GET IN TOUCH

- Please wait...

![SMART Blended Finance Program [Part II]: Mitigating Financial Barriers for MSMEs](https://www.lightcastlebd.com/wp-content/uploads/2023/01/B-SkillFUL-Case-Part-2.jpg)

This is the second of a three-part case study on the SMART Blended Finance Program. This part will set the scene for MSMEs’ financial needs and explain how the blended finance program helped them overcome the financial barrier to seeking financial assistance from conventional banking institutions.

Bangladesh’s Micro, Small, and Medium Enterprises (MSMEs) are failing to realize their full potential due to inadequate financing. From an investor/lender perspective, most MSMEs appear to be either too small/risky for commercial lenders or too large for MFIs.

Despite the fact that Bangladesh has nearly 60 banks, 34 NBFIs, 760 MFIs, and 17 alternative investment companies, MSMEs face significant challenges in attracting capital that aligns with their needs and characteristics. As a consequence, they are quite often prevented from developing to their full potential.

Characterized by inadequate revenue generation and high lending risks, the vast majority of MSMEs are deemed ‘unbankable’ by financial institutions. As a result, they are often excluded from traditional financing even though this is the only form of financing these MSMEs are qualified for.

Furthermore, MSMEs’ insufficient knowledge and ability to document financials keep on resulting in the gap between lenders and borrowers being widened.

Given the current state of the ecosystem, MSMEs require patient or risk capital; however, such options are scarce at the moment. Institutional frameworks are not aligned in terms of patient or risk capital, which is why the range of financing options circles back to mostly leverage choices.

Moreover, there is an absence of interoperability between a variety of financial institutions. Such financing mechanisms and options expose enterprises to a slew of operational risks. Assets purchased with such financing options may lose value quickly, and financial losses may increase as financial leverage grows.

Furthermore, such funds have very high associated costs and necessitate frequent cash payments, which may not correspond to the cash cycle of an enterprise. Agent banks are also currently more focused on deposit mobilization than credit disbursement.

Blended Finance can play a pivotal role in addressing this major gap in the market. This is particularly important in the context of Bangladesh, where innovation in products and services is needed to reach the underserved segments of the population.

By utilizing market-correcting strategies and cutting-edge financial tools to persuade capital providers to take on greater risks and achieve sustainable development through private investment, blended finance is poised to be the future of global development. It allows for organizations with different objectives to invest alongside one another while achieving their own goals (whether financial return, social impact, or a blend of both).

Executed properly, and to the extent, it matches an enterprise’s desired requirements, blended finance can serve as a powerful tool to pave the way for the next wave of sustainable development of the MSME ecosystem in Bangladesh and beyond.

Blended Finance instrument allows for different financial partners to contribute and ensure sustainable development for MSMEs.

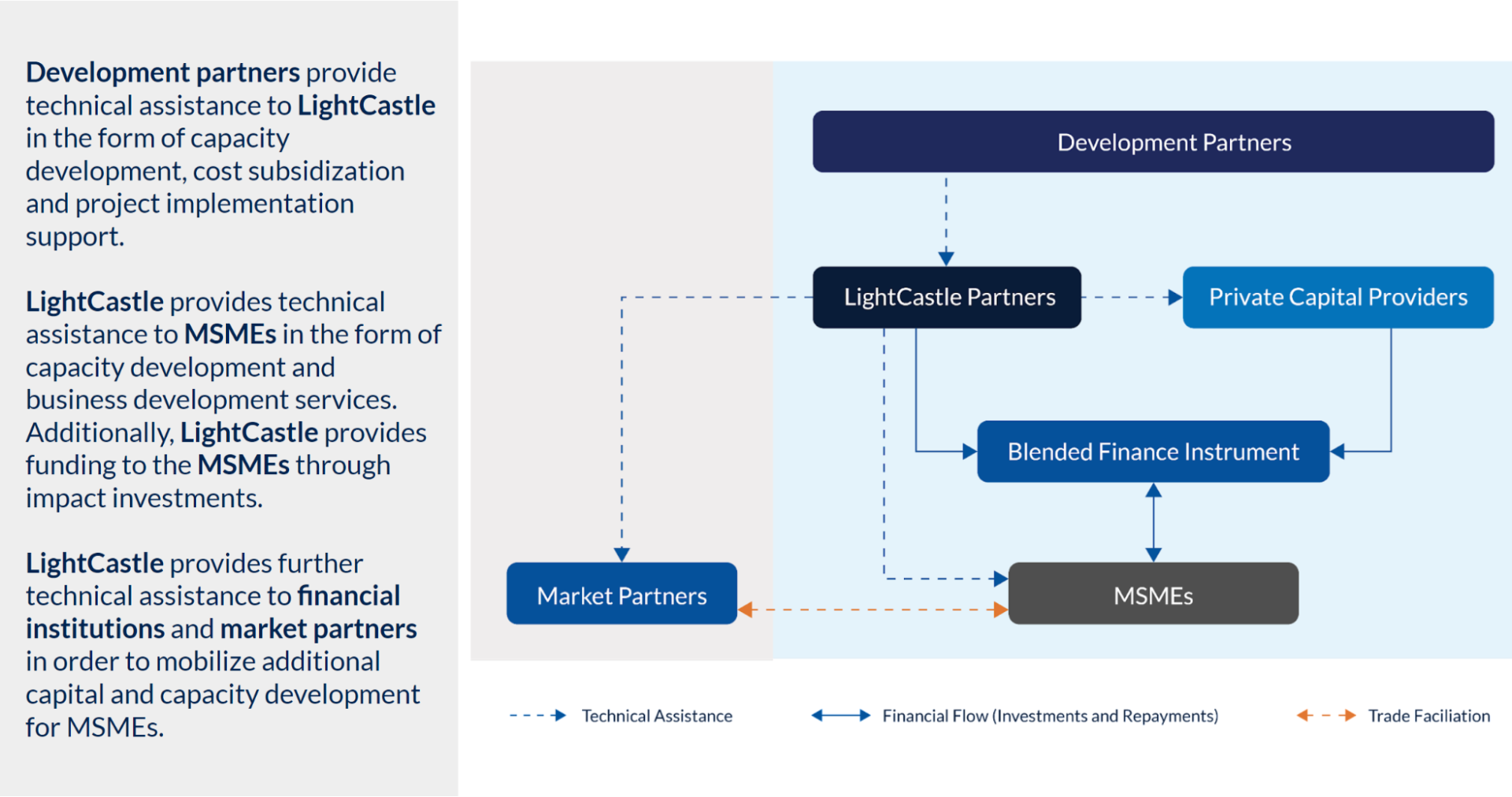

On the one side, the model did focus on strengthening partnerships with private capital providers (impact investors, banks, NBFIs, and fin-techs). On the other, it also focused on addressing the key needs of the MSMEs and subsequently provided them with business development support services (BDS) – knowledge, record-keeping, digitalization, branding/marketing, and good governance – to increase their ability to absorb and manage investments to move up the ladder.

This way, the model attained its objective of becoming a self-sustaining mechanism for the future whereby MSMEs can easily move along the spectrum, attracting the right capital from the right set of investors/lenders within the ecosystem. The model is depicted below:

An in-depth look at the Blended Finance Instrument (BFI):

The Blended Finance Instrument had two specific components:

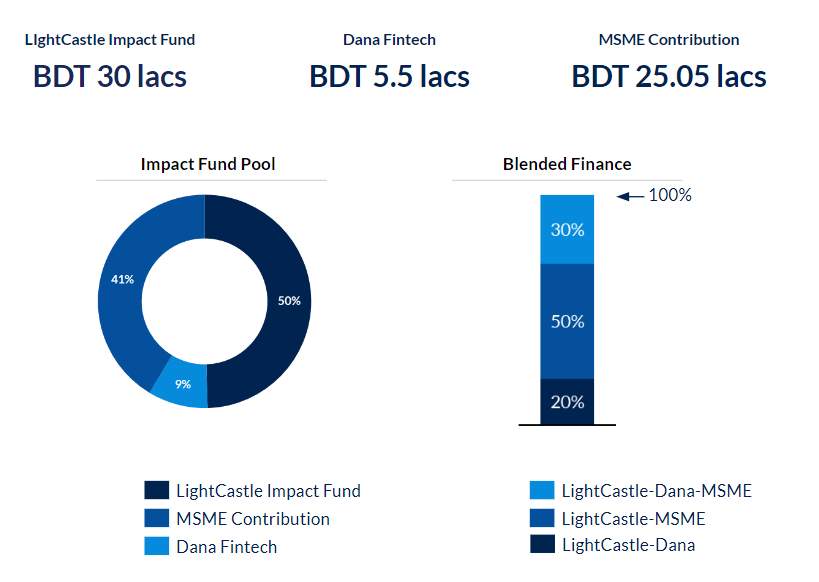

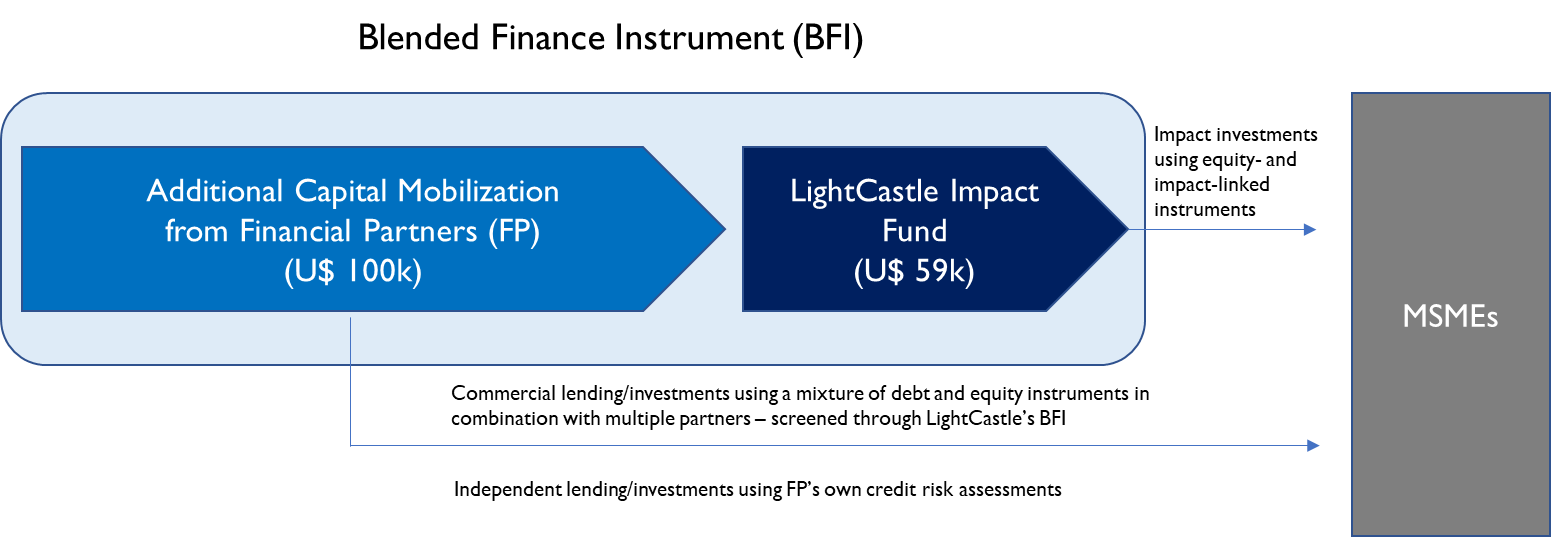

Through the LightCastle Impact Fund, we provided up to U$59,000 ~ 60 lakhs in guaranteed financing to 10 MSMEs. The LightCastle Impact Fund is a collective fund made up of contributions from LightCastle Partners, Dana Fintech, and MSME Contribution.

Two formal Financial Institutions (FIs) were onboarded during the project phase: Bank Asia, and IDLC. However, there were multiple other interested financial institutions such as the Brac Bank, One Bank, Premier Bank, Modhumoti Bank, Social Islami Bank, LankaBangla Finance Ltd, and Islamic Finance & Investment Ltd.

The formal financial partners undertook independent credit assessments and have narrowed down further 8 MSMEs to provide financial support. Additionally, there is another U$100,000 in the pipeline, and these FIs are keen to contribute capital if their requirements are satisfied.

Below is a complete illustration of the Blended Finance Instrument:

Our Blended Finance Instrument (BFI) is an equity-and-impact-linked instrument, which aims to promote LRDW (Labor Rights and Decent Work), OHS (Occupational Health and Safety) & GESI (Gender Equality and Social Inclusion) through investments.

In order for the MSMEs to access the Impact Fund they had to fulfill the following clauses.

Clause 01: Enabling fire extinguishers in the factory and setting up periodical fire safety training in the working environment.

Clause 02: Installing first aid box and establishing PPE for worker safety.

Clause 03: Developing a compliance culture of hiring based on documented contracts and mentioning the relevant clauses before hiring; moreover, setting a policy for employee work culture.

Clause 04: Promoting the hiring of female employees and ensuring decent working conditions.

Overall, the instrument was designed to help MSMEs become self-sufficient and improve as an organization.

To be continued.

Our experts can help you solve your unique challenges