GET IN TOUCH

- Please wait...

The OXFAM ‘Empowering Youth for Work (EYW)’ project aims to have a lasting impact on young rural people: increased employment, reduced vulnerability to climatic risks, improved sexual and reproductive health rights and increased influence and participation in decision-making. To identify the economic sectors best suited to empower youth, the project has looked for sectors that provide opportunities to reach large numbers of young people; have good economic prospects; and support climate-resilient practices and adaptation in the Khulna and Rajshahi divisions in Bangladesh. In doing so, the EYW project has observed that there is a big gap with regards to access to finance for SMEs.

According to the World Bank, lack of proper access to finance is the second most cited obstacle faced by SMEs in growing their businesses in developing economies. Despite the importance of proper access to financing for SMEs, Bangladesh lacked a single policy with a systematic plan to improve the state of financing for SMEs in the country. Given the current state of the financial ecosystem of Bangladesh, most SMEs can only turn towards traditional forms of finance in order to obtain capital for their business. Furthermore, a lot of SMEs may be involuntarily excluded from using traditional forms of financing for businesses. This is because there are a lot of SMEs which are considered to be un-bankable from the perspective of financial institutions since they do not have enough income or present too high a lending risk. As per World Bank estimates, this has led to a $2.8 billion dollar financing gap in Bangladesh’s SME sector.

For the ecosystem to mature and become more level-playing, early-stage enterprises/entrepreneurs must have access to patient or risk capital. For micro and small enterprises, the options at present, however, are mostly leverage – microfinance or agent banking. Both have their respective de-merits. Microfinance, besides high cost of funds, requires frequent payments (not necessarily matching the enterprises’ cash cycle) and also often requires investment in a savings scheme. Similarly, agent banks are more focused on deposit mobilization compared to credit disbursement. This is where blended capital can make a difference.

The concept of blended capital is powerful with wide-ranging benefits. Blended capital can serve as a critical mechanism to bridge the gap in financing for SMEs. It is essentially a mix of government/non-profit grants, equity investments and loans put into a company. Sequenced right and at the right proportion, this can create sustainable growth for the SME entrepreneurship ecosystem. To learn more on how the concept works, read here.

At LightCastle Partners, we believe that entrepreneurship development is critical for the growth of Bangladesh. We strive to impact the ecosystem by supporting small- and medium-sized ventures that have high potential, but fail to grow due to lack of proper business skills, market connections and access to finance. To learn more on how we support SMEs and startups, visit here.

To address the specific financial obstacle for EYW, we have proposed to design and deploy a quasi-equity instrument that would help generate greater impact and social returns for 15 promising impact enterprises across Khulna and Rajshahi.

The way the fund is designed to work is fairly simple. After a rigorous selection process, we will identify and shortlist 15 entrepreneurs, who would be eligible for the impact investment. Characteristics of this financing method are often similar to that of a flexible loan repayment schedule. However, quasi-equity is different from a traditional loan in the sense that the repayment of the investment is dependent upon the performance of the enterprise once the investment is made. This form of investment will involve the enterprises to enter into a revenue-sharing agreement with LightCastle for three years. Once the three-year period is completed, the enterprises will no longer have the obligation to continue sharing their revenue with the fund. If the enterprise fails to reach the expected performance benchmark in terms of revenue, the fund will receive a lower return. On the other hand, if the business is more profitable and is able to grow higher than expected, the fund will receive a greater financial return. Although the fund is eligible to receive greater financial returns, LightCastle will cap the return to not more than 1.5 times the initial investment.

The introduction of the fund aims to create a new and innovative financing channel for SMEs that are in need of financing but are either not willing to or are not able to acquire a direct bank/equity loan. LightCastle believes that this fund will be able to increase financial inclusion in the economy and thus promote financial stability and sustainable economic growth – which aligns with EYW’s goals.

At first, we identified two local partners – one in Rajshahi and Khulna each – and collaborated with them to identify some solid local impact enterprises. In two weeks, the team was able to accumulate close to 50 solid applications. After the initial shortlisting, we organized two back-to-back impact investment bootcamps with 41 youth entrepreneurs across the two divisions. The participants represented a diverse group of industries including Agriculture, Retail, Pharmaceutical, and Service among others. Because of the Covid imposed lockdown situation, we had to be creative and organize the bootcamps online on May 24 and 25. During the bootcamp, each enterprise was given the opportunity to share their business plan and track record in sufficient detail with our expert pool of judges, who took part in the session to evaluate applications. While the enterprises were largely evaluated based on their ability to create social impact, all applications were scored against the following criteria to create a robust decision-making model:

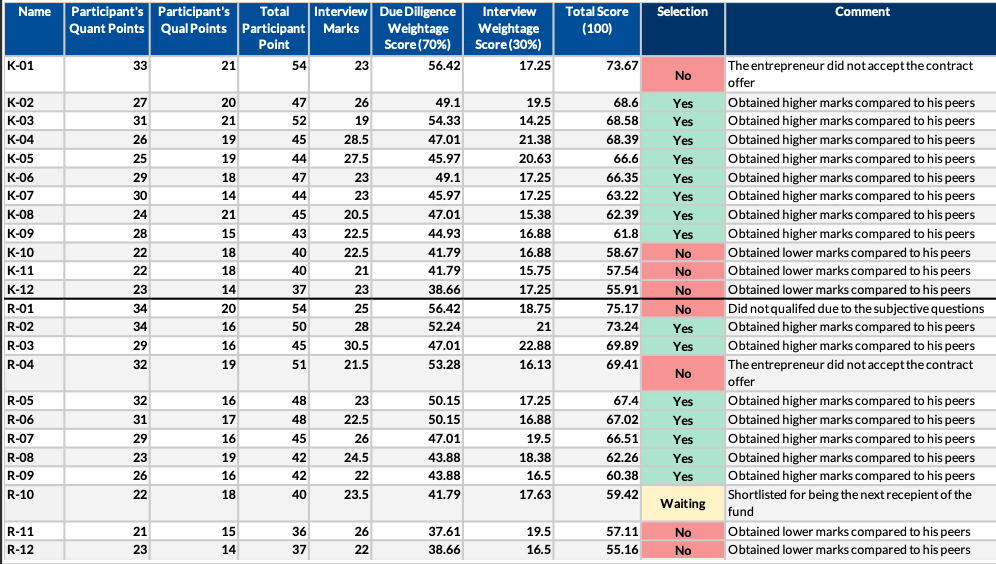

By the end of May, we were able to determine the top 24 enterprises and engaged field-level due diligence for deeper verification. By combining findings from the due diligence and bootcamp score sheet, we developed a weighted-scoring impact investment rating model that allowed us to select the top 15 enterprises, who have now become eligible for investment.

Currently, we are in the process of conducting legal agreement formalities with the final 15 list of enterprises (8 from Khulna, 7 from Rajshahi). By early July, we hope to complete the first round of investment.

Tanwi Golder, a young, bold female entrepreneur in Khulna, at the age of 22, started her own vermicompost plant – Jhorbhanga Vermicompost – in Khulna in 2017. While she has been doing fairly well in her community, she now aspires to create a brand for her vermicompost – something innovative that no one in her locality have thought of. She has the rough business plan sorted out, but she can’t proceed due to the current hurdles in SME financing. She needs approximately BDT 1 lac as initial investment. Considering the size of her capital requirement and unavailability of bankable assets, it is unlikely that she will be able to get proper access to funds through traditional financing methods. However, she fits the bill for LightCastle SME Blended Capital. By working her way up through our assessment process, she now sits as one of the top 15 enterprises to receive the impact investment. We believe she has the right traits to become a successful impact entrepreneur and be a beacon of hope for others in her community.

Alongside financing, over the next 12 months, we will provide the following support to the enterprises so that they can fully realize their potential and move up the business value chain.

We believe impact investment will drive the next wave of development financing. To that end, impact funds will play a pivotal role in helping chart the next growth story of thousands of small and medium businesses, spread all over the emerging economies. We are eagerly looking forward to doing our part in the development of a robust and sustainable SME ecosystem in Bangladesh.

Mrinmoy Sobhan, Business Analyst, Omar Farhan Khan, Senior Business Consultant and Ivdad Ahmed Khan Mojlish, Director, at LightCastle Partners, have prepared the write-up. For further clarifications, contact here: [email protected]

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights