GET IN TOUCH

- Please wait...

What does the barren Atacama desert in Chile and the foaming Accra sea beaches in Ghana have in common? Tonnes of discarded clothes from all over the world. Earlier estimates suggest that annually over 92 million tonnes of textile waste is generated, although the amount is currently expected to be much higher. Both Chile and Ghana are importers of garments from the West which are either re-sold in the vibrant second-hand clothing markets or thrown in garbage patches or incinerated.

Every year these garbage patches keep growing across Africa and South America. Containing the patch of garbage (now visible from satellite) has become a challenge, one which sadly has its source in the top exporting sector of our country.

In essence, fast fashion, and its many faster versions such as ultra-fast or real-time fashion, originating in the Western world, has been one of the key global drivers of not only the rising pile of unmanageable waste across the globe but also paradoxically, increasing employment, export volume and rising profit in Bangladesh. However, being one of the most vulnerable nations to climate change, Bangladesh is also suffering the extent of disasters caused by rampant consumption of fossil fuels, deforestation and pollution.

Adopting sustainability is not only a requirement for staying competitive but also a moral imperative, as the second largest RMG producer in the world.

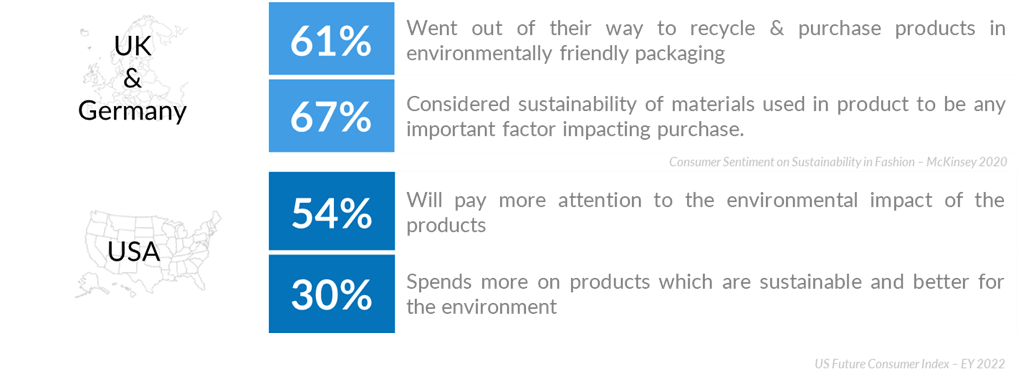

The growing green consciousness across the globe has led to a more conscious effort to make the global RMG sector more sustainable. In a survey of over 2,000 UK & German customers during April 2020, McKinsey found that over 60% of customers were now going out of their way to recycle & purchase products in environmentally friendly packaging, and 67% reported sustainability of raw materials used to be any important factor impacting purchase.

On the other hand, in the US, a survey of more than 21,000 consumers by Ernst & Young (EY) found that 30% of respondents were now spending more on products that are sustainable and better for the environment, 54% said they will pay more attention to the environmental impact of the products and 31% planned to increase the purchase of sustainable products in a year.

As more brands feel the pressure of consumer choices and preferences towards ensuring transparency and sustainability, they have started to re-assess the value chain and revamp the current business model in the fashion industry. Brands now need to ensure that sustainability concerns are addressed to remain competitive, even if the speed of fast fashion hasn’t damped.

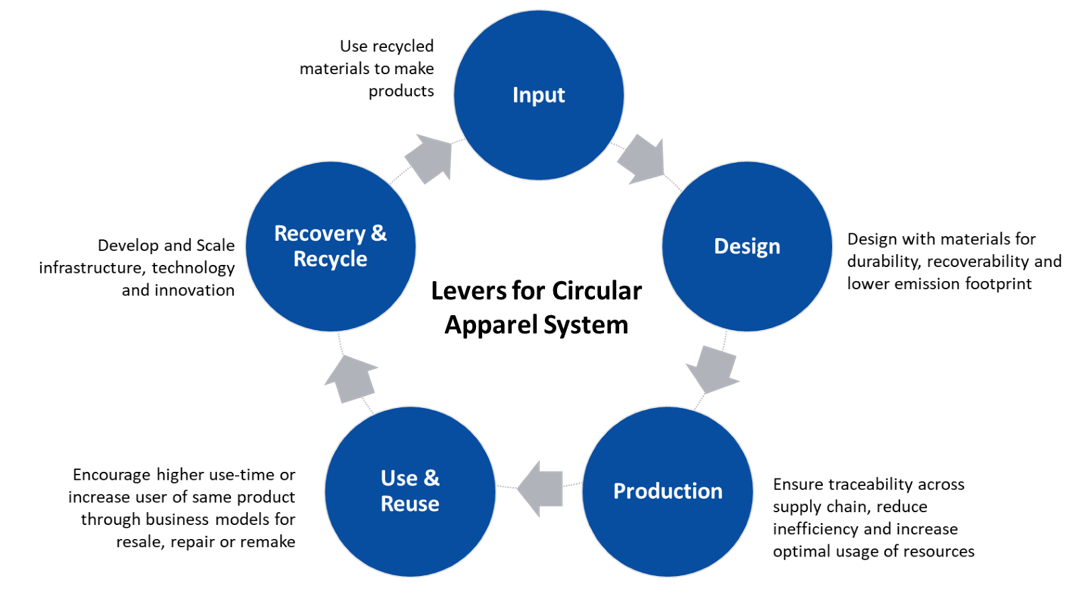

As an antidote to fast fashion, circularity is now commonly prescribed as the sustainable business model that can help address the challenges of depleting resources by ensuring resources are kept productive and within the flow of the economic system. This can be done in various ways – including limiting or altering demand, changing the production process, and designing products in a way that increases longevity or helps ensure resources can be recycled post end-use.

In the apparel sector, circularity has been making the rounds in the tables of discussions for some time now. The high content of water used in cotton production (2,700 liters per T-shirt) along with fossil fuel used in the production of polyester fibers adds to the tremendous pressure on finite resources.

With newer incoming regulations on traceability, increasing global competitiveness, and brands opting to use more recycled materials in their products (both to satisfy regulators and react to market sentiments), Bangladesh’s RMG sector has to look for ways to brand itself as a reliable and sustainable sourcing location for buyers. Hence, adopting a circular business model is the call of the time for the RMG sector, particularly as it prepares for the upcoming changes due to LDC graduation.

Circular system establishes a chain of life-cycle that allows raw materials to be re-integrated and re-used in production, thereby extending its shelf life. Although the loop doesn’t ensure 100% non-leakage or non-wastage, it still can help to keep fibers from landing in landfills too soon. Starting from the design phase, production, use phase (by the consumer), end of life, and back to the input of materials following re-cycling, the circular perspective has to be integrated at each phase of the fashion industry to ensure effective impact. As a sourcing hub, Bangladesh is well poised to play a significant role in the production and input stage (and to some extent design stage too).

Bangladesh currently has a vibrant informal “jhoot” market for fabric scraps, off-cuts, and excess productions in the apparel sector. The collected fabrics are used as fillers for insulation, felts, furniture padding, panel linings, etc. This process, while it does help to reuse the products as materials in other industries, the downcycling process degrades the quality of the original fabric.

To truly close the loop, raw materials have to be re-inserted within the system of production, in a way that the quality is not compromised to ensure a longer lifespan of the products. For the apparel sector, this means tearing the fabric down and re-spinning the fibers to produce yarn. The recycled yarn has quickly caught the attention of brands, as brands can market products under green and conscious labels.

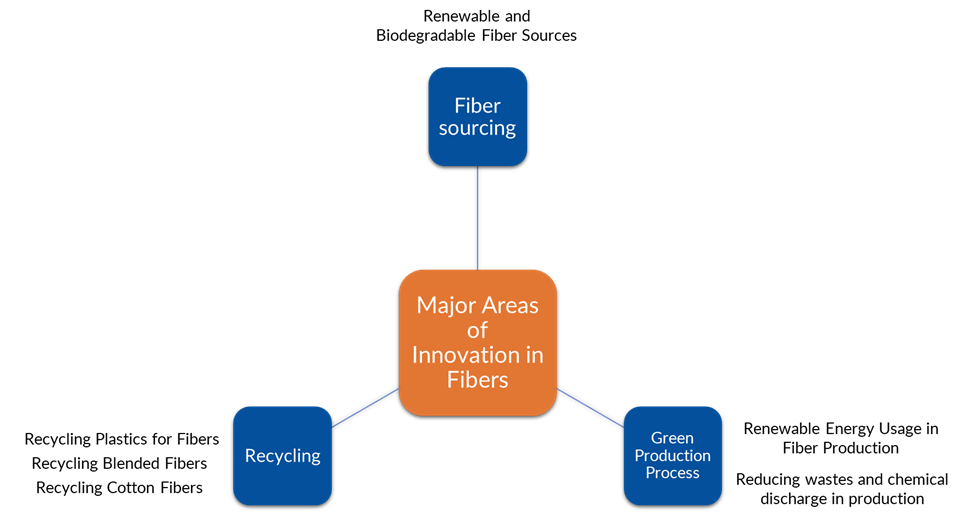

Across the world, innovative techniques to recycle fibers from cotton, cotton blends, viscose, polyester, and cellulosic materials are constantly being developed keeping a low carbon footprint, low chemical usage, and low water usage as key factors. Beyond innovation, scalability is also a primary concern for the nascent recycling industry across the globe.

There are primarily two kinds of recycling technologies at present – mechanical recycling and chemical recycling. Mechanical recycling involves manual shredding of the fabrics, followed by re-spinning (usually this requires virgin cotton to be blended with the shredded fibers) to produce recycled yarns. This is most easily done with cotton-based materials as polyesters or synthetic blends require more energy-intensive processes to decompose the polymers and separate the different fibers.

In India, Pakistan, and China, recycling industries are commonly of the mechanical kind as those require low machinery investment and are mostly labor intensive, which is abundant in these regions.

Chemical recycling, on the other hand, uses chemical solutions to change the molecular composition of the fibers and break down the blends for them to be recycled. In the case of chemical recycling, the primary challenge is the high energy and chemical-intensive process requirements. This not only means a higher carbon footprint which might offset the gain from recycling, but also, can have harmful effects from chemical discharge during the process. Innovations in this sector are primarily driven by companies in the West and require long-term research and development along with large investments to launch.

Before we deep dive into whether recycling can be adopted on a large scale in Bangladesh, we take a quick look at some of the interesting case studies across the globe.

In Italy, the town of Prato has been recycling garments to produce new yarns and fabrics since the mid 19th century. Different districts within the town specialize in different parts of the recycling process such as sorting, shredding, cleaning, drying, and reweaving.

Around eight tons of garments reach the warehouse, from where those in good and reusable condition are sent to Africa and Eastern Europe. In Prato, there are around 7,000 textile and fashion companies and it is the biggest textile district in Europe.

Through a mechanical recycling process, Rewoven uses off-cuts from garments and plastic waste to produce 100% recycled fabric. After collecting the off-cuts, Rewoven sorts those according to color and processes to produce cotton fiber. The cotton fiber is then blended with recycled plastic waste.

Consequently, the final re-spun yarn contains 60% of pre-consumer textile waste and 40% of plastic waste, which is then woven and knitted into fabrics [1]. The process doesn’t use any water or additional dyes and the resulting fabric is also recyclable.

With a patented technology that involves both mechanical shredding and chemical processing, Renewcell is revolutionizing the recycling of cotton scraps, cotton-based products, and worn-out jeans into new cellulosic fiber – Circulose.

Renewcell can produce man-made cellulosic fibers out of 100% recycled textiles, without using any virgin cotton or fibers. They have started operating on an industrial scale following a successful pilot phase, and have also partnered with multiple brands such as H&M, Levi’s, Gina Tricot etc. Renewcell plans to recycle 1.4 Billion T-shirts every year by 2030.

Hong Kong Research Institute of Textiles & Apparel Limited – HKRITA, in a project funded by the H&M Foundation, came up with the technology to break down blended fabrics – which make up the biggest variation of textiles used across the globe.

The Green Machine, as it’s called, is already being ordered for commercial usage by brands such as ISKO, and a feasibility study is underway in Cambodia. The resulting output is separated polyester fibers and cellulose powders, both of which can be recycled in multiple ways.

Situated in Melbourne, Upparel specializes in the mechanical recycling of cotton-based textiles. However, for blended fabrics that the company can’t recycle, the company has formed a symbiotic partnership with BlockTexx.

BlockTexx is the only commercially viable chemical recycling plant in Australia. BlockTexx separates polyester blends to flake and cotton to cellulose, as pellets, which can be re-spun into fibers.

Bangladesh has a long history of circularity as part of its culture, even though it has rarely been termed as such. Old sarees get reused to make new “Kantha” (blankets) with beautifully sewn designs. Hand-me-down clothes are part of a tradition, with younger siblings growing up sometimes eager to access the market of new clothes only during festivals.

Washcloths and cleaning rags, alongside makeshift mittens, and mattress stuffing are often the final form of most of the apparel and apparel waste. It is not just applicable to clothes, the country also has a zero-waste food culture, where almost all parts of a vegetable, fruit, or slaughtered livestock are put to use as different dishes. The ongoing circularity movement thus aligns nicely with the culture.

Spurred on by brands, global yarn recycling and new bio-fabric manufacturing through less intensive techniques is now a vibrant landscape, with rapidly rising demand. On the national front though, Bangladesh mostly exports much of the post-industrial waste.

In an estimate by Reverse Resources, the garment sector of the country produces around 570,000 tonnes of textile waste or “jhoot” per annum. Around 60 percent of this is exported to other countries earning USD 300 Million. In 2019, the country imported 1.63 million tonnes of staple cotton fiber valued at USD 3.5 billion [2].

This means that Bangladesh not only exports usable raw materials, but also, imports it back to use it in the very same sector.

Currently of the total cotton-based jhoot produced within the country, only 5% is recycled by over 20 local recycling companies, while the rest are incinerated [3]. Of the total exported jhoot, nearly half of it is highly recyclable cotton wastes, which are easily recyclable and could help reduce the burden on imported recycled cotton as well.

The number of recycling companies has been increasing over the last five years. CYCLO by Simco Spinning and Textile Ltd in Bangladesh is a glowing example of successful mechanical recycling of textiles. The company has expanded rapidly since 2010 and currently produces 13 tonnes of yarn a day according to the director [4].

With the entrance of Reverse Resources, an Estonia-based company, and a partner of the Circular Fashion Partnership under Global Fashion Agenda, more brands have participated, bringing their manufacturers within the chain connecting recycling companies with the textile wastes of the manufacturers in Bangladesh. As more recycling companies enter the market, some local, some international and many manufacturers now opting to have their own recycling plant, the RMG sector is slowly but surely moving towards seeing waste as an opportunity.

However, the obstacles are deep-rooted and require a concerted effort from all stakeholders before any significant progress can be made. The biggest hurdle at present is the informal market of waste. Not only is the market for textile scraps highly fragmented, but the value chain of the waste, particularly for those going off to other industries than textile, is also very difficult to track.

At present, proper study that looks into the post-industrial waste and the subsequent use of it in different sectors must be undertaken to ensure that a proper environment for recycling companies to thrive through ease of collection of waste, can be nurtured. Policies to help incentivize companies to recycle, such as tax rebates, can be looked into, as well as finding ways to connect and create synergy between local recyclers and garment manufacturers, to help see the value of the waste, and work to ensure smoother collection of non-contaminated textile waste.

‘Sorting system’ established within the assembly line of factories could help in not only increasing the quality of the textile waste which are recycled but also help segregate waste early in the production, thus increasing efficiency.

Moreover, it is crucial to expand and deepen the adoption of renewable energy to allow recycling sectors/innovators to thrive and offset the carbon footprint of the textile industry. Innovative sources for fibers such as pineapple skins, banana leaves, etc. are being successfully experimented with by a local company called Classical Handmade Products BD. Similar biodegradable sources can be looked into.

Policies to help scale up fiber innovations can aid in creating stronger backward linkage for the textile industry.

As Bangladesh looks towards being a green sourcing hub, with the impending regulations and removal of GSP facilities, it is time to find innovative ways to position Bangladesh as a brand, while also ensuring backward linkage is built that reduces our dependence on imports. Recycling of textile waste is the lowest hanging fruit and Bangladesh’s RMG sector with its high share of cotton-based products, is ripe with possibilities.

The article was authored by Subrina F Eusa, Business Consultant at LightCastle Partners. For further clarifications, contact here: [email protected]

[1] https://www.rewoven.africa/reclaimed-fabrics

[2] https://bangladeshtextilejournal.com/bangladesh-faces-shortage-of-waste-cotton-and-textile-scraps/

[3] https://thefinancialexpress.com.bd/public/views/us30-billion-market-remains-untapped-1668525938

[4] https://en.prothomalo.com/business/local/incredible-success-in-the-reuse-of-fashion-waste

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights