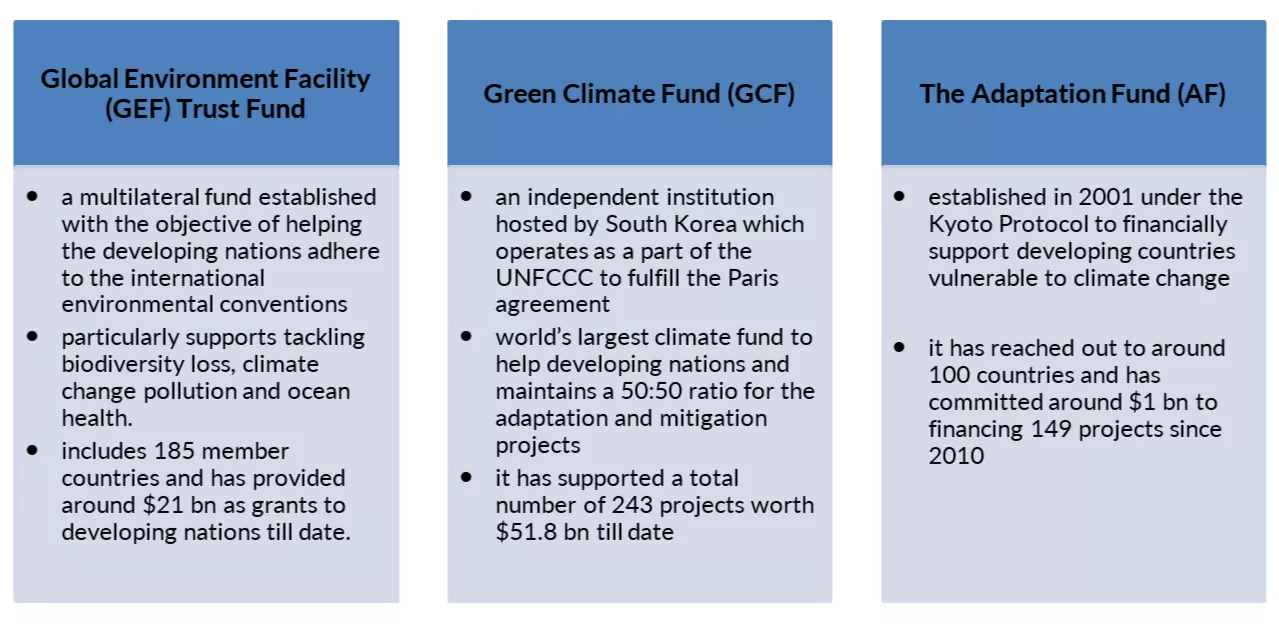

The Convention set up a financial structure to provide climate funding to developing nations. The following mechanism is also in accordance with the Kyoto Protocol and the Paris Agreement. The Global Environment Facility (GEF) has managed the Convention’s finance mechanism since its inception in 1994 following which the Green Climate Fund (GCF) became an official part of the international financial framework in 2011.

Apart from the GEF and GCF, parties have established the Special Climate Change Fund (SCCF) and the Least Developed Countries Fund (LDCF), both of which are handled by the GEF. All of these funds reinforce the financing commitment of the Paris Agreement while the Adaptation Fund (AF) supports the Kyoto Protocol [9].

In Bangladesh, agricultural development and growth are crucial for ensuring food security, but the industry is dealing with a number of issues that prevent growth and impede development.

Some of these issues include the gradual loss of arable land, declining soil fertility and salinization, lack of funding for agricultural research and education, poor credit support for farmers, an unfavorable land-tenure system, outmigration, and a labor shortage in rural areas. In addition, the need to deal with the increasing effects of climate change and to adapt to these issues has become paramount [23].

The agricultural sector has been an integral part of the economy of Bangladesh. According to the most recent data, it contributed to 11.38% of the GDP of Bangladesh, while employing almost about 40% of the workforce [24] [25]. However, owing to the recent climate changes, the agricultural sector of Bangladesh is particularly at risk. It is expected to lose one-third of its GDP by 2050. Arable land for crops may shrink by 18% due to climate change [26].

According to reports, a 4-degree increase in temperature is expected to reduce 28% of rice production and a staggering 68% of wheat production [27]. Thus, it is of absolute importance that sufficient steps are taken to incorporate the proper utilization of climate funds in the agriculture sector.

As Bangladesh is situated in an alluvial delta plain, it is particularly susceptible to sea level rises and salinization of inland water resources. An increase in salinization and the growing infusion of salt and water from rivers and canals will further reduce the land available for crop production. Salinization is a major cause of concern especially in the coastal regions due to the sea level rise. This is also resulting in a change in production patterns as farmers cannot grow multiple crops in a year now.

The rising sea level is also accelerating the risk of water logging and floods in the coastal plain which is only 3-5 meters from the sea level. Bangladesh’s main challenge is to help farmers escape low-profitable rice farming by lowering labor costs. In order to achieve lower labor costs, Bangladesh needs to take sufficient steps to improve mechanization and water conservation through effective on-farm irrigation efficiency. The decreasing availability of agricultural land due to infrastructural projects has escalated the necessity of increasing crop productivity [28].

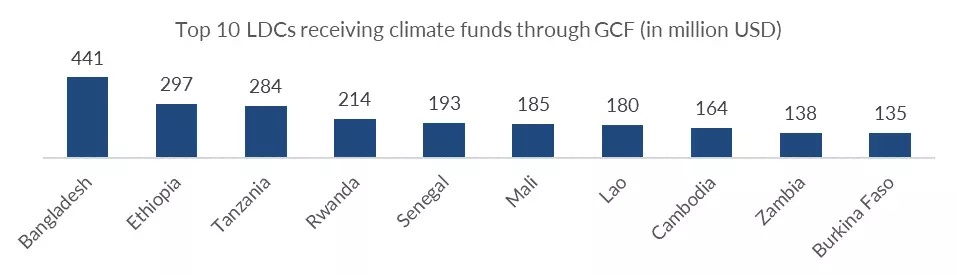

Among the LDC countries, Bangladesh has received the highest funding through GCF. Vulnerable countries such as Bangladesh are particularly in need of climate funds in order to adapt and mitigate the effects of climate change.

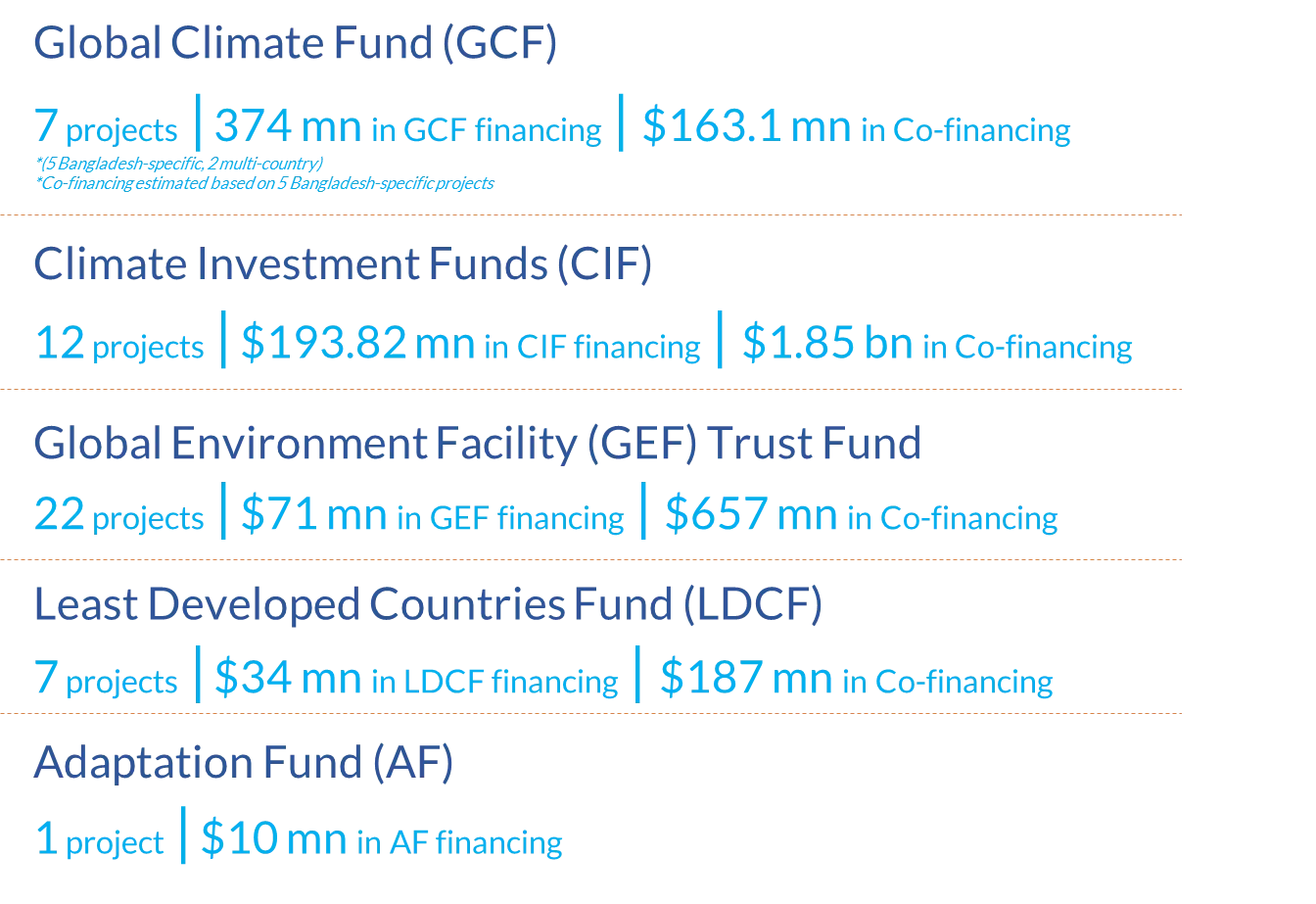

The Green Climate Fund (GCF) and the Infrastructure Development Company Limited (IDCOL) signed an agreement of concessional financing of which $256 million has been approved in GCF financing for an energy-saving project in the RMG industry. The objective of the project is to reduce GHG emissions by allowing the transition to modern equipment [20]. To date, Bangladesh has been allocated $441.2 million in GCF financing for a total of 9 projects. To facilitate the country’s readiness for managing climate funds, 8 projects with a total value of $6.1 million have been approved [21].

Apart from the GCF, some other key international funding sources for Bangladesh include the Climate Investment Funds (CIF) and the Global Environment Facility (GEF), among others [22]. As of December 2022, Bangladesh has received $193.82 million to implement 12 CIF-approved projects. 62% of $1.85 billion in co-financing for these projects is provided by multilateral development banks. Bangladesh began a $10 million project in 2021 with financing from the Adaptation Fund. It is being implemented by UNDP and is focused on climate adaptation in coastal areas and riverine islands [29].

Due to the dependency on climatic factors such as temperature, rainfall, and sunlight intensity, the agricultural sector is one of the most vulnerable sectors. Additionally, estimates indicate that the sector has emitted as high as 50 million tonnes of C02 per year due to rice cultivation, fertilizer-induced farming, field residue burning, livestock production, and manure management [30]. Hence, it is important to facilitate a smooth flow of funds to the smallholder farmers, enabling them to focus on climate-resilient crops and reduce emissions.

The Ministry of Agriculture has been allocated about BDT 9,326 Crores in 2022-23, with a climate-relevant allocation of 37% [31]. Only 20% of the required funding for climate change adaptation comes from international sources [32]. Resilient crop varieties, new and varied cropping patterns, irrigation techniques, sustainable land management, early warning systems, and new research are just a few examples of the agricultural sector’s adaptation to climate change.

In this scenario, climate finance serves as a remedy by assisting in the adoption of numerous strategies to deal with the current problems and those that the nation will likely face in the future. One of the most popular uses of climate funds is the application of Climate-Smart Agriculture (CSA) which has been elaborated below [23].

Just acquiring the climate fund is not sufficient, it is important to effectively utilize the climate fund to produce effective results. One such intervention is the implementation of Climate-Smart Agriculture (CSA) which can address climate change challenges and ensure a proper utilization of the funds. It can lead to improving food security and minimizing the impact of climate change.

Apart from CSA, other interventions such as crop diversification, ensuring optimal and efficient use of water resources, infrastructural development, education, and capacity building are also potential areas of intervention that would ensure proper utilization of the climate funds in improving the agricultural sector [33].

One of the applications of the CSA technology could be through the implementation of a hydroponic system in Bangladesh which is also known as floating gardens. The introduction of biofortification of crops and the development of seed varieties, the use of ribbon-retting methods, and solar-powered irrigation would also be possible applications of CSA intervention.

The CSA practices are already in use in certain regions of the country as they are derived from traditional farming practices. However, it is important to ensure that the practices become widespread for the implementation of CSA to be successful [22].

In December 2014, the FAO named Bangladesh’s floating garden hydroponics system a Globally Important Agricultural Heritage System (GIAHS) for its ingenuity, sustainability, and flexibility. Currently, there are 47 sites in 8 countries of the Asia-Pacific region including China, India, and Japan which have implemented such a farming method [34].

The floating gardens help to utilize the wetland resources for farmers who cannot find sufficient cultivable land [35]. Farmers in areas with long-term floods have built floating fields with organic beds of water hyacinth, algae, and other plant residues. This environmentally friendly way uses wetlands to grow vegetables and other crops almost year-round, benefiting the local population.

Water hyacinth-layered vegetable plots in tidal flooded areas reduce climate risk. Improved kangkong (water spinach) varieties can boost yield. Waterlogged Bangladeshi farmers have used many ridging and furrowing methods. The fund could be used for owning or renting a seedbed. There are also additional expenses of hiring labor and helping hands along with the cost of purchasing seedlings and pesticides.

Bangladesh can also take inspiration from Mauritius which managed to develop heat-tolerant tomato varieties as a part of the CSA practice. This was developed in collaboration with the Plant Breeding and Genetics researchers at the Joint FAO/IAEA Centre, and scientists at the Food and Agricultural Research and Extension Institute of Mauritius. Warm temperatures of the field were replicated in controlled growth chamber environments which enabled the screening of heat-tolerant tomato lines. This method was proven to be successful in Mauritius and the seeds are now being distributed for cultivation. [36].

Among the countries affected by climate change, the Philippines has successfully started using climate finance to develop resilience in its agricultural sector. The country is expected to receive $39.2 million ($26.2 GCF grant and $12.9 million co-financing) to adapt agricultural systems to climate change.

Over seven years, the project will directly benefit 1.25 million low-income smallholder farmers in nine regions and five vulnerable provinces by raising their awareness of risks and risk-reduction measures, building their capacity on climate-resilient agriculture practices and enterprises, and incorporating climate-resilient technologies into their work.

The program integrates climate-resilient agriculture into national and local development goals. Through this project, the Department of Agriculture and Philippine Atmospheric and Geophysical and Astronomical Services Administration-funded effort will reduce 4.38 metric tonnes of carbon emissions over 20 years through better land use and climate-friendly agriculture.

In Cambodia, $42.8 million will be invested to prepare small farmers, especially women, to cope with climate change in the flood-prone area of the Northern Tonle Sap Basin. Of the $42.8 million, $6.6 million will be funded through co-financing from the Ministry of Agriculture, Forestry and Fisheries, the Ministry of Environment, and The Food and Agriculture Organization of the United Nations (FAO). The project is expected to reach out to 450,000 vulnerable farmers by educating them about climate-resilient, higher-value, diversified, and sustainable agricultural production and processing [37].

The Mujib Climate Prosperity Plan intends to improve access to agro-meteorological services in order to adapt agricultural, fisheries, livestock, and poultry supply chains to climate change. Conducting research in climate-resilient plant varieties, improving production systems, formalizing supply chains, improving farmers’ access to financial institutions, and implementing culturally sensitive solutions will protect the communities prone to climate change.

Nature-based solutions such as seaweed cultivation, floating gardens, aqua-geoponics, and vertical farming are some of the innovative operating models proposed. Extreme heat can lead to lower yields, hence discouraging investments in the agricultural sector. Thus, to address this issue, a financial support liquidity and social protection scheme will be made available. It has set a target milestone of improving supply chain access to agro-meteorological services by 100% by 2030 [38].

The Delta Plan 2100, National Determined Contribution 2030, Bangladesh Climate Change Strategy Action Plan 2009, and the recently drafted National Adaptation Plan require 2.20% of GDP for implementation but the current allocation is only 0.74% as of June 2023 [39] [40]. From the Nationally Determined Contribution (NDC), it can be found that Bangladesh is committed to reducing its greenhouse gas emissions by 6.73% with its own funds. An additional 15.12% can be reduced with support from international partners by 2030 [29].

The government has allocated BDT 4,880 Crore for the development of climate-resilient cropping systems and production technologies while BDT 3,060 Crore will be allocated for the adaptation against drought, salinity, submergence, and heat in 2023-24.

A total of BDT 37,052 crore has been allocated as a climate-related allocation in the budget for the 2023-24 fiscal year which is 9% of the total budget [31]. The National Adaptation Plan (NAP) will be the core guideline for determining investments to tackle climate change for the upcoming 28 years.

Bangladesh has committed to achieving six goals through the implementation of the interventions in NAP i.e. i) ensuring protection against climate change and disasters; ii) developing climate-resilient agriculture; iii) building climate-smart cities; iv) protecting nature for adaptation; v) integrating adaptation into planning; and vi) ensuring capacity-building and innovation in adaptation. The 113 major interventions identified in NAP will require 75% of about $230 billion by 2040 [41].

Locally-led Adaptations (LLA) help to mobilize climate funds to ensure the ownership of local actors in adaptation planning and implementation. This results in a higher quality of finance, governance, and decision-making [42]. One such example of an LLA would be the Adaptation Clinic by BRAC which has been discussed below.

BRAC is engaged in the development of salt-tolerant agricultural crops and with constant research they aim to produce seeds that will be tolerant to salinity of up to 15 ppt of salt. Recently, BRAC introduced a variety of salt-tolerant sesame seeds. The adaptation clinics, situated in Jamuna Char, also have storage facilities that allow the farmers to market seeds at the most profitable time of the year.

Adaptation clinics are also capable of storing up to forty kilograms of products. Farmers can forecast meteorological conditions with the assistance of adaptation clinics and may discover potential markets for product distribution via clinics. Such adaptation clinics are examples of LLA which adhere to the eight principles of locally-led adaptations that were co-developed by the Global Commission on Adaptation, BRAC, the Global Center on Adaptation, and other organizations [43].

Despite being one of the most vulnerable countries, the rate of obtaining international funds is not satisfactory for Bangladesh. This is mainly because of the lack of results monitoring and insufficient impact reporting which results in slow rates of obtaining funds. Bangladesh needs to focus on improving transparency along with building its capacity to increase the efficiency of its fund management [44]. Clarifying reporting ambiguities is essential for increasing accountability, transparency, and confidence.

Receiving funds is extremely competitive for developing nations. Hence, it is of prime importance that the government properly utilizes the funds to reduce its emissions in order to obtain future financial flows. There has to be a balance between climate financing initiatives and other infrastructure development projects with environmental repercussions to avoid any risks of losing out on the climate funds [45].

For Bangladesh to achieve its targets, private investments and innovations are extremely important. Research, development, and dissemination of climate-smart agriculture can be achieved through the collaboration between producer groups and the private sector. It could be supported with an investment potential of $117 million, helping 60 million people [46].

Private sector finance in the form of green bonds and insurance can be used to meet the finance needs. Debt for adaptation swaps can be used to encourage more LLA [47]. The gaps in the fiduciary system have to be mitigated to access climate finance from the Green Climate Fund (GCF). The lack of historical climate data poses a challenge in determining whether a natural occurrence, such as a flood in the haor region, is a result of climate change or a routine event [19].

One of the strong references for Bangladesh could be Egypt’s global efforts towards climate adaptation, mitigation, and coordinated financing. In order to facilitate the transition to a more sustainable and climate-resilient economy, the Egyptian government has recently launched the National Climate Change Strategy. By issuing the region’s first sovereign green bond, Egypt has facilitated the development of the green finance market. This initiative intends to provide funding for sustainable water management and renewable transport projects [48].

There is a scope to double down on advocacy efforts to receive support from the international bodies. Accessing a climate finance fund is a lengthy and tedious process as of now which requires the developing countries to provide scientific proof dating back to as long as 30 years to establish the need for a climate finance fund of the particular country. This slows down the entire process of obtaining climate finance, hence discouraging the countries from being proactive in their efforts to control climate change.

Despite the claims by GCF regarding accelerating the flow of climate finance, it took a duration of six months to obtain approval for the Funded Activity Agreement (FAA). This led to an approximately two years’ long process to facilitate the integration of climate-resilient infrastructure in Bangladesh. According to a report by the Infrastructure Development Company Limited (IDCOL), the process of obtaining accreditation took approximately two years and necessitated the submission of 188 documents [19].

Climate finance provides the necessary financial resources required to reduce the amount of greenhouse gas emissions present in the environment. It plays an important role in helping to adapt to climate change. Those working in the agricultural sector can continue to cultivate crops and generate income by employing climate-tolerant seed varieties. It is important that the government actively allocates public finance to fund initiatives for which private finance is either not available or unlikely to be solicited.

For example, the utilization of public finances to strengthen river embankments in order to impede inundations is a ubiquitous practice. The importance of private funds should not be underestimated. It is essential that private finance contributes to achieving climate objectives and participates in green economy endeavors.

Shehrin Radiyat Shahnawaz, a Content Writer, has prepared the write-up with Shubham Roy, Business Consultant at LightCastle Partners. For further clarifications, contact here: [email protected].

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights