GET IN TOUCH

- Please wait...

Globally most of the startups are either shutting down, laying off staff or drastically changing their strategies in the wake of COVID-19. Many of the Bangladeshi startups which raised a lot of money on the promise of rapid growth are facing plummeting demand as consumer spending stalls and unemployment is set to surge. Even the buzzy sectors like fintech, healthtech, edutech and deep tech are not immune from the effects of the pandemic.

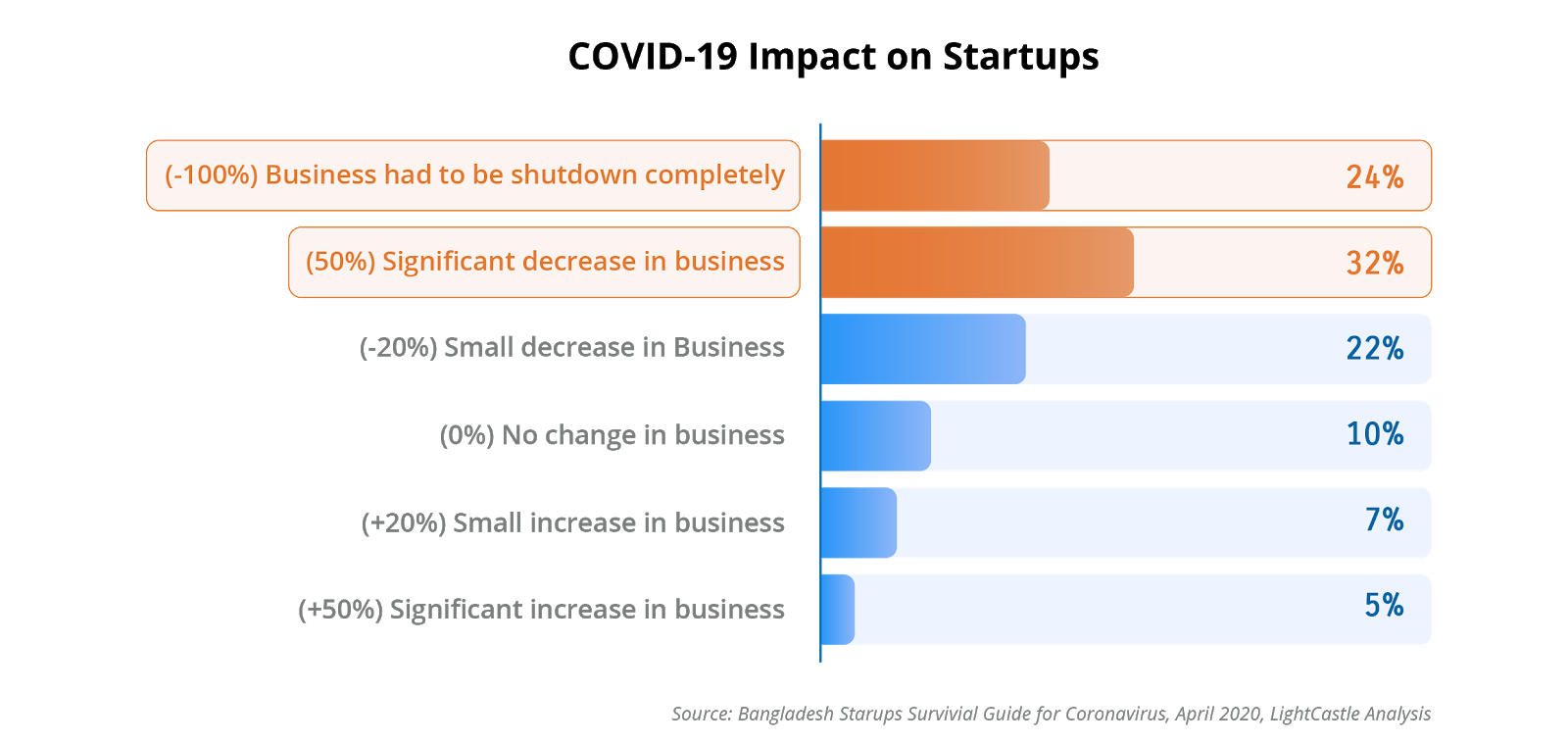

A quick survey of startup founders during these uncertain times shows that there has been a significant fall in their business activities : 32% reported a decline in business activities by more than half while another 24% reported a complete business closure.

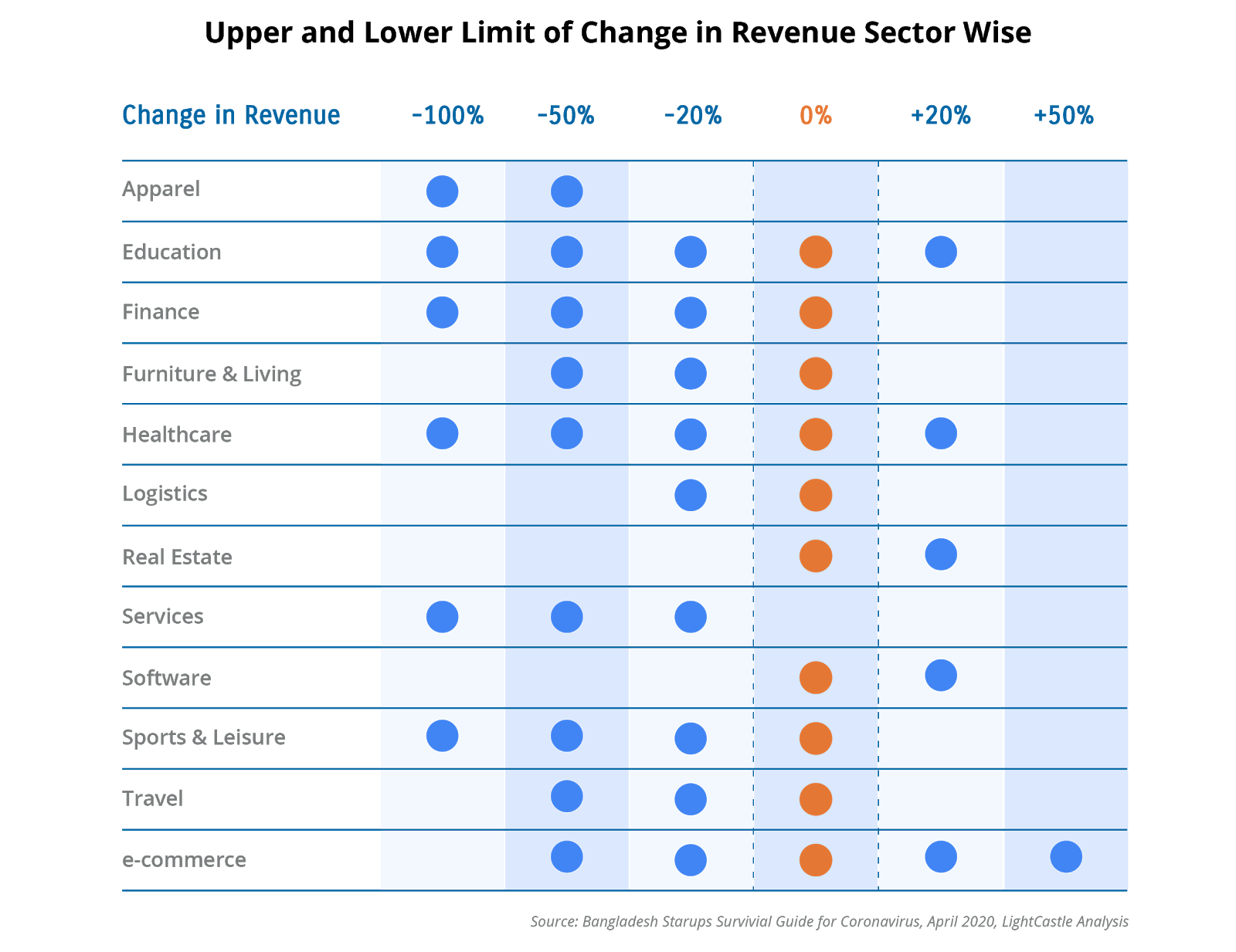

In Bangladesh, the coronavirus pandemic has hit sectors like Apparel, e-Services and Tourism the hardest. Education (including edutech), finance (including fintech), healthcare (including healthtech) sectors have faced an initial blow but might recover partially provided that consumers will need them more if the current situation persists. Although logistics sector players have reported a loss in revenue by 20%, the sector can bounce back if they improve their operational plan by partnering with e-commerce companies. With the onset of this lockdown, some of the e-commerce sector players have reported a 50% increase in business.

According to Venture Capital and Private Equity Association of Bangladesh (VCPEAB), around 300 startups fear a loss of more than USD 53 M as sales of products and services have come to a halt. Also, startups having an export-oriented income have experienced an 80% fall in revenue recently. The jobs of almost 150K people– directly employed in these startups– are on the line now while about 700K service providers associated with these startups are currently not in a position to provide services either.

Each startup is different and needs to customize its survival strategy based on its market offering and value proposition. For example, Edutech startups can promote their professional courses as “skills you need to develop to survive in a post-corona world” through digital media. Most of the people have been working from home and thus doing online courses sounds way realistic than buying apparels online. On another note, many areas inside Dhaka are going into complete lockdown recently. In the face of this challenge, healthtech, e-commerce and logistics companies can come up with rescue strategies.

As a global recession awaits us, Bangladesh startup founders will have to deal with difficult decisions ranging from executing operations for the next one to two months to strategically planning the next 12-18 months. Based on our exhaustive research on available survival guides and interviews with industry experts, we have come up with some measures that might help the startups to navigate through the rough waters.

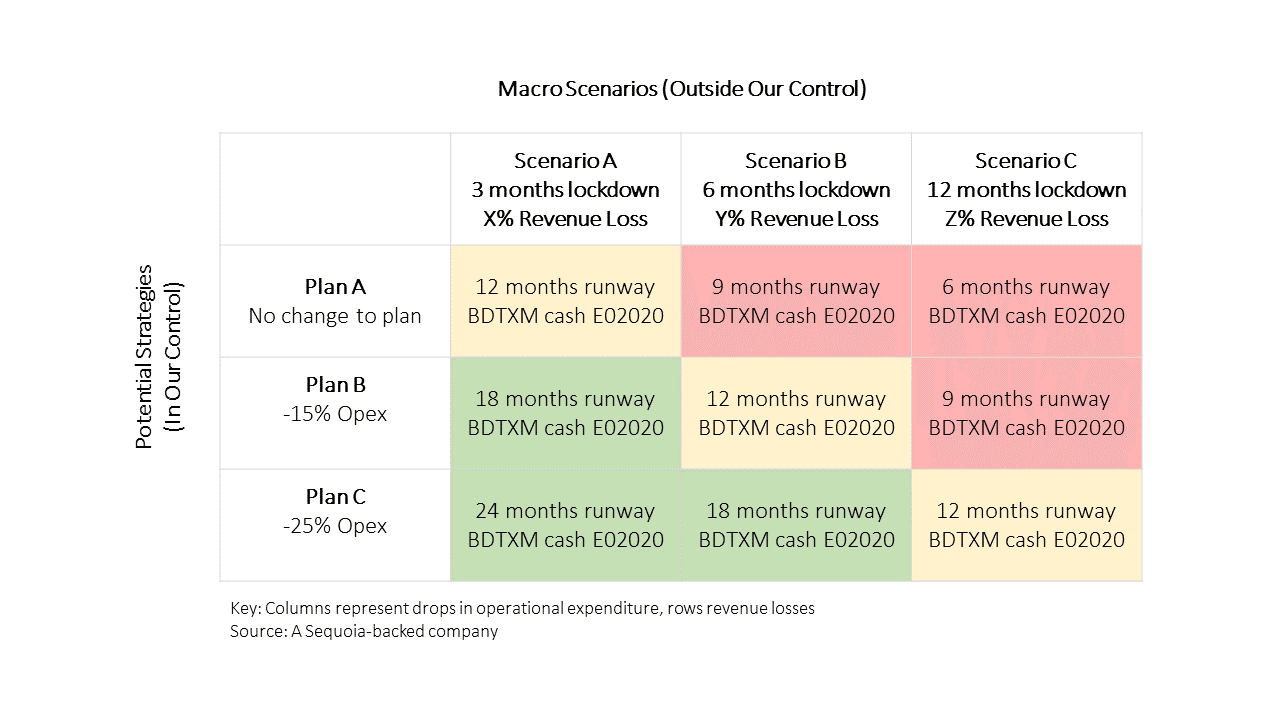

The first question every startup CEO needs to ask themselves now is what is their burn rate and runway. Before determining the runway, the founders have to look into KPIs such as debt to income ratio, revenue to employee ratio and monthly gross expenses. Then they need to ask themselves how many months their companies can survive burning the current amount of cash. It should be noted that the traditional demand and sales forecasting might not work in a recession-struck market. Therefore founders should emphasize on scenario planning to capture the real picture.

A model to map out potential strategies in regard with macro scenarios has been provided by Sequoia capital. Here the X axis represents the macro environment i.e the duration of the lockdown which is directly linked to revenue. The Y axis represents company actions i.e. curbing down the operational expenditures. Startups should implement actions from the left and gradually streamline their operations as the macro environment provides more brevity. Ideally the goal should be to be in the green zone but the yellow zone should be enough to survive the storm.

At the same time, the systematic risks should be minimized by closely monitoring both the macroeconomic indicators and business performance indicators like revenue/employee, debt/income among other metrics. The founders must check whether the sectors they operate in are getting affected and to what extent. Positive diversifying can play an instrumental role in helping startups to land on their feet. Bangladeshi ridesharing platform Pathao has recently relaunched its delivery service Pathao Tong and partnered with Shwapno to deliver goods to consumers’ doorstep, while online service marketplace Sheba.xyz has started a fund named “mission save Bangladesh” for the underprivileged and those who are deemed most at risk from the coronavirus in partnership with The Daily Star and Samakal.

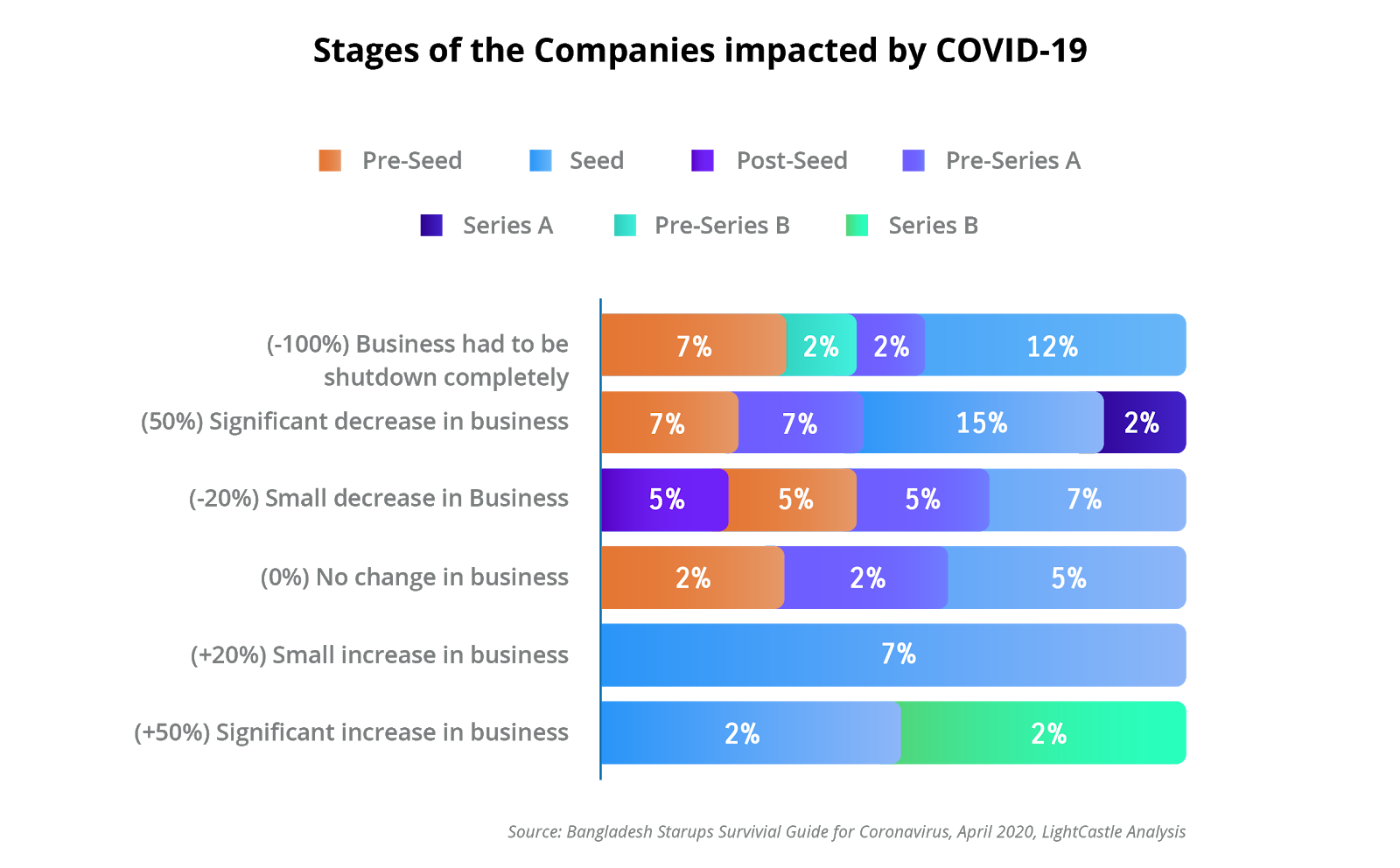

Our survey with startup founders shows that early stage companies are the immediate sufferers in the current scenario. Funding opportunities have dried up in the short-term, and perhaps for the rest of the year. Many startups will fail, unless they are able to solve their immediate cash flow deficit. Even in the most “normal” of circumstances, startups move fast and fail fast. The COVID-19 crisis has put the startup ecosystem at the brink of collapse.

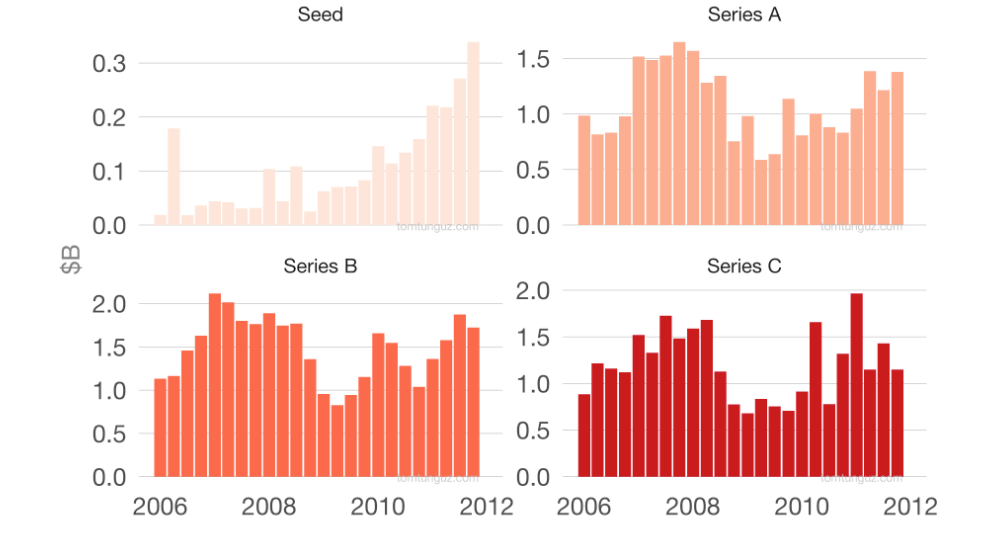

If we take a look at the 2008 financial crisis, we can observe the VC investment trend during a bear market. VCs invested around USD 3.5 Bn per quarter in seed, A, B and C rounds during 2006 which grew to USD 5 Bn per quarter in 2007 and early 2008. Then the investment velocity dropped by half to USD 2.9 Bn, USD 2.7 Bn and USD 2.3 Bn in the quarters following the crash. In the second quarter of 2010, the market finally bounced back. Seed was the fastest to recover while series C was the slowest. The long eight quarter rebound time might have worked in a recession-struck market but can take even longer in a post-pandemic world.

Fundraising was tough enough as it is, and with COVID-19, many will either a) not be able to fundraise, or b) have their earlier commitments withdrawn. Additionally in a recessionary environment, foreign capital will focus first into countries they already have operations first before Bangladesh which is a new country for most.

Bangladeshi startups should optimize their runways at these trying times to keep the existing investors motivated. Second step should be to keep looking for new sources. Going after impact investments like catalytic fund or matching fund could be a timely option for early stage startups. In a pandemic struck market, getting access to a patient capital can only help the startups buy more time. Recently, a catalytic fund named Biniyog Briddhi has been launched in the country powered by the Swiss Agency for Development and Cooperation and Roots of Impact, and implemented by LightCastle Partners. The fund aims to both train, finance and advocate impact investors and enterprises through Impact Ready Matching Fund (IRMF up to USD 100K) and Social Impact Incentives (SIINC up to USD 250K). (details) Additionally, programmes like UNDP Youth Co-Lab with a strong impact focus can be reached by early stage startups.

Globally startups are slashing ad budgets, giving away products, and using content to stay connected with shoppers. The situation should not be different in Bangladesh. These work from home days are perfect for differentiating resources that are absolute musts from resources that are just nice to have.

Recently Airbnb has suspended its marketing activities to save USD 800 Mn and the CEO has promised to spend USD 250 Mn to reimburse hosts for cancelled bookings. If the lockdown persists for an extended period of time, startups in Bangladesh can also look into measures to cut expenses. Getting rid of a high maintenance office, telling employees to use their own resources rather than company laptops, organizing webinars instead of events, arranging virtual meetings instead of physical ones, using digital marketing methods instead of expensive advertising are some of the most common ways to keep the cost minimal even when the lockdown is lifted.

The founders of Airbnb have declared to not draw salary for the next six months while top executives will take a 50% cut. Airline industry, being one of the worst affected by the pandemic, has been taking extreme measures to survive. Players like Emirates and Malindo have been asking pilots and cabin crews to take unpaid leaves while other airlines are simply laying off people and halted new hiring from the beginning of March. Tesla will cut pay for all of its salaried employees and will flaying off hourly workers until May 4 when it intends to resume production of electric cars. Media company BuzzFeed announced a graduated salary reduction for the majority of employees, some of whom will see a nearly 25% pay cut and the CEO will forego his salary as their advertising revenue declines. Wonderschool, a childcare startup backed by VC firm Andreessen Horowitz, has laid off 75% of its staff via a Zoom call.

At the same time some companies are following less drastic measures like salary cuts going into the employee option pool. While most of the sectors are furloughing people, Amazon, among other logistics sector players, plans to hire an additional 100,000 warehouse and delivery workers amid a surge in online orders due to the coronavirus outbreak. The company is also raising pay for warehouse and delivery workers by USD 2/hour in the U.S. market.

Some of the Bangladeshi startups had to cut jobs or reduce payroll while some of them introduced salary cuts for executives as a loan to the company. If this continues, not only will it result in a domino effect on local consumption, but may also lead the best talent to opt for safer haven of large multinational companies instead of helping the local ecosystem. Letting people go in the face of an economic downturn has some legal implications and is definitely not considered as a good practice.

Additionally this concept is culturally unprecedented in Bangladesh. In the more cutthroat economies like the U.S. the practice of laying off people in difficult times has worked out mostly due to the fact that the state provides them with minimal benefits, but in our country it will lead to a dismal display of unemployment.

As startups scale faster, they will play an instrumental role in driving innovation and speeding up economic recovery in these testing times. Therefore the government needs to provide specific response packages to startups. While the GoB has declared stimulus packages to export-oriented industries like working capital refinancing, EDF funding, pre-export capital, industry and MSME credit at discounted rate (4.5%) totaling USD 8.5 Bn – Startups weren’t directly a part of the package. Given Startups often do not directly operate with bank financing – and investors at least take 6 to 12 months to bounce back and invest – we assume the startups are going to need support for 3 to 6 months of working capital. The size of each startup is different but if we take a look at larger ones who have 100+ employees they would need between USD 500K to 1 million as a 3 to 6 months runway. Depending on the number of Startups that needs to be supported the total response package needed would be around USD 12.5 Mn (USD 500k each on average *25 Startups) at least. If the big ones survive the benefit would trickle down to the smaller ones.

In the coming years, Bangladesh’s startup ecosystem which was set to finally come of age, will face a major setback. Startups who will adapt quickly by pivoting their businesses can navigate their way back, while companies failing to do so will get lost. In order to weather the storm, Bangladeshi businesses need to become increasingly inclusive and start creating social and environmental returns on top of positive economics. And the role of startups would become even more critical for equitable growth.

This article was written by Silvia Rozario, Business Consultant, LightCastle Partners. For any queries, you can reach us at [email protected].

The LightCastle team has been analyzing the macro and industry level picture and possible impacts wrought about by the Covid-19 crisis. Over the following days, we’ll be covering the major sectors shedding light on the possible short and long term ramifications of the global pandemic. Read all the articles in the series.

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights