GET IN TOUCH

- Please wait...

In the ever-evolving landscape of consumerism, a transformative trend has emerged, reshaping traditional notions of commerce and consumption. This paradigm shift is encapsulated in the concept of Recommerce, an innovative economic model that breathes new life into pre-owned or second-hand goods. The focus extends beyond mere decluttering – it revolves around embracing a sustainable lifestyle.

With the widespread presence of thrift stores, online marketplaces, and an increasing appreciation for vintage items, the understanding of the term ‘new’ is undergoing a transformation in Bangladesh. From the street-side thrift carts to online platforms, the concept of re-commerce is starting to gain traction.

This article explores how a shift in consumer mindset is rejuvenating second-hand items while shedding light on the pivotal role played by innovative startups in reshaping the future of retail in Bangladesh. While the trajectory appears promising, a closer look at the sector reveals the challenges and obstacles that may pose a potential barrier to this revolutionary shift.

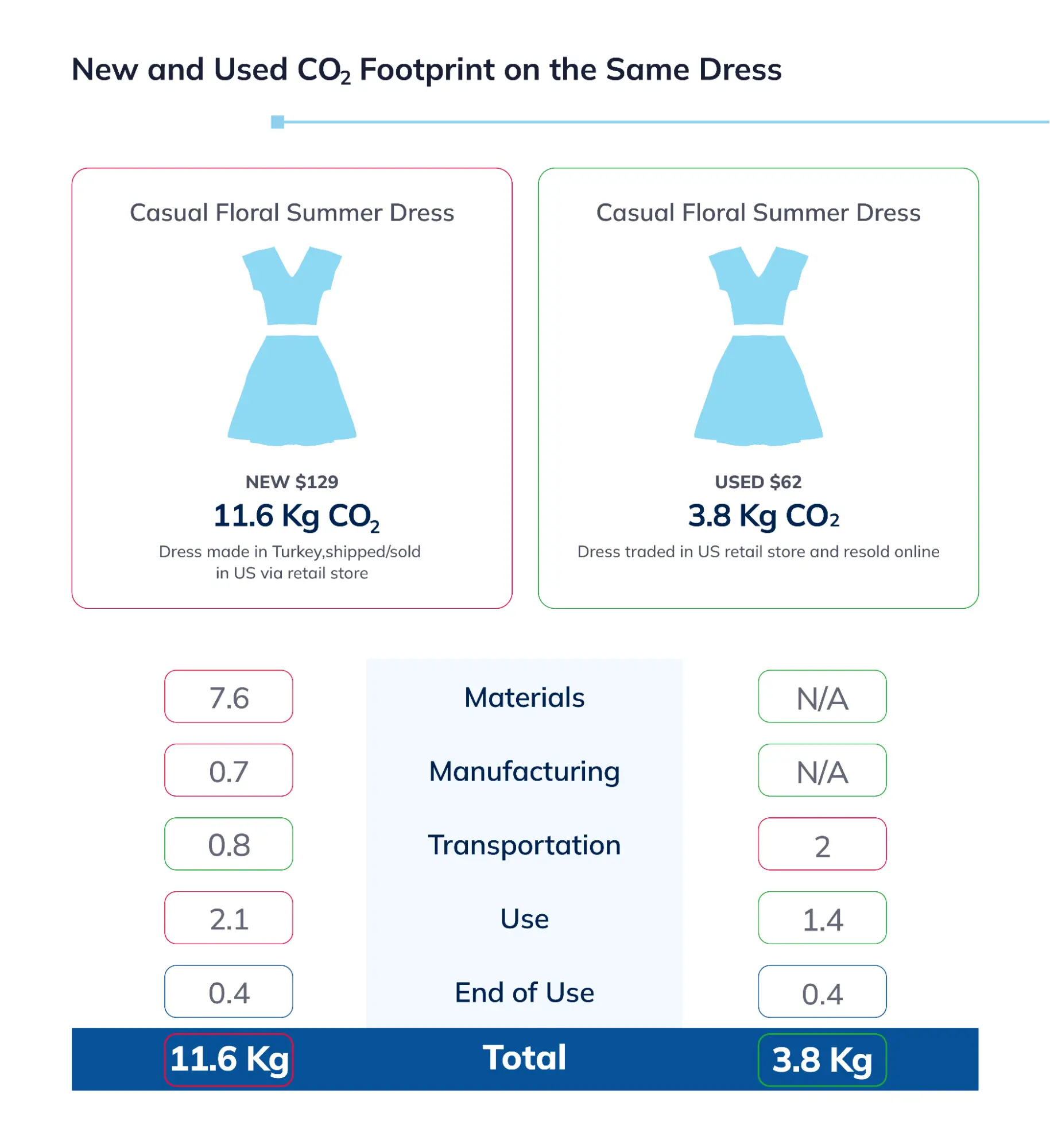

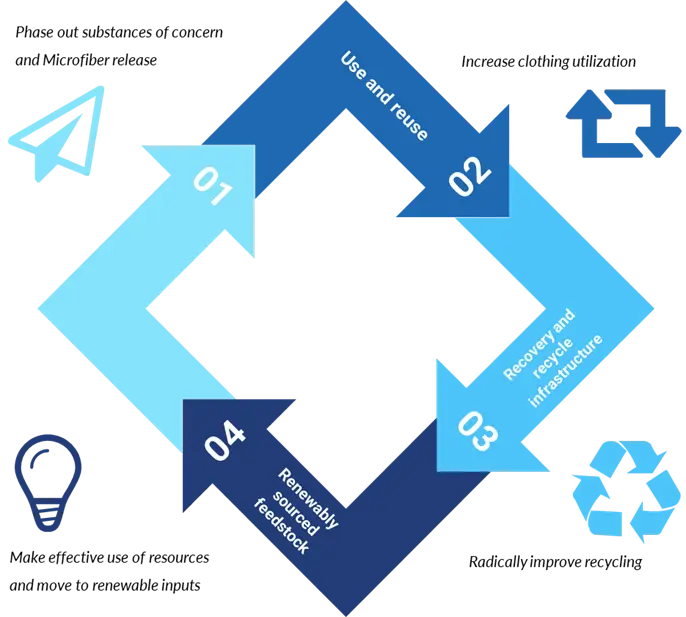

Rooted in the principles of circular economy, re-commerce centers around the resale, reuse, and repurposing of pre-owned or second-hand goods, effectively prolonging their lifespan and reducing environmental impact. Rather than discarding items, re-commerce intervenes by finding new homes for old belongings, preventing them from contributing to landfills.

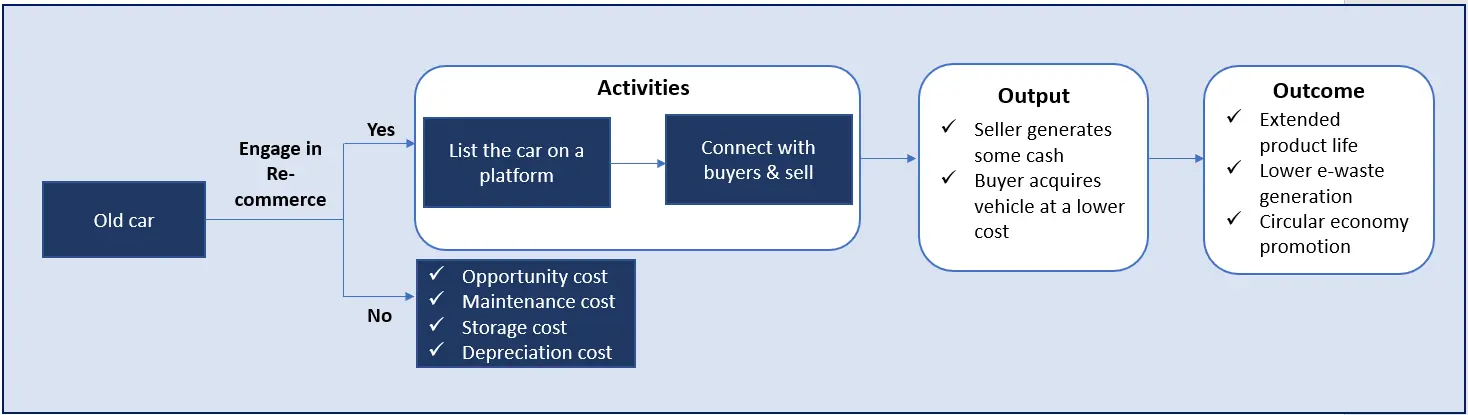

For instance, instead of letting an old car sit unused in the garage, the owner can engage in re-commerce by putting it up for sale. By listing the car on a platform, they can connect with potential buyers interested in acquiring a pre-owned vehicle. This approach benefits both parties involved: the buyer acquires a vehicle at a lower cost compared to purchasing a new one, and the seller generates some cash from an item they no longer require. This mutually beneficial arrangement aligns with the concept of a “Circular Economy,” emphasizing the reuse and recycling of goods to mitigate the environmental impact associated with waste and carbon emissions.

In essence, re-commerce breathes life into the circular economy by challenging the linear “use and dispose” model. Together, these concepts emphasize the importance of second-hand markets in shaping a greener future.

The concept of re-commerce is not a fleeting trend; rather, it is steadily picking up momentum for a variety of compelling reasons.

The key insights from the report include:

“As people’s access to the internet grows we’re seeing the sharing economy boom — I think our obsession with ownership is at a tipping point and the sharing economy is part of the antidote for that.” — Richard Branson, Virgin Group

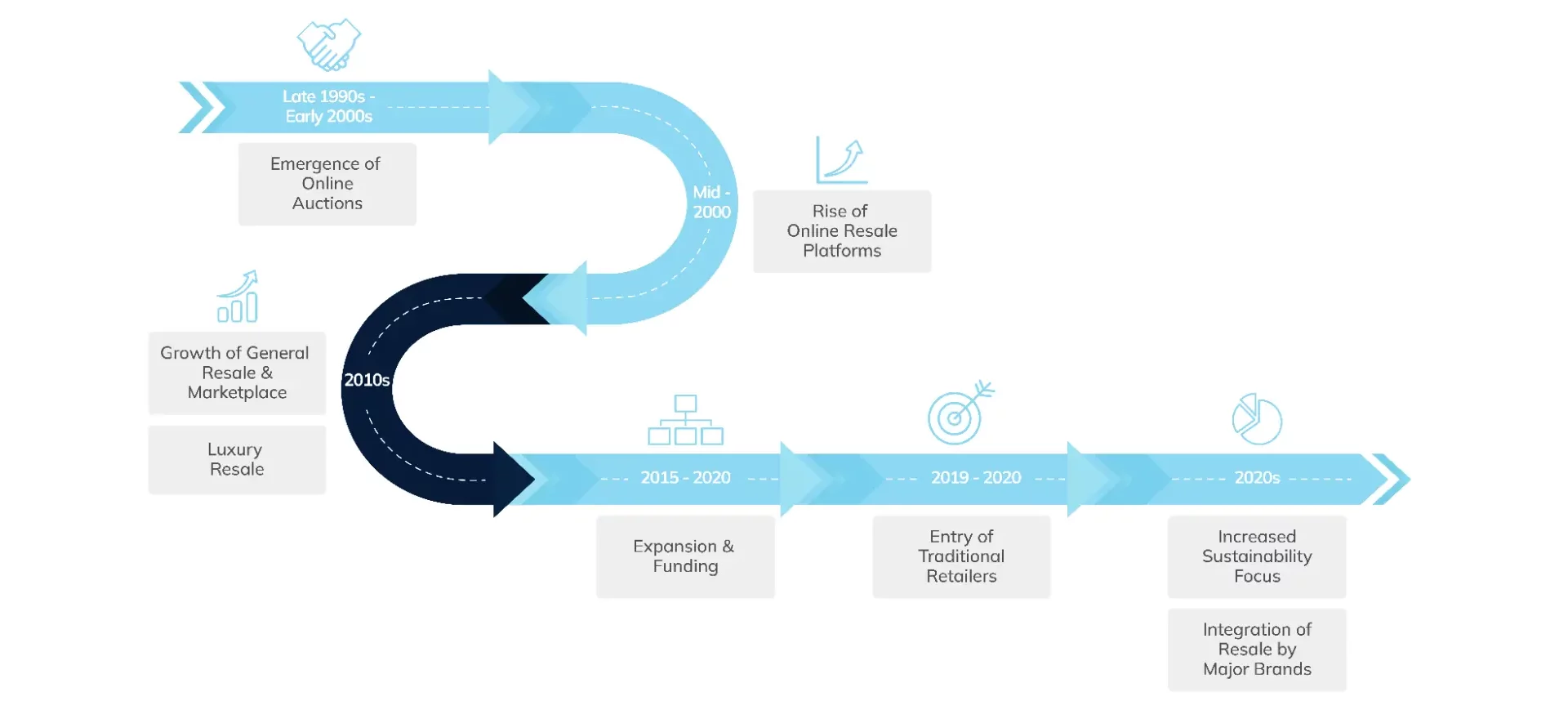

The evolution of the resale industry has undergone several key milestones over the years. Since its establishment in 1995, eBay has been a key player in popularizing the idea of “secondhand shopping.” Following that, in the mid-2000s, specialized resale platforms emerged, such as Poshmark (2011), focusing on secondhand clothing and accessories. At the same time, luxury resale platforms like The RealReal (2011) gained prominence, allowing users to buy and sell pre-owned designer items.

Since 2016, traditional retailers have begun incorporating re-commerce into their business models. Companies like Patagonia started promoting used clothing sales alongside new products. Particularly, in 2019, thrift shopping gained popularity, driven by sustainability trends and a desire for unique, vintage items.

Starting from 2020, re-commerce became more mainstream with large retailers, such as H&M and Nordstrom, introducing resale initiatives. H&M has a second-hand clothing platform Sellpy which offers second-hand products from H&M Group brands, as well as third-party labels. In 2021, resale platforms like thredUP and The RealReal went public, highlighting the economic viability and investor interest in the re-commerce sector.

With regards to China, the re-commerce shift began around the mid-2010s with the emergence of “super apps” like Xianyu (Alibaba Group) enabling users to buy, rent, or even donate their unwanted things in every possible product category. [3]

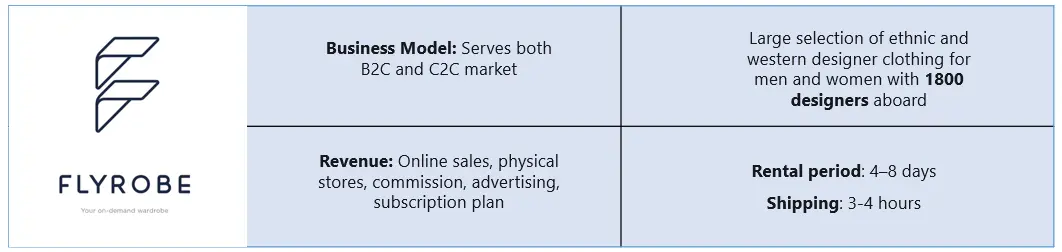

Meanwhile, India is also intensifying its efforts in the re-commerce sector with fashion reselling sites like Flyrobe challenging regular e-tailers such as Myntra, Flipkart, etc.

With such endeavors, it is anticipated that the worldwide re-commerce sector will attain a valuation of $84 billion by the year 2030. [4]

In Bangladesh, the practice of handing down clothes within families has been a longstanding tradition deeply rooted in values of frugality and sustainability. Additionally, worn-out or outgrown clothes find new life through creative repurposing, such as the art of crafting blankets known as “katha.” This cultural norm of reusing clothes reflects a sustainable approach to consumption while nurturing a sense of shared history within the family unit.

While Bangladeshi consumers are value-conscious, they also harbor aspirations and a keen interest in the “Statusphere” – the inclination to elevate one’s status by choosing products of higher quality or with superior features, all while maintaining a comparable price point.

To give a bit more perspective, according to a study conducted by BCG in 2015, the MAC (Middle and Affluent Class) population in the country is expected to hit 25% by 2025, thanks to greater access to education, a growing working-age population and strong upward mobility. [5] This expansion of the middle class is expected to impact consumption patterns, presenting an opportunity for emerging re-commerce companies to capitalize on this shift in consumer behavior.

At present, the Gen Z cohort, in particular, is increasingly embracing the sharing economy. This trend is further endorsed by the LightCastle survey results, indicating that 90% of respondents within the urban consumer base are fairly acquainted with the concept of “Re-commerce.”

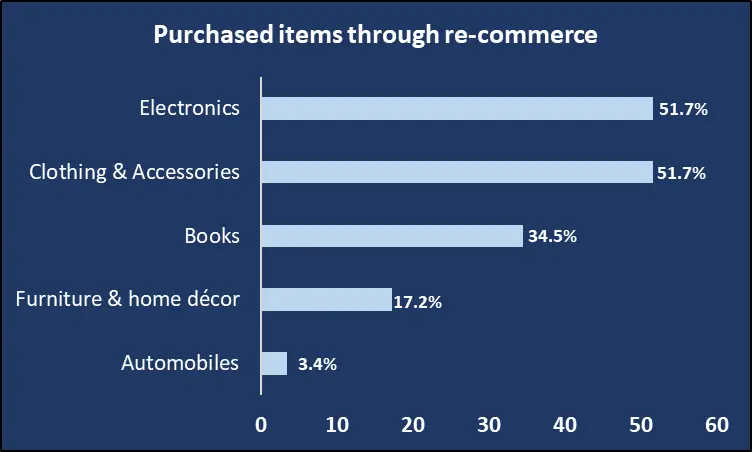

Within this group, 61% of respondents purchased second-hand products through re-commerce platforms, including online marketplaces, thrift stores on social media, the Facebook marketplace, or physical secondhand shops. With regards to category, clothing, and electronics are the most dominant, with books and furniture following closely behind.

The market for used goods in Bangladesh illustrates a notable informal structure. Despite the considerable market potential, there are very few re-commerce platforms established in the country. Additionally, the re-commerce industry is predominantly led by electronic product platforms that cater to a growing demand for low-cost gadgets while putting a leash on the 2.81 million tons of e-waste generated annually.

However, almost 40% of customers who purchase new gadgets choose not to resell them after use, causing these items to stay outside the resale market. [6] Among the remaining 60%, there is a tendency to forgo active selling, with individuals often opting to pass on the product to a family member or acquaintance at a discounted price.

Bikroy.com: Founded in October 2012, Bikroy.com has emerged as a well-known online marketplace, serving the diverse needs of P2P, B2B, and B2C markets. Functioning as a dynamic platform, it facilitates the listing of an extensive array of items for sale, encompassing electronics, furniture, clothing, vehicles, property, and beyond.

SWAP: Launched in 2020, SWAP merges the realms of e-commerce and re-commerce, both in the B2B and B2C domains. It offers customers the opportunity to both buy customized items and sell their unwanted goods, including items like smartphones, laptops, appliances, and vehicles. The company has recently launched a program that provides startups with certified pre-owned laptops, allowing them to reduce their capital expenses.

Additionally, startups have the flexibility to receive these laptops in convenient installments. So far, the platform has served over 80,000 customers thus far, and has helped reduce about 3,650 metric tons of carbon emissions. [7]

Flipper: Officially launched in 2021, Flipper is a re-commerce brand with twin ambitions: to make re-commerce mainstream in Bangladesh and to address the growing challenge of e-waste management. The core business model of Flipper revolves around purchasing used electronic devices from customers, repairing them, and reselling them in the market.

Although the company originally concentrated on the B2B sector, it has since broadened its scope to include a thriving B2C operation that incorporates both offline and online sales channels.

The assertion regarding the informal second-hand market is supported by the results of the LightCastle survey, revealing that nearly 66% of participants engage in reselling through social media thrift stores, while physical second-hand shops follow closely in popularity. Specifically for pre-owned clothing, the global fashion rental market is expected to expand at a CAGR of 11% from 2021 to 2031. [8]

In Bangladesh, these items are extensively available on the sidewalks, often featuring defects and being offered at significantly reduced prices. Certain online thrift stores, particularly on Facebook and Instagram, procure items from these sidewalks and resell them with a markup.

According to EPB data, the “jhut” (pre-consumer textile waste) exports from Bangladesh stood at US$116 million in FY 22-23. [9] Presently, the recyclers find it expensive to collect scraps from local waste handlers. As a result, it is more cost-effective for recyclers to collect directly from factories which ensures better quality of scraps.

Approximately 30-35% of this waste is repurposed domestically to manufacture various products including baby wear, pillows, quilts, and mattresses. Thus, formalizing the recycling sector would encourage sustainable consumption.

As the second-hand goods market in Bangladesh is still largely unorganized, consumers are used to dealing with a lack of transparency, limited selection, and uncertainty about a product’s authenticity. To give an example, there has been a notable increase in the market for pilfered/stolen mobile devices in the country. These items are commonly traded in sidewalk stores and within the Gulistan vicinity.

Initially, the stolen phone is sold to a technician or buyer for BDT 4,000-8,000 (USD 36.56-73.11). If the security features are disabled, these phones are then sold for prices spanning from BDT 20,000 to BDT 60,000 (USD 182.7-548.3). [10] In fact, with minimal verification processes on online platforms, miscreants have found it incredibly easy to offload stolen devices.

In addition, the reverse supply chain, involving the return of products from customers, is a critical aspect of re-commerce. Handling returns, refurbishing items, and reintroducing them into inventory efficiently is a logistical challenge. As such, re-commerce companies will require efficient systems to track and manage the status, location, and condition of each product.

With consumers becoming more environmentally conscious and financially savvy, re-commerce is poised to reshape the industry, leading to the inevitable emergence of numerous companies in this space.

At the moment, BGMEA is exploring the potential of creating B2B and B2C platforms to sell rejected items and stock lots in global markets.[11]

Furthermore, they plan to actively engage in advocacy efforts with buyers to authorize the resale of surplus stock both domestically and internationally.

The following endeavors will further propel the sector to greater heights:

Naziba Ali, Business Analyst at LightCastle Partners, has authored the write-up. For further queries, contact [email protected].

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights