GET IN TOUCH

- Please wait...

On 7 September 2022, the B-SkillFUL program brought together MSMEs from the leather product, and furniture-making industries for an illustrious corporate connect event with the vision to link MSMEs with key ecosystem builders. Several distinguished guests from renowned financial institutions and potential buyer organizations attended the event. This event has helped in increasing the accessibility of MSMEs by connecting them with buyers and financial institutions.

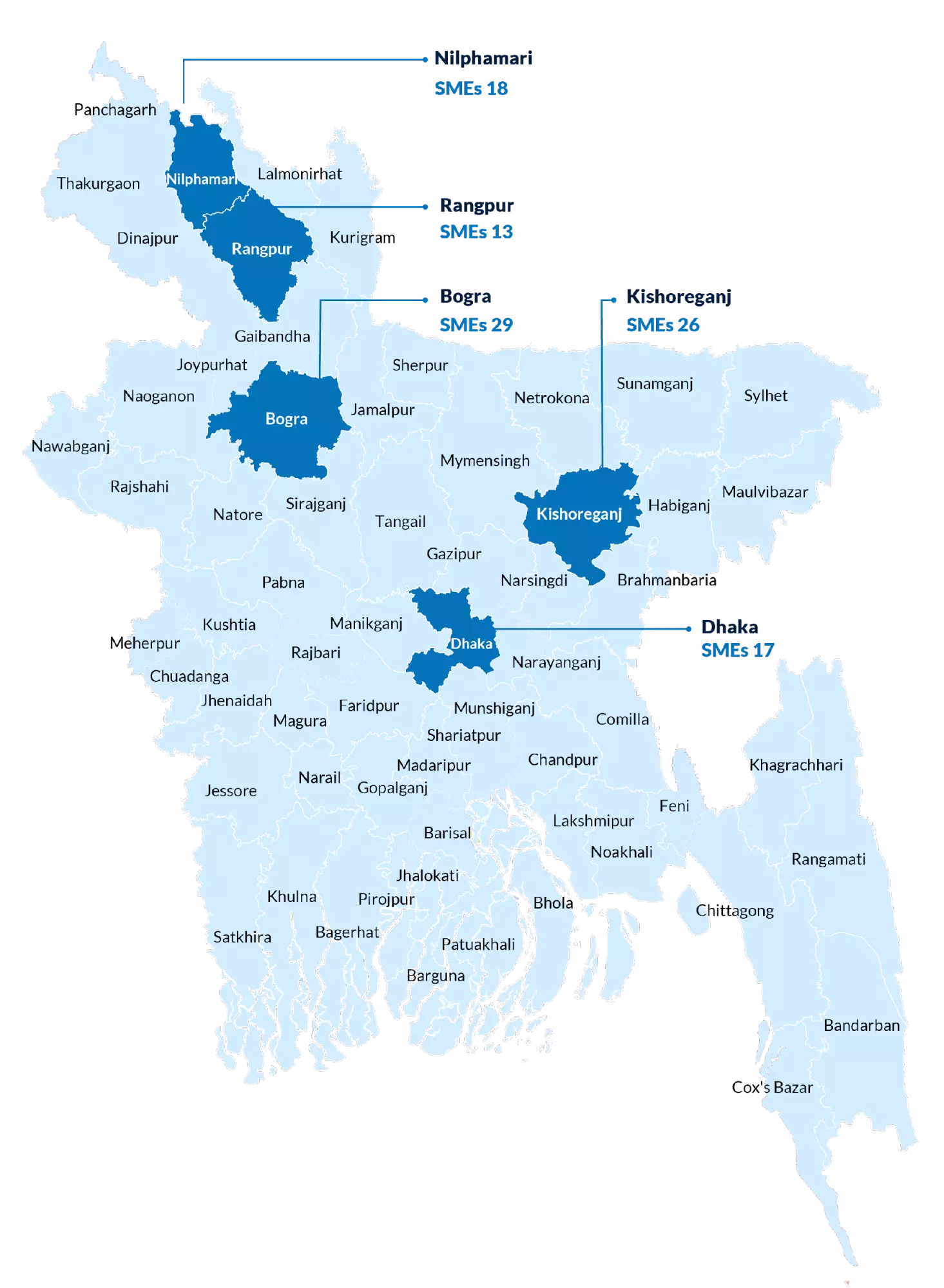

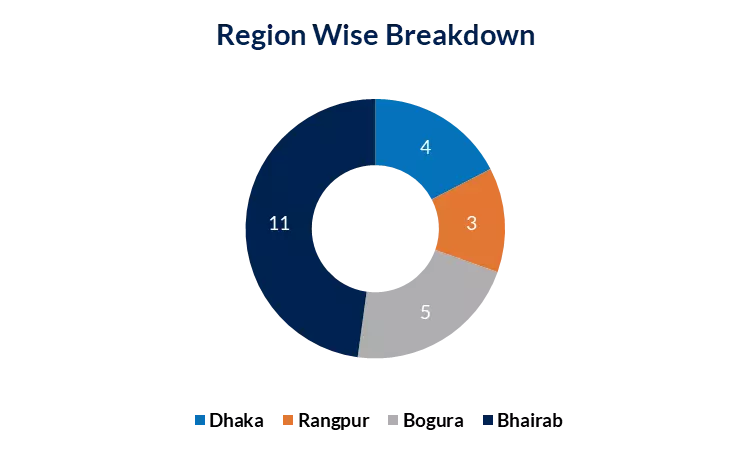

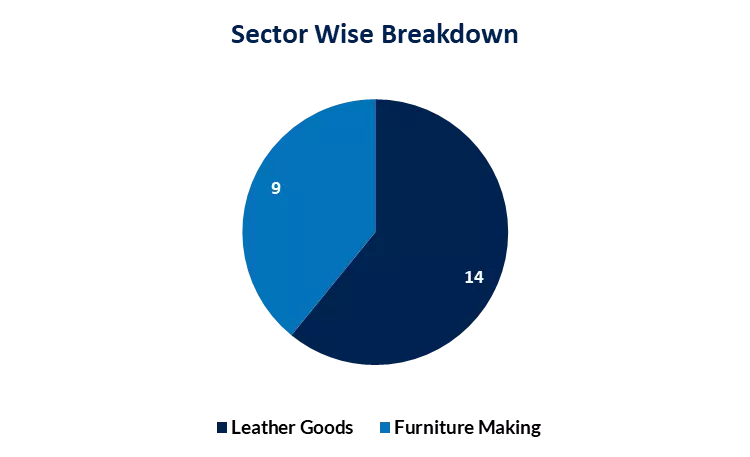

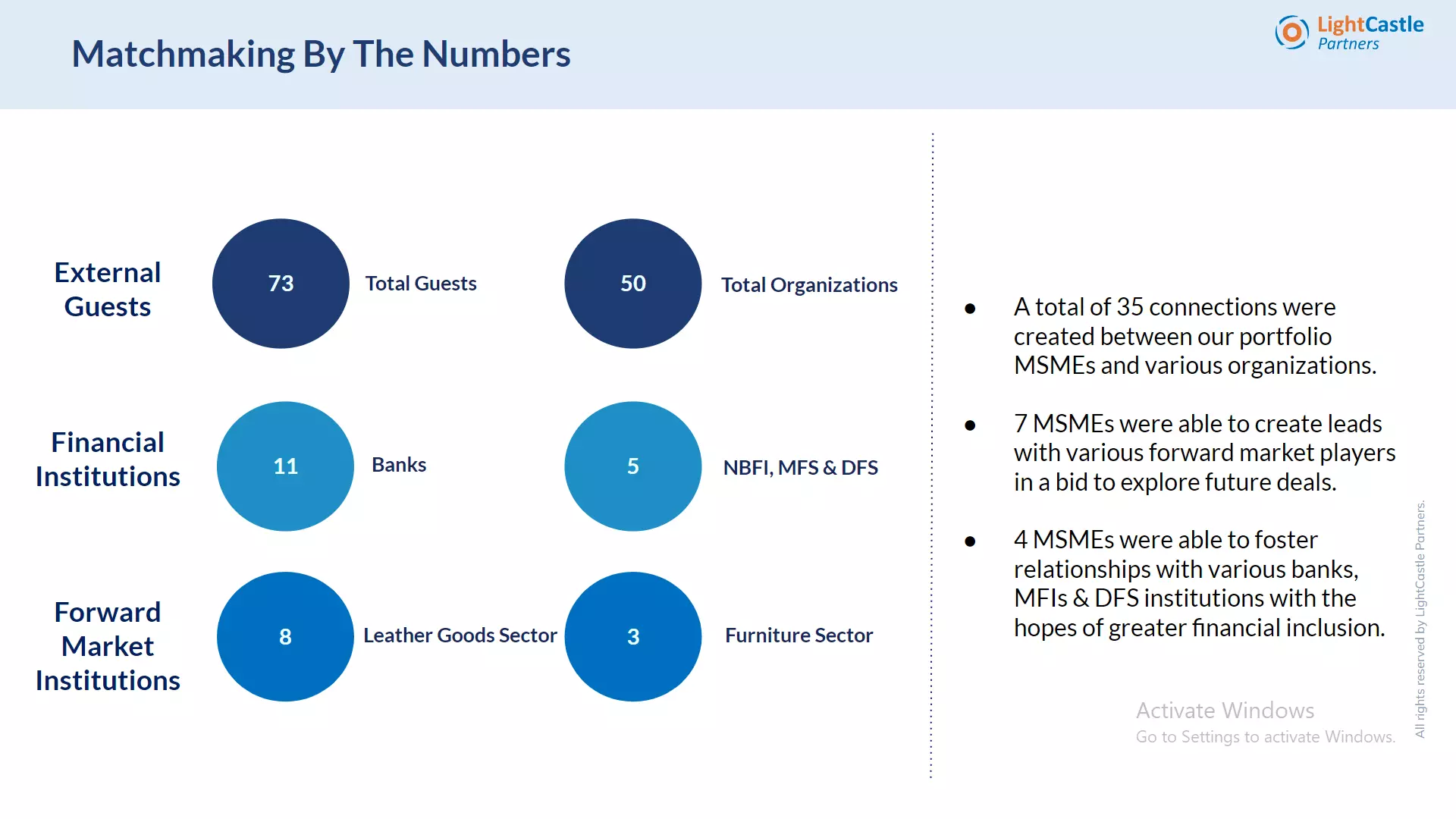

From our pool of 100+ MSMEs, 24 MSMEs were shortlisted for participating in the event, out of which 23 attended, ensuring 96% attendance. This is a testament to the massive success of the event. Of the 23 participating MSMEs, 9 were from the leather sector and 14 from the furniture sector. The MSMEs came from all over Bangladesh, including- Nilphamari, Rangpur, Bogura, Kishoreganj, and Dhaka. Besides, a total of 73 external guests were present from 50 different organizations.

The MSMEs provided individual stalls to display their products. In addition, they also got to display their products via LED screens installed besides their stalls for the audience to see. The MSMEs co-shared the cost of these facilities.

| Particulars | Number |

| MSMEs Shortlisted for Event | 24 |

| MSME Attendance | 23 |

| MSME Attendance (%) | 96% |

| Furniture Sector MSMEs | 9 |

| Leather Sector MSMEs | 14 |

| Total No. of External Guests | 73 |

| Total No. of External Organizations | 48 |

| Total No. of Financial Institutions | 10 |

| Total No. of Potential Buyers | 38 |

| Sl. | Name of the Organization |

| 1 | Bank Asia Ltd. |

| 2 | BRAC Bank |

| 3 | Citi Bank |

| 4 | DBL Group |

| 5 | IDLC Finance Ltd. |

| 6 | Islamic Finance |

| 7 | Lankabangla Finance |

| 8 | One Bank |

| 9 | Premier Bank |

| 10 | Social Islami Bank Ltd. |

| Sl. | Name of the Organization |

| 1 | A&E Bangladesh Ltd. |

| 2 | a2i-Aspire to Innovate |

| 3 | Aarong |

| 4 | Aazuba Classic |

| 5 | ABUNX |

| 6 | Annex Leather BD |

| 7 | AP Trading Corporation |

| 8 | Apon Wellbeing Ltd. |

| 9 | Aurora |

| 10 | Baah Store Ltd. |

| 11 | Baataza.com |

| 12 | Bay Emporium Ltd. |

| 13 | BD Fairs.com |

| 14 | BdOSN-Bangladesh Open Source Network |

| 15 | Concord Ventures |

| 16 | Daraz BD |

| 17 | Dhaka Material Zone |

| 18 | Emerging Bangladesh |

| 19 | Grid Furniture |

| 20 | iSocial Ltd. |

| 21 | Jute Mart and Craft in Bangladesh |

| 22 | Juteland BD |

| 23 | KAY KRAFT |

| 24 | La Mode |

| 25 | MA |

| 26 | Manim’s Bangladesh |

| 27 | Marconi Asia Ltd. |

| 28 | Peninsula |

| 29 | Savoir BD |

| 30 | Sutari International |

| 31 | Tahoor Studio |

| 32 | The Comilla Tannery Ltd. |

| 33 | Time Expo |

| 34 | TST Corporation |

| 35 | Viento BD |

| 36 | Wild Woven |

| 37 | North South University |

| 38 | Jahangirnagar University-IBA |

The prime objective of hosting the event was to connect MSMEs with lead enterprises, corporate businesses, and private houses. The overarching goal is to support MSMEs in better revenue generation by giving them access to large-scale buyers. This will help in increasing the accessibility of MSMEs for overall growth.

The event started with the opening remarks from Dajna Sorensen, Team Lead, B-SkillFUL at Swisscontact, and Makbul Hossain, Senior Manager-Partnership & Strategy, B-SkillFUL at Swisscontact. The session progressed to the presentation of Ivdad Ahmed Khan Mojlish, Co-Founder and Managing Director LightCastle Partners, where he shed light on the achievements of the program run so far.

The official launching of Ponnobithi, an online marketplace also took place at the event. Ponnobithi has been designed to cater to the needs of the leather sector MSMEs onboarded for the B-SkillFUL program. This marketplace plays a great role in increasing the accessibility of MSMEs in the leather sector. To know more about Ponnobithi, please visit: https://www.ponnobithi.co/

A panel discussion was also hosted on the day. The principal objective of the discussion was to address the two of the most critical challenges faced by MSMEs when it comes to operations and propelling them towards success – access to finance and access to the market.

The panel discussion comprised key industry experts representing banking institutions, enterprises, and market access partners from the leather and furniture-making sectors.

Ivdad Ahmed Khan Mojlish, Co-founder & Managing Director LightCastle Partners, moderated the discussion. Some of the challenges faced by MSMEs and recommendations put forward by the industry experts during the panel discussion are highlighted below:

Because the buyers are always looking for exceptional products in terms of quality and design, even though the MSMEs have years of experience, they often fail to ensure the quality of their products which may provide access to a broader export market. This is a big hurdle for them in terms of expanding their businesses.

2. Low penetration of MSMEs in the export market:

Drawing from the previous point, MSMEs have very little access to the export market because of the above reasons. Additionally, they are unaware of the documentation procedures that must be followed to successfully export products in the export market.

3. Poor access to traditional financing due to lack of proper documentation in MSMEs:

Lack of financial support from banks and financial institutions is a critical challenge for the MSMEs that has come up in the discussion multiple times. One thing is evident: there is a significant gap between the two parties-financial institutions and the MSMEs regarding information. If this gap can be addressed, then the issue of financing can be tackled easily.

4. Supply & demand parity in existing financial products available in the market:

There is a significant gap between the type of financial products that will benefit the MSMEs and what the banks currently offer. As such, the enterprises cannot fully avail the financial products’ benefits.

Innovation and sustainability can help MSMEs stay relevant to the current trends. This will not only ensure more sales for their business but also help them build a sustainable business model for the future.

MSMEs need training in regards to the proper documentation for their businesses so that they can avail loans and financial assistance from the banks, financial institutions, and the government by utilizing them.

One of the entrepreneurs at the event pointed out that customized solutions for each MSME’s needs can significantly impact their business. That will help resolve the issues each MSME has to deal with and make the changes more efficient.

Digital literacy is imperative for MSMEs to reach out to broader target audiences, and that too in an efficient manner. The spread of digital technologies is a global phenomenon. But unfortunately, the MSMEs in Bangladesh are still lagging in this area. As such, we must ensure that entrepreneurs have access to the necessary knowledge and tools to increase their digital presence.

There is a significant information gap between the banks/ financial institutions and the MSMEs. This deprives them of various benefits that the banks are ready to provide. We can help MSMEs get access to financial services by addressing these information gaps.

MoU Signing with ekshop,a2i:

In addition, an MoU signing ceremony was conducted at the event between ekshop,a2i and LightCastle Partners. Upon this agreement, a2i will act as access to market partners for the MSMEs onboarded for the B-SkillFUL program.

The goal of this event was to facilitate the access of MSMEs to market partners and financial institutions by bringing them all under one roof through a day-long corporate connect event. This event has achieved great success by increasing the accessibility of MSMEs. The outcomes drawn from this event are highlighted below, signifying the event’s success in achieving its goal.

After the successful completion of Phase I, B-SkillFUL Phase II commenced operations in September 2020 with the aim to improve the productivity and competitiveness of micro, small and medium enterprises (MSMEs) and create better jobs in the furniture-making, light engineering, and leather goods manufacturing sectors across Bangladesh.

For the B-SkillFUL program, LightCastle Partners worked as one of the key implementation partners and provided Business Development Services (BDS) to 103 MSMEs from the furniture, leather, and light engineering sector.

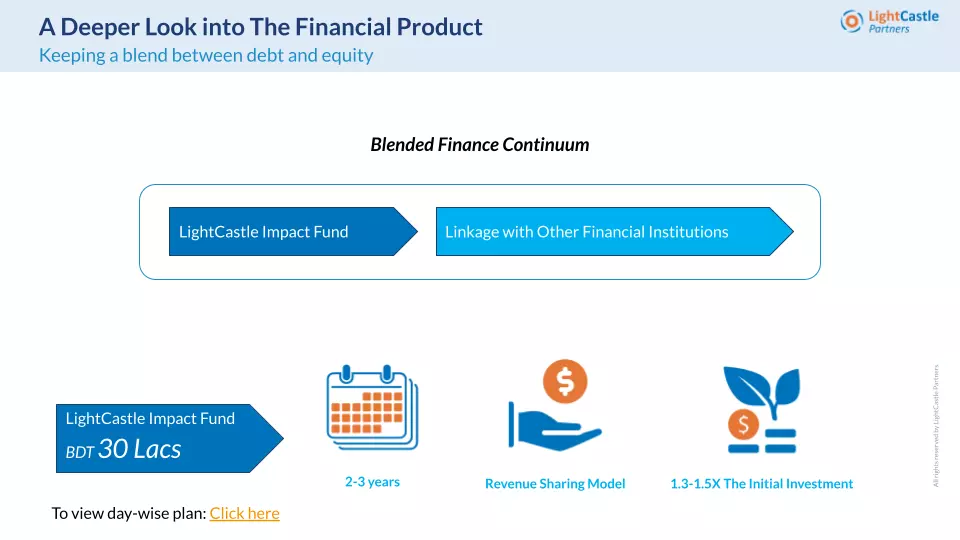

To reach the goal of this program, LightCastle designed a 3-way strategy keeping the SMART Blended finance program at its center: capacity development, access to the market, and improving the business environment.

| # | Components | Activities |

|---|---|---|

| 1 | Capacity Development | > Financial literacy and transversal themes workshop > Online marketing & website management workshop Periodical mentorships |

| 2 | Access to Market | > Facebook business pages & promotion product catalogs > Case studies highlighted in Entrepreneurs of Bangladesh – an MSME storytelling platform > Market connections and deal signings with private firms > Ponnobithi – a one-stop digital marketplace for leather-based MSMEs > MSME business connect event – a matchmaking event between lead firms and MSMEsBrand enhancement tools |

| 3 | Business Environment | > Transversal education-related tools MSME administrative support |

To know more about the blended finance program please visit: here

The Covid-19 pandemic had a drastic impact on the MSMEs. Such intervention is a clarion call of the time to help MSMEs overcome the challenges and survive in the post-pandemic economy. Eventually, this will help in increasing the accessibility of MSMEs. Against this backdrop, we need to prioritize these initiatives more through promotions and purpose-driven strategies.

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights