GET IN TOUCH

- Please wait...

Bangladesh, being the second largest exporter of apparel, has come a long way in the sector globally, starting from establishing a backward linkage and connecting the value chain with textile manufacturers to having the highest number of green factories in the world. However, the industry is transitioning towards the production of man-made fiber (MMF) products from cotton-based products, while Bangladesh’s apparel industry is predominantly based on cotton (70%).

Adapting to a new fabric not only requires the usage of new technology and machinery but also incurs a demand for a skilled workforce. This will result in a diverse product portfolio and will help the country remain competitive and relevant to buyers in the long run.

The growing global demand for apparel has led to the rise of fast fashion and, more recently, recycled clothing. In order to cope with it, the industry has been opting for advanced machinery and the usage of 4IR technology to increase efficiency and reduce lead time.

While the likes of China and Vietnam have adopted new technology, Bangladesh is still dependent on low-valued products such as basic t-shirts. Buyers are actively looking to diversify their investment into other Asian countries from China due to labor costs increasing 3 times and the USA-China trade war. From this standpoint, Vietnam is considered the most lucrative alternative due to its strategic location, focus on value-added products, and backward linkage.

On the other hand, Bangladesh’s point of advantage comes from its large production capacity at a low price and acceptable quality. However, due to limitations with skilled manpower, Bangladesh is losing its unique advantage to the likes of Vietnam. They not only have well-educated but also aptly trained workers and this has been a key factor in Vietnam’s apparel industry growth story, producing garments with higher value addition (3.71 USD/M2 in 2022 for Vietnam in comparison to 3.10 USD/M2 for Bangladesh).

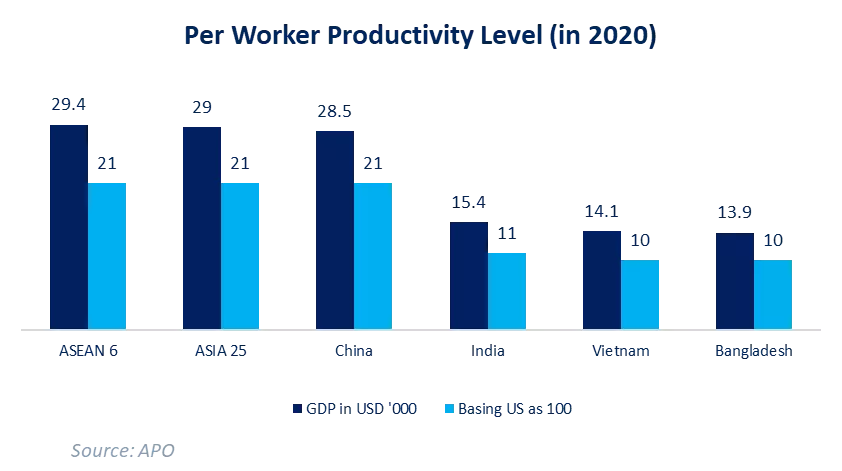

According to the Asian Productivity Organization (APO), the per-worker labor productivity level of Bangladesh is 9.2% with a per-worker GDP contribution of USD 13,900. Cambodia is the only competing country below Bangladesh with a 4.8% productivity level, while major players such as China, India, and Vietnam with productivity levels of 19%, 10.2%, and 9.4%, respectively. The average per-worker labor productivity of ASEAN6 countries and Asia31 have a higher GDP contribution of USD 30,200 and 29,400 than that of Bangladesh.

On the other hand, labor productivity from 2015-2020 grew one of the most for Bangladesh with an average growth rate of 5.1%, the same as that of China. Only Vietnam experienced a slightly higher growth rate of 5.2% in this period, however, their progress is significant considering the average growth rate was only 3.8% from 2010-2015. This is an indication of the impact of Vietnam’s emphasis on upskilling its labor force.

In the year 2019-2020, the productivity growth rate of Bangladesh fell to 2.2% while that of Vietnam was at 4.4%. Important factors in productivity growth have been the focus on SMEs, innovative manufacturing, adopting better technologies, growth in modern services, and an emphasis on marketable skills. The 7th Five Year Plan acted as the guidebook during that phase.

The Bangladesh Government’s National Productivity Organization (NPO) worked with the Asian Productivity Organization (APO) to formulate the National Productivity Master Plan 2021-2030, to continue improving with an aim of 5.6% growth in productivity per year. The focus of the plan goes into the economic enablers, structure, and supporting sectors and enterprises to enhance total productivity.

The apparel industry has been facing significant levels of the skills gap that is hindering the workflow of factories. It has been estimated that knitting factories face a skill gap of nearly 69% while woven factories experience a 48% skill gap.

A study by SEIP revealed that 53.74% of RMG enterprises were facing skill gaps. Positions including lockstitch machine operator, flatlock machine operator, overlock machine operator, printing machine operator, quality inspector, chain stitch machine operator, embroidery machine operator, and cutting activities require skills training.

On the other hand, management of employees, quality controllers, and some finishing operators also contribute to a larger share of the overall skill gap. According to the Asian Center for Development Survey, it was estimated that around 2,200 foreign professionals were working in the RMG sector, with 84% working in management positions and 16% in technical ones.

Overall, in all industries, there have been reports suggesting 50,000 foreign workers are active in the country causing an annual loss in revenue of approximately USD 5-6 BN.

Rising demand for fast fashion and increased climate action have led to the automation of the garment industry as it not only increases efficiency and improves lead time but also reduces the usage of water and electricity in different parts of the production process. While global adoption of technology has taken significant innovative strides, automation in the apparel industry of Bangladesh has been relatively slow. This is certainly due to the complexity of the technical adoption and cost concerns as it is difficult for manufacturers to predict the long-term number of orders, making the investment risky.

That being said, backward integration, especially the textile manufacturing process including ginning, spinning, weaving, and knitting in the apparel industry has been largely automated. Alongside, in the RMG manufacturing process, the adoption of improved fabric inspection, spreading, cutting, sorting, pressing, and dyeing is taking place.

While sewing operations are still manually being done globally, new machinery has improved the efficiency of the process. Sewing operations are being done using semi-automatic machines such as lockstitch machines, flatlock machines, overlock machines, and button holding and attaching machines.

Automated machinery like sewbots is at an experimental stage and is not being adopted globally due to its increased cost. Due to regular innovation in the apparel manufacturing process, workers are lacking expertise in operating an updated machine. The majority of the factories in Bangladesh do not necessarily have an automation adoption strategy. New machinery is brought in based on a need-basis due to increased orders and suggestions from buyers.

Since the availability of labor at a cheap rate, factories aren’t necessarily inclined towards adopting new technology that is expensive even if it reduces the need for workers. Also at times even with automated machines, there is a need to keep additional manual processes in place to quickly meet demands in case of a machine failure.

As the industry is adapting to ‘Industry 4.0’ and revolutionizing the production process, usage of major applications such as IoT, Augmented Reality, Machine-To-Machine communication, 3D printing, Artificial Intelligence integrated ERP (Enterprise Resource Planning), and Radio Frequency Identification Devices (RFID) have been on the rise. These new interventions use Programmable Logic Controllers (PLCs) and computer-based automated systems rather than controlled by human hands, for which a highly-skilled workforce is needed to operate.

In Bangladesh, the education sector faces significant dropouts after the completion of primary education. According to BANBEIS 2021, with a 97.4% net enrollment rate of students, the dropout rate in primary level education is 14.1% while that of secondary education is significantly high at 35.6%. This dropout rate increased for girls in 2021 compared to 2020 from 34.8% to 40.3%. This has a direct impact on the adoption of new technology as the majority of the workers — especially females — only complete primary education.

Enrolling in Technical and Vocational Education and Training (TVET) and Technical Training Center (TTC) requires the individual to be at least a Grade 8 graduate. According to a recent survey conducted by the GWD, it was found that a significant percentage (82%) of workers had to drop out of school before completing their secondary school certificate exam. It also revealed a notable gender disparity in educational attainment, with only 13% of female workers compared to 33% of male workers achieving secondary school certificates.

The primary reasons cited for these high dropout rates among workers include early marriage, financial difficulties within their families, and the burden of education fees and expenses. Additionally, young girls took over familial responsibilities when both parents went to work due to financial limitations. This also leads to a lack of awareness about workplace rights and other forms of discrimination, making them susceptible to such incidents.

The apparel industry is comprised of skilled, semi-skilled, and unskilled workers, where over 50% are skilled workers. Skilled workers generally do not require supervision and are experts in handling multiple tasks while semi-skilled workers prioritize in one kind of operation. In Bangladesh, as of 2017, the total number of government Technical Training Centers was 53 and it had the capacity to train over 26,000 workers. It had been estimated that the current capacity would be around 36,000 while the demand for training capacity would be around 460,000.

Even though development practitioners and RMG associations are readily providing training through different programs, the gap would still persist.[4] Recently, graduates from fashion and textile-specific universities are entering the industry in technical roles, however, according to industry experts, Bangladesh does not have any state-of-the-art laboratories to train the students for the upcoming 4 IR adoption. Additionally, collective efforts between universities and industrialists are missing that might help fresh graduates to transition to the industry. A prospect that will also reduce the dependency on foreign workers.

A recent survey analysis showed that around 68% of the workers did training before joining the industry, however, nearly 44% out of them did 1-day training while only 13% did training for only 6 months. This is an indication that workers are not well trained as according to industry experts the minimum training days required to have competent learning is at least a week. Due to this, it has been seen that around 96% of the workers did training after joining the workforce to mostly specialize in focus areas. [5]

This depicts the need for a cohesive training module that is provided under one authority and follows a structured singular curriculum that is up to date according to technological advancements. Since the lack of infrastructure persists, online training modules with certification exams should also be facilitated to cater to the massive workforce.

Certification exams are more likely to be funded by industry associations or government-run training programs, whereas on-the-job programs are taken care of by the factories. The training module should also prioritize the communication skills of workers as it is one of the core reasons why the apparel industry hires foreign nationals. Lastly, increasing awareness about the importance of 4IR will improve acceptability among mid-level managers and operators.

Even though a recent survey by SEIP has found 93% of workers recognize the need to upskill, innovation management would go through a top-down approach driven by total industry readiness and infrastructure support. A collective effort of training providers, government institutions, manufacturers and buyers will enhance the skills of the workforce and prepare for the upcoming changes in the apparel industry.

The article was authored by Fahmid Kaisar, Business Consultant, with support from Radi Shafiq, Portfolio Manager at LightCastle Partners. For further clarifications, contact here: [email protected]m

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights