GET IN TOUCH

- Please wait...

Bangladesh, the 8th most populous country, is positioned to experience a growing consumption in tandem with its increasing population. Out of Bangladesh’s staggering population of 171 million people, an alarming 50% lack access to safe drinking water. Additionally, The World Bank estimates there will be a 200% surge in household water usage by 2050 in Bangladesh. The lack of access to safe drinking water is a particularly critical issue for the southern and coastal regions of the country, where climatic conditions, such as the increase in salinity, have exacerbated the situation.

Public sector and donor funding account for 50% and 30% of Water, Sanitation, and Hygiene (WASH) financing respectively. However, with Bangladesh’s upcoming graduation from the Least Developed Country (LDC) status, which will result in an eventual decline in donor funding, there is a pressing need to find alternative measures to financially support suppliers in water-scarce areas.

Blended finance, defined by USAID as strategically combining public and philanthropic funds to attract private investments for developmental goals, poses the potential to address the increasingly important financing challenges in the water sector.

On this note, LightCastle Partners, together with Grundfos and BRAC, partnered to investigate potential innovative financing models that could help to close the funding gap in the water industry. The proposed blended finance models are designed to support two water sector stakeholders:

While both water sector stakeholders were looked into in-depth, the primary focus of the study fell heavily on investigating the demand and supply-side challenges faced by small-scale water entrepreneurs.

The “Establishing Financing Products for Water Treatment Plants (WTPs) and Effluent Treatment Plants (ETPs)” study utilized a mixed methods approach, combining secondary research and consultations with stakeholders. The primary research was conducted using:

Secondary research involved extensive use of international sources like The World Bank, UNICEF, and USAID, as well as national documents from reputable sources such as Bangladesh Bank, the National Advisory Board, Water Resource Planning Organization, and Bangladesh Garment Manufacturers and Exporters Association (BGMEA). Insights from previous studies conducted by LightCastle Partners were also incorporated into the research.

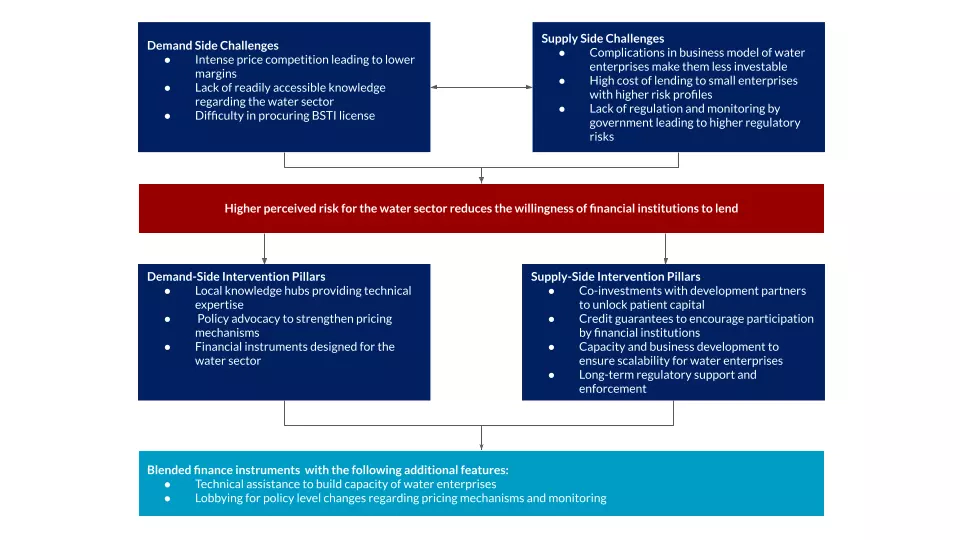

As depicted below, after compiling the research found by analyzing the demand and supply side challenges, which translated into higher perceived risk for the water sector (ultimately deterring lending) the team was able to come up with intervention pillars to support financing in the sector. To address these interventions a blended finance instrument, with additional elements of technical assistance and public sector support, was suggested.

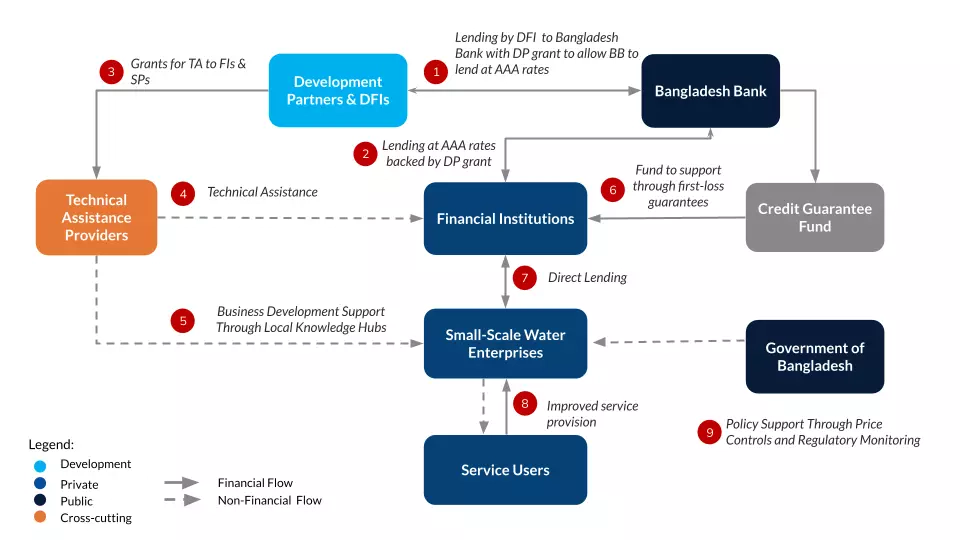

To bridge the funding gap for small water enterprises in Bangladesh, two blended finance models were proposed:

Opportunities include CSR mandates, imposed by Bangladesh Bank, which require certain companies to dedicate a specific percentage of their average net profits to CSR activities. According to a guideline issued by Bangladesh Bank in 2022, banks need to spend 20% of their CSR funds on climate change and mitigation efforts, including the implementation of pure drinking water programs in climate-vulnerable areas.

There are also refinancing schemes, which are loans provided at a concessionary rate by Bangladesh Bank to set up a fund for a refinancing facility against financial institutions’ investments in the water sector, and credit guarantee schemes, which are credit guarantees provided by Bangladesh Bank to banks and financial institutions to make investments less risky in order to increase investor appetite.

Opportunities for this fund include growing interest in impact investing, a favorable regulatory environment, and increased willingness of banks and non-bank financial institutions to participate.

Challenges include the need for impact enterprises to scale and sustain their business models, lack of standardization in impact measurement and reporting, and difficulties in measuring impact in the water sector due to existing business models.

While these models have the potential to make it easier for private investors to support the water sector, they do not go without specific challenges. However, through embracing these interventions, there is an opportunity to catalyze a transformative change in Bangladesh’s water sector, fostering an environment where entrepreneurs can thrive, access finance, and, most critically, serve communities in need more effectively.

Our experts can help you solve your unique challenges