GET IN TOUCH

- Please wait...

LightCastle’s Impact Investments in the form of “Patient Capital” is bearing fruits both for the farmers & investors at higher than traditional financial instruments; a successful case of asset-based equity financing for creating sustainable investments. CMSMEs in Bangladesh are benefitting through the Blended Capital Program.

Zorina Begum hails from Kaunia, Rangpur; a remote village in the northwest region of Bangladesh that still has not seen signs of significant development apart from electrification and road connectivity. A self-dependent widow who has held the reins of her family single-handedly after the demise of her husband, Zorina is an ordinary Bangladeshi villager dependent on agriculture for her family’s sustenance.

Experienced in chili and corn cultivation with over a decade of involvement in this field and like most other village households, Zorina is also involved in animal husbandry at a small scale within her house. She wanted to expand her cow farm and slowly move to a commercial scale, but this was quite challenging for her due to the scarcity of capital. Many of us can relate to a typical case of access to finance – or rather lack it – for a rural CMSME entrepreneur. Learn more about the pain points of CMSMEs in this article here.

To support entrepreneurs like Zorina, LightCastle Partners teamed up with Oxfam Bangladesh for the project titled, “Building Oxfam’s Footprint in Bangladesh Entrepreneur Ecosystem.” The project’s goal was to provide capacity development and impact investments for OXFAM’s CBO Network under the REE-CALL project and new entrepreneurs. As part of the project, LightCastle supported OXFAM Bangladesh’s beneficiary enterprises by providing technical and facilitation support on enterprise incubation and acceleration interventions to 20 CMSMEs. The top 5 CMSMEs received impact investments worth BDT 500,000 as asset-based equity financing. Furthermore, LightCastle worked to improve the CMSME’s business and financial management capacity, facilitated access to finance with other financial institutions & helped connect markets for high-performing CMSMEs and Community Building Organizations (CBOs).

LightCastle’s flagship Accelerator Program, “SMARTCAP” i.e. Smart Capital is the gateway whereby CMSMEs get onboarded in their journey of growth and impact. We began our program by conducting a feasibility study. For this, the team visited Kaunia to assess the current CMSME landscape. A pool of more than 50 SMEs was interviewed during the scouting process and had been assessed for shortlisting; 25 made it through to the next step. Over three weeks, the top 25 selected entrepreneurs underwent a 5-day capacity-building training program. After their pitching on the Demo Day, the five best performing entrepreneurs of the accelerator program were selected to receive equity investments worth BDT 100,00 each.

Zorina Begum and 25 other entrepreneurs went through LightCastle’s business incubation training program (SMARTCAP) covering business concepts, Business Model Canvas (BMC), management, accounting & bookkeeping, and financial management along with investment raising. As a result of this training, they were able to learn about flexible financial Instruments to match their cash flow and the business cycle, structure out business planning & bookkeeping, and how keeping branded voucher bills would ensure proper transaction documentation, leading to building a good banking transaction history for getting access to quality finance & stimulus loans in the days to come.

After the capacity development phase, LightCastle with support from OXFAM deployed an equity-based blended capital program. The purpose of this fund was to initially invest in 5 SME entrepreneurs in the Rangpur Division of Bangladesh. Considering the environmental & social benefit factors, the funds were expected to generate a sustainable return & develop the capacity of the entrepreneurs.

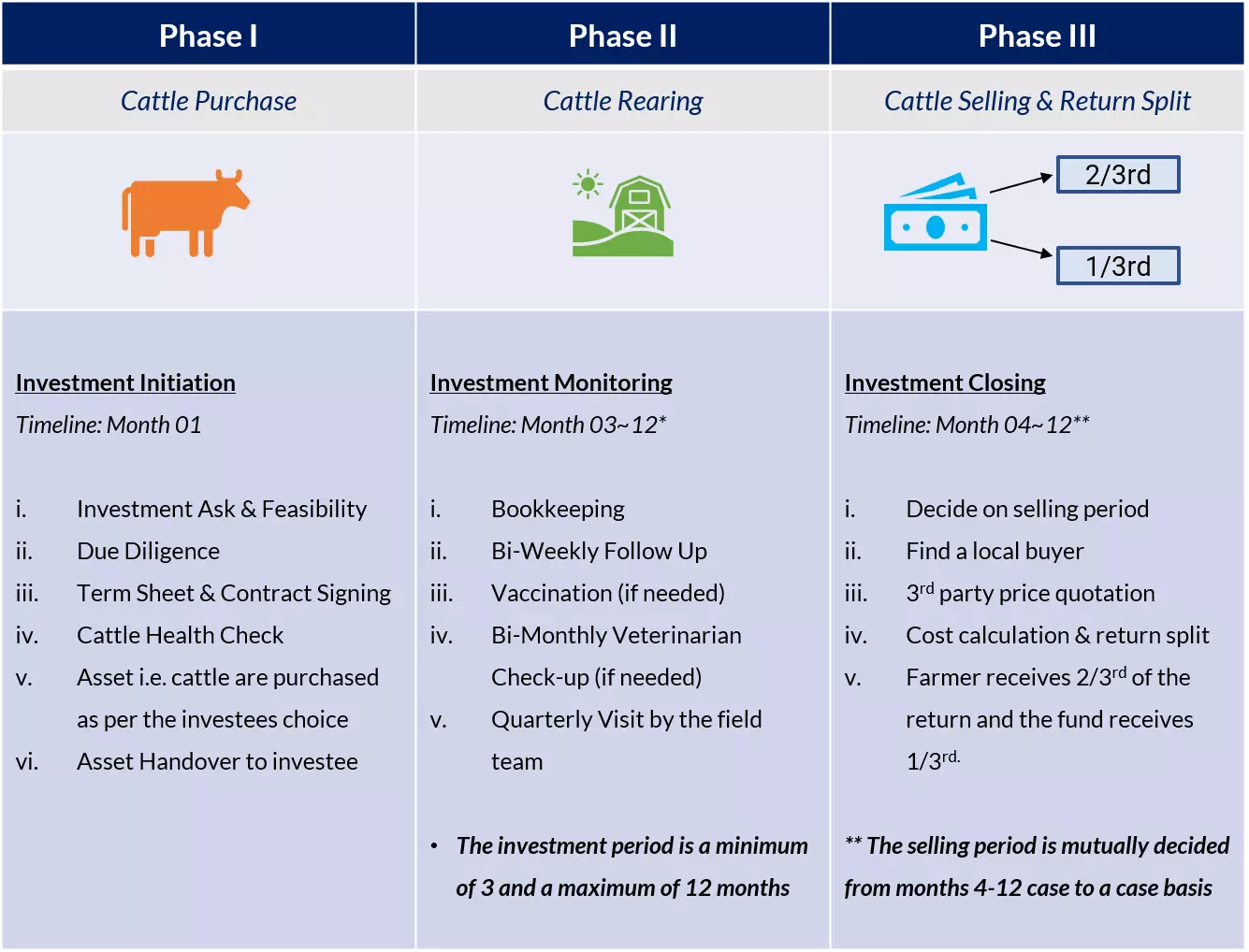

The fund operates on an investor and investee sweat equity model, where the initial investment of buying the assets is borne by the investor i.e. LightCastle & OXFAM; the investees provide their share by contributing time, energy, and shed space; moreover, extrinsic food and vaccination cost during the investment period is also borne by the entrepreneurs, which gets paid back after the asset handover is completed while selling the asset.

Blended capital is essentially a mix of government/non-profit grants, equity investments, and loans put into an enterprise. If sequenced rightly and in the right proportion this can create sustainable growth for the enterprise.

Patient Capital: The HallMark of Impact Investing

Untimely repayment installments, i.e. EMI-Equal Monthly Installments are a big ailment for seasonal enterprises that have not reached the critical threshold of being sustainable. Crops and cattle cannot be sold until ripe or mature which means that the cash flow comes after a certain time which can range from 3 to 12 months, sometimes extending up to 18 months. They need to move into an autopilot mode of operations where their own funds are enough to keep their working capital flowing. Patience Capital which we may also label Growth Capital enables enterprises to reach a level of sustenance where they can walk on their own and gradually move into taking traditional capital from banks & NBFI where the cost of capital is lower. The grace period of patience capital gives cash-crunched enterprises the time to move from bootstrapping to scaling on their own without the additional burden of making payments when the business is not generating sufficient cash flow.

This novel idea to support CMSMEs render their scope for growth and proved to be a successful intervention. We invested in 5 CMSMEs related to cattle rearing & dairy. In three months, 40% (2 out of 5) of the CMSMEs gained an ROI of ~8-11%. One was Zorina Begum and the other was Aktarun Nahar. They returned the principal and the capital gains in due time to us.

Zorina Begum received her choice of cattle from the local haat (cattle market) upon investment (BDT 100,000). The purchased cattle were then taken by her to their cattle shed; she initially bore food, water, general maintenance & vaccination costs for the investment duration. The investment period of 3 months was mutually agreed upon based on the financial feasibility and needs of the entrepreneur.

At the end of the decided investment period, 3rd party quotations and buyer scouting started to find a prospective deal for selling the cattle. Upon striking a good deal with price verification from the market, the cattle were sold to the new buyer in the presence of Zorina and LightCastle. All kinds of costs are calculated to find the final expenditure value. The capital gain from the deal was divided into three portions, 2/3rd remains with the Zorina while 1/3rd gets paid back to the fund.

During the initial testing phases of the project, we found that Zorina was making a return of 8% on behalf of the sweat equity and the fund earned a return of ~8% on its initial investment in a 3-month period.

The same model was applied to Aktarun Nahar too where she purchased a Hofstede Friesian bull and she made a return of 11% for her time, effort and cattle shed usage in the three months. Her bull being large in size and selling before the Eid-Ul-Adha gave her above-average returns; the fund earned a return of 8%

This investment model proved to be better than a traditional MFI loan as it does not burden them with the payment of fixed installments from the first month; moreover, by keeping the return variable and market-driven, we are allowing the CMSMEs to get the maximum possible return from their asset. Based on the market condition and demand, the price of the cattle sold is decided thus making it fair and square for both the investor and investee. After the initial round of success, they are also interested in going for the 2nd round of investments and repeating the investment cycle with higher capital.

The remaining 3 CMSMEs are also on track with rearing their cattle, aiming for a longer investment time frame of 9~12 months. One of them bought a bred heifer to raise, the cow is expected to give birth to a calf in a few months which will give even a higher return than the rest; as in the cattle rearing business, the cows which can be bred offer a significantly higher return than cow fattening; this is because the calf alone after its weaning period can be sold for 40~50K BDT!

The other two focus on bull fattening whereby they plan to sell their bulls after an extended period to maximize the gains.

Like a toddler, the first steps to walking are the most complex and challenging but once they master their balance they are sprinting all over; the same we believe is for our enterprises where they are struggling to gather the capital to kickstart their enterprises or for initial expansion programs. We believe the blended capital model and capacity development can be a safe way of investment for potential investors in the agricultural sector and a blessing for the investees by allowing them a grace period in payback and taking returns based on market conditions. This model’s simplicity and adaptability make it a lucrative opportunity to explore further and reap its unbound potential. With the rise of global warming, geopolitical conflicts, and embargos it has become ever important that we focus on becoming self-sufficient in agriculture to ensure food security. As the saying goes “One of the sustainable approaches to food security is sustainable agricultural practices” to this we would like to add “sustainable agricultural financing”

The Case Study is authored by Ivdad Ahmed Khan Mojlish, Managing Director & Omar Farhan Khan, Senior Business Consultant at LightCastle Partners

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights