GET IN TOUCH

- Please wait...

![Bangladesh Startup Investment Report 2022: A Year In Review [Readable Version]](https://www.lightcastlebd.com/wp-content/uploads/2023/05/Bangladesh-Startup-Investment-Report-2022-A-Year-In-Review-Readable-Version-1.webp)

The Russia-Ukraine war amid a global economy recovering from the pandemic has resulted in supply-chain issues around the world. These have led to uncertainties rising globally, with climbing inflationary pressures and recessionary phases looming in the majority of economies around the world.

Economic slowdowns and climbing inflationary pressures are seen around the world, with the South Asian economy experiencing the bulk of the global conditions. Global inflation was predicted to reach 8.9% in 2022, doubling from 4.7% in 2021.

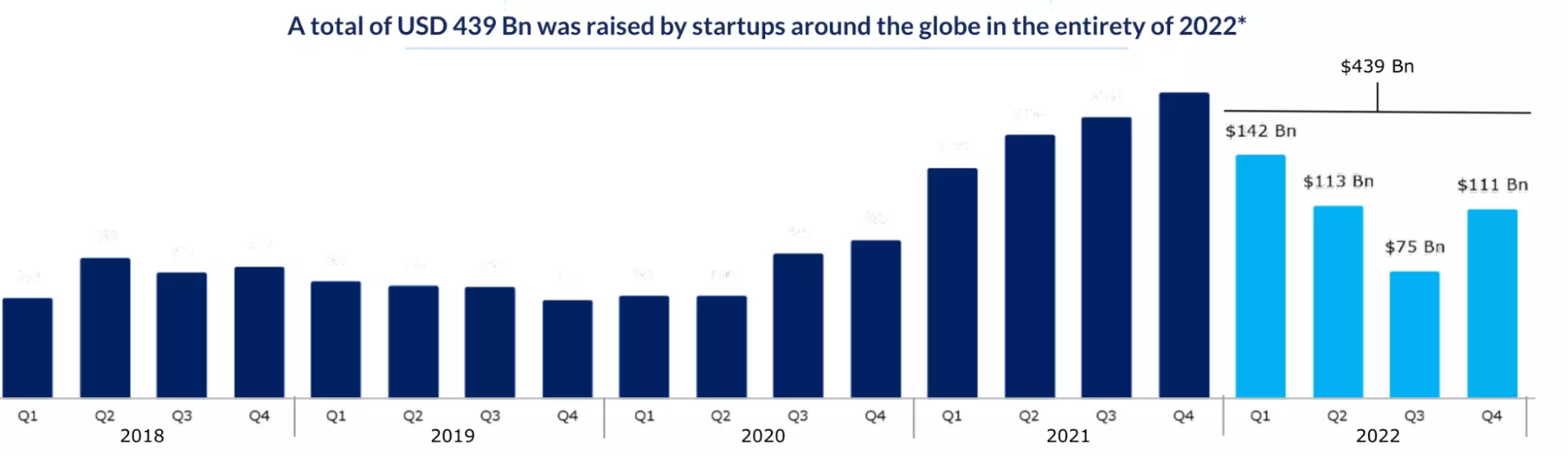

Year-on-Year decrease in funding was projected at 30% for startups around the world, from USD 630 Bn in 2021 to USD 439 Bn forecasted in 2022. Exacerbated by deteriorating economic conditions, investors tightened funding in 2022, especially in the second half of the year.

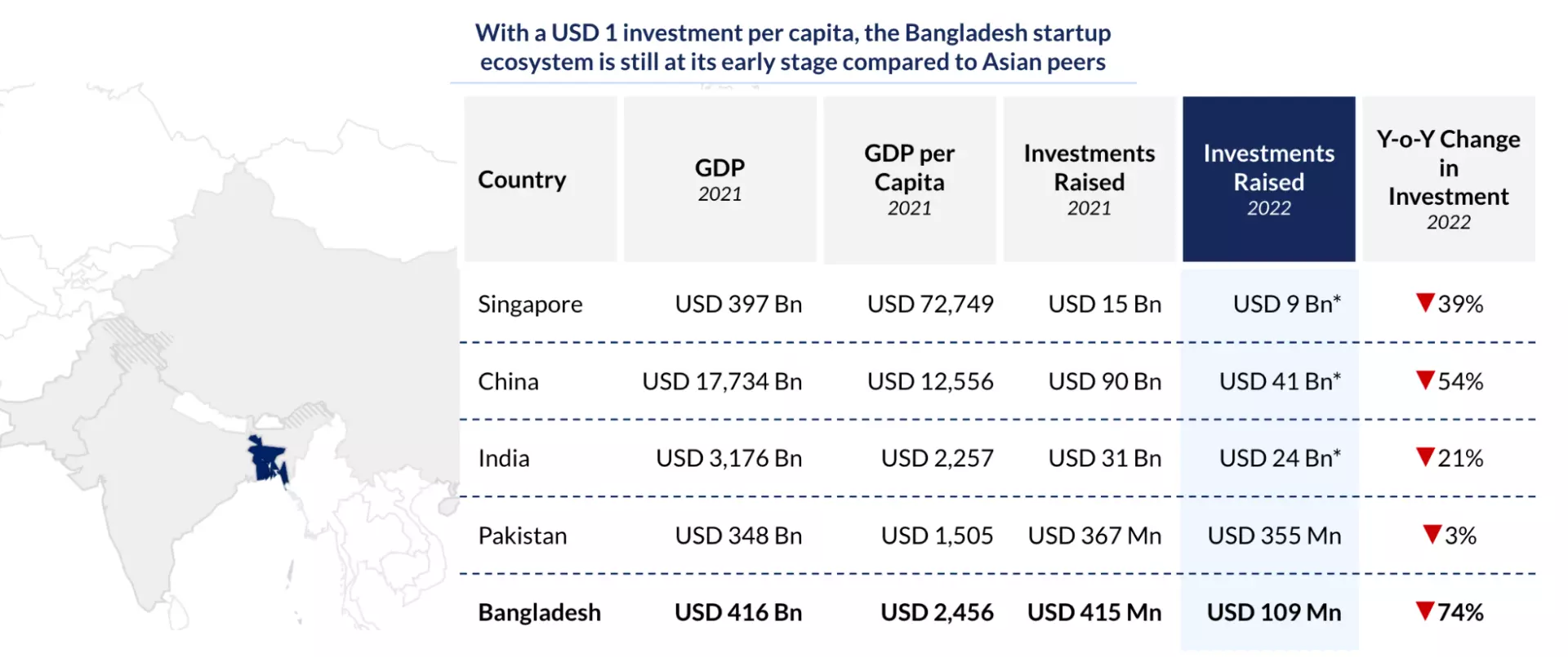

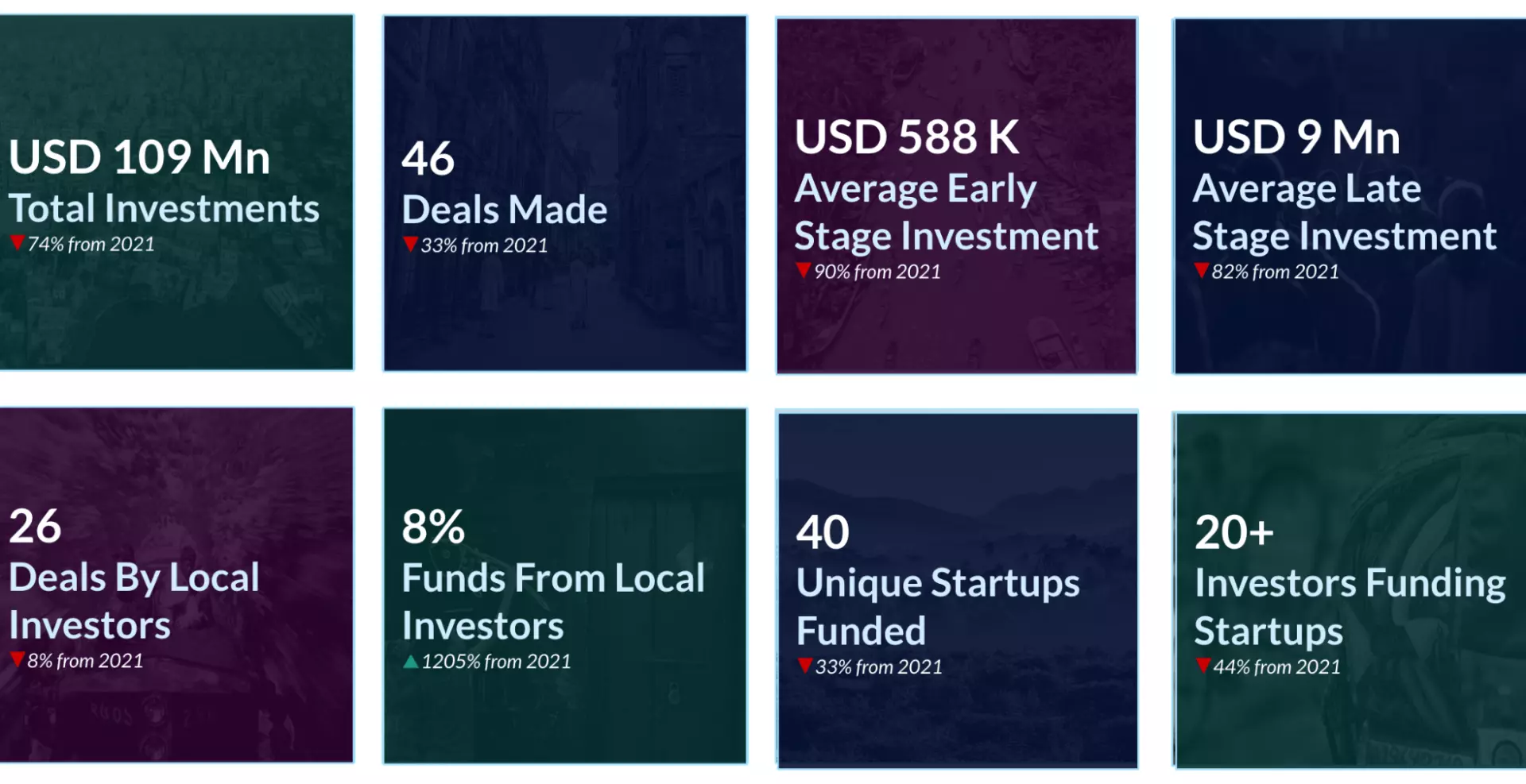

The recent global events have left startups worldwide feeling a gap in funding, with Asian startups, in particular, being impacted strongly. Even in the strongest hubs such as Singapore and China, investments reduced significantly in 2022 compared to 2021. With the Bangladeshi startup ecosystem at a nascent stage, the slowdown in funding was 74%, from USD 415 Mn to USD 109 Mn.

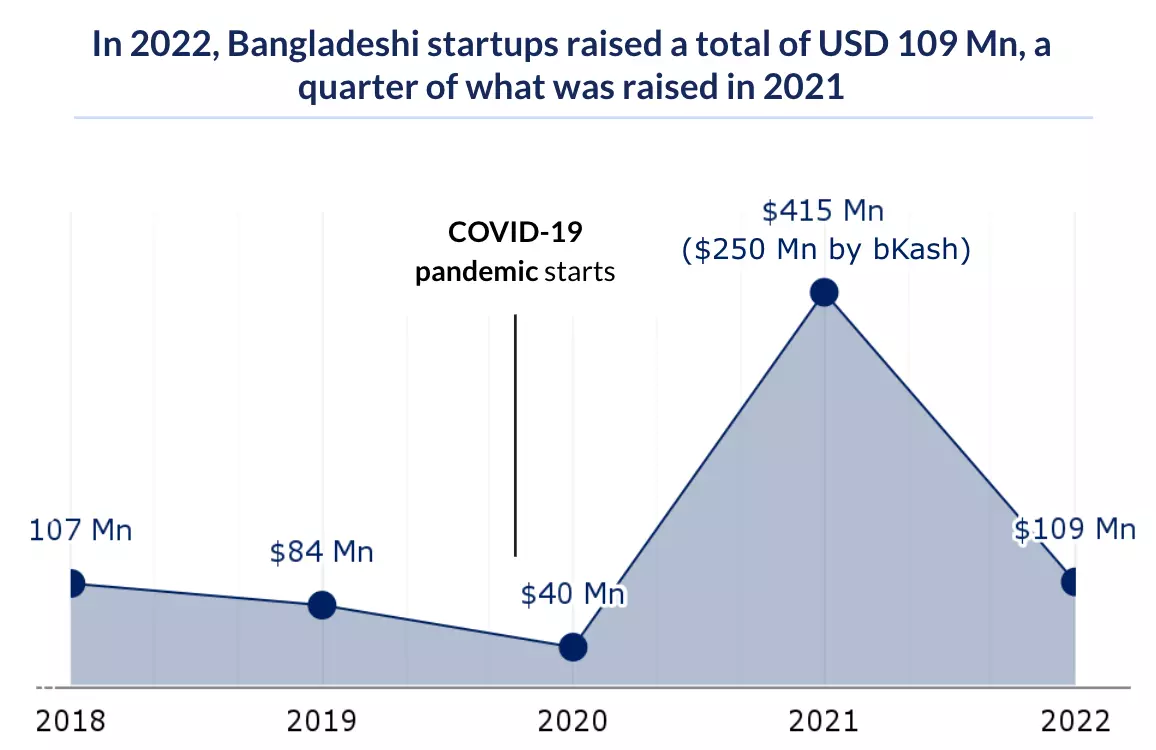

While the COVID-19 pandemic had strong impacts on startup funding in Bangladesh, dropping 2020’s investment to the lowest in the past 5-year period, the ecosystem at home showed a healthy recovery in 2021 to USD 415 Mn (including the bKash-SoftBank deal of USD 250 Mn) – an all-time high.

Only a quarter of the previous year’s investments were raised in 2022, at USD 109 Mn, with a 74% year-on-year drop.

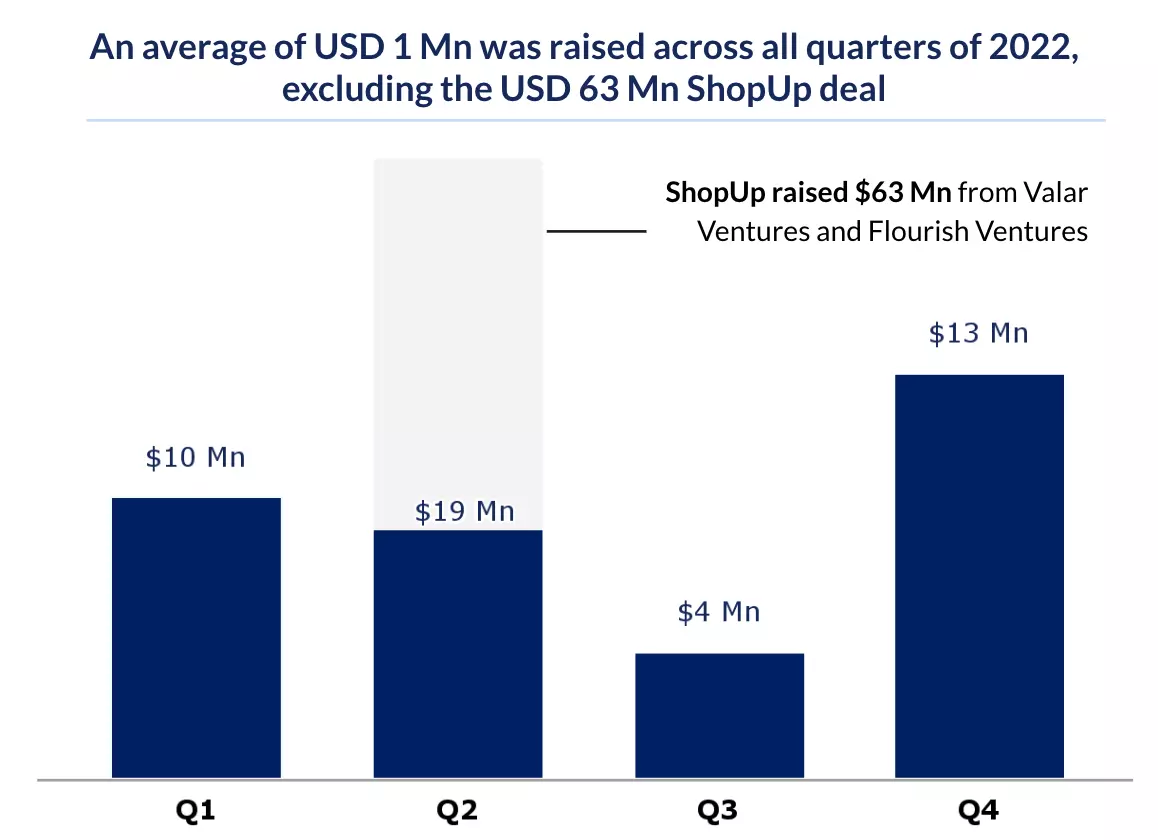

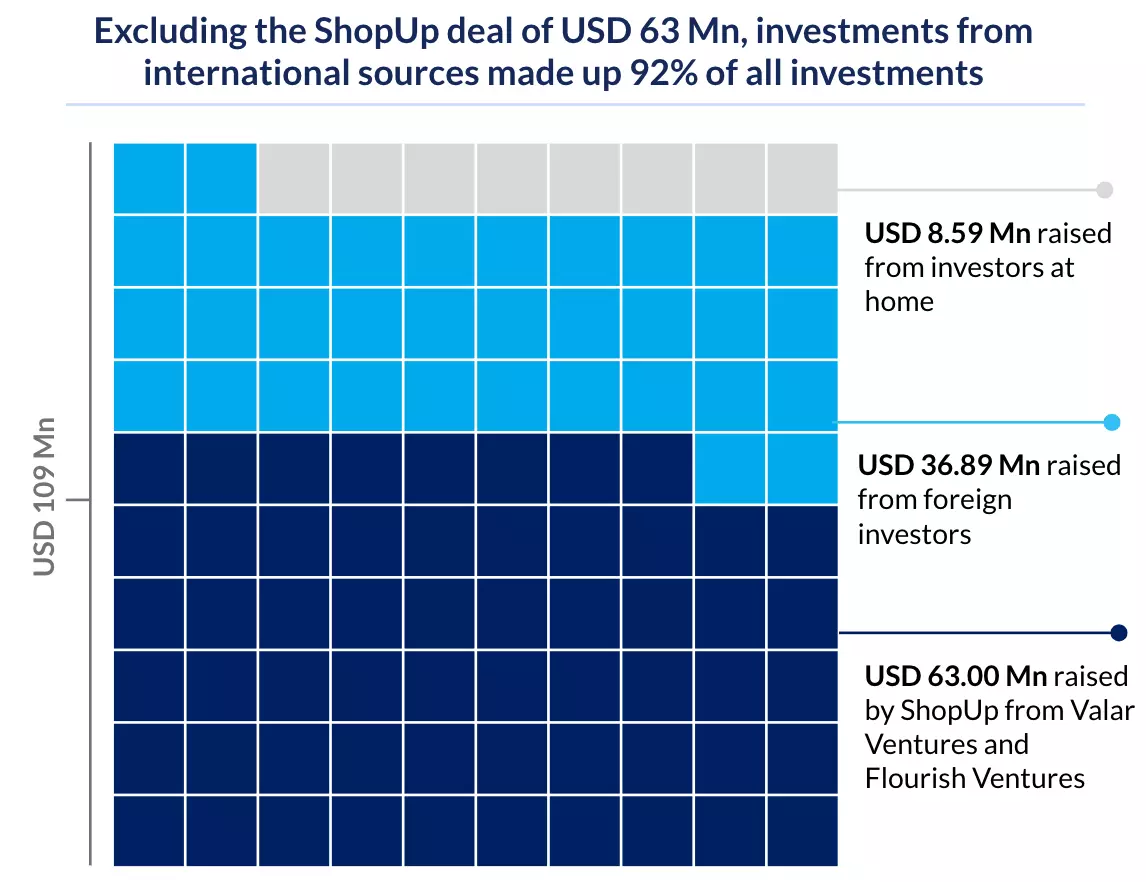

2022 saw a total investment of USD 109 Mn raised in all quarters. This includes the sizable USD 63 Mn deal by Shopup, Valar Ventures, and Flourish Ventures. Excluding this, the quarters averaged at a ticket size of USD 1 Mn, with the majority of the funds being raised in the first half of 2022.

58% of the total investments raised came from ShopUp’s USD 63 Mn deal. Excluding this deal, 34% came from foreign sources, and 8% came from local investors. Despite their lower funding volume, local investors made up 55% of all deals in 2022.

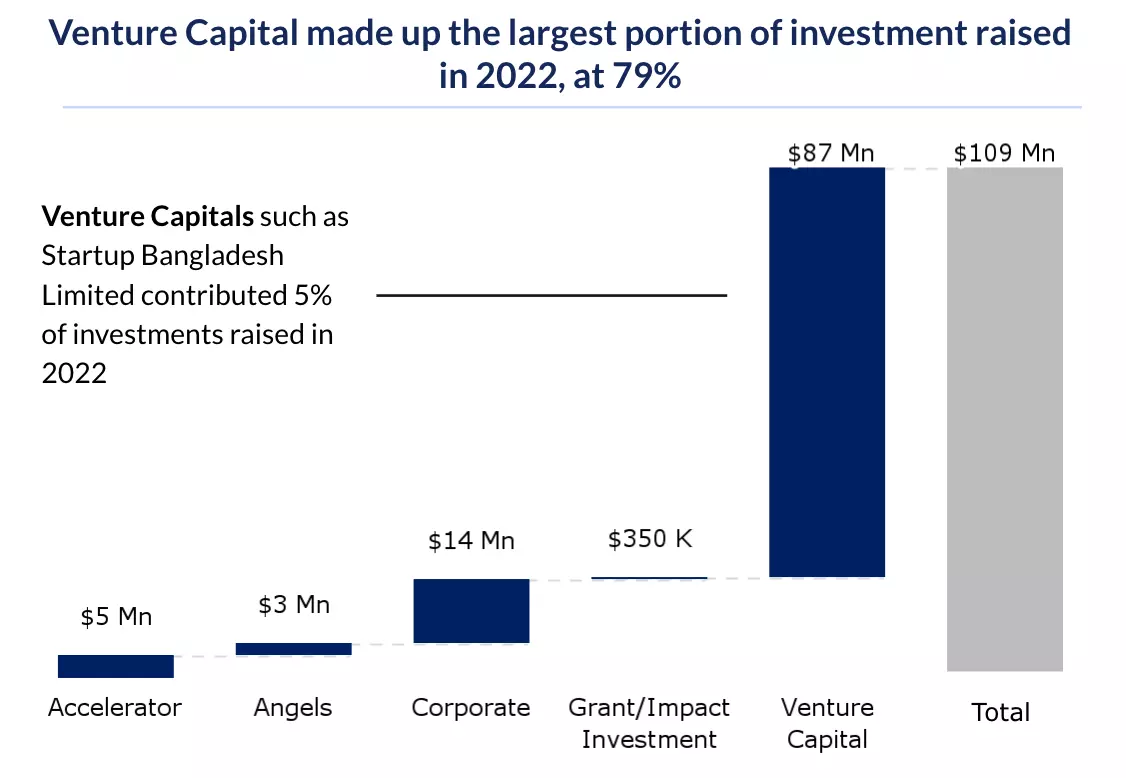

Venture Capital made the majority of all investments (79.9%) through 28 deals. Funding USD 14 Mn, Corporate investors raised 12.8% of all funds through 2 deals. Angel Investors made up 11 deals, investing 2% of all funds, while the remaining was funded by Accelerators and Incubators, Impact Investors, and Development Financial Institutions.

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights