GET IN TOUCH

- Please wait...

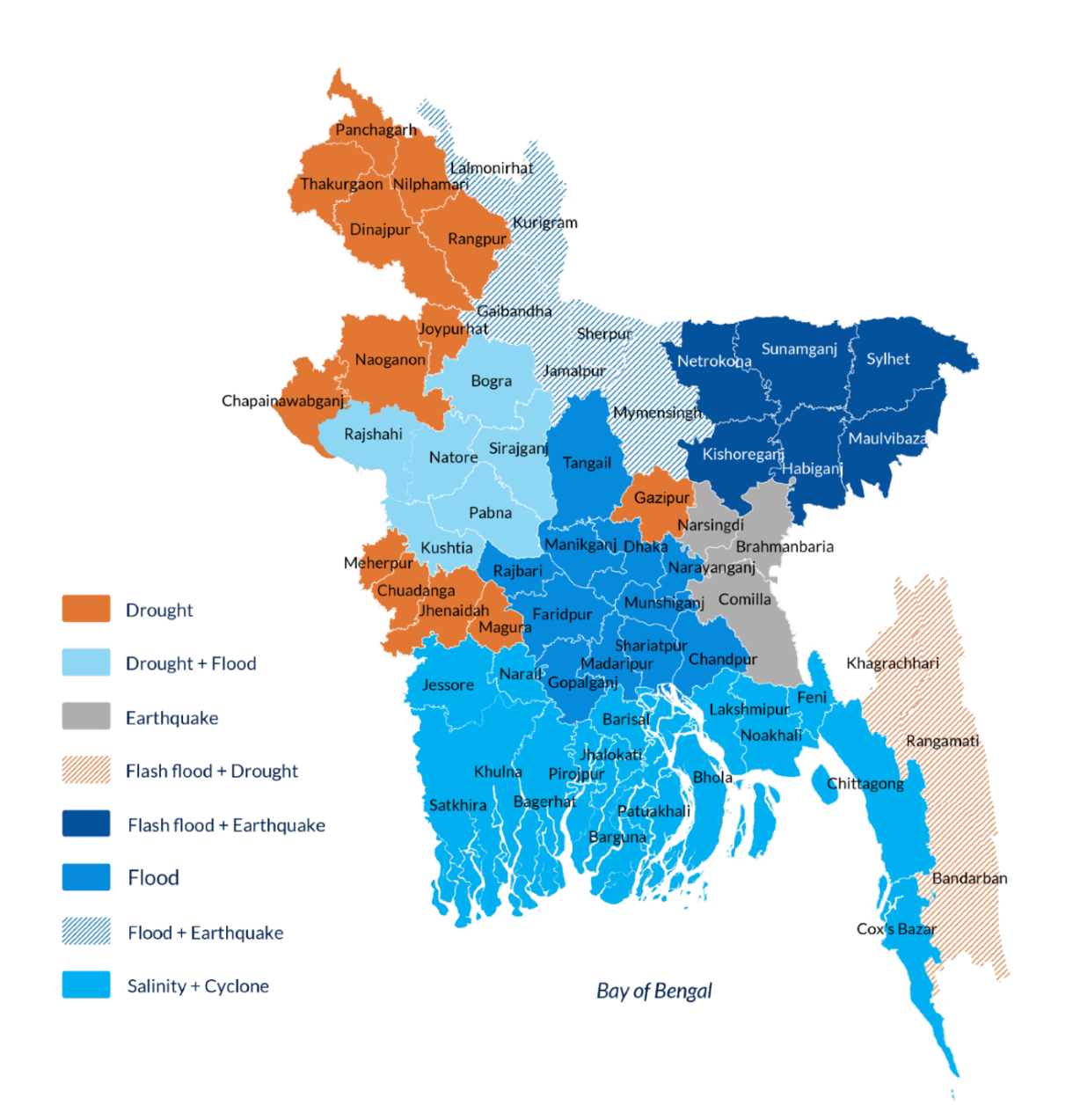

Bangladesh ranks 94th in the world in terms of land area, accounting for only 0.1% of the total landmass of the world. However, this small nation is subjected to a myriad of climate change-induced calamities, with significant regional variations. Diversity is etched in the geographic make-up of the nation, with populations in the districts of Bogura and Sylhet, distanced a mere 390 km from each other, facing strikingly different climate vulnerabilities.

Even though Bangladesh only accounts for 0.51% of the total greenhouse gas (GHG) emissions in the world, it ranks 7th on the global climate risk index. Delving deeper, the country ranks 9th worldwide in terms of fatalities and 37th in terms of losses in GDP due to climate-related disasters. This disproportionate risk allocated to the country is the result of various geographic and socioeconomic factors.

As Bangladesh is positioned to face the disproportionate effects of climate change, the government has made climate action a key in its national narrative.

The Government of Bangladesh (GoB) has outlined priority areas for climate action in national plans with a range of estimated financial requirements:

| Year | Plan | Proposed Investment | Total Plan(U$ Bn) |

|---|---|---|---|

| 2018 | Bangladesh Delta Plan 2100 | Adaptive water management and multisectoral infrastructure | 38.0 |

| 2021 | Nationally Determined Contributions(Unconditional) | Energy | 30.8 |

| Agriculture, forestry and other land use | 0.8 | ||

| Waste | 0.6 | ||

| Total for Unconditional NDCs | 32.3 | ||

| 2021 | Nationally Determined Contributions(Conditional) | Energy | 137.5 |

| Agriculture, forestry and other land use | 2.5 | ||

| Waste | 3.8 | ||

| Total for Conditional NDCs | 143.7 | ||

| 2022 | Mujib Climate Prosperity Plan | Accelerated adaptation | 44.1 |

| Just transition of labor, technology transfer | 11.6 | ||

| Increasing public revenue | 3.9 | ||

| Climate and disaster risk financing and management | 4.9 | ||

| 21st century technologies for wellbeing | 4.6 | ||

| Renewable energy, energy efficiency, power and transportation resilience | 20.6 | ||

| Total for MCPP | 89.7 | ||

| 2022 | National Adaptation Plan | Water Resources | 99.2 |

| Disaster, social safety and security | 22.4 | ||

| Agriculture | 15.9 | ||

| Fisheries, aquaculture and livestock | 13.4 | ||

| Ecosystems, wetlands and biodiversity | 4.9 | ||

| Urban areas | 31.6 | ||

| Policies and institutions | 1.3 | ||

| Capacity development, innovation and research | 2.5 | ||

| Total for NAP | 191.2 | ||

The total estimated cost of plans set forth by the government adds up to approximately U$ 456.9 Bn. In order to put these plans in motion, these costs need to be supported by both domestic and international streams of finance. Currently, the main pillars supporting climate finance include public and foreign funds.

Prominent sources of international funding for climate action include the Green Climate Fund, under which U$ 374Mn has been approved, the Climate Investments Fund, which totals U$ 2.04Bn and the Least Developed Countries Fund which has approved U$ 34.4 Mn.

Domestic allocation for climate finance is outlined in the government’s budget report. The fiscal year 2021-22 saw a budget allocation of approximately U$ 209 Mn. Other domestic resources include the Bangladesh Climate Change Trust Fund, which totaled U$ 450 Mn between 2009 and 2020, and the Green Transformation Fund, which is a U$ 200 Mn refinancing scheme.

While the weight of climate finance is being pulled mainly by international development funding and domestic public funding, as Bangladesh is set forth to graduate from its LDC status in 2026, Overseas Development Assistance (ODA) and LDC-specific funding are likely to decline. Simultaneously, Bangladesh could also see an increase in the cost of loans from various bilateral and multilateral partners.

To soften this anticipated fall in funding, private sector investment in the climate action space could play an integral role. Blended finance, which is still a relatively new concept, involves combining private-sector capital with public funding to achieve development goals. It works to de-risk private sector investment, thereby stimulating investor appetite.

| Risk | Example in Bangladesh | Blended Finance Rationale |

|---|---|---|

| Policy Risk | While renewable energy (solar) projects tend to have long payback periods of 5-7 years, the policy environment regarding renewable energy is volatile | Blended finance could de-risk unclear regulatory frameworks |

| Project Risk | Lack of green skilling in agriculture/agro-processing sector | Blended finance models could account for providing technical assistance for upskilling workers |

| Liquidity Risk | Disbursal of climate finance from commercial channels too cumbersome | Blended finance models could provide more direct access to finance for enterprises working in the climate space |

The key catalytic factor of blended finance is that it can mobilize additional financial resources to support development. While the concept is still at an early stage, numerous examples of blended finance models have been implemented across the globe.

Development partners such as USAID have successfully been implementing blended finance models in countries like Indonesia and Mexico. While blended finance examples in Bangladesh exist in many cross-cutting sectors such as agriculture, employment and healthcare, similar models can be replicated in the climate space.

Two such models could be a climate loan facility and a climate impact fund.

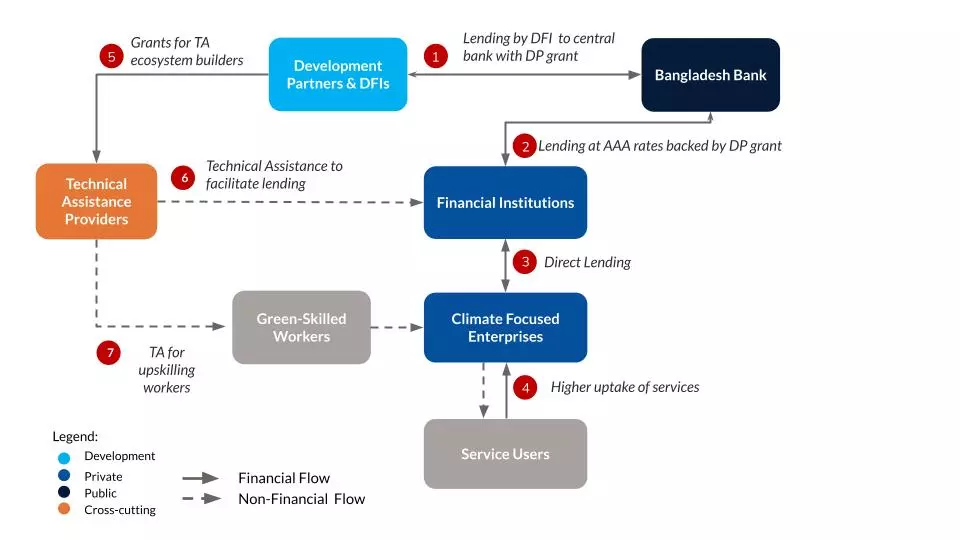

In a potential climate loan facility, Development Financial Partners (DFIs) could provide grant funding to the Central Bank of Bangladesh, which will lend to financial institutions at concessional rates.

Development partners could also provide grants for technical assistance to TA providers who will upskill workers to be better equipped with green skills. These workers will act as inputs for the climate-focused enterprises, who will work to achieve better climate action outcomes.

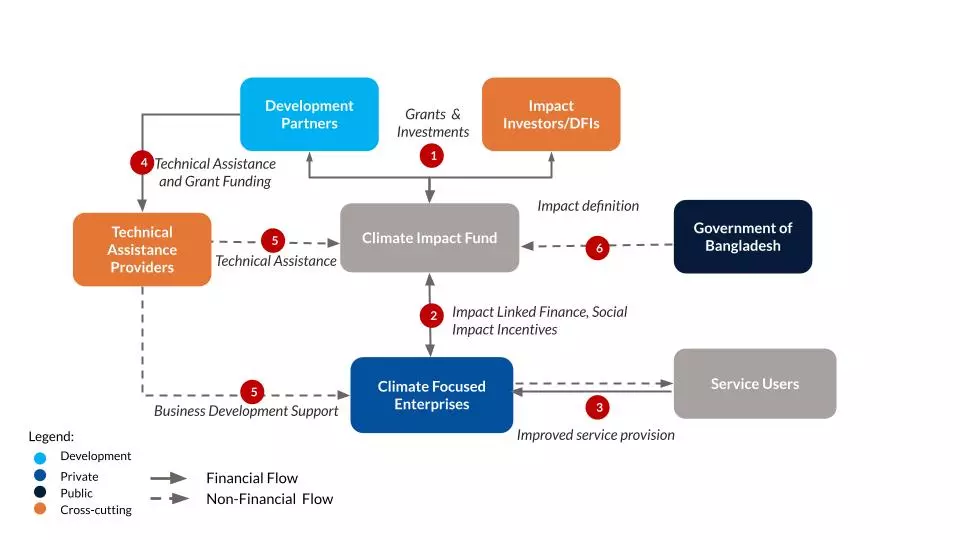

Alternatively, a climate impact fund would consist of development partners and impact investors working together to set up a common fund. Based on eligibility criteria set around impact metrics, enterprises can avail the fund.

Ecosystem Service Organizations (ESOs) can help in capacitating climate-focused enterprises to become more investment-ready, and the government of Bangladesh could step in to provide a standardized impact definition and measurement framework.

For financial instruments to bring about material change, they have to be widely accepted among the relevant stakeholders. In Bangladesh, blended finance is still a relatively new concept, which hampers its uptake within the ecosystem.

Due to the infancy of blended finance in Bangladesh, existing stakeholders do not have the relevant knowledge regarding innovative financing instruments. This means the current ecosystem is not ready for wide-scale implementation, and requires capacity building and knowledge development.

The existing policy framework still comprises multiple gaps while common standards and frameworks are still at an early stage. Policy tools need to be devised to tailor impact measurement and metrics to different sectors and types of enterprises, within the local Bangladeshi context.

While players such as the Netherlands Development Organization (SNV) have been implementing blended finance models within the climate space, local examples and use cases are still very too few in number, and not widely recognized. In order for blended finance to truly catalyze investments in the climate space, more use cases need to be spotlighted to build confidence.

Bangladesh’s ongoing chapter on climate change requires innovative solutions in the realm of climate financing. Blended finance, with its potential to leverage private sector investment, offers a promising avenue to bridge the funding gap and drive impactful change. As Bangladesh charts its course towards climate resilience and sustainable development, blending public and private resources could be a critical step forward in the pursuit of a greener, more secure future.

Wasema Rahman, Business Analyst at LightCastle Partners, has prepared this write-up. For further queries, please contact [email protected].

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights